Bombora Alternatives: Best Intent Data Tools 2025

Find the Best Intent Data Solutions Beyond Bombora for Every Budget and Industry in 2025

Blogby JanMay 30, 2025

Intent data shouldn't be a luxury reserved for enterprise budgets. Most sales and marketing teams seek platforms that offer accessible pricing for buyer signals, provide broad coverage across various sectors, and enable straightforward implementations that deliver quick time-to-value.

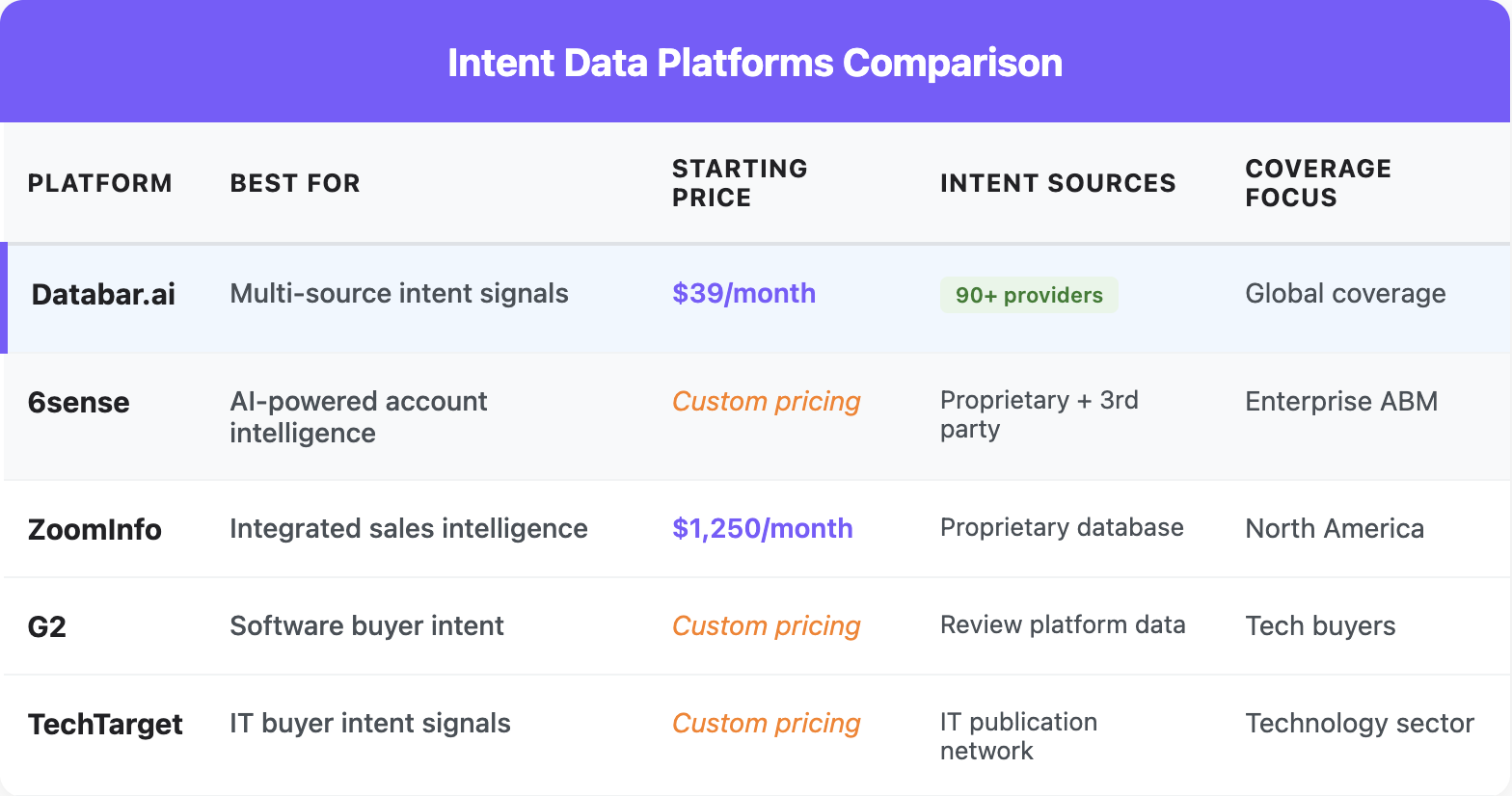

Here's what you need to know about the top Bombora alternatives in 2025:

This analysis reveals why thousands of revenue teams are exploring alternatives to Bombora to find more accessible, flexible, and thorough intent data solutions. You'll discover which alternative delivers the highest ROI for your specific buyer signal needs, industry focus, and go-to-market strategy.

Understanding Bombora: Capabilities and Market Positioning

Bombora has established itself as a pioneer in B2B intent data, providing insights into companies actively researching specific topics and solutions. The platform aggregates content consumption patterns across business publications and websites to identify accounts showing buying intent signals.

What Bombora does well:

- Comprehensive content network for intent signal collection

- Topic-based intent scoring and account identification

- Integration with major marketing automation and CRM platforms

- Focus on account-level intent rather than individual contact behavior

Areas where teams might seek alternatives:

Enterprise pricing focus makes Bombora primarily accessible for larger organizations with substantial budgets. The platform's enterprise positioning means starting costs that often exceed 5-figures annually, which may be challenging for most mid-market and small business teams seeking intent data solutions.

Industry coverage concentration affects teams selling outside technology and professional services sectors. Bombora's content network emphasizes tech-focused publications, which may create coverage gaps for teams targeting manufacturing, healthcare, financial services, and other traditional industries.

Implementation requirements can extend time-to-value for teams needing immediate buyer signal intelligence. The platform typically requires extensive setup, data integration, and account mapping that may take months to deploy effectively across sales and marketing organizations.

Account-level focus provides limited actionable intelligence for teams needing contact-level insights. Bombora identifies companies showing intent but offers minimal guidance on specific individuals researching solutions within those organizations.

