Apollo.io Competitors: Comparing the Top Sales Intelligence Platforms in 2025

How Databar.ai and Other Top Apollo.io Competitors Stack Up

Blogby JanMay 23, 2025

Many sales teams today are seeking the perfect blend of prospecting data and engagement tools. While Apollo.io has emerged as a widely adopted and effective platform integrating these critical functions, the sales intelligence market continues to evolve. Modern sales and marketing leaders understand that maximizing revenue often requires a specialized approach, as no single platform can optimally serve every unique strategy or business need.

Apollo.io competitors are not merely alternatives; they represent a spectrum of specialized solutions designed to cater to distinct requirements for data depth, advanced engagement, global compliance, or seamless integration within diverse tech stacks. This comprehensive guide will explore the top 10 platforms sales teams are leveraging today, either alongside or as a primary alternative to Apollo.io. We'll uncover their strategic strengths, ideal use cases, and how to identify the perfect fit to enhance your sales pipeline and achieve exceptional growth in 2025.

The key to optimizing your sales tech stack lies in identifying the strategic approach that aligns precisely with your sales methodology, target market, and operational objectives. By the end of this analysis, you'll gain a clear understanding of which platform can best address your specific sales intelligence challenges, potentially leading to improved efficiency and significant boosts in team performance.

Why Sales Teams Are Exploring Apollo.io Alternatives

While Apollo.io excels as an integrated solution for prospecting and outreach, many sales organizations are encountering specific limitations that drive them to explore alternatives. The sales intelligence market has matured, offering specialized tools that address these evolving needs:

- Niche Data Quality & Coverage: While Apollo.io boasts a vast database, teams targeting highly specialized industries, niche roles, or specific international markets may find data accuracy or depth inconsistent. Alternatives often offer superior verification processes or leverage multi-source aggregation for unparalleled data quality in these areas.

- Cost Optimization for Specific Use Cases: While Apollo.io offers competitive pricing, its per-user model might not be optimal for all team structures or usage patterns. Some alternatives offer more flexible, value-based, or usage-based pricing that better aligns with specific budgetary constraints or consumption models.

- Specialized Intelligence Needs: Sales teams focused on account-based marketing strategies, intent-based selling, or relationship-driven strategies may require platforms that specialize in these areas, offering deeper insights into buyer behavior, organizational hierarchies, or technology adoption than a general-purpose tool.

- Advanced Sales Engagement & Automation: For sophisticated sales operations, Apollo.io's engagement features, while robust, may not provide the granular control, advanced A/B testing, multi-channel orchestration, or deep analytics offered by dedicated sales engagement platforms.

- Compliance & Privacy Concerns: As global privacy regulations (e.g., GDPR, CCPA) intensify, organizations operating internationally or in highly regulated sectors seek platforms with built-in, verifiable compliance frameworks that go beyond basic adherence.

- Integration with Complex Tech Stacks: Enterprise teams with mature CRMs and marketing automation platforms often require more flexible API-first solutions or deeper bidirectional integrations than Apollo.io's standard offerings to ensure seamless data flow and workflow automation.

The most effective sales tech stacks often involve a combination of specialized platforms, leveraging each tool's core strengths. Understanding how different Apollo.io competitors complement each other enables more strategic technology investments that deliver higher ROI and empower sales teams to close more deals.

Strategic Framework: How to Evaluate Sales Intelligence Platforms

Before diving into specific Apollo.io competitors, a structured evaluation framework helps align platform capabilities with your organizational requirements and strategic sales objectives.

Data Strategy Alignment

- Lead-Focused vs. Account-Based: Do you prioritize high-volume lead generation or deep account-level insights for strategic accounts? Platforms excel at one over the other, impacting the type of data and intelligence they prioritize.

- Inbound vs. Outbound Emphasis: Does your sales motion rely on converting inbound leads with rich contextual data, or initiating cold outbound campaigns with vast contact lists and robust engagement tools?

- Data Freshness & Accuracy: How critical is real-time data verification and continuous updating for your prospecting efforts? Evaluate platforms based on their data sourcing, verification methodologies, and update frequency.

Sales Engagement & Workflow Assessment

- Engagement Depth: Do you need basic email sequences, or advanced multi-channel cadences with AI-driven personalization, call recording, and sophisticated analytics?

- Integration with CRM & Existing Tools: How seamlessly does the platform integrate with your current CRM (e.g., Salesforce, HubSpot), marketing automation, and other sales tools? Look for bidirectional sync, custom field mapping, and API flexibility.

- User Experience & Adoption: How intuitive is the platform for your sales reps? Consider the learning curve, ease of use, and whether it enhances or disrupts existing workflows.

Global Sales Operations & Compliance Considerations

- Regional Data Quality: If you operate internationally, evaluate platforms based on their specific coverage and data quality in target geographies, beyond just North America.

- Regulatory Framework Alignment: For global teams, compliance with GDPR, CCPA, and other regional privacy laws is non-negotiable. Prioritize platforms with robust compliance features and transparent data handling practices.

- Scalability & Team Management: Can the platform grow with your team? Consider features for user management, role-based access, team reporting, and coaching tools.

Top 10 Apollo.io Competitors: Strategic Analysis

Each of the following platforms offers a distinct approach to sales intelligence, providing compelling alternatives or complements to Apollo.io based on specific needs.

