Prospect Research: From First Touch to Closed Deal

How Knowing Your Prospect Better Makes Sales Easier

Blogby JanJuly 04, 2025

Prospect research is where deals are won or lost before you even send the first email. While everyone talks about building lists and finding contacts, the real competitive advantage lies in understanding prospects so deeply that your first message feels like mind reading.

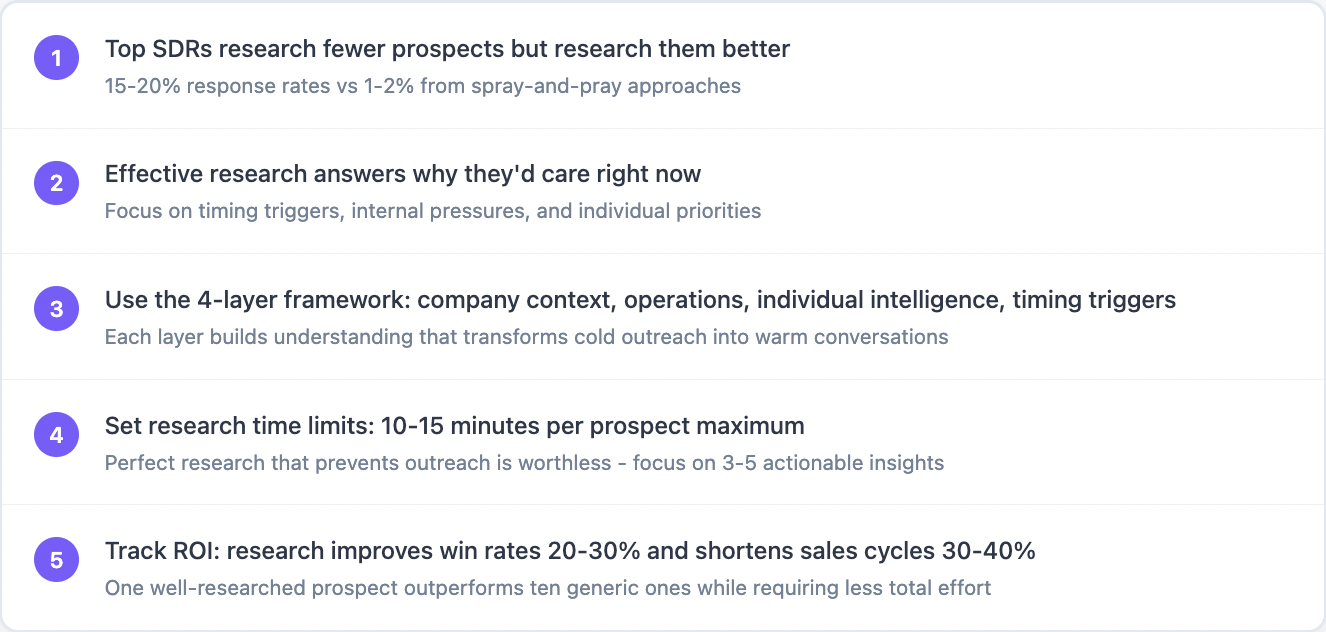

Sales teams consistently report that SDRs with the highest close rates spend significantly more time researching individual prospects than their peers. But here's the counterintuitive part - they actually research fewer prospects overall. They just research them better.

This guide reveals exactly how top performers conduct prospect research that turns cold outreach into warm conversations. You'll learn the intelligence-gathering techniques that separate amateur spray-and-pray from professional sales engagement.

