Cognism Alternatives Analysis 2025

How the Top Global Sales Intelligence Platforms Compare

Blogby JanMay 21, 2025

Finding the right Cognism alternatives requires understanding the distinct approaches different platforms take to global sales intelligence. While Cognism has carved out a position as a compliance-focused provider with strong European coverage and mobile data, understanding how it compares to competitors is crucial for making an informed decision about which platform best suits your specific international prospecting needs.

This competitive analysis goes beyond simple feature comparisons to examine the fundamental differences in business models, regional strengths, and compliance frameworks among the leading global sales intelligence platforms in 2025. Whether you're considering Cognism or evaluating alternatives, this guide will help you understand the competitive landscape and identify which solution aligns best with your organization's international data requirements.

Understanding Cognism: Features, Benefits, and Key Differentiators

Cognism has established itself as a distinctive player in the global sales intelligence market with several key characteristics:

Core Platform Focus

At its foundation, Cognism offers:

- A B2B contact and company database with strong European coverage

- Compliance-first approach with emphasis on GDPR documentation

- Sales acceleration capabilities combining data and engagement

- Mobile phone number focus with strong direct dial coverage

- Trigger-based intelligence for event-driven selling

Primary Use Cases

Cognism typically serves organizations that:

- Prioritize European market prospecting

- Operate in regulated industries with strict compliance requirements

- Utilize phone-based selling approaches requiring direct dials

- Need balanced data and engagement capabilities

Distinctive Approach

What sets Cognism apart from many competitors:

- Built from the ground up with European regulations in mind

- Focus on mobile number accuracy rather than just email

- Trigger-event orientation rather than static profiles

- Mid-market positioning between basic tools and enterprise platforms

Understanding these fundamentals provides context for how Cognism competes in the broader marketplace and why alternatives might better suit different organizational needs.

The Global Sales Intelligence Competitive Landscape in 2025

The global sales intelligence market in 2025 has evolved significantly, with platforms differentiating themselves through specialized capabilities, regional focus, and business models. To understand how Cognism competitors position themselves, we need to examine the distinct market segments that have emerged:

Compliance-Focused vs. Feature-Rich Platforms

The market has split into two primary approaches to data governance:

Compliance-Focused Providers like Cognism, Databar.ai, and Select.io prioritize regulatory adherence with extensive documentation, transparent data sourcing, and built-in compliance frameworks. These platforms typically trade some functionality breadth for stronger governance features, appealing to organizations in regulated industries or with stringent privacy requirements.

Feature-Rich Platforms like ZoomInfo and Apollo.io emphasize breadth of capabilities, often including intent data, technographics, and advanced analytics. While still addressing compliance, these platforms tend to focus more on maximizing functionality than on governance documentation. They appeal to organizations prioritizing capability range over specialized compliance features.

European Specialists vs. Global Providers

Another key differentiator is regional specialization:

European Specialists like Cognism, Vainu, and Global Database have built their offerings around exceptional European market coverage. These platforms typically offer deeper penetration in European countries, better understanding of local business structures, and stronger regional compliance expertise. They appeal to organizations with significant European operations.

Global Providers like Databar.ai, ZoomInfo, and InsideView aim for balanced worldwide coverage. While they may have relative strengths in certain regions, their approach emphasizes consistent global data rather than exceptional depth in specific markets. These contact discovery platforms enable worldwide prospecting through comprehensive database access.

Cognism positions itself primarily as a compliance-focused European specialist with trigger-based capabilities, targeting mid-market and enterprise customers who need strong European coverage with solid compliance documentation. This positioning shapes both its strengths and limitations when compared to alternatives.

How Cognism's Business Model Shapes Its Competitive Position

Cognism's business approach significantly influences how it compares to competitors. Understanding this model helps explain where it excels and where alternatives might offer advantages.

The Cognism Approach

At its core, Cognism operates as a European-focused, compliance-oriented sales intelligence platform. Its business model centers around several key elements:

Regional Prioritization: Emphasis on European markets with particularly strong UK and Western European coverage, with secondary focus on North American and other global markets.

