ZoomInfo Competitors: Analysis of Data Providers in 2025

Comparing Leading Enterprise Data Platforms: Strategic Strengths Beyond Pricing

Blogby JanMay 23, 2025

Your sales team just missed another quarter because they spent weeks chasing the wrong prospects with outdated contact information. Sound familiar? 67% of enterprise sales teams report that poor data quality directly impacts their ability to hit revenue targets.

While ZoomInfo has dominated the enterprise data intelligence market, the landscape has evolved dramatically. New platforms have emerged with specialized capabilities that often deliver better results for specific use cases, compliance requirements, or organizational structures. Some provide access to data sources ZoomInfo doesn't cover, while others offer more flexible pricing models or superior international coverage.

ZoomInfo competitors aren't just alternatives—they're often strategic advantages waiting to be discovered. This guide examines the top 10 platforms that enterprise teams use instead of or alongside ZoomInfo, revealing which situations favor each approach and how to make the right choice for your organization.

The key isn't finding a universal "best" platform, but identifying which strategic approach aligns with your specific data strategy, technical capabilities, and global requirements. By the end of this analysis, you'll understand exactly which platform can solve your unique intelligence challenges while potentially reducing costs and improving results.

Why Enterprise Teams Are Exploring ZoomInfo Alternatives

The enterprise data intelligence market has matured beyond the "one-size-fits-all" approach that dominated early platforms. Modern enterprise teams face challenges that require more sophisticated solutions than traditional contact databases can provide.

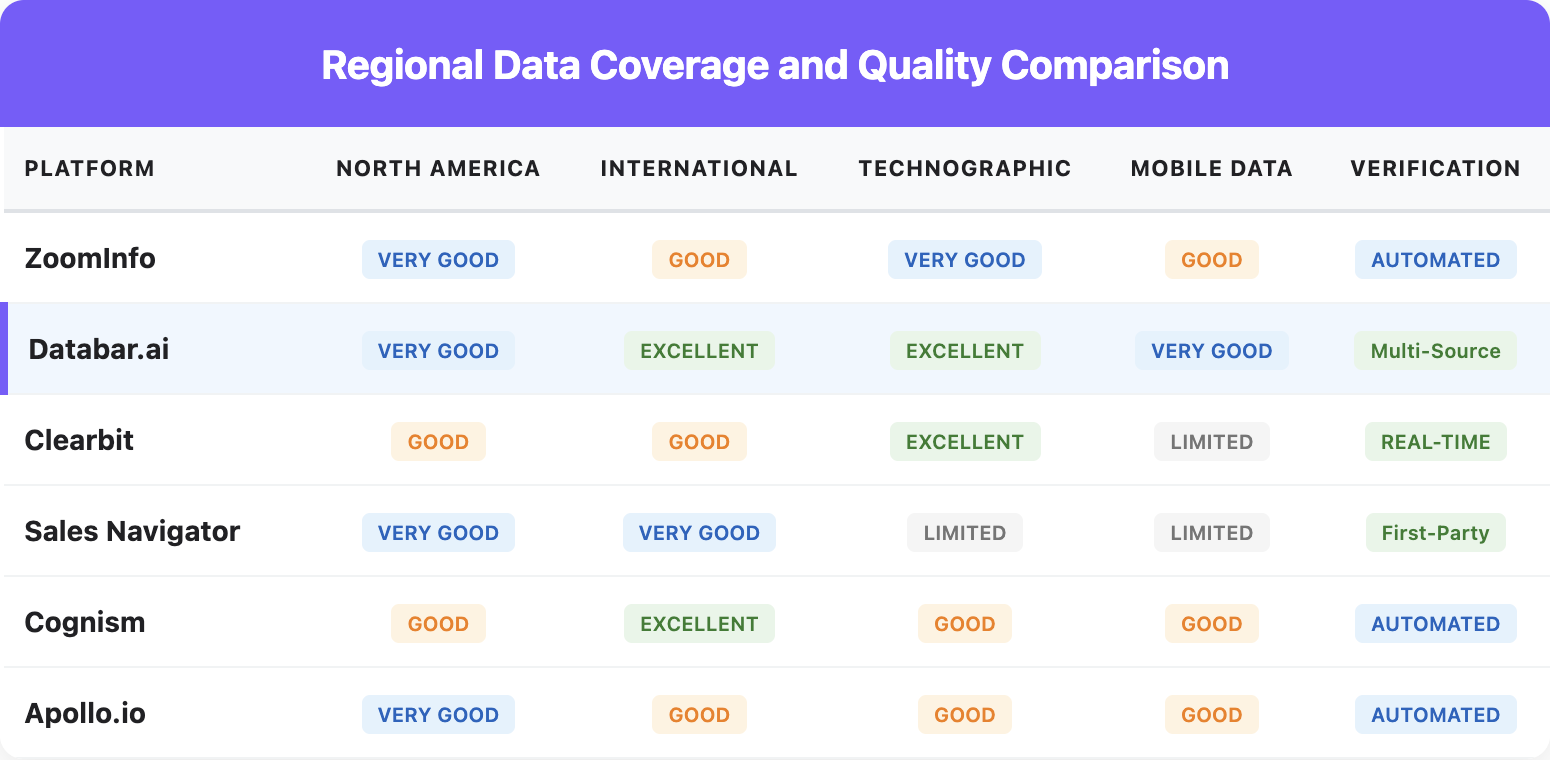

Data coverage gaps represent the most common driver for exploring alternatives. While ZoomInfo excels in North American markets, many enterprises need deeper international coverage through global data platforms, specialized industry data, or access to niche professional networks that aren't well-represented in mainstream databases. Effective b2b contact discovery tools address these coverage limitations through multi-source approaches.