Topic coverage scope concentrates on predefined categories that may not align with specialized or emerging solution areas. Teams selling innovative or niche products sometimes find limited topic coverage for their specific market segments.

These considerations have created demand for more accessible, flexible intent data solutions that provide immediate value without enterprise complexity or industry limitations.

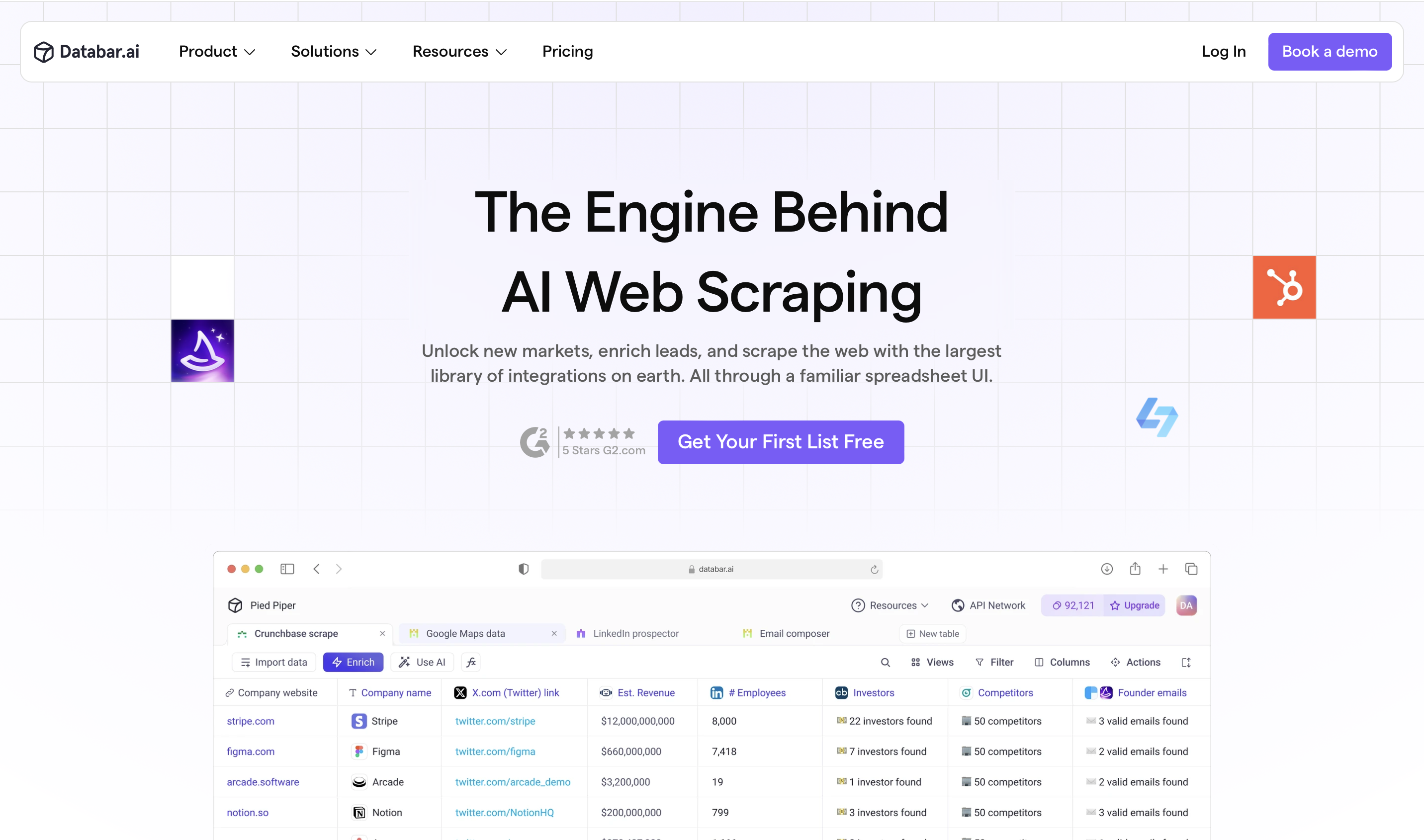

1. Databar.ai

Databar.ai reshapes intent data access by aggregating buyer signals from over multiple specialized providers, offering broad coverage that surpasses any single-source solution while maintaining accessible pricing for teams of all sizes.

Advantages of Databar.ai:

Extensive intent coverage resulting from combining multiple intent data sources rather than relying on a single content network. While Bombora monitors specific publications, Databar.ai accesses intent signals from job postings, company news, hiring patterns, funding announcements, technology adoptions, and dozens of other buyer signal sources automatically.

Real-time signal processing provides fresh buyer intelligence as it emerges rather than waiting for content aggregation delays. The platform's AI monitoring capabilities identify intent signals from company websites, job postings, and public announcements within seconds of running a query.

Contact-level intelligence combines account intent signals with decision-maker identification and contact information. Unlike Bombora's account-focused approach, teams receive actionable insights including specific individuals researching solutions for enriched prospecting workflows.

Advanced AI research capabilities go beyond traditional intent monitoring to provide contextual insights about buyer behavior and company initiatives. The platform's research agent can analyze company websites, recent announcements, and hiring patterns to identify specific pain points and timing signals.

Transparent, accessible pricing starts at $39 monthly with clear credit-based consumption, making enterprise-grade intent data available to growing companies and small teams. This represents a fraction of Bombora's enterprise pricing while providing broader coverage and more actionable insights.

Global market intelligence includes intent signals from international markets and non-English content sources that expand beyond Bombora's primarily English-language content network. Teams pursuing global expansion benefit from local market insights.