Why Most Prospect Research Fails (And How to Fix It)

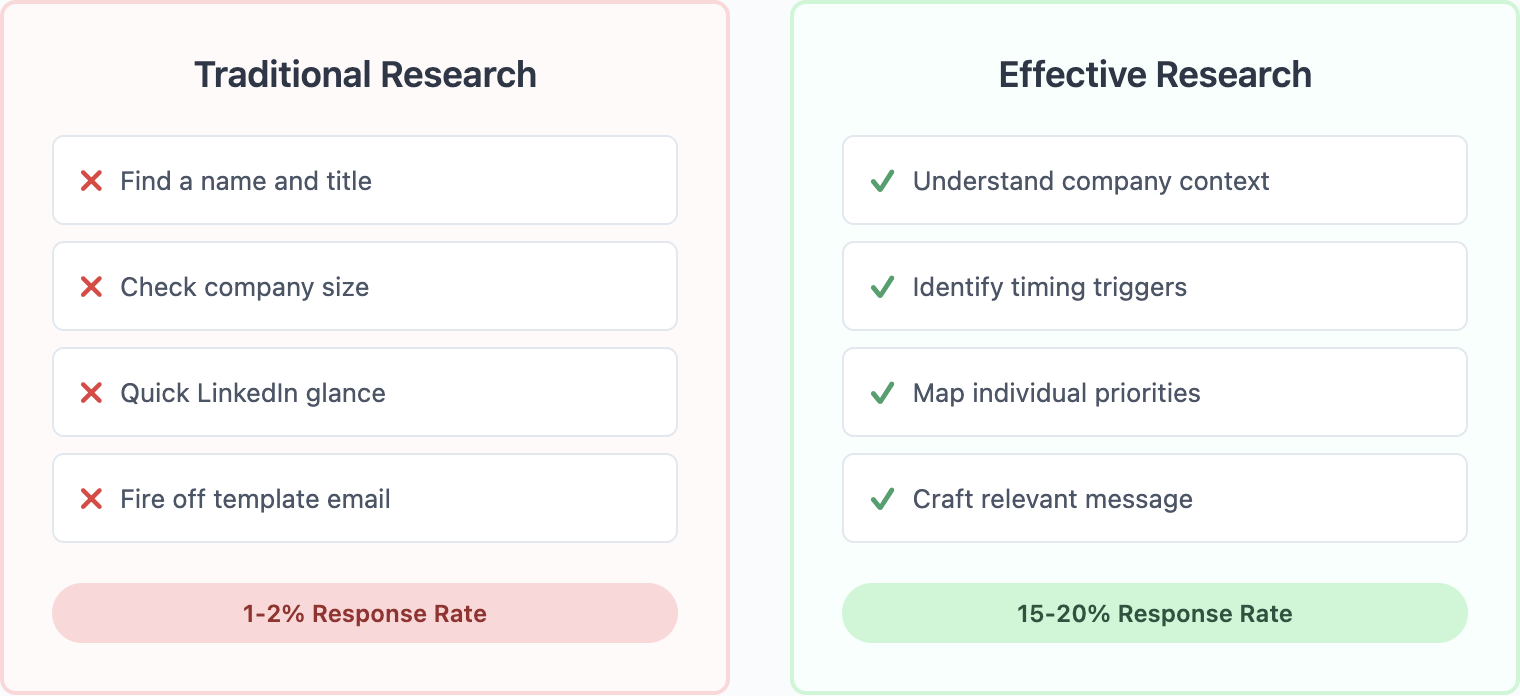

Traditional prospect research looks like this: find a name, grab their title, check the company size, and fire off a template. It's fast, scalable, and completely ineffective in today's market.

Modern buyers can smell generic outreach from a mile away. They delete emails that could apply to any company in their industry. They ignore calls from reps who clearly know nothing about their specific situation. And they're right to do so - why waste time with someone who hasn't bothered to understand their world?

The problem isn't laziness. It's that most salespeople don't know what to research or where to find it. They check LinkedIn, maybe glance at the company website, and call it done. Meanwhile, the information that actually drives conversations - recent initiatives, technology pain points, competitive pressures - sits untapped in plain sight.