Cost optimization drives many enterprise evaluations as teams seek more flexible consumption models.Traditional seat-based pricing often doesn't align with modern usage patterns, leading organizations to explore cost-effective data solutions with more granular or value-based pricing structures.

Specialization needs emerge as sales strategies become more sophisticated. Teams implementing advanced account-based approaches often require deeper company intelligence, while those focusing on intent-based selling need platforms optimized for buying signal identification rather than contact discovery.

Compliance requirements have become increasingly critical as global privacy regulations evolve. Organizations operating in multiple jurisdictions often need platforms with specialized compliance features that go beyond basic GDPR documentation to include advanced consent management and regional data handling capabilities.

Integration complexity forces many organizations to seek platforms that embed more naturally into their existing tech stacks. Enterprise teams with mature marketing automation platforms often prefer API-first providers that enhance current workflows rather than requiring adoption of new standalone interfaces.

The most successful enterprise implementations often involve multiple platforms working together rather than relying on a single provider. Understanding how different ZoomInfo competitors complement each other enables more strategic technology investments that deliver better results at lower total costs.

Strategic Framework: How to Evaluate Data Intelligence Platforms

Before diving into specific competitors, understanding the evaluation framework helps identify which platforms align with your organizational requirements and strategic objectives.

Data Strategy Alignment

Centralized Intelligence Hubs work best for organizations that want comprehensive platforms with broad feature sets accessible through unified interfaces. These approaches simplify training and vendor management but may sacrifice depth in specialized areas.

Distributed Intelligence Models often deliver better results for enterprises with mature tech stacks and integration capabilities. These strategies emphasize embedding intelligence directly into existing workflows rather than requiring teams to adopt new primary interfaces.

Hybrid Approaches combine multiple specialized platforms to optimize different aspects of the intelligence workflow. This strategy requires more complex vendor management but often delivers superior outcomes by leveraging each platform's strengths.

Implementation Capability Assessment

Technical Resource Availability significantly impacts which platforms will deliver value. API-first solutions require development resources for optimal implementation, while interface-driven platforms need minimal technical support but may offer less customization flexibility.

Change Management Capacity determines how easily your organization can adopt new platforms or workflows. Teams with limited change bandwidth often benefit from solutions that enhance existing processes rather than requiring fundamental workflow modifications.

Integration Timeline Requirements affect platform selection based on how quickly you need results. Some platforms offer immediate value through simple interfaces, while others require extensive configuration but deliver more sophisticated capabilities once properly implemented.

Global Enterprise Considerations

Regional Data Quality varies dramatically between providers, with some excelling in specific geographic markets while offering limited coverage elsewhere. Global enterprises often need specialized regional providers rather than platforms claiming universal coverage.

Regulatory Framework Alignment becomes crucial for organizations operating across multiple jurisdictions. Platforms with specialized compliance features may justify higher costs through reduced legal and operational risk.

International Workflow Support includes language capabilities, local support availability, and cultural alignment with regional business practices. These factors often prove more important than raw feature comparisons for global implementations.