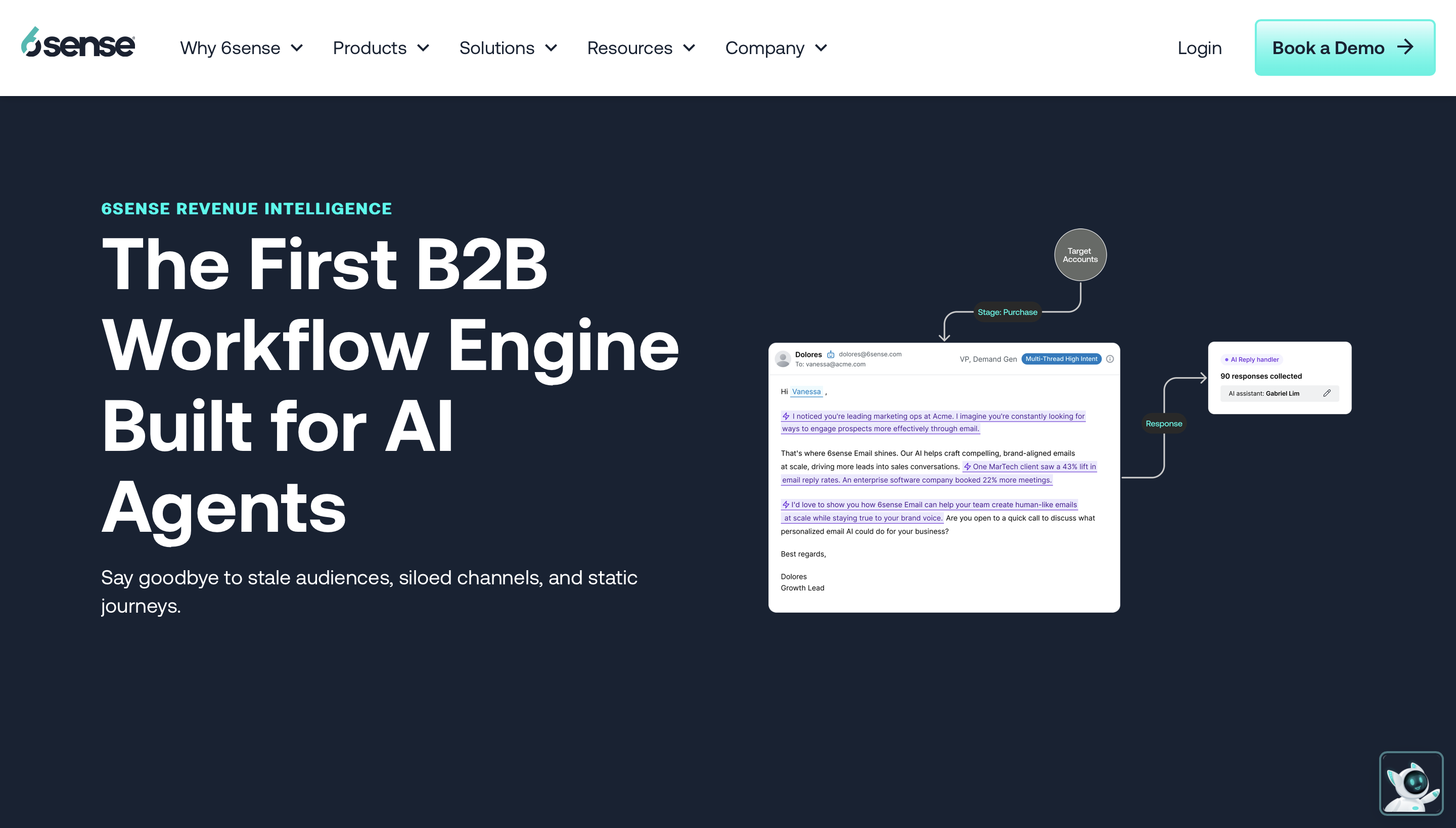

2. 6sense

6sense takes a sophisticated approach to intent data by combining proprietary AI algorithms with multiple data sources to identify account-level buying stages and optimal engagement timing through comprehensive buyer journey analysis.

AI-driven intelligence advantages:

6sense employs machine learning models to analyze anonymous website behavior, content engagement patterns, and technographic changes to identify accounts entering buying cycles before traditional intent signals become apparent.

The platform's predictive analytics capabilities forecast account buying probability and optimal timing for sales engagement, providing strategic advantages for account-based marketing and sales approaches.

Comprehensive account insights:

6sense combines intent data with account profiling, contact discovery, and engagement orchestration to provide end-to-end revenue intelligence rather than isolated intent monitoring.

Anonymous visitor identification helps teams understand which accounts are researching solutions without revealing themselves through form submissions or direct engagement, providing early-stage intent signals.

Intent data sources and coverage:

The platform aggregates intent signals from web behavior, content consumption, technographic changes, and third-party data partnerships to create comprehensive buying stage analysis.

Industry coverage extends across multiple sectors though with particular strength in technology and professional services markets where digital research behavior is most pronounced.

Enterprise complexity and investment requirements:

6sense targets large enterprises with sophisticated revenue operations, requiring substantial implementation efforts and dedicated resources for effective deployment and optimization.

Custom pricing models typically require significant annual commitments that may exceed most mid-market budgets, though the platform provides comprehensive functionality for organizations that can support the investment.

Enterprise ABM scenarios: Large organizations implementing sophisticated account-based marketing programs find 6sense's comprehensive approach valuable for coordinated sales and marketing efforts, though smaller teams may find the complexity and cost considerations challenging.