- Compliance-First Development: Built with GDPR and European regulations as foundational considerations rather than retrofitted compliance.

- Mobile-Centric Data: Strong focus on direct dial and mobile phone numbers compared to competitors' more email-centric approaches.

- Trigger Event System: Investment in detecting and alerting on company changes rather than just providing static profiles.

- Mid-Market Positioning: Feature set and pricing targeted between basic contact finders and premium enterprise platforms.

Competitive Strengths from this Model

This approach gives Cognism distinct advantages in certain areas:

- European Data Quality: Generally superior match rates and accuracy in European markets compared to global generalists.

- Regulatory Documentation: More comprehensive GDPR compliance resources than many competitors.

- Phone-Based Selling Support: Better direct dial and mobile coverage facilitating phone outreach.

- Event-Based Selling Enablement: More sophisticated trigger detection than basic contact platforms.

- Balanced Functionality: Practical combination of data and engagement features without the complexity of full enterprise platforms.

Competitive Vulnerabilities

However, this same model creates challenges when competing against certain alternatives:

- Global Coverage Imbalance: Less comprehensive data outside Europe compared to other platforms.

- Feature Depth Limitations: Fewer advanced capabilities than premium enterprise alternatives.

- Scalability Considerations: Pricing structure can become less competitive at larger scales.

- North American Coverage Gaps: Relative weakness in some US and Canadian data compared to North American specialists.

- Specialized Integration Limitations: Less extensive connectivity with certain marketing and sales platforms.

Understanding these fundamental aspects of Cognism's approach helps explain the specific competitive dynamics when comparing it directly to alternatives.