Top 10 ZoomInfo Competitors: Strategic Analysis

1. Databar.ai: The Multi-Source Enterprise Intelligence Platform

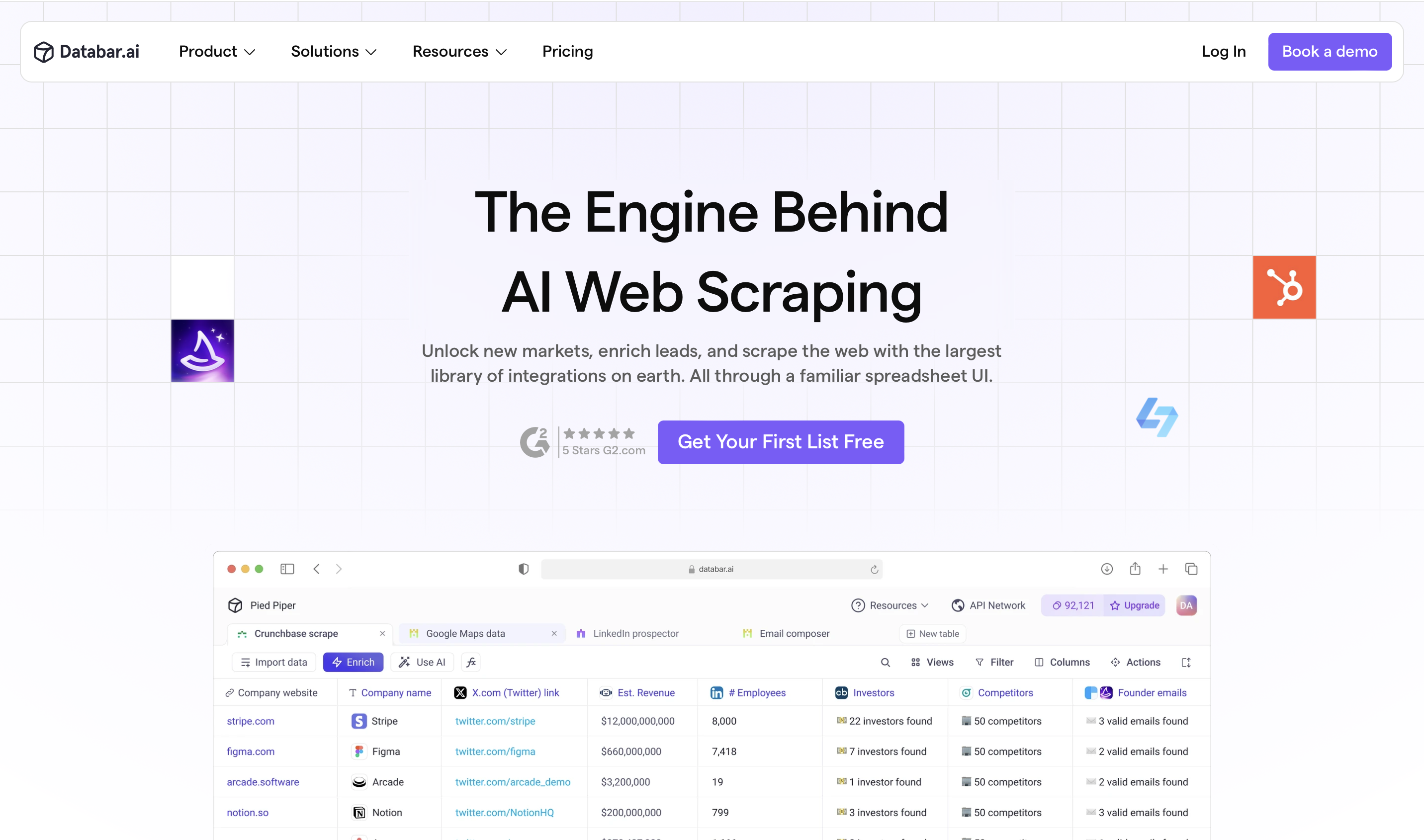

Databar.ai has positioned itself as the enterprise solution for organizations needing access to diverse data sources without managing multiple vendor relationships. Instead of building a proprietary database, Databar connects users to 90+ specialized providers through a unified interface.

Strategic Positioning:

- Primary Market: Enterprises requiring specialized industry data or global coverage

- Core Value Proposition: Access to the best data for your specific needs without vendor lock-in

- Competitive Advantage: Data diversity and workflow customization vs ZoomInfo's standardized approach

Key Differentiators:

- AI agent to scrape specialist data from the entire web, which traditional databases don’t cover

- Specialized industry coverage through integrations with multiple niche data providers

- Cross-provider data verification improving accuracy through multiple source validation

- Flexible consumption models aligned with enterprise value-based purchasing

- Visual workflow builder enabling custom data processes without developer resources

- Comprehensive compliance framework supporting global regulatory requirements

Best Use Cases:

- Global enterprises needing regional data specialists

- Organizations in specialized industries poorly covered by mainstream providers

- Teams requiring custom data workflows or unique verification processes

- Companies seeking to reduce vendor lock-in while maintaining data quality

Implementation Considerations: Databar offers an initial workflow configuration but provides extensive customization capabilities. Best suited for organizations that view data intelligence as a strategic capability requiring flexible, evolving approaches.

2. Clearbit: The API-First Enterprise Data Provider

Clearbit focuses exclusively on embedding intelligence directly into existing enterprise systems rather than providing standalone platforms. This approach appeals to organizations with strong technical capabilities and established workflows.

Strategic Positioning:

- Primary Market: Enterprises with mature tech stacks and development resources

- Core Value Proposition: Real-time data enhancement integrated seamlessly into existing systems

- Competitive Advantage: Background enrichment vs ZoomInfo's standalone platform approach

Key Differentiators:

- Enterprise-grade APIs designed for sophisticated implementation requirements

- Real-time enrichment supporting dynamic personalization at scale

- Deterministic matching algorithms enhancing accuracy through advanced logic

- Website visitor identification enabling anonymous prospect engagement

- Marketing technology focus with deep digital channel integration

Best Use Cases:

- Organizations with strong technical teams and custom-built systems

- Marketing automation platforms requiring real-time data enhancement

- Companies prioritizing workflow integration over standalone functionality

- Teams implementing sophisticated personalization strategies

Implementation Considerations: Requires technical resources for optimal implementation but delivers seamless user experiences once properly configured. Best for organizations viewing data as infrastructure rather than a primary user interface.

3. LinkedIn Sales Navigator: The Professional Network Intelligence Platform

LinkedIn Sales Navigator leverages Microsoft's professional network to offer relationship-based intelligence rather than traditional contact discovery. This approach emphasizes quality connections over quantity of prospects.