➔ View a thorough comparison between Databar.ai and 6sense

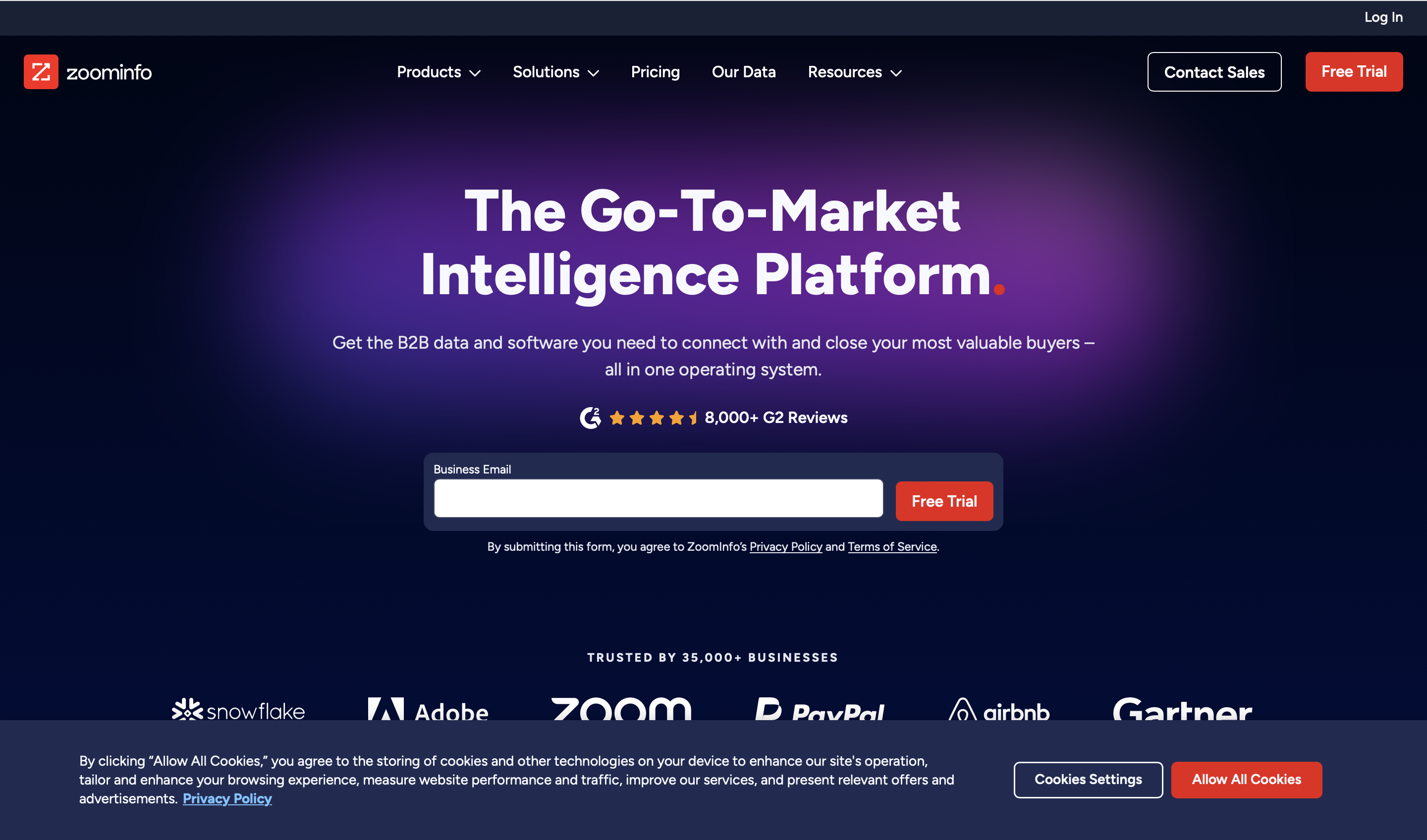

3. ZoomInfo

ZoomInfo combines intent data capabilities with comprehensive contact and company intelligence, offering buyer signals alongside prospect identification within a unified sales intelligence platform.

Intent data integration advantages:

ZoomInfo's intent monitoring integrates seamlessly with contact discovery and company intelligence, providing comprehensive account insights that combine buyer signals with decision-maker identification and contact information.

The platform's extensive company database enables intent signal correlation with firmographic data, helping teams understand account characteristics and buying potential beyond isolated research activity.

Intent signal sources and methodology:

ZoomInfo aggregates intent data from content consumption patterns, website behavior, and technographic changes within their proprietary data collection network.

Scoops feature provides intent signals through company news, funding announcements, and organizational changes that often correlate with increased solution research activity.

Sales-focused intent application:

Intent signals connect directly to contact records and account profiles, enabling immediate outreach to prospects showing buyer behavior without requiring separate data correlation or research steps.

Built-in sales engagement features allow teams to act on intent signals through coordinated email, phone, and social outreach campaigns within the same platform.

Enterprise investment and geographic considerations:

Pricing typically starts around $15,000 annually for basic access, with comprehensive intent data often requiring premium packages that exceed $30,000 yearly for full functionality.

Intent monitoring shows strongest performance in North American markets and technology sectors, which may limit effectiveness for international teams or specialized industries.

Enterprise sales scenarios: Large sales organizations with substantial budgets and dedicated operations support find ZoomInfo's integrated approach valuable for combining intent intelligence with comprehensive prospect development, particularly in North American technology markets.

➔ Get an in-depth look at Databar.ai compared to ZoomInfo

4. G2

G2 specializes in software buyer intent data by monitoring review activity, comparison research, and vendor evaluation behaviors on their platform, providing high-quality intent signals for technology vendors.

Review-based intent intelligence:

G2's intent data comes from genuine buyer research activity including software reviews, vendor comparisons, and category research that indicates active evaluation processes.

High-intent signal quality emerges from monitoring actual buyer behavior rather than passive content consumption, providing stronger correlation with purchase intent and timing.

Software category expertise:

Comprehensive coverage of software categories and vendor comparisons provides detailed intent intelligence for technology companies selling business software solutions.

Category-specific intent monitoring helps teams understand competitive landscape dynamics and identify accounts comparing multiple vendors or solution types.

Buyer journey intelligence:

G2 tracks buyer progression through research stages including initial category exploration, vendor comparison, and detailed evaluation activities that indicate buying stage advancement.

Intent signal timing correlation with review activity and comparison research provides actionable intelligence for optimal sales engagement timing.

Technology sector focus and scope:

Strong performance in software and technology markets may provide limited value for teams selling non-technology solutions or targeting industries outside G2's primary user base.

Intent data coverage focuses on companies actively researching software solutions rather than broader business intelligence or service provider evaluation.