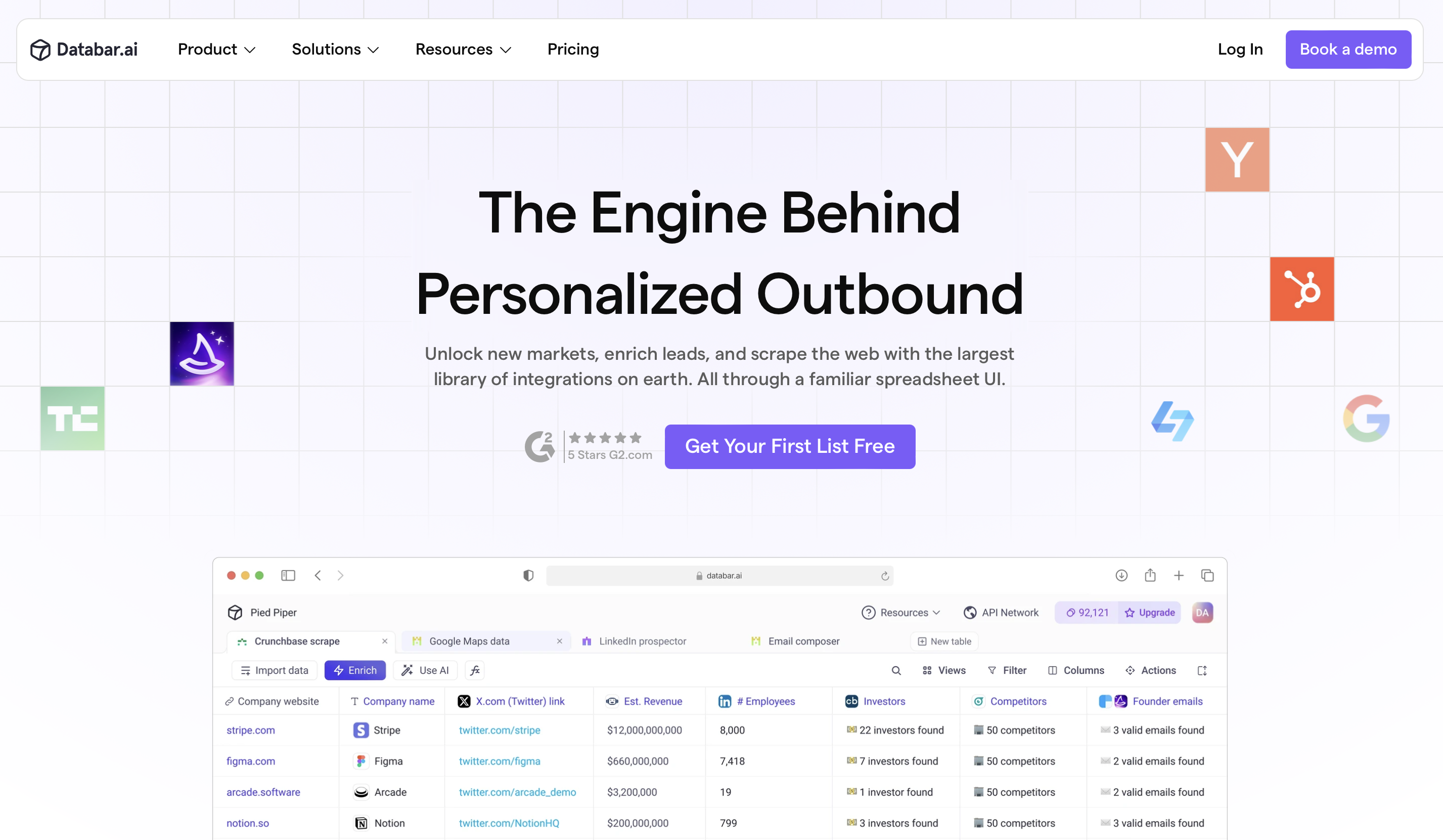

1. Databar.ai: The Multi-Source Enterprise Prospecting Platform

Databar.ai stands apart by providing access to a vast ecosystem of over 90 specialized data providers through a single, flexible platform, directly challenging Apollo.io's proprietary database model. It's ideal for sales teams needing specific, accurate data beyond the confines of a single provider.

- Strategic Positioning:

- Primary Market: Sales organizations requiring highly specific, diverse, or global data from multiple specialized sources.

- Core Value Proposition: Unrivaled data diversity and accuracy for complex prospecting, without vendor lock-in.

- Competitive Advantage: Multi-source data aggregation and customizable workflows versus Apollo.io's single database and integrated engagement.

- Key Differentiators:

- Access to over 90 data providers and scrapers.

- AI agent to scrape data from any webiste that traditional databases miss.

- Access to specialized industry data and niche professional networks.

- Cross-provider data verification for superior accuracy and match rates.

- Flexible, value-based consumption models (pay only for data needed).

- Best Use Cases:

- Teams targeting highly specific industries or global markets requiring deep, specialized data.

- Teams looking to create personalized outbound campaigns at scale.

- Organizations needing to validate contacts against multiple sources for higher accuracy.

- Sales ops teams building custom data enrichment workflows.

- Enterprises seeking to reduce data vendor sprawl without sacrificing data quality.

- Implementation Considerations: Offers significant customization. Best for teams that view data intelligence as a strategic asset requiring tailored, evolving approaches. Start your free trial today.

2. ZoomInfo: The Enterprise Data Depth Powerhouse

While Apollo.io is an all-in-one, ZoomInfo remains a leader in enterprise-grade B2B data, offering unparalleled depth and breadth, especially for North American markets. It's often chosen when data quality and comprehensive company intelligence are paramount.

- Strategic Positioning:

- Primary Market: Large enterprises requiring the most extensive and accurate B2B contact and company data for sales and marketing.

- Core Value Proposition: Deep, verified B2B intelligence with extensive firmographic, technographic, and intent data.

- Competitive Advantage: Superior data depth and enterprise-level features vs. Apollo.io's more integrated, mid-market-friendly approach.

- Key Differentiators:

- Massive, proprietary B2B contact and company database.

- Advanced intent signals identifying active buyers.

- Robust technographic data for targeting by tech stack.

- Strong integrations with major CRMs and sales engagement platforms.

- Go-to-market orchestration features for large sales teams.

- Best Use Cases:

- Large sales organizations needing the most comprehensive and verified enterprise data

- Teams focused on account-based strategies requiring deep company and intent insights.

- Enterprises in North America prioritizing data breadth and accuracy.

- Implementation Considerations: Premium pricing and often requires a dedicated sales ops team for full utilization. Can be used alongside Apollo.io, where ZoomInfo provides the data and Apollo handles engagement.