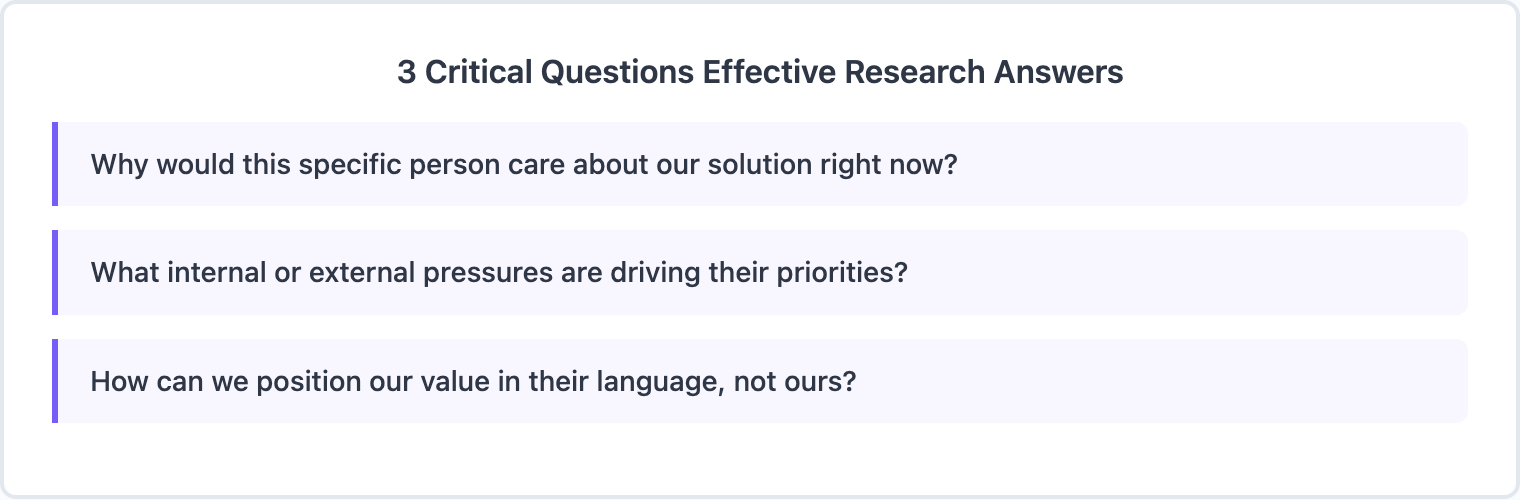

Effective prospect research answers three critical questions that list building alone can't address: Why would this specific person care about our solution right now? What internal or external pressures are driving their priorities? How can we position our value in their language, not ours?

When you can answer these questions before the first contact, everything changes. Response rates jump from 1-2% to 10%+. Conversations flow naturally because you're addressing real challenges. Deals close faster because you've eliminated the education phase.

Winning Prospect Research Framework

Great prospect research follows a systematic process that builds layers of intelligence. Unlike building B2B lead lists which focuses on quantity and coverage, prospect research is about depth and context.

Start with the company context. Not just industry and size, but their specific market position. Are they a leader defending territory or a challenger attacking incumbents? Are they in growth mode or optimization mode? These strategic positions determine budget priorities and decision-making speed.

Next, understand their operational reality. What technologies do they use? How is their team structured? What initiatives are they pursuing? This operational intelligence reveals practical constraints and opportunities that generic pitches miss.

Then dive into individual situation. Beyond titles and tenure, what does this person care about? What have they published or shared? What's their professional trajectory? This personal context transforms cold outreach into relevant conversation.

Finally, identify timing triggers. What recent events create urgency? New leadership, funding rounds, competitive moves, regulatory changes - these catalysts turn nice-to-have into must-have solutions.

Everything comes together when you connect these layers. A VP of Sales at a fast-growing SaaS company using Salesforce but not your category of tools who just received Series B funding isn't just a name on a list - they're a perfect prospect with clear needs and budget to address them.

Deep-Dive Company Insights

Company research goes far beyond checking their About page or the basic firmographics you'd collect when building lists. The real intelligence lies in understanding their trajectory, challenges, and unstated priorities.

Financial health indicators tell you more than revenue numbers. Look at their funding history - not just amounts but investor quality and terms. Examine hiring patterns - are they adding aggressively or optimizing carefully? Check their customer logos - are they moving upmarket or down?