Strategic Positioning:

- Primary Market: Enterprise teams practicing relationship-based selling methodologies

- Core Value Proposition: First-party professional data with relationship mapping

- Competitive Advantage: Connection quality and context vs ZoomInfo's data breadth

Key Differentiators:

- First-party data provided directly by professionals rather than third-party collection

- Relationship mapping highlighting introduction paths within organizations

- InMail capabilities for direct communication within professional context

- Microsoft ecosystem integration enhancing cross-platform intelligence

- Social selling emphasis aligned with modern enterprise sales methodologies

Best Use Cases:

- Enterprise teams focusing on relationship-based selling approaches

- Organizations with complex, long-cycle sales processes

- Teams prioritizing warm introductions over cold outreach

- Companies implementing sophisticated account-based strategies

Implementation Considerations: Minimal technical implementation but requires sales methodology alignment. Most effective when combined with relationship-based sales training and account-based strategies.

4. Cognism: The Compliance-Focused Global Data Provider

Cognism has carved out a strategic position emphasizing global compliance and European market coverage, particularly valuable for enterprises with complex regulatory requirements.

Strategic Positioning:

- Primary Market: Global enterprises with European operations and strict compliance mandates

- Core Value Proposition: Compliant global data with superior European coverage

- Competitive Advantage: Regulatory compliance and international coverage vs ZoomInfo's North American focus

Key Differentiators:

- Comprehensive GDPR documentation supporting enterprise compliance teams

- Superior European market coverage addressing international expansion needs

- Strong mobile phone data enhancing direct connectivity capabilities

- Event-based selling capabilities enabling timely outreach

- Compliance-first architecture built specifically for regulated environments

Best Use Cases:

- Global enterprises with significant European operations

- Organizations in regulated industries requiring detailed compliance documentation

- Teams needing mobile phone data for direct outreach campaigns

- Companies prioritizing data governance and regulatory risk management

Implementation Considerations: Straightforward implementation with emphasis on compliance training. Particularly valuable for organizations expanding into European markets or facing increased regulatory scrutiny.

5. TechTarget Priority Engine: The Technology Intent Intelligence Platform

TechTarget specializes in technology sector intent data, focusing on identifying active technology buying cycles rather than general contact discovery. This platform excels for technology vendors targeting enterprise IT departments.

Strategic Positioning:

- Primary Market: Technology vendors targeting enterprise IT purchasing teams

- Core Value Proposition: Real-time technology buying signals with decision-maker identification

- Competitive Advantage: Deep technology intent data vs ZoomInfo's broader but less specialized approach

Key Differentiators:

- Technology purchase intent data identifying active buying cycles

- IT decision-maker intelligence with role-based targeting capabilities

- Content consumption tracking revealing specific technology interests

- Account prioritization algorithms identifying most engaged prospects

- Technology sector specialization with deep category coverage

Best Use Cases:

- Technology vendors selling to enterprise IT departments through intent-based platforms

- Organizations implementing intent-based marketing strategies

- Teams focusing on active buyers rather than cold prospect development

- Companies needing detailed technology stack and decision-maker insights

Implementation Considerations: Requires integration with existing sales and marketing systems for optimal value. Most effective when combined with intent-based sales and marketing methodologies.

6. Bombora: The Cooperative Intent Data Network

Bombora operates as a cooperative intent data provider, aggregating B2B content consumption across business publications rather than building traditional contact databases.

Strategic Positioning:

- Primary Market: Enterprises implementing advanced intent-based marketing and sales strategies

- Core Value Proposition: Company Surge® data identifying businesses researching relevant topics

- Competitive Advantage: Topic-based research intent vs ZoomInfo's contact-focused approach

Key Differentiators:

- Cooperative data network aggregating signals across business publications

- Topic surge identification revealing research intensity increases

- Intent-based account prioritization enhancing sales efficiency

- Bidirectional CRM and marketing automation integrations

- Privacy-compliant design supporting enterprise governance requirements

Best Use Cases:

- Account-based marketing teams needing intent signal identification

- Organizations implementing sophisticated lead scoring models

- Teams prioritizing timing optimization over contact discovery

- Companies seeking to complement existing contact data with behavioral insights

Implementation Considerations: Typically used alongside contact data sources rather than as standalone solution. Requires integration with existing CRM and marketing automation platforms for optimal value delivery.

7. Apollo.io: The Integrated Sales Engagement Platform

Apollo.io combines data intelligence with native outreach capabilities, offering unified platforms for both prospect identification and engagement execution.

Strategic Positioning:

- Primary Market: Enterprises seeking combined intelligence and engagement capabilities

- Core Value Proposition: Unified platform for data access and outreach execution

- Competitive Advantage: Integrated engagement functionality vs ZoomInfo's pure data focus

Key Differentiators:

- Integrated sequence builder enabling direct campaign execution

- Engagement analytics providing outreach effectiveness insights

- Large proprietary database with competitive coverage

- Chrome extension enhancing workflow integration

- Competitive pricing structure providing enterprise value

Best Use Cases:

- Organizations seeking to consolidate sales intelligence and engagement tools

- Teams needing immediate outreach capabilities alongside data access

- Small to mid-size enterprises preferring unified platform approaches

- Companies prioritizing cost efficiency over specialized functionality

Implementation Considerations: Minimal technical implementation with emphasis on sales process integration. Most effective for teams seeking simplified vendor management over specialized capabilities.

8. 6sense: The AI-Powered Account Engagement Platform

6sense focuses on AI-powered account engagement and anonymous buyer journey tracking rather than traditional contact discovery, emphasizing predictive intelligence over descriptive data.