3. Lead411: The Growth Signal Intelligence Platform

Lead411 differentiates itself from Apollo.io by focusing on real-time growth signals and intent-rich contact data, eliminating usage caps that often frustrate sales teams. It's designed for high-growth teams that need accurate, actionable intelligence without the complexity or hidden limits of traditional platforms.

Strategic Positioning:

- Primary Market: SMB and mid-market sales teams seeking high-intent prospect data with growth signals for timely outreach.

- Core Value Proposition: Real-time verified contact data combined with growth intent signals and unlimited access options.

- Competitive Advantage: Growth-focused intelligence with transparent unlimited pricing vs. Apollo.io's usage-based limitations and broader but less intent-focused data.

Key Differentiators:

- Growth intent signals including hiring, funding, and technology adoption for identifying buying windows.

- Real-time email verification and mobile direct dials with no additional fees.

- True unlimited access options without daily or monthly export caps.

- Native email cadences and reply tracking reducing third-party integration needs.

- Transparent month-to-month or annual pricing with 7-day free trial.

Best Use Cases:

- Sales teams targeting prospects during key growth phases based on buying signals.

- Organizations requiring high-volume prospecting without per-export pricing constraints.

- SDR teams and agencies focused on phone and email cold outreach campaigns.

- Companies seeking integrated sales intelligence and email automation in a single platform.

Implementation Considerations: Fast same-day onboarding with straightforward CRM integrations. Best suited for teams prioritizing prospecting efficiency over advanced pipeline management features. U.S.-based support ensures quick response times during setup and ongoing usage.

4. Clearbit: The API-First Data Enrichment Specialist

Clearbit focuses on real-time data enrichment and marketing intelligence, operating primarily through APIs. It contrasts Apollo.io by emphasizing seamless data integration into existing systems rather than a standalone prospecting and engagement suite.

- Strategic Positioning:

- Primary Market: Marketing and sales operations teams with mature tech stacks and development resources.

- Core Value Proposition: Real-time B2B data enrichment and visitor identification for personalized experiences.

- Competitive Advantage: API-first, automated enrichment and website visitor insights vs. Apollo.io's database-first, integrated engagement.

- Key Differentiators:

- Robust APIs for integrating data directly into CRMs, marketing automation, and custom apps.

- Real-time data enrichment on inbound leads and website visitors.

- Reveal feature for identifying anonymous website visitors.

- Focus on marketing and sales operations automation.

- Best Use Cases:

- Organizations automating lead scoring, routing, and personalization based on real-time enrichment

- Teams enriching existing CRM records and marketing databases.

- Companies prioritizing data integration into their existing workflow over a new platform.

- Implementation Considerations: Requires technical resources for optimal setup and integration. Best for enhancing existing workflows rather than providing a new interface for prospecting.

5. LinkedIn Sales Navigator: The Relationship Intelligence Engine

LinkedIn Sales Navigator leverages the vast professional network of LinkedIn to provide relationship-based intelligence, standing apart from Apollo.io's cold outreach focus by emphasizing warm connections and contextual insights.

- Strategic Positioning:

- Primary Market: Sales professionals and teams focused on social selling, relationship building, and leveraging existing networks.

- Core Value Proposition: First-party professional network data with relationship mapping and insights for targeted engagement.

- Competitive Advantage: Deep professional network insights and relationship-driven outreach vs. Apollo.io's broader contact data and cold email sequences.

- Key Differentiators:

- Access to LinkedIn's unique, self-reported professional data.

- Advanced search filters based on connections, groups, and job changes.

- InMail capabilities for direct communication within LinkedIn.

- Lead recommendations and account alerts.

- Integration with the broader Microsoft ecosystem.

- Best Use Cases:

- Sales teams with complex, long sales cycles benefiting from warm introductions.

- Professionals focused on social selling and building rapport.

- Account-based strategies that prioritize understanding organizational structures and key relationships.

- Implementation Considerations: Best used as a complementary tool to traditional sales intelligence, focusing on the quality and context of relationships rather than pure volume.

6. Cognism: The Compliance-First Global Prospecting Platform

Cognism differentiates itself from Apollo.io with a strong emphasis on GDPR compliance and superior data coverage, particularly in European markets, making it a crucial choice for international sales teams.

- Strategic Positioning:

- Primary Market: Global enterprises, especially those with operations in Europe, needing compliant B2B contact data.

- Core Value Proposition: Highly accurate and GDPR-compliant B2B data with strong international and mobile phone coverage.

- Competitive Advantage: Deep compliance focus and superior European data accuracy vs. Apollo.io's broader global reach and integrated engagement.

- Key Differentiators:

- Robust GDPR compliance framework with transparent data sourcing.

- Exceptional mobile phone data quality for direct dials.

- Strong coverage in EMEA and APAC markets.

- Intent data and sales triggers for timely outreach.

- Chrome extension for LinkedIn prospecting.

- Best Use Cases:

- Organizations with significant European sales operations or strict global privacy mandates.

- Teams prioritizing direct phone outreach with highly accurate mobile numbers.

- Companies expanding into international markets.

- Implementation Considerations: Requires clear understanding of compliance best practices. Often seen as a premium data provider that can integrate with various sales engagement tools.

7. Outreach.io: The Enterprise Sales Engagement Leader

Outreach.io is a dedicated sales engagement platform that offers more advanced automation, analytics, and workflow orchestration than Apollo.io's integrated approach. It focuses on optimizing the entire sales cycle, not just prospecting and basic outreach.

- Strategic Positioning:

- Primary Market: Enterprise sales organizations requiring sophisticated multi-channel engagement, workflow automation, and revenue intelligence.

- Core Value Proposition: End-to-end sales execution platform for predictable pipeline generation and deal closure.

- Competitive Advantage: Deeper sales engagement automation, advanced analytics, and revenue intelligence vs. Apollo.io's more all-in-one approach to data and engagement.

- Key Differentiators:

- Highly customizable multi-channel sequences (email, calls, social).

- Advanced A/B testing and performance analytics for sequences.