Software vendor scenarios: Technology companies selling business software find G2's review-based intent data particularly valuable for identifying accounts actively evaluating solutions and understanding competitive positioning within buyer research processes.

5. TechTarget

TechTarget provides intent data through their extensive network of IT-focused publications and content properties, offering deep coverage of technology buyer research activity and solution evaluation processes.

IT-focused content network:

TechTarget's intent data emerges from comprehensive monitoring of IT publication readership, content engagement, and research activity across dozens of specialized technology publications.

Industry expertise and content quality provide high-relevance intent signals for teams selling enterprise technology solutions, cybersecurity, cloud services, and IT infrastructure.

Deep technology coverage:

Specialized publications covering specific technology categories including security, networking, storage, and enterprise software provide granular intent intelligence for niche technology markets.

Technical content depth attracts serious technology buyers conducting detailed solution research, resulting in higher-quality intent signals compared to general business publications.

Enterprise technology focus:

Intent monitoring concentrates on enterprise IT decision-makers and technology evaluation processes, providing strategic intelligence for vendors selling complex technology solutions.

Content network reach and audience quality help identify accounts researching specific technology categories with genuine budget and buying authority.

Industry and market scope:

Technology sector focus may provide limited value for teams selling outside IT and enterprise technology markets, requiring additional intent sources for broader industry coverage.

Enterprise focus may offer limited insight into small business or mid-market technology buying behavior that occurs through different research channels.

Enterprise technology scenarios: Vendors selling enterprise technology solutions including cybersecurity, cloud infrastructure, and business software find TechTarget's specialized intent monitoring valuable for identifying serious technology buyers and understanding competitive research activity.

6. Demandbase

Demandbase combines intent data with comprehensive account intelligence and ABM orchestration, providing coordinated buyer signal monitoring and engagement automation for account-based marketing programs.

ABM-integrated intent intelligence:

Demandbase integrates intent monitoring with account-based marketing automation, enabling coordinated engagement based on buyer signal detection and account prioritization.

Account scoring combines intent data with firmographic and technographic intelligence to identify high-value accounts showing buying behavior and optimal engagement timing.

Multi-source intent aggregation:

The platform combines proprietary intent data collection with third-party sources to provide comprehensive buyer signal coverage across content networks and research activities.

Intent signal correlation with account intelligence helps teams understand buying committee dynamics and decision-maker engagement patterns within target accounts.

Marketing automation integration:

Deep integrations with marketing automation platforms enable automated campaign orchestration based on intent signals and buying stage identification for coordinated ABM programs.

Account journey tracking combines intent data with engagement history to provide comprehensive views of buyer progression and optimal next-step recommendations.

Enterprise complexity and investment:

Demandbase targets large enterprises with sophisticated marketing operations, requiring substantial implementation efforts and dedicated resources for effective ABM program deployment.

Custom pricing models and enterprise focus may exceed requirements and budgets for smaller teams seeking basic intent data without comprehensive ABM orchestration.

Enterprise ABM scenarios: Large marketing organizations implementing sophisticated account-based marketing programs find Demandbase's integrated approach valuable for coordinated intent-driven engagement, though smaller teams may require simpler intent data solutions.

7. LeadSift

LeadSift specializes in social media intent monitoring by analyzing social conversations, professional discussions, and community engagement that indicates buying interest and solution research activity.

Social conversation intent monitoring:

LeadSift monitors social media platforms, professional communities, and industry forums to identify conversations indicating buying intent, solution research, and vendor evaluation activities.

Social listening capabilities extend beyond traditional content monitoring to capture informal buyer research and peer recommendation activities that other intent platforms may miss.

Real-time social intelligence:

Social media monitoring provides immediate intent signals as conversations develop, enabling rapid response to buying signals and competitive mentions within professional communities.

Community engagement analysis helps identify influential voices and decision-makers participating in solution research discussions within industry-specific groups.

Conversation quality and context:

Social intent signals include conversational context and peer interaction patterns that provide strategic insights into buyer priorities, challenges, and evaluation criteria.

Industry community monitoring captures intent signals from specialized professional groups and trade association discussions that general content networks cannot access.

Platform coverage and scope:

Focus on social media and community platforms may miss intent signals from traditional content consumption and formal research activities that other platforms monitor effectively.

Social conversation volume varies significantly by industry and solution category, potentially limiting signal availability for specialized markets or emerging solution areas.

Social engagement scenarios: Teams selling to industries with active professional communities and social media engagement find LeadSift's social conversation monitoring valuable for identifying informal buyer research and peer influence activities.