Technology footprints reveal operational maturity. Companies using modern tech stacks approach problems differently than those on legacy systems. But don't just list their tools - understand what gaps exist. Using Databar.ai's technographic enrichment, you can identify not just what they have but what they're missing.

Competitive positioning shapes every decision. Who do they compete with? How do they differentiate? What market share are they defending or attacking? This context determines their appetite for risk and innovation.

Cultural indicators predict buying behavior. Companies that publish thought leadership value expertise. Those emphasizing customer success prioritize retention. Remote-first organizations need different solutions than office-centric ones. These cultural cues guide your positioning.

News and announcements provide timing intelligence. But look beyond press releases to job postings, patent filings, and partnership announcements. These operational signals often precede official announcements by months.

Individual Prospect Intelligence: Understanding People

This is where prospect research diverges completely from list building. Individual research transforms names into people with goals, pressures, and preferences. This human intelligence drives response rates more than any other factor.

Professional trajectory reveals ambition and priorities. Did they come from a larger company seeking startup agility? Or from a startup seeking enterprise structure? Are they building something new or optimizing something existing? These patterns predict what resonates.

Published content and thought leadership shows what they actually care about. Blog posts, conference talks, podcast appearances - these reveal priorities more accurately than any job description. AI-powered research tools can analyze this content at scale, surfacing themes and pain points.

Social engagement patterns indicate communication preferences. Active LinkedIn publishers appreciate thoughtful comments. Twitter users value brevity and wit. Non-social executives prefer direct, professional approaches. Match your outreach to their style.

Network connections reveal influence and information sources. Who do they follow and engage with? What groups do they participate in? These connections often provide warm introduction paths and conversation starters.

Career transitions create unique opportunities. New executives bring fresh budgets and mandates. Recently promoted leaders want quick wins. Job changers often implement solutions that worked at previous companies. These transitions create natural entry points.

Digital Footprint: Where to Find It and What It Says

Every company and individual leaves digital breadcrumbs that reveal priorities, challenges, and opportunities. This goes far beyond the basic data you'd gather for a prospect list - it's about understanding behavior and intent.

Website behavior tells stories that companies don't explicitly share. Recent website redesigns often signal repositioning. New product pages indicate expansion. Removed features suggest strategic shifts. Job posting pages reveal growth areas and pain points.

Content marketing strategies expose thinking and priorities. What topics do they cover? What problems do they address? What solutions do they promote? This content reveals how they view their market and challenges.

Social media activity provides real-time intelligence. Beyond corporate posts, look at employee advocacy and engagement. Happy, engaged employees share company content. Struggling companies see minimal employee amplification.

Technology signals hide in plain sight. JavaScript libraries, analytics tools, and marketing pixels reveal their tech stack. Domain registration changes, SSL certificates, and hosting providers indicate infrastructure investments. These technical details predict needs and compatibility.

Review sites and forums contain unfiltered truth. What do customers complain about? What do employees say on Glassdoor? What questions appear in industry forums? This unguarded feedback reveals gaps your solution might fill.

Trigger Event Monitoring

Timing turns good research into great results. While list building gives you who to contact, trigger monitoring tells you when. The same prospect who ignores you today might desperately need you tomorrow.