- Conversation intelligence for call analysis and coaching.

- Robust Salesforce integration and CRM sync.

- AI-powered insights for deal progression and forecasting.

- Best Use Cases:

- Large sales teams needing to standardize and scale complex outreach processes.

- Organizations focused on optimizing sales representative productivity and coaching.

- Teams requiring deep analytics to understand engagement effectiveness.

- Implementation Considerations: Requires a well-defined sales process and often integrates with third-party data providers. More of an engagement orchestration tool rather than a primary data source like Apollo.io.

8. Salesloft: The Holistic Sales Engagement Platform

Similar to Outreach, Salesloft is a leading sales engagement platform (SEP) known for its comprehensive capabilities in orchestrating buyer journeys across multiple channels. It offers a more robust and scalable engagement solution compared to Apollo.io's integrated features.

- Strategic Positioning:

- Primary Market: High-growth and enterprise sales teams focused on optimizing every touchpoint in the sales cycle.

- Core Value Proposition: A unified platform for sales engagement, forecasting, and coaching.

- Competitive Advantage: Enterprise-grade engagement, robust dialer, deep analytics, and coaching tools vs. Apollo.io's more basic engagement functionality coupled with data.

- Key Differentiators:

- Advanced cadence builder with conditional logic and personalization at scale.

- Comprehensive calling features, including local presence and transcription.

- Robust analytics and reporting on engagement, pipeline, and team performance.

- Conversation intelligence for sales call analysis.

- Deep CRM integrations and a marketplace of complementary tools.

- Best Use Cases:

- Sales development teams managing high-volume outbound campaigns.

- Account executives needing to manage complex multi-touch sales cycles.

- Sales leaders focused on improving team performance through coaching and analytics.

- Implementation Considerations: Does not include a built-in database like Apollo.io, requiring integration with dedicated data providers. Geared towards sophisticated sales operations.

9. 6sense: The AI-Powered Account Engagement Platform

6sense takes a differentiated approach by focusing on AI-powered account engagement and anonymous buyer journey tracking, prioritizing predictive intelligence and account-level insights over basic contact discovery, making it a strategic alternative for ABM-focused teams.

- Strategic Positioning:

- Primary Market: Enterprises implementing sophisticated account-based experience (ABX) and revenue intelligence strategies.

- Core Value Proposition: AI-powered anonymous intent identification and buyer journey mapping for hyper-targeted engagement.

- Competitive Advantage: Deep intent data and AI-driven predictive analytics at the account level vs. Apollo.io's lead-centric and basic intent data.

- Key Differentiators:

- Proprietary AI for identifying buying stages and hidden demand signals.

- Anonymous website visitor identification and account matching.

- Predictive analytics for account prioritization and forecasting.

- Dynamic account segmentation for personalized campaigns.

- Integration with CRM and marketing automation for coordinated ABM.

- Best Use Cases:

- Account-based marketing and sales teams seeking to engage accounts at the optimal time.

- Organizations wanting to identify and prioritize accounts showing buying intent.

- Teams focused on understanding the entire buyer journey, including anonymous stages.

- Implementation Considerations: Requires integration with existing systems and a mature ABM strategy for full impact. More of an intelligence layer than a direct prospecting tool.