Strategic Positioning:

- Primary Market: Enterprises implementing sophisticated revenue intelligence strategies

- Core Value Proposition: AI-powered anonymous intent identification and journey mapping

- Competitive Advantage: Buying stage intelligence vs ZoomInfo's contact details focus

Key Differentiators:

- AI-powered intent prediction identifying early-stage research activities

- Anonymous visitor identification uncovering hidden demand signals

- Buying stage identification supporting journey-based engagement strategies

- Predictive analytics enhancing revenue forecasting accuracy

- Dynamic account segmentation enabling personalized experiences

Best Use Cases:

- Enterprise teams implementing advanced account-based experience strategies

- Organizations with sophisticated marketing automation and CRM systems

- Teams prioritizing predictive intelligence over contact discovery

- Companies seeking to identify anonymous demand before competitor engagement

Implementation Considerations: Requires substantial technical integration and sales methodology alignment. Most effective for organizations with mature account-based strategies and advanced technical capabilities.

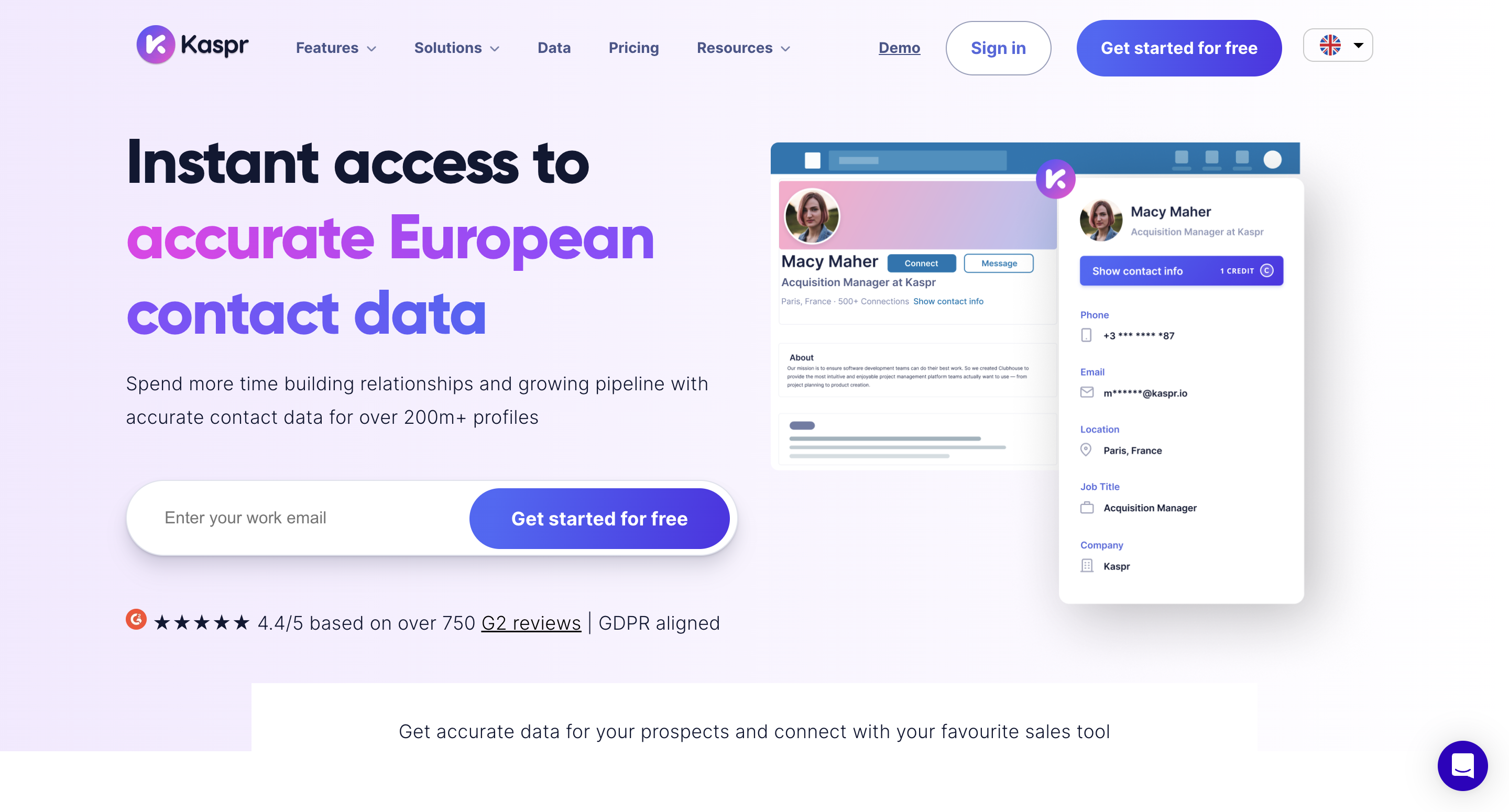

9. Kaspr: The GDPR-Compliant Contact Discovery Platform

Kaspr positions itself as the privacy-first contact intelligence platform, specializing in verified B2B contact data with built-in GDPR compliance for European markets and global privacy-conscious organizations.