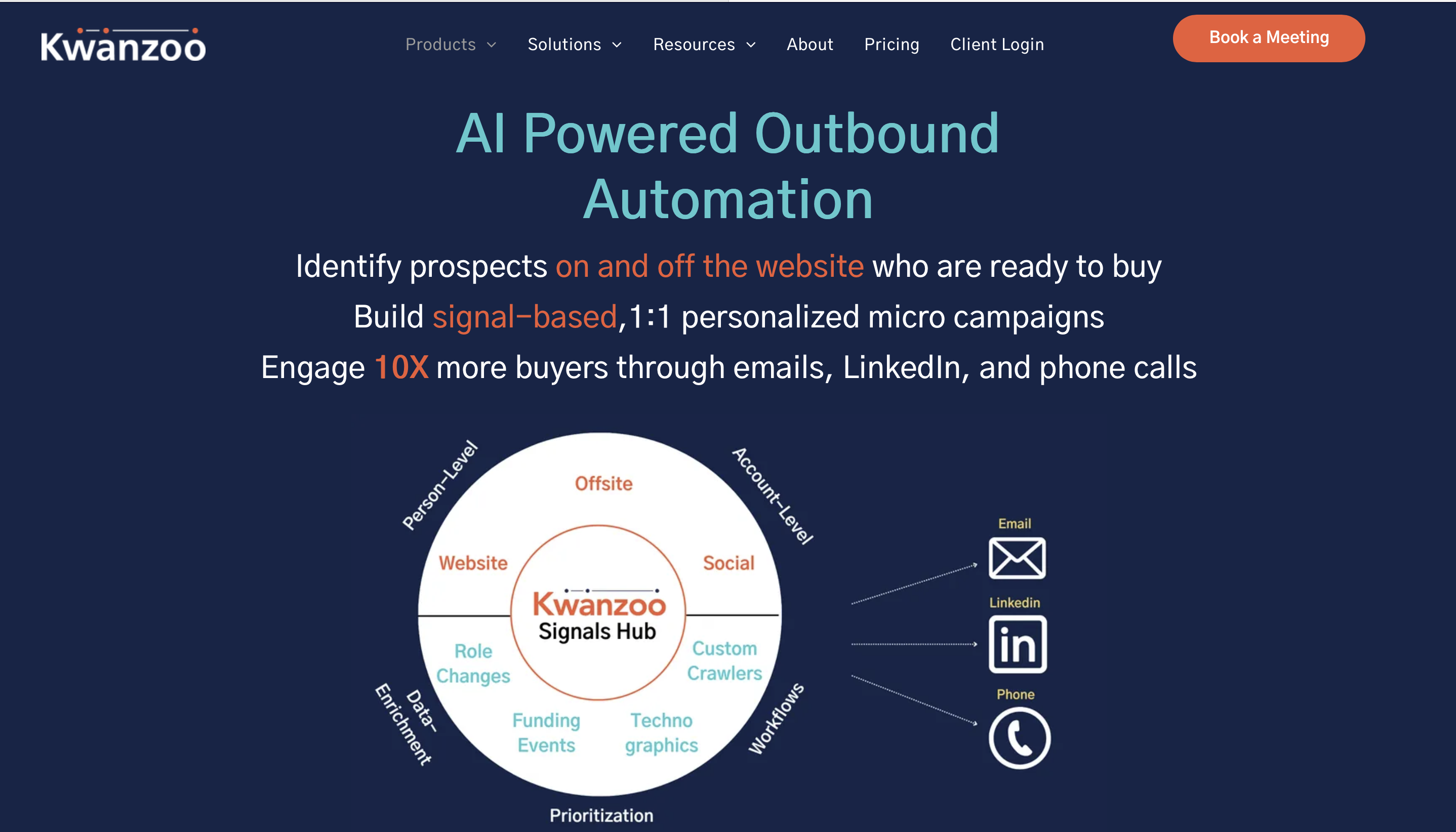

8. Kwanzoo

Kwanzoo specializes in aggregating intent data from multiple third-party sources, providing comprehensive buyer signal intelligence through partnerships with various content networks and data providers.

Multi-source intent aggregation:

Kwanzoo combines intent signals from multiple content networks, publication sources, and research platforms to provide comprehensive buyer signal coverage that exceeds single-source limitations.

Data aggregation approach allows teams to access diverse intent sources through unified reporting and analysis rather than managing multiple intent data subscriptions.

Intent signal normalization:

The platform standardizes intent signals from various sources into consistent scoring and reporting formats, simplifying analysis and activation of multi-source buyer intelligence.

Cross-source validation helps improve intent signal accuracy by correlating buyer behavior across multiple research channels and content consumption patterns.

Flexible source selection:

Teams can customize intent data sources based on industry focus, solution categories, and buyer research patterns specific to their target markets and customer segments.

Source transparency allows teams to understand intent signal origins and quality, enabling optimization of data sources for maximum relevance and accuracy.

Implementation and integration considerations:

Multi-source aggregation may require more complex setup and configuration compared to single-source intent platforms, though with potential for broader coverage.

Integration capabilities vary depending on selected data sources and may require additional technical resources for optimal deployment and ongoing management.

Multi-source scenarios: Teams seeking comprehensive intent coverage across multiple data sources find Kwanzoo's aggregation approach valuable for maximizing buyer signal intelligence without managing separate vendor relationships.

9. RB2B

RB2B specializes in website visitor identification and intent signal capture, providing immediate intelligence about prospects actively researching solutions on your website and competitor sites.

Real-time visitor identification:

RB2B deanonymizes website visitors to reveal company and contact information for prospects actively browsing your solution pages, providing immediate intent signals from first-party engagement.

The platform captures visitor behavior patterns including page views, content engagement, and research duration to provide actionable intelligence about buying stage and solution interest.

Direct engagement intelligence:

Website tracking capabilities identify specific prospects researching solutions, enabling immediate outreach while buyer interest is peak and research activity is fresh.

Integration with Slack and CRM platforms ensures intent signals reach sales teams immediately for rapid response to high-intent visitor activity.

US market focus and compliance:

RB2B concentrates on US-based visitor identification with strong compliance frameworks including GDPR, CCPA, and CPRA adherence for regulatory requirements.

The platform provides detailed contact information including job titles, LinkedIn profiles, and direct contact details for identified website visitors.

Implementation and scope considerations:

Focus on US market visitors may limit value for teams with significant international traffic or global prospect targeting requirements.

Website-based intent signals provide immediate engagement opportunities but may require supplementary sources for comprehensive market intelligence.

Direct engagement scenarios: Teams seeking immediate response to website visitor intent find RB2B's real-time identification valuable for capturing prospects during active research phases.