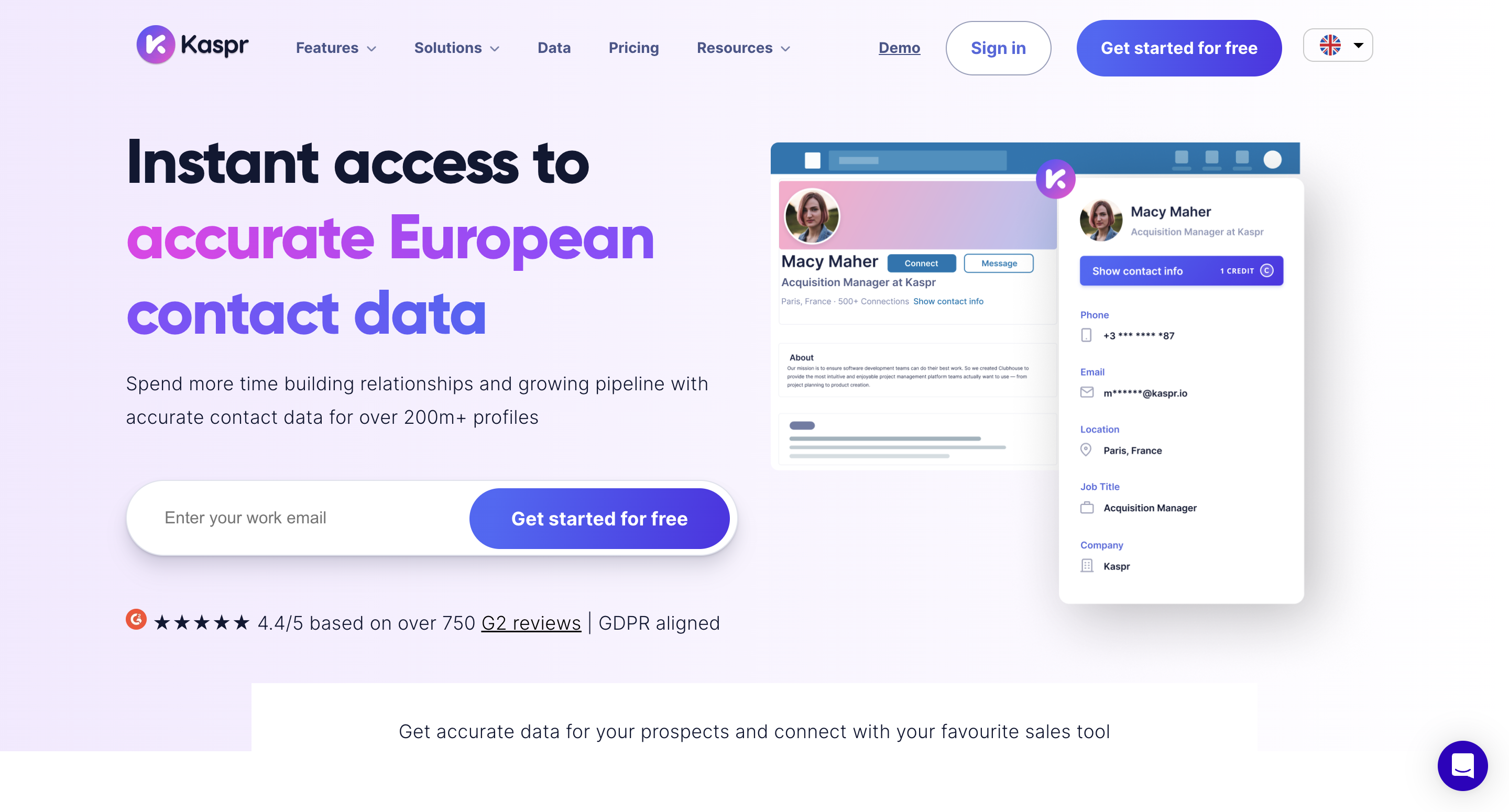

10. Kaspr: The GDPR-Compliant LinkedIn Prospecting Tool

Kaspr positions itself as a privacy-first contact intelligence platform, specializing in verified B2B contact data with built-in GDPR compliance, particularly for European markets. It's a simpler, more privacy-conscious alternative for LinkedIn-centric prospecting compared to Apollo.io.

- Strategic Positioning:

- Primary Market: European enterprises and global companies prioritizing privacy-compliant prospecting and LinkedIn-based outreach.

- Core Value Proposition: Verified contact discovery directly from LinkedIn with comprehensive privacy compliance.

- Competitive Advantage: Strong GDPR compliance and LinkedIn-native contact verification vs. Apollo.io's broader database and integrated but less specialized compliance.

- Key Differentiators:

- GDPR-native architecture ensuring compliant data collection and processing.

- Real-time contact verification for high email accuracy rates.

- Lightweight Chrome extension for instant contact discovery on LinkedIn.

- Includes phone numbers (mobile and direct dial) and email addresses.

- Consent management system for data usage permissions.

- Best Use Cases:

- Organizations operating in European markets with strict GDPR requirements.

- Sales professionals who primarily prospect through LinkedIn.

- Teams needing a simple, privacy-focused tool for direct contact information.

- Implementation Considerations: Primarily a contact discovery tool; less focused on comprehensive sales engagement compared to Apollo.io. Simple to set up and use.

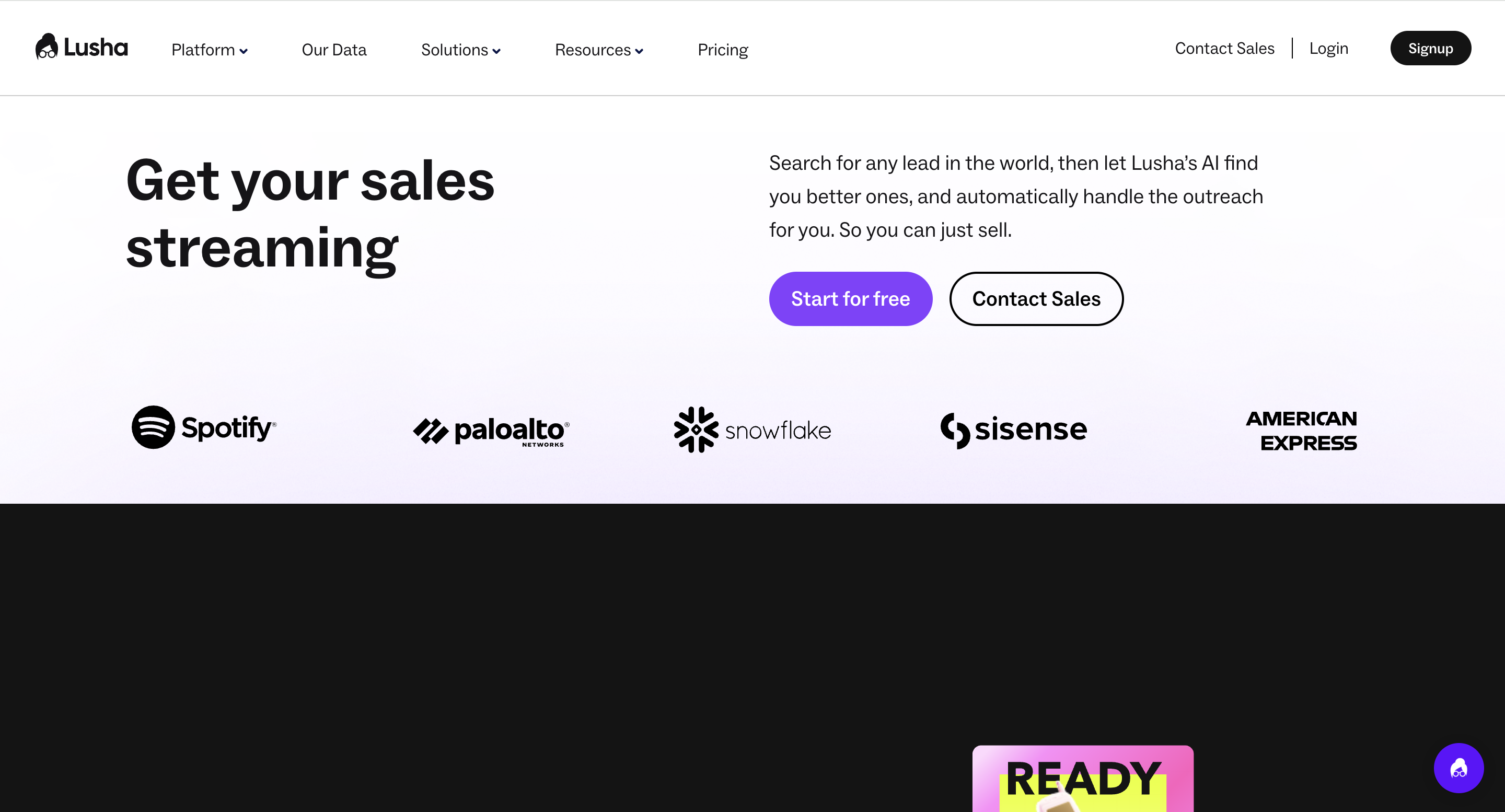

11. Lusha: The Accessible Contact Intelligence for SMBs

Lusha positions itself as an easy-to-use and cost-effective contact intelligence platform, emphasizing simplicity and immediate value, making it a popular choice for SMBs and individual sales professionals who might find Apollo.io's full suite too comprehensive or costly.