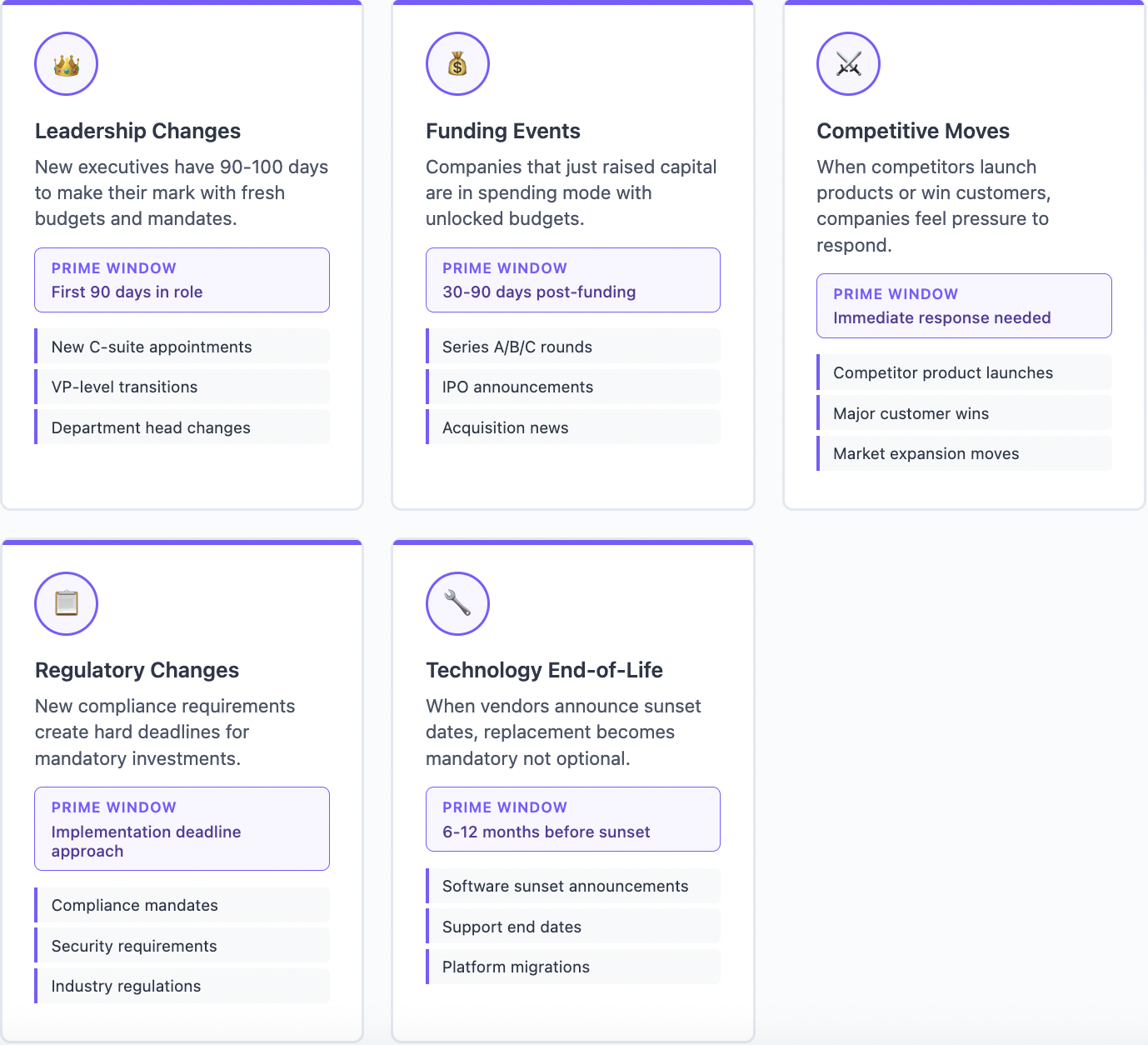

Leadership changes drive new initiatives. New executives have 90-100 days to make their mark. They bring fresh perspectives, new budgets, and mandates for change. Monitor C-suite and VP-level transitions in target accounts for immediate opportunities.

Funding events unlock frozen budgets. Companies that just raised capital are in spending mode. But don't wait for TechCrunch announcements - monitor SEC filings and investor portfolios for earlier signals.

Competitive moves create reactive needs. When their competitor launches a product, expands geographically, or wins major customers, companies feel pressure to respond. Track your prospects' competitors as closely as you track prospects themselves.

Regulatory changes force urgent action. New compliance requirements, industry regulations, or security mandates create hard deadlines. Companies can't delay these investments, making them ideal entry points.