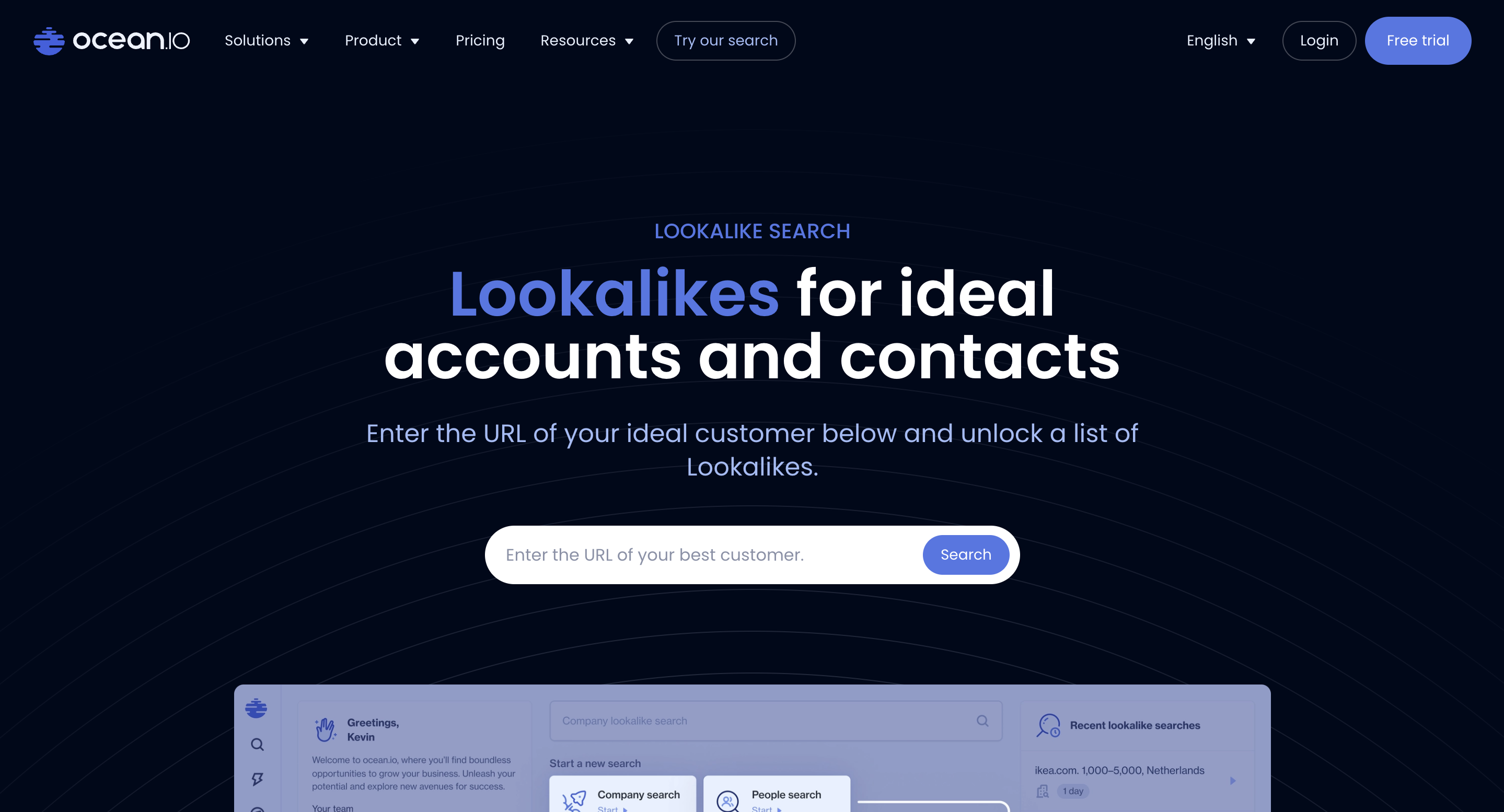

10. Ocean.io

Ocean.io leverages artificial intelligence and machine learning to identify intent signals through lookalike customer analysis, helping teams discover prospects with similar buying patterns and characteristics to existing successful customers.

AI-driven lookalike intelligence:

Ocean.io uses machine learning algorithms and natural language processing to analyze existing customer profiles and identify similar prospects showing comparable buying behavior and solution research patterns.

The platform's AI-driven approach identifies intent signals by recognizing patterns in company characteristics, technology usage, and market behavior that correlate with successful customer profiles.

Advanced filtering and refinement:

Comprehensive filtering capabilities allow teams to refine lookalike searches based on specific criteria including industry, company size, technology stack, and behavioral patterns for targeted prospect identification.

Search refinement tools enable teams to customize intent signal detection based on successful customer characteristics and buying journey patterns specific to their solution categories.

Intent signal correlation:

Ocean.io identifies prospect intent by correlating company behavior with successful customer patterns, providing intelligence about accounts likely to show buying interest based on historical success data.

Behavioral analysis helps teams understand which companies are entering buying cycles similar to successful customer journeys, enabling proactive engagement strategies.

Scale and automation benefits:

Automated prospect identification scales intent signal detection across large market segments, enabling teams to identify high-potential accounts without manual research requirements.

Continuous learning algorithms improve intent signal accuracy over time by analyzing customer success patterns and refining prospect identification criteria.

Customer replication scenarios: Teams with established customer bases seeking to identify similar prospects showing comparable intent signals find Ocean.io's AI-powered approach valuable for scaling successful customer acquisition patterns.

11. Trigify

Trigify specializes in social media intent monitoring by analyzing social conversations, engagement patterns, and community discussions that indicate buying interest and solution research activity across professional networks and industry communities.

Social conversation intent monitoring:

Trigify monitors social media platforms, professional communities, and industry forums to identify conversations indicating buying intent, solution research, and vendor evaluation activities within target markets.

Social listening capabilities extend beyond traditional content monitoring to capture informal buyer research, peer recommendations, and competitive discussions that other intent platforms may miss.

Real-time social intelligence:

Social media monitoring provides immediate intent signals as conversations develop, enabling rapid response to buying signals and competitive mentions within professional communities and industry groups.

Community engagement analysis helps identify influential voices and decision-makers participating in solution research discussions within industry-specific groups and professional networks.

Industry conversation tracking:

Social intent signals include conversational context and peer interaction patterns that provide strategic insights into buyer priorities, challenges, and evaluation criteria within specific market segments.

Industry community monitoring captures intent signals from specialized professional groups and trade association discussions that general content networks cannot access effectively.

Engagement trend analysis:

Trigify identifies topics and trends that prospects interact with most frequently, enabling teams to tailor outreach strategies and content approaches based on demonstrated social engagement patterns.