- Strategic Positioning:

- Primary Market: Small to mid-size businesses, individual sales professionals, and recruiters.

- Core Value Proposition: Simple, immediate contact discovery with transparent pricing.

- Competitive Advantage: Ease of use, affordability, and reliable contact data for quick lookups vs. Apollo.io's broader feature set and enterprise aspirations.

- Key Differentiators:

- Intuitive browser extension for quick contact lookups on LinkedIn and company websites.

- Transparent, credit-based pricing model.

- Focus on direct dial phone numbers and verified emails.

- Minimal learning curve and immediate value.

- Integration with popular CRMs and sales tools.

- Best Use Cases:

- Small sales teams or individual contributors needing quick, reliable contact information.

- Organizations prioritizing cost efficiency and ease of adoption.

- Recruitment teams needing fast access to candidate contact details.

- Implementation Considerations: More focused on contact discovery than full sales engagement. Best for users who value simplicity and efficiency over an all-in-one platform.

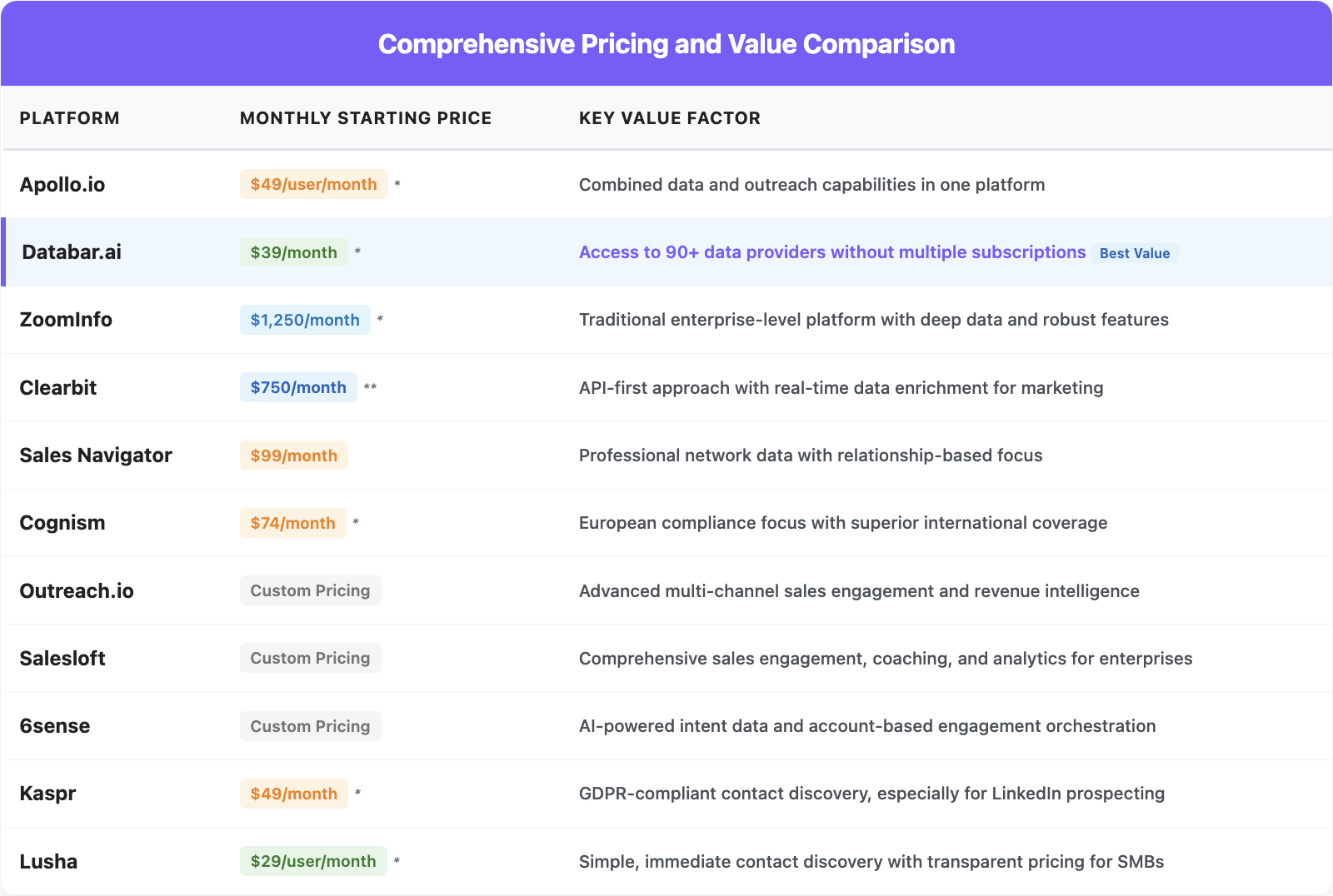

Pricing and Value Considerations: Apollo.io Alternatives Cost Breakdown

Understanding the monthly starting prices for Apollo.io competitors helps in making a more informed budget decision. Note that enterprise packages often include custom configurations, priority support, and volume discounts.

Note on pricing: Prices are typically for annual billing or lowest tier. Monthly billing might be higher. "Custom Pricing" indicates no public starting price is available.