Strategic Positioning:

- Primary Market: European enterprises and global companies requiring privacy-compliant prospecting

- Core Value Proposition: Verified contact discovery with comprehensive privacy compliance

- Competitive Advantage: GDPR compliance and data privacy focus vs ZoomInfo's broader data collection approach

Key Differentiators:

- GDPR-native architecture ensuring compliant data collection and processing

- Real-time contact verification providing 95%+ email accuracy rates

- LinkedIn extension offering instant contact discovery during social selling

- Phone number database including verified mobile and direct dial numbers

- Consent management system tracking data usage permissions automatically

Best Use Cases:

- Organizations operating in European markets requiring GDPR compliance

- Teams prioritizing data privacy and consent management

- Sales professionals practicing LinkedIn-based social selling

- Companies needing verified phone numbers for direct outreach campaigns

Implementation Considerations: Simple browser extension setup with immediate functionality. Requires basic privacy training for compliance best practices but minimal technical implementation complexity.

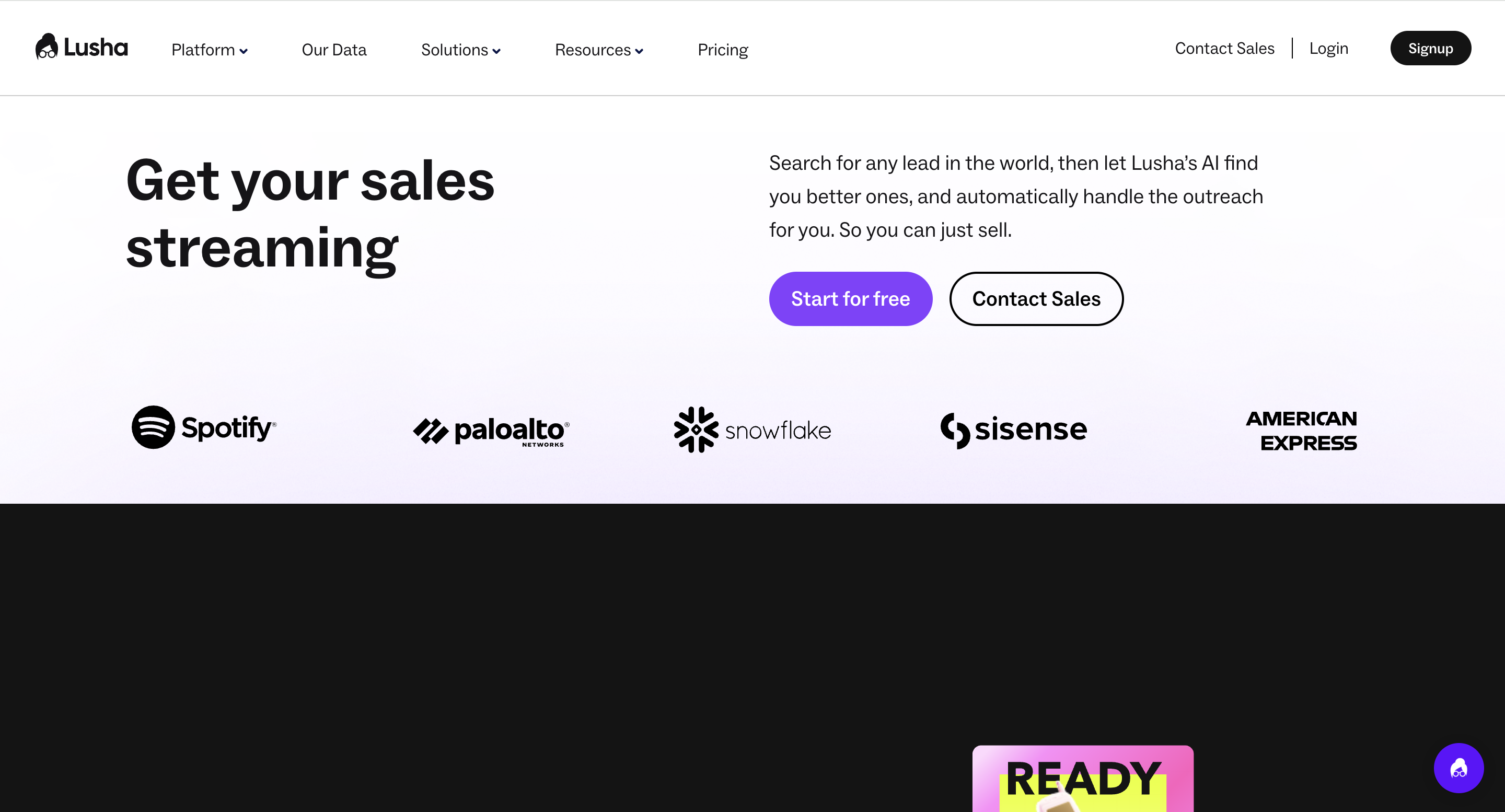

10. Lusha: The SMB-Focused Contact Intelligence Platform

Lusha positions itself as the accessible contact intelligence platform, emphasizing ease of use and immediate value delivery over comprehensive enterprise features.