Technology end-of-life drives replacement cycles. When vendors announce sunset dates or companies outgrow current solutions, replacement becomes mandatory. Monitor technology lifecycle events in your prospects' stack.

Building Your Tech Stack

Manual research doesn't scale, but automation without intelligence creates noise. The key is building a tech stack that multiplies human insight rather than replacing it.

Databar.ai serves as the intelligence hub, aggregating data from 90+ sources into unified prospect profiles. Unlike tools focused on list building, this enables deep individual research across multiple dimensions.

News and trigger monitoring requires dedicated tools. Google Alerts covers basic needs, but platforms like Owler or Crunchbase alternatives provide deeper company intelligence (both are accessible inside Databar). The key is setting precise alerts that surface signals, not noise.

Social listening tools reveal unguarded moments. Beyond LinkedIn Sales Navigator, tools like Twitter Advanced Search or Reddit monitoring surface problems prospects discuss openly. These candid moments provide perfect conversation starters.

Technology detection services like BuiltWith or Wappalyzer reveal stack details that predict needs. Knowing they use Salesforce but not marketing automation identifies clear opportunities. Seeing recent technology additions suggests budget availability.

Intent data platforms identify active researchers. When prospects consume content about your category, visit your sites, or search relevant terms, they signal buying readiness. Layer this onto your research for perfect timing.

Research-to-Revenue Workflow

Research without action is procrastination. The best prospect intelligence becomes stale quickly, so you need workflows that move from insight to engagement efficiently.

Start with research sprints. Spend 10-15 minutes gathering core intelligence: company context, individual background, recent triggers, and conversation hooks. More time rarely yields proportionally better results.

Document insights systematically. Create research templates that capture essential insinghts in scannable formats. Include sources for credibility and timestamps for freshness. This documentation helps entire teams leverage individual research.

Turn research into talk tracks. Don't just note that they use Salesforce - identify specific Salesforce limitations your solution addresses. Don't just see they're hiring - understand what problems rapid growth creates. Connect every insight to value.

Build feedback loops from outreach results. Which research points generated responses? What intelligence predicted success? Use these patterns to refine future research priorities. The goal is maximizing impact, not gathering maximum information.

Create research handoffs that preserve intelligence. When SDRs pass qualified prospects to AEs, include research summaries. When customers expand, share original research that predicted success. This institutional memory improves over time.

Your Prospect Research Action Plan

Turning prospect research from time-sink to revenue-driver requires systematic change. Here's your roadmap to research that actually drives results.