Databar.ai in the Sales Intelligence Landscape

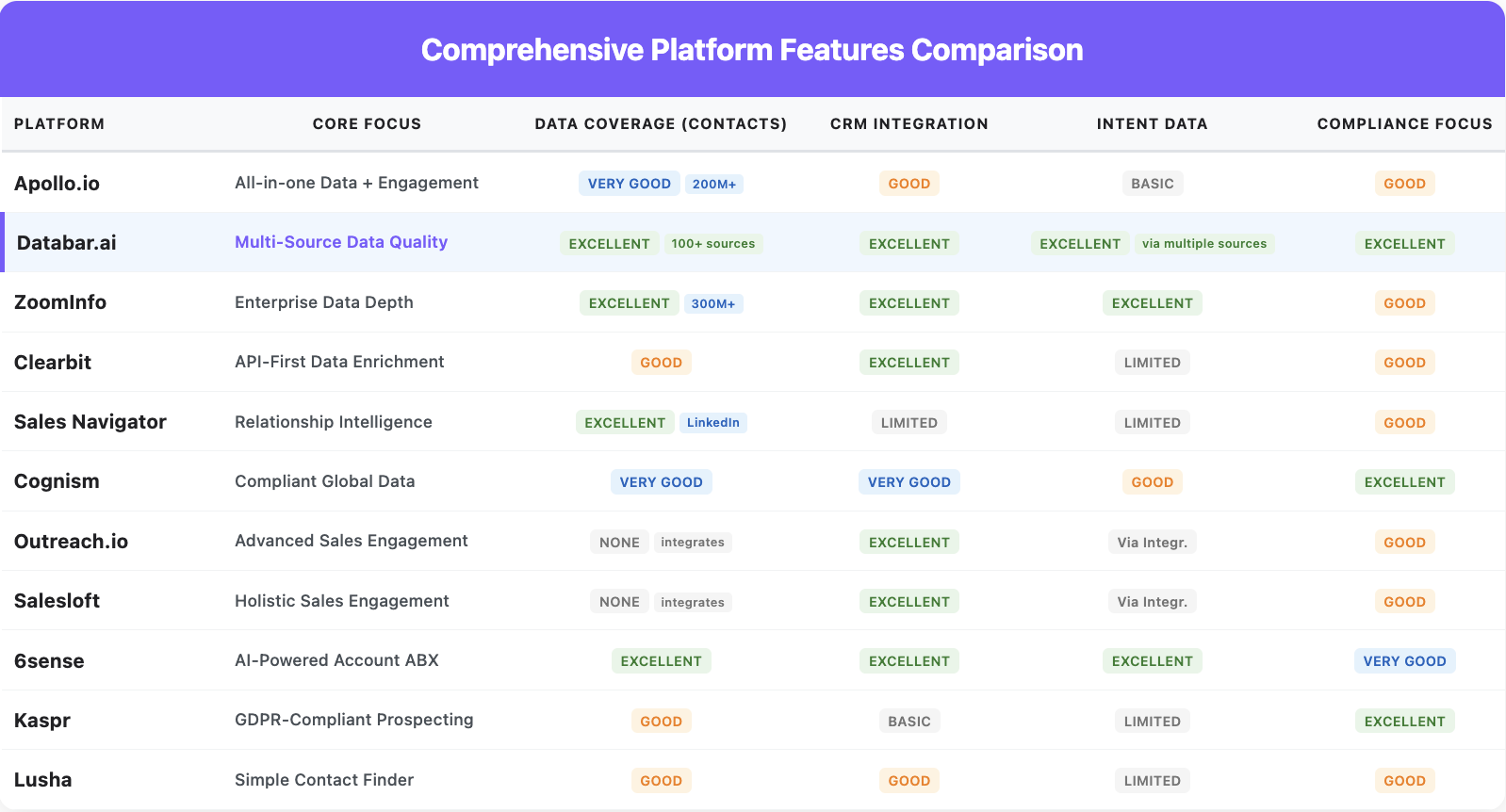

Sales intelligence platforms must balance feature breadth with data depth. In case you're wondering how we compare to other products when evaluating Apollo.io competitors, here's how our specialized approach delivers superior intelligence for modern sales teams:

- Our focus vs ZoomInfo - Specialized intelligence focus through 90+ data providers versus enterprise database approaches.

- Databar.ai compared to Cognism - Global sales intelligence through multi-source aggregation versus regional compliance platforms that specialize in European market coverage and GDPR-focused data handling.

- How we optimize vs Clay - How do these tools compare when building out custom workflows?

- Databar.ai vs LinkedIn Sales Navigator - Multi-source intelligence providing in-depth contact and company data versus social platform approaches that leverage professional network insights and relationship mapping.

These architectural differences highlight how platform selection depends on whether your sales organization prioritizes comprehensive data access across multiple sources or specialized functionality within specific intelligence categories.

Strategic Decision Framework: Choosing the Right Platform

The "best" platform depends entirely on your specific sales strategy, team size, target market, and existing tech stack. Here's a guide on when to choose each Apollo.io competitor:

Choose Databar.ai when:

- You need complete, accurate data from multiple specialized sources beyond a single database.

- Your revenue targets depend on data quality and you need to fill gaps in Apollo.io's coverage for niche markets or global regions.

- You require flexible, customizable data workflows that adapt to unique sales and marketing processes.

- You require robust intent data from multiple sources to identify active buyers.

- You prioritize budget efficiency by paying for actual data enrichment needs rather than rigid seat licenses.

- Global data coverage and specialized regional insights are critical.

- Compliance requirements are non-negotiable, and you need comprehensive data governance.

Choose ZoomInfo when:

- Your primary need is the deepest, most comprehensive B2B contact and company data for enterprise sales.

- You require robust intent data and technographic insights to identify active buyers.

- You operate predominantly in North American markets and prioritize data accuracy there.

- Your team needs a full suite of sales intelligence features beyond basic prospecting and engagement.

Choose Clearbit when:

- Your organization has strong technical resources and a mature marketing automation stack.

- Real-time data enrichment within your existing CRM or marketing systems is a top priority.

- You want to identify anonymous website visitors and personalize their experience.