Strategic Positioning:

- Primary Market: Small to mid-size businesses and individual sales professionals

- Core Value Proposition: Simple, immediate contact discovery with transparent pricing

- Competitive Advantage: Simplicity and accessibility vs ZoomInfo's enterprise complexity

Key Differentiators:

- Browser extension providing immediate contact discovery

- Transparent, usage-based pricing model

- Simple interface requiring minimal training

- LinkedIn integration enabling seamless prospect research

- Mobile app supporting field sales activities

Best Use Cases:

- Small to mid-size businesses with limited technical resources

- Individual sales professionals needing immediate contact access

- Teams prioritizing simplicity over comprehensive functionality

- Organizations seeking cost-effective contact discovery solutions

Implementation Considerations: Minimal implementation requirements with immediate value delivery. Best suited for organizations prioritizing simplicity and cost efficiency over enterprise-grade capabilities.

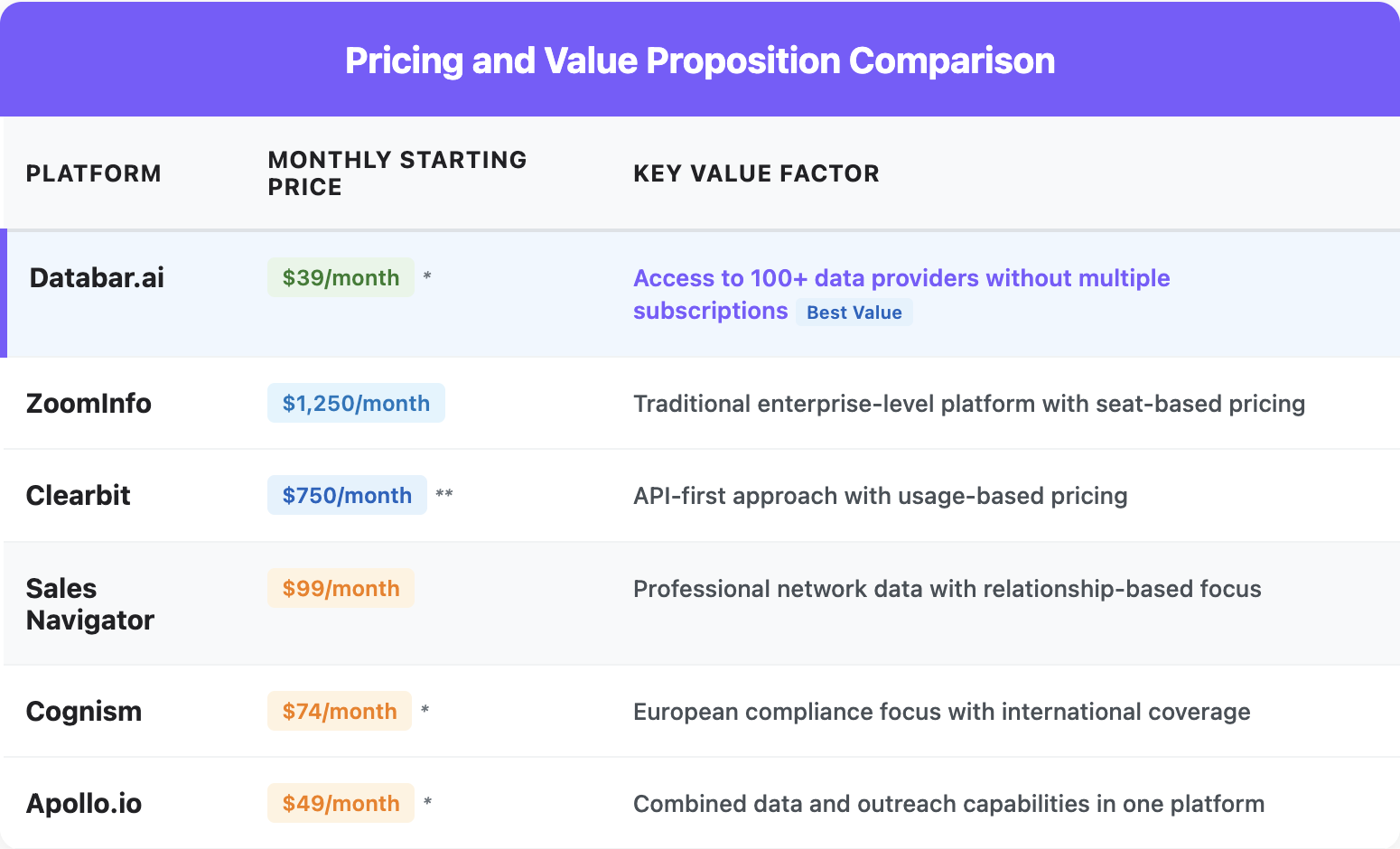

Pricing and Value Considerations: ZoomInfo Alternatives Cost Breakdown

Want to know exactly what you'll pay before committing to a data enrichment platform? Let's break down the monthly starting prices for the top ZoomInfo competitors so you can make a more informed budget decision:

Note: Enterprise packages typically include custom configurations, priority support, and volume discounts. Actual pricing will vary based on specific requirements and usage levels.

Databar.ai in the Enterprise Data Intelligence Landscape

Enterprise data solutions shouldn't require enterprise complexity or costs. In case you're wondering how we compare to other products when evaluating ZoomInfo competitors, here's how we deliver enterprise-level intelligence with accessible implementation approaches:

- Our depth vs Apollo.io - Enterprise data depth through 90+ specialized providers versus integrated platform approaches that combine data access with engagement functionality.