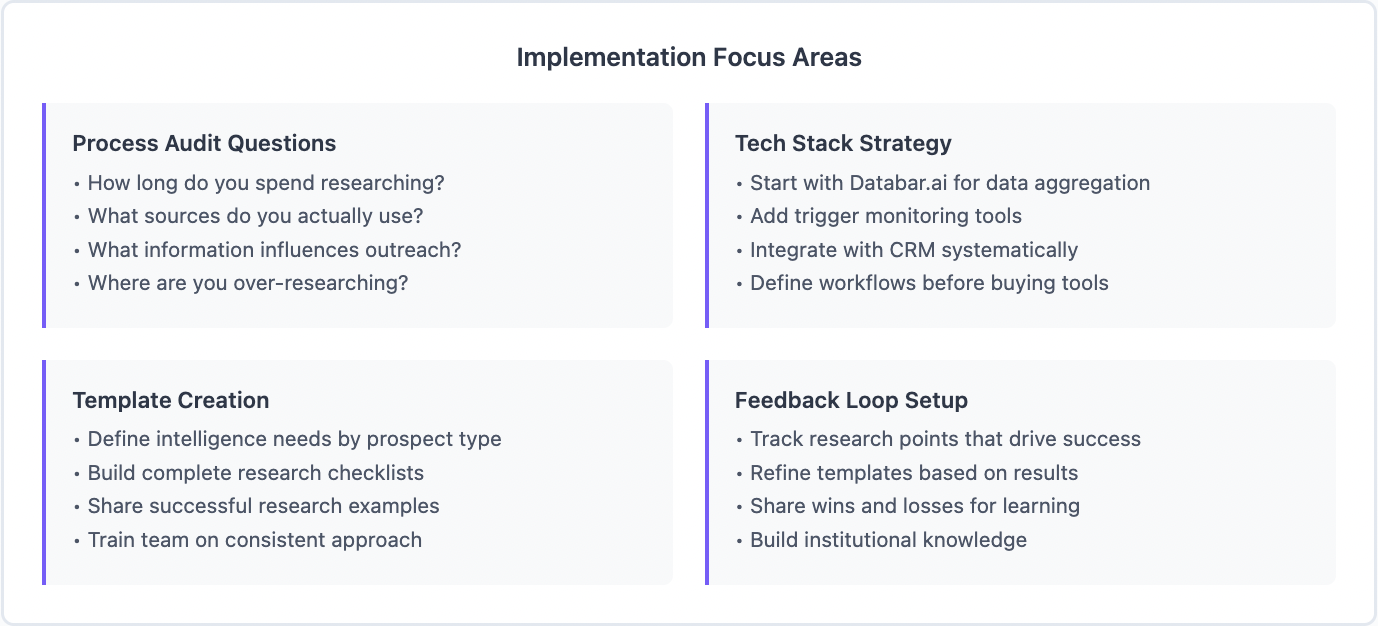

Start by auditing your current process. How long do you spend researching? What sources do you use? What information actually influences your outreach? Most teams discover they're over-researching some areas while missing critical intelligence.

Build your research tech stack strategically. Start with Databar.ai for comprehensive data aggregation, add monitoring tools for triggers, and integrate with your CRM for systematic documentation. Don't buy tools hoping they'll magically improve research - integrate them into defined workflows.

Create research templates that drive consistency. Define exactly what intelligence you need for different prospect types. Build checklists that ensure complete research without waste. Share successful research examples to train your team.

Implement feedback loops that improve continuously. Track which research points correlate with success. Refine your templates based on results. Share wins and losses to build institutional knowledge. Research should get better, not just faster.

Remember that prospect research is a means, not an end. The goal isn't knowing everything about prospects - it's knowing enough to start valuable conversations. Focus on actionable intelligence that drives engagement, not impressive databases that gather dust.

The companies winning today don't have more data - they have better intelligence. They've learned to find, interpret, and act on the signals that matter. With the right approach to prospect research, you can join them.

FAQ

How much time should I spend researching each prospect? For targeted outreach, spend 10-15 minutes per prospect gathering core intelligence. High-value enterprise prospects might justify 30-45 minutes. The key is setting time limits - perfect research that prevents outreach is worthless. Focus on finding 3-5 unique insights that can personalize your approach.

What are the most important things to research about a prospect? Focus on recent changes and current initiatives first - new leadership, funding, expansion, or technology adoption. Then understand their competitive position and market challenges. Finally, gather individual intelligence about their priorities and communication style. These three layers create compelling outreach angles.

How do I research prospects who have minimal online presence? Start with their company's digital footprint - website changes, job postings, and news mentions often reveal individual priorities. Check industry publications and trade associations. Use tools like Databar.ai to aggregate data from multiple sources. Sometimes a phone call to ask qualifying questions works better than endless online searching.

Should I research before or after identifying prospects? Both, but in different depths. Do light company research to identify prospects worth pursuing. Once identified, do deeper individual research before outreach. Don't waste time deeply researching companies that don't fit your ICP. Think of it as progressive research - each stage justifies the next.

How do I organize and document prospect research? Create consistent templates in your CRM that capture company context, individual intelligence, trigger events, and conversation hooks. Include sources and dates for credibility. Use tags or custom fields to make research searchable across your team. Good documentation turns individual research into team intelligence.

What's the difference between prospect research and lead qualification? Prospect research happens before first contact to enable personalized outreach. It's about understanding their world to start conversations. Lead qualification happens after initial interest to determine fit and readiness. Research gets you in the door; qualification determines if you should stay.

Related articles

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026