- You prefer an API-first approach for integrating data directly into your workflows.

Choose LinkedIn Sales Navigator when:

- Your sales methodology is heavily focused on relationship-based selling and social selling.

- You prioritize warm introductions and leveraging existing professional connections.

- Your sales cycles are long and benefit from deep insights into professional networks.

- You primarily prospect and nurture leads within the LinkedIn ecosystem.

Choose Cognism when:

- European market coverage and GDPR compliance are critical for your sales operations.

- You require highly accurate mobile phone data for direct outreach campaigns.

- Your global expansion strategy necessitates a platform with strong international data capabilities.

- Data governance and regulatory risk management are top priorities.

Choose Outreach.io or Salesloft when:

- You need advanced, multi-channel sales engagement automation beyond Apollo.io's built-in sequences.

- Your sales team requires deep analytics, A/B testing, and conversation intelligence for optimization.

- You operate at an enterprise scale and need robust workflow orchestration and team management features.

- You are willing to integrate with separate data providers for best-in-class engagement functionality.

Choose 6sense when:

- Your organization is committed to an account-based marketing (ABM) or revenue intelligence strategy.

- You need AI-powered intent data and anonymous buyer journey tracking to identify in-market accounts.

- Prioritizing account-level engagement and predictive insights is crucial for your sales team.

- You have the technical capabilities to integrate a sophisticated platform into your tech stack.

Choose Kaspr when:

- Your sales professionals primarily prospect directly from LinkedIn profiles.

- GDPR compliance and data privacy are paramount for your contact discovery efforts.

- You need a simple, privacy-first tool for verified contact information (emails and phone numbers).

- You want an easy-to-use solution that integrates seamlessly with your LinkedIn workflow.

Choose Lusha when:

- You are an SMB or individual sales professional needing a straightforward, cost-effective contact finder.

- You prioritize simplicity, ease of use, and immediate access to contact details.

- Your primary need is reliable direct dial phone numbers and verified emails for quick outreach.

- You seek transparent, usage-based pricing without comprehensive sales engagement features.

Common Implementation Pitfalls and How to Avoid Them

When choosing an Apollo.io competitor, organizations often stumble into common traps that hinder successful adoption and ROI.

-

Overlooking Data Niche Requirements: Many teams assume a large database equals good data. If your ICP is very specific (e.g., small businesses in a niche manufacturing sector in Germany), a general database may fall short, leading to low match rates and wasted credits.

- Solution: Clearly define your Ideal Customer Profile (ICP) and conduct targeted data tests for specific regions/industries with shortlisted platforms. Don't rely solely on reported database size.

-

Underestimating Engagement Complexity: While Apollo.io offers engagement, assuming any alternative's engagement features will be "good enough" can be a mistake. Highly customized, multi-channel cadences with dynamic content and branching logic require dedicated SEPs.

- Solution: Map out your ideal sales engagement workflows. If they are complex, prioritize platforms specializing in engagement (e.g., Outreach, Salesloft) and plan to integrate data separately.

-

Ignoring Integration Depth: A platform might list CRM integration, but the depth varies wildly. Poor bidirectional sync, lack of custom field mapping, or limited API access can create data silos and manual work.

- Solution: Involve your sales operations and IT teams early. Conduct detailed integration checks and ask for specific use case demonstrations (e.g., pushing custom lead statuses, syncing call notes).

-

Neglecting User Adoption: A powerful tool is useless if your sales reps don't use it. Complex UIs, disrupted workflows, or lack of proper training can lead to shadow IT or underutilization.

- Solution: Involve end-users in the demo and trial process. Prioritize platforms with intuitive interfaces and strong onboarding support. Plan for ongoing training and champion programs.

-

Focusing Only on Starting Price: The lowest monthly starting price doesn't always reflect total cost of ownership (TCO). Factor in additional credits, user seats, integration costs, and the potential need for complementary tools.

- Solution: Request detailed quotes for your projected usage and team size. Calculate TCO over 1-3 years, including any necessary add-ons or separate data/engagement tool subscriptions.

Conclusion: Making the Strategic Choice for Sales Intelligence

The sales intelligence landscape in 2025 offers a wealth of options beyond Apollo.io's robust, all-in-one approach. While Apollo.io provides exceptional value as an integrated solution for prospecting and engagement, the competitive market has diversified to meet highly specialized needs for data quality, advanced automation, global compliance, and seamless integration.

The key insight from this analysis is that the "best" Apollo.io competitor is not a universal truth but a strategic choice deeply intertwined with your sales methodology, target markets, team structure, and existing technology stack. Whether you prioritize unparalleled data depth, sophisticated multi-channel engagement, stringent global compliance, or hyper-specific niche data, a specialized alternative often delivers superior results.

By leveraging this strategic framework, you can move beyond feature-by-feature comparisons to identify platforms that truly empower your sales team. Consider how each competitor's core strengths can fill the gaps in your current approach, complement your existing tools, and ultimately drive more predictable revenue growth.

For organizations seeking access to the broadest range of specialized data sources while maintaining enterprise-grade governance and flexible workflows, Databar.ai offers a compelling alternative. Its multi-source aggregation allows teams to access the most relevant and accurate data for any industry, region, or specific use case, minimizing vendor lock-in and maximizing data utility.

By making a strategic choice, you can build a sales tech stack that not only meets today's demands but also adapts to the evolving challenges of prospecting and engagement in 2025 and beyond.

Ready to optimize your sales intelligence strategy? Try Databar.ai free today →

Related articles

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026

How to Automate GTM Research with Claude Code

How Claude Code Cuts Weeks of GTM Research into Hours Without Sacrificing Depth

by Jan, February 20, 2026

Best MCP Servers for Sales Teams in 2026

How MCP servers are turning AI into a hands-on sales assistant that gets real work done

by Jan, February 20, 2026

How to Scrape Google Maps and Find Business Owners with Claude Code

A Step-by-Step Guide on How to Find Business Leads and Owner Emails From Google Maps with Claude Code

by Jan, February 19, 2026