- Databar.ai compared to Cognism - Global enterprise data coverage through multi-source aggregation versus regional compliance specialization with focused European market expertise.

- Our intelligence vs 6sense - Complete data intelligence across contact and company information versus intent-focused platforms emphasizing buying signal identification and predictive analytics.

- Databar.ai versus Crunchbase - Evaluating enterprise data breadth across multiple provider sources

These architectural differences demonstrate how platform selection depends on whether your organization prioritizes comprehensive data access through multiple sources or specialized functionality within specific intelligence categories.

Strategic Decision Framework: Choosing the Right Platform

When to Choose Each ZoomInfo Competitor

Choose Databar.ai when:

- You need complete, accurate data from multiple specialized sources without managing several vendor relationships

- Your revenue targets depend on data quality and you can't afford gaps in contact information

- You require flexible, customizable workflows that adapt to your specific sales and marketing processes

- Budget efficiency matters and you want to eliminate wasted spend on unused seats or irrelevant data

- Global data coverage is essential and you need specialized regional insights beyond North America

- Compliance requirements are non-negotiable and you need comprehensive documentation for GDPR, CCPA, and other regulations

- You value a future-proof solution that adapts to changing data needs without requiring platform migrations

Choose Clearbit when:

- Your organization has strong technical resources and mature tech stacks

- Real-time data enrichment within existing systems is priority

- Marketing automation and website personalization are key use cases requiring automated enrichment

- You prefer API-first approaches over standalone platforms

Choose Sales Navigator when:

- Relationship-based selling is your primary methodology

- Teams focus on warm introductions and social selling approaches

- Microsoft ecosystem integration provides additional value

- Quality of connections matters more than quantity of contacts

Choose Cognism when:

- European market coverage is critical to your business

- Regulatory compliance requires specialized documentation and features

- Mobile phone data access is essential for your outreach strategy

- Global expansion requires platform with strong international capabilities

Choose Intent-Focused Platforms (TechTarget, Bombora, 6sense) when:

- Timing optimization is more important than contact discovery

- Your sales cycles are long and require early-stage engagement

- Account-based strategies emphasize buying signal identification

- Teams implement sophisticated lead scoring and prioritization

Common Implementation Pitfalls and How to Avoid Them

Over-Engineering the Solution

Many enterprises fall into the trap of selecting the most feature-rich platform rather than the one that best aligns with their actual requirements and capabilities. This often leads to under-utilization, user frustration, and poor ROI.

Solution: Start with clear use case definition and success metrics before evaluating platforms. Focus on platforms that excel in your specific priority areas rather than those offering the broadest feature sets.

Underestimating Integration Complexity

Platform evaluations often focus on features and pricing while underestimating the technical and organizational effort required for successful implementation, leading to delayed value realization and budget overruns.

Solution: Include technical teams early in the evaluation process and require detailed implementation plans from vendors. Factor integration complexity into total cost of ownership calculations.

Ignoring User Adoption Requirements

Selecting platforms that don't align with existing user workflows and capabilities often results in poor adoption, regardless of technical capabilities or data quality advantages.

Solution: Include end users in the evaluation process and prioritize platforms that enhance rather than disrupt existing productive workflows. Plan comprehensive change management alongside technical implementation.

Focusing Solely on Data Volume

Many organizations prioritize contact quantity over data relevance and quality, leading to inefficient outreach campaigns and poor conversion rates despite having access to large databases.

Solution: Evaluate platforms based on data relevance to your specific market, geography, and use cases rather than total database size. Prioritize quality metrics over volume statistics.

Conclusion: Making the Strategic Choice

The enterprise data intelligence landscape has evolved far beyond simple contact databases to sophisticated platforms serving specific strategic needs. While ZoomInfo remains a strong general-purpose solution, ZoomInfo competitors often deliver superior results for organizations with specialized requirements, compliance mandates, or technical capabilities.

The most successful implementations focus on strategic alignment rather than feature checklists. The key insight from this analysis is that the "best" platform depends entirely on your specific context, requirements, and capabilities. Rather than seeking universal solutions, focus on platforms that excel in your priority areas while integrating naturally with your existing systems and workflows.

For organizations seeking access to the broadest range of specialized data sources while maintaining enterprise-grade governance and compliance capabilities, Databar.ai offers a compelling alternative to traditional approaches. By connecting teams to 90+ data providers through a unified platform, Databar enables access to the most relevant data for specific industries, regions, and use cases without the vendor lock-in of proprietary databases.

The enterprise data intelligence market will continue evolving as buyer behavior becomes more sophisticated and regulatory requirements expand. Organizations that choose flexible, strategic approaches to data access will be better positioned to adapt to these changes while maintaining competitive advantages through superior intelligence capabilities.

Related articles

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026

How to Automate GTM Research with Claude Code

How Claude Code Cuts Weeks of GTM Research into Hours Without Sacrificing Depth

by Jan, February 20, 2026

Best MCP Servers for Sales Teams in 2026

How MCP servers are turning AI into a hands-on sales assistant that gets real work done

by Jan, February 20, 2026

How to Scrape Google Maps and Find Business Owners with Claude Code

A Step-by-Step Guide on How to Find Business Leads and Owner Emails From Google Maps with Claude Code

by Jan, February 19, 2026