Head-to-Head Comparisons: Cognism vs. Key Competitors

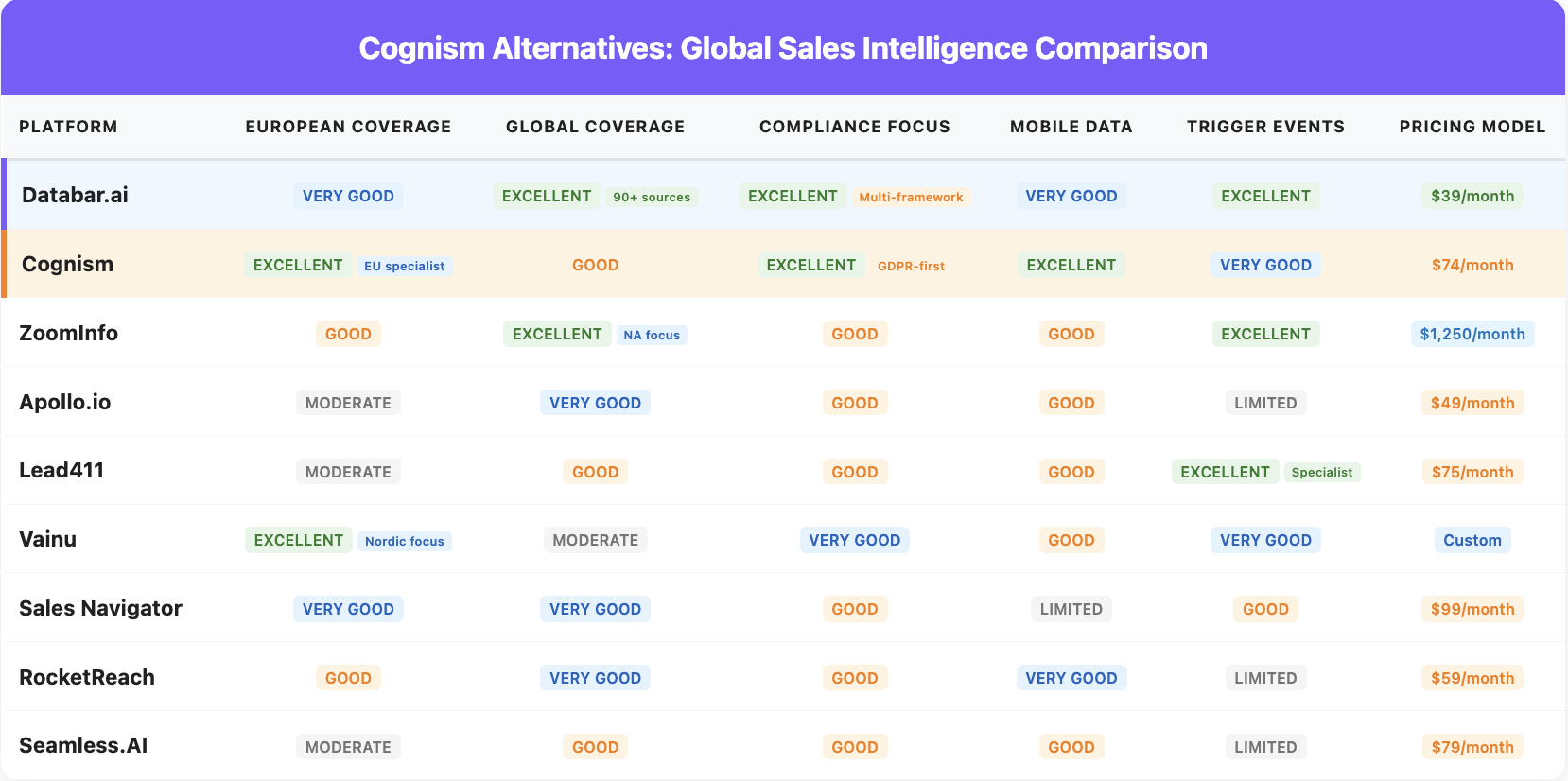

When evaluating Cognism against its major competitors, it's helpful to compare them directly across key categories that matter most to potential users. Here's how Cognism stacks up against five of its primary competitors in 2025:

Cognism vs. Databar.ai

Data Coverage:

- Cognism excels in European markets with particularly strong UK and Western European data

- Databar.ai offers more balanced global coverage through its multi-source approach connecting to over 90 data providers

Compliance Approach:

- Cognism provides excellent GDPR documentation and European compliance frameworks

- Databar.ai offers comprehensive multi-framework compliance covering GDPR, CCPA/CPRA, and other regional regulations

Platform Features:

- Cognism combines sales intelligence with basic sales acceleration capabilities

- Databar.ai focuses on customizable data workflows with extensive integration capabilities

Pricing Model:

- Cognism typically requires annual contracts with seat-based pricing

- Databar.ai offers more flexible options including monthly subscriptions and different consumption models

Best For:

- Cognism: Organizations primarily targeting European markets with phone-based selling

- Databar.ai: Global operations requiring balanced data across multiple regions with custom workflows

For teams needing flexible global coverage with strong integration capabilities, Databar.ai often provides superior value, while those focused specifically on European markets may prefer Cognism's regional depth.

Cognism vs. ZoomInfo

Data Coverage:

- Cognism offers strong European data with particular UK excellence

- ZoomInfo provides premium global coverage with North American superiority

Platform Sophistication:

- Cognism delivers focused functionality at a mid-market price point

- ZoomInfo offers comprehensive enterprise-grade capabilities at premium pricing

Key Differentiators:

- Cognism emphasizes mobile numbers and GDPR compliance

- ZoomInfo excels in technographic data, intent signals, and advanced analytics

Pricing Comparison:

- Cognism typically costs significantly less than ZoomInfo's enterprise offerings

- ZoomInfo requires substantial budget commitment but delivers broader capabilities

Best For:

- Cognism: Mid-market organizations with European focus and moderate budgets

- ZoomInfo: Enterprise organizations requiring comprehensive functionality with substantial data budgets

Companies weighing this choice must balance ZoomInfo's broader feature set against Cognism's more accessible price point and European strength.

➔ Get an in-depth look at Databar.ai compared to ZoomInfo.

Cognism vs. Apollo.io

Core Focus:

- Cognism concentrates on compliance-first European data with trigger events

- Apollo.io combines a large contact database with built-in sales engagement features

Platform Approach:

- Cognism emphasizes data quality and regulatory compliance, particularly in European markets

- Apollo.io focuses on providing an all-in-one platform with prospecting and outreach capabilities

Pricing Structure:

- Cognism typically requires contact with sales for custom enterprise pricing

- Apollo.io offers a freemium model with transparent tiered pricing starting at lower entry points

Key Differentiators:

- Cognism provides superior European coverage and mobile numbers with strong GDPR documentation

- Apollo.io offers integrated email sequences, a larger overall database, and more accessible pricing tiers

Best For:

- Cognism: Organizations prioritizing European markets, compliance requirements, and phone-based selling

- Apollo.io: Teams seeking combined prospecting and engagement capabilities with lower entry costs

While Cognism offers advantages for European-focused operations with regulatory concerns, Apollo.io appeals to teams looking for an integrated sales engagement platform with more accessible pricing and North American data strength.

Cognism vs. Lead411

Trigger Event Capabilities:

- Cognism offers solid event monitoring as part of its broader platform

- Lead411 specializes specifically in comprehensive trigger event coverage

Event Types Covered:

- Cognism tracks standard business changes like leadership transitions and funding

- Lead411 provides extensive event coverage including technology implementations, hiring patterns, and business expansions

Platform Balance:

- Cognism balances event monitoring with contact data and engagement

- Lead411 focuses more exclusively on trigger-based intelligence

Best For:

- Cognism: Teams wanting balanced data and trigger capabilities

- Lead411: Organizations heavily committed to event-based selling strategies

Teams that prioritize timely, event-driven outreach often find Lead411's specialized focus delivers more actionable intelligence than Cognism's more general approach.

➔ Check out how Databar.ai compares to Lead411 in this detailed review.

Cognism vs. Other Alternatives

Cognism vs. Vainu:

- Cognism offers broader European coverage

- Vainu provides deeper Nordic and Northern European data

- Best fit depends on specific regional priorities

Cognism vs. RocketReach:

- Cognism focuses on company intelligence with contact data

- RocketReach specializes in comprehensive individual contact methods

- Choice depends on whether company or contact intelligence is primary

➔ Get going with RocketReach inside Databar.ai now with our native integration.

Cognism vs. Sales Navigator:

- Cognism provides ready-to-use contact data for direct outreach

- Sales Navigator offers relationship-based prospecting within LinkedIn's network

- Many teams use both for complementary approaches

Cognism vs. Seamless.AI:

- Cognism delivers verified data with European strength

- Seamless.AI offers unlimited contact access with real-time verification

- Decision typically hinges on usage volume and verification preferences

Cognism vs. Global Database:

- Cognism combines data with sales acceleration

- Global Database focuses on comprehensive company intelligence

- Selection depends on whether engagement tools or depth of company information is prioritized

Each alternative offers distinct advantages that may better align with specific organizational requirements, target markets, or sales methodologies.

Choosing Between Cognism and Competitors: Decision Framework

When evaluating global sales intelligence platforms, focus on these five key factors to determine which solution best fits your specific needs:

1. Regional Prioritization

Your target geographies should drive platform selection. Organizations primarily targeting European markets often find Cognism's regional strength valuable, while those needing balanced global coverage may prefer Databar.ai's multi-source approach or Sales Navigator's comprehensive database. Companies focusing on specific regions should evaluate each platform's match rates in their particular priority markets rather than overall global claims.

2. Compliance Requirements

Different regulatory environments demand different platform capabilities. Teams operating under strict GDPR requirements often appreciate Cognism's compliance-first approach and extensive documentation. Organizations navigating multiple regulatory frameworks might prefer Databar.ai's multi-regulation support. Companies in highly regulated industries like healthcare or financial services may need the enterprise-grade compliance features of ZoomInfo or Databar.ai.

