Cognism Competitors: The Definitive Comparison Guide for 2025

A detailed comparison of leading Cognism alternatives tailored to your prospecting needs

Blogby JanMay 23, 2025

Sales organizations constantly seek reliable data to fuel their outreach, but a rapidly evolving market, coupled with changing deliverability regulations, means that having adaptable and comprehensive sales intelligence is more critical than ever. While Cognism has established itself as a strong player, particularly for compliant European data, the sales intelligence landscape has diversified significantly. Platforms are developing specialized strengths, but some also offer broader, more flexible data access to meet every prospecting challenge.

Whether you're actively exploring alternatives to Cognism or simply researching sales intelligence platforms for the first time, this definitive guide provides an in-depth look at how the top Cognism competitors truly differentiate themselves in 2025. We'll help you navigate this increasingly specialized ecosystem to find the perfect match for your specific prospecting and compliance needs.

Why Consider Cognism Competitors?

While Cognism has established itself as a leading provider of compliant B2B data, particularly in European markets, several factors may lead organizations to explore alternatives:

- Global Coverage Requirements: While Cognism excels in Europe, teams with a strong focus on North America or other regions may find that other platforms offer superior data quality and coverage in those areas.

- Specific Data Needs: Organizations requiring highly specialized data, such as detailed technographics, intent data, or niche industry information, may find that certain competitors offer a more targeted approach.

- Alternative Data Collection Methods: Cognism relies on a proprietary database.Organizations seeking access to a wider range of data sources through comprehensive data platforms or real-time data enrichment may find multi-source aggregation platforms more appealing.

- Budget Considerations: Cognism's pricing, while competitive for its target market, may not be the most cost-effective option for all organizations. Some competitors offer more flexible pricing models or lower entry points.

- Integration with Existing Tech Stack: Teams with complex CRM and marketing automation systems may prioritize platforms that offer deeper, more customizable integrations than Cognism's standard offerings.

- Sales Engagement Functionality: While Cognism focuses primarily on data quality and compliance, teams seeking integrated sales engagement features may prefer platforms that combine prospecting data with outreach tools.

The key is to understand that the "best" sales intelligence platform is not a universal concept. It depends entirely on your organization's specific needs, target markets, and sales strategy.

Strategic Framework: How to Evaluate Sales Intelligence Platforms

When evaluating Cognism competitors, consider the following framework to align platform capabilities with your specific requirements:

- Regional Focus: Which geographic markets are most critical to your sales efforts? Prioritize platforms with strong coverage and data quality in those regions.

- Data Type Specialization: What specific data points (e.g., mobile phone numbers, email addresses, technographics, intent data) are most important for your prospecting? Choose platforms that excel in those areas.

- Integration Needs: How well does the platform integrate with your existing CRM, marketing automation, and other sales tools? Look for seamless data flow and workflow automation.

- Sales Methodology: Does your team rely on outbound prospecting, account-based marketing, or a combination of approaches? Choose platforms that align with your sales strategy.

- Budget and Pricing: Consider the total cost of ownership, including subscription fees, usage limits, and any necessary add-ons or integrations.

- Compliance Requirements: If you operate in Europe or handle sensitive data, prioritize platforms with robust GDPR compliance and data privacy features.

Top 10 Cognism Competitors: Strategic Analysis

Here's a detailed comparison of 10 leading Cognism competitors, highlighting their key strengths and ideal use cases:

1. Databar.ai: Combining 90+ data providers in one platform

Databar.ai takes a unique approach by connecting users to a vast ecosystem of over 90 specialized data providers through a single, flexible platform. This allows access to a wider range of data sources and often results in superior coverage and accuracy, particularly in niche markets and for specialized data types.- Strategic Positioning:

- Primary Market: Organizations needing diverse, accurate, and global data from multiple specialized sources.

- Core Value Proposition: Unrivaled data diversity and accuracy for complex prospecting, without vendor lock-in.

- Competitive Advantage: Multi-source data aggregation and customizable workflows versus Cognism's proprietary database and European focus.

- Key Differentiators:

- Access to 90+ specialized data providers through a unified interface.

- Capability to scrape every page on the web with it's AI agent

- Cross-provider data verification for superior accuracy and match rates.

- Flexible, value-based consumption models (e.g., Launch from $39/month for 1,000 credits).

- Data visualization builder for custom data graphs and analysis.

- Robust compliance framework supporting global regulatory needs.

- Best Use Cases:

- Teams targeting highly specific industries or global markets requiring deep, specialized data through industry-focused tools

- Organizations needing to validate contacts against multiple sources for higher accuracy.

- Sales ops teams building custom data enrichment workflows.

- Enterprises seeking to reduce data vendor sprawl without sacrificing data quality.

- GTM teams aiming to automate large portions of their GTM processes.

- Comparison to Cognism: While Cognism excels in European data, Databar.ai offers a more comprehensive global solution with access to a wider range of data sources and greater workflow flexibility. Start your free trial today.

- Strategic Positioning:

-

2. ZoomInfo: Enterprise Data Provider

ZoomInfo is a leading provider of B2B data, particularly in North America. It offers a vast database with deep firmographic, technographic, and intent data, making it a strong choice for enterprise organizations.- Strategic Positioning:

- Primary Market: Large enterprises requiring the most extensive and accurate B2B contact and company data for sales and marketing.

- Core Value Proposition: Deep, verified B2B intelligence with extensive firmographic, technographic, and intent data.

- Competitive Advantage: Superior North American data depth and enterprise-level features vs. Cognism's European focus.

- Key Differentiators:

- Massive, proprietary B2B contact and company database (over 300M+ contacts).

- Advanced intent signals identifying active buyers.

- Robust technographic data for targeting by tech stack.

- Strong integrations with major CRMs and sales engagement platforms.

- Go-to-market orchestration features for large sales teams.

- Best Use Cases:

- Large sales organizations needing the most comprehensive and verified B2B data.

- Teams focused on account-based strategies requiring deep company and intent insights.

- Enterprises in North America prioritizing data breadth and accuracy.

- Pricing (Est.): Starts around $15,000/year for basic plans, scaling significantly with features and users.

- Comparison to Cognism: ZoomInfo offers superior North American data and more advanced features, while Cognism focuses on European data and compliance.

3. Apollo.io: The Integrated Sales Engagement Platform

Apollo.io combines prospecting data with sales engagement features, offering an all-in-one solution for outbound sales teams. It's known for its user-friendly interface and competitive pricing.- Strategic Positioning:

- Primary Market: Sales teams seeking a combined data and engagement platform for efficient outbound prospecting.

- Core Value Proposition: Unified platform for data access and outreach execution.

- Competitive Advantage: Integrated engagement functionality and competitive pricing vs. Cognism's data-focused approach.

- Key Differentiators:

- Integrated sequence builder for direct campaign execution.

- Engagement analytics providing outreach effectiveness insights.

- Large proprietary database with competitive coverage (200M+ contacts).

- Chrome extension enhancing workflow integration.

- Competitive pricing structure providing enterprise value.

- Pricing (