Competitor conversation monitoring helps teams understand market positioning and identify prospects comparing multiple vendors through social research activities.

Social engagement scenarios: Teams selling to industries with active professional communities and social media engagement find Trigify's social conversation monitoring valuable for identifying informal buyer research and peer influence activities.

Strategic Recommendations: Choosing the Right Intent Data Solution

The optimal Bombora alternative depends entirely on your team's budget considerations, industry focus, implementation timeline, and strategic intent data objectives. Teams benefit from comprehensive prospecting tools that integrate intent signals with contact discovery.

For Small Businesses and Startups (Under 50 employees): Databar.ai provides the best combination of comprehensive intent coverage and accessible pricing for growing teams. Small businesses gain access to enterprise-level buyer signal intelligence without the implementation complexity or budget considerations that may make other platforms challenging.

For Mid-Market Companies (50-500 employees): Databar.ai again emerges as the optimal choice, offering flexibility to customize intent monitoring for specific industries and solution categories while supporting rapid implementation and immediate value creation.

For Enterprise Organizations (500+ employees): Large enterprises should evaluate Databar.ai's Enterprise tier alongside 6sense and Demandbase, considering implementation complexity, integration requirements, and comprehensive intent data program needs.

For Technology Companies: G2, TechTarget, and Foundry provide specialized technology buyer intent monitoring, though Databar.ai's multi-source approach often delivers broader coverage including technology and adjacent markets.

For Account-Based Marketing: 6sense and Demandbase excel in ABM integration and orchestration, though Databar.ai provides more accessible entry points for teams developing ABM capabilities.

Implementation Strategy

Moving toward more accessible intent data solutions requires strategic planning to maintain buyer signal intelligence while gaining improved coverage and cost efficiency.

Current Usage Assessment: Document your current usage patterns, industry coverage needs, and integration requirements. Identify specific considerations like budget constraints, implementation complexity, or industry coverage gaps that drive the need for alternatives.

Establish baseline metrics including intent signal quality, coverage effectiveness, and cost per qualified signal to measure improvement after transition.

Platform Evaluation and Testing: Test alternatives with your actual target markets and industry requirements. Focus on intent signal quality, coverage breadth, and workflow integration rather than just feature comparisons.

Run parallel testing for 4-6 weeks comparing results between existing platforms and preferred alternatives, paying attention to signal relevance, implementation ease, and cost efficiency.

Migration Planning and Execution: Plan gradual transition starting with specific industry segments or use cases to validate new platform performance. Maintain existing access during transition to handle urgent needs while teams adapt.

Configure integrations and train teams on new workflows, emphasizing capabilities that address previous considerations like improved accessibility or enhanced industry coverage.

Performance Optimization: Monitor key metrics during the first month including intent signal quality, industry coverage, and workflow efficiency. Document best practices and optimization opportunities discovered during transition.

Scale successful approaches across the organization while maintaining focus on industry-specific optimization for maximum ROI.

Frequently Asked Questions About Intent Data Alternatives

How do intent platforms that gather data from many providers compare to single network providers like Bombora? Platforms like Databar.ai collect intent data from dozens of specialized providers, which greatly increases the amount of data and the variety of industries covered. Single network providers may have a wide reach across many publications, but they can miss important signals when certain industries or buyer behaviors are outside their main content areas. Platforms that combine data from multiple sources fill these gaps by checking different providers, often resulting in broader coverage and more diverse signals.

How do specialized platforms like G2 or TechTarget compare to comprehensive intent solutions? Specialized platforms excel in their focus areas but may require supplementary sources for comprehensive coverage. G2 provides superior software buyer intent while TechTarget offers excellent IT buyer intelligence. Most teams benefit from combining specialized sources with comprehensive platforms like Databar.ai for complete market coverage.

What about implementation timelines between these alternatives? Implementation timelines vary significantly between platforms. Databar.ai enables immediate activation with minimal setup, while enterprise platforms may require more time for configuration. Self-service platforms generally offer faster time-to-value compared to enterprise solutions, which often require extensive customization

Conclusion: Selecting Your Optimal Intent Data Solution

In 2025, the intent data market provides strong alternatives to Bombora’s enterprise-centered model, offering great accessibility, broad industry reach, and simple implementation to help more teams effectively use buyer signal intelligence.

Databar.ai stands out for most revenue teams, combining comprehensive intent coverage through 90+ specialized providers, immediate implementation value, and accessible pricing starting at $39 monthly. The platform's multi-source approach addresses single-network limitations while providing enterprise-grade intelligence without enterprise complexity.

For teams with specific requirements, specialized alternatives offer targeted value: G2 for software buyer intent, TechTarget for IT buyer signals, and 6sense for sophisticated ABM programs. Many teams discover that Databar.ai's wholistic approach provides the flexibility to address diverse intent monitoring needs while maintaining cost efficiency. The future belongs to adaptable platforms that can access the best intent sources for any industry, solution category, or buyer behavior pattern.

No credit card required. Full access to 90+ data providers in one platform.

Intent data becomes actionable when combined with comprehensive prospect intelligence. In case you're wondering how we compare to other products, here's how we enhance intent-driven strategies before selecting Bombora alternatives:

- Our approach vs 6sense - Intent-enhanced prospecting with multi-source coverage (access to 90+ data providers)

- Databar.ai compared to ZoomInfo - Accessible intent intelligence with transparent pricing models

- How we differ from Persana - See detailed platform comparison

Related articles

Context Engineering for GTM Teams: The Complete Guide

Turn Your GTM Approach with AI That Knows Your Audience and Plays by Your Rules

by Jan, February 27, 2026

How to Build Claude Code Skills for GTM (With Templates)

Master GTM Automation with Step-by-Step Claude Code Skill Templates

by Jan, February 26, 2026

Claude Code for GTM Engineers: The Practical Guide to Building Campaigns in 2026

How GTM engineers can save time and boost accuracy with Claude Code

by Jan, February 25, 2026

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026