3. Outreach Methodology

Your sales approach significantly impacts platform value. Phone-based sellers typically benefit from Cognism's strong mobile and direct dial coverage or Databar.ai's phone number waterfall enrichment. Teams practicing trigger-based selling might prefer Lead411's specialized event detection. Account-based marketing organizations often find InsideView's deep company intelligence more valuable than transactional contact data. The platform should enhance your existing methodology rather than forcing adaptation.

4. Integration Ecosystem

Your existing tech stack should influence platform selection. Evaluate the depth of integration with your specific CRM beyond simple presence—does it sync the data fields you need? Consider connections to your marketing automation, sales engagement, and analytics tools. Assess API flexibility for custom applications. The ease of data transfer between systems can significantly impact team efficiency and adoption.

5. Budget Alignment

Different pricing models work better for different organization types. Enterprise teams with predictable needs may accept annual contracts like Cognism's for favorable terms. Growth-stage companies might prefer Databar.ai's flexible consumption options to accommodate changing requirements. High-volume users could find Seamless.AI's unlimited model more cost-effective. Consider not just headline price but total cost including implementation, training, and scaling as your usage grows.

By systematically evaluating these factors according to your specific requirements, you can identify which global sales intelligence platform will deliver the most value for your organization's unique situation.

Final Thoughts: Navigating the Global Sales Intelligence Landscape

Choosing between Cognism and its competitors requires careful consideration of your specific needs, regional priorities, and sales methodologies. While Cognism offers strong European coverage with a compliance-first approach that works well for many organizations, alternatives provide distinct advantages for different use cases.

For organizations with truly global operations requiring balanced data across multiple regions, Databar.ai offers a compelling alternative with its multi-source approach connecting to over 90 specialized regional providers. Teams with enterprise-level needs and budgets might find ZoomInfo's comprehensive feature set valuable despite its premium pricing. Organizations heavily committed to event-based selling could benefit from Lead411's specialized trigger focus, while those with complex enterprise sales cycles might prefer InsideView's intelligence-oriented approach.

The global sales intelligence market continues to evolve rapidly, with specialized regional providers, compliance innovations, and advanced analytics reshaping competitive dynamics. Successful organizations will select platforms that not only meet their current needs but are positioned to adapt to these emerging trends.

Ultimately, there's no universal "best" platform—only the solution that best fits your specific requirements. By understanding the distinct approaches of Cognism and its competitors, you can make an informed decision that positions your team for success in an increasingly data-driven global sales environment. Try Databar.ai for free today and see how our multi-source platform, wide range of data providers, and flexible workflows can boost your international prospecting.

If you're wondering how we compare to other products when evaluating Cognism alternatives, here are in-depth comparisons:

- Our expansion support vs ZoomInfo - Global expansion support through 90+ specialized providers versus enterprise implementation approaches that emphasize single-source comprehensive coverage with significant resource requirements.

- Databar.ai versus Apollo.io - International data coverage through multi-source aggregation versus platform approaches that provide integrated engagement capabilities with varying regional data strengths.

- How we stack up against other B2B Tools - Worldwide data intelligence through specialized regional providers versus traditional platforms that focus on specific market segments.

Related articles

How to Scrape Google Maps and Find Business Owners with Claude Code

A Step-by-Step Guide on How to Find Business Leads and Owner Emails From Google Maps with Claude Code

by Jan, February 19, 2026

Cold Email in 2026: How Claude Code Is Changing Outbound Strategy

How smarter, faster testing is breathing new life into cold email outreach

by Jan, February 18, 2026

Best Data APIs for Claude Code: 12 Providers GTM Teams Use

Automate your outbound campaigns using the 12 best data APIs tailored for Claude Code workflows

by Jan, February 17, 2026

How to Build an Outbound Campaign with Claude Code (Step by Step)

How to Use Claude Code to Build a Fully Automated Outbound Email Campaign in Under an Hour

by Jan, February 17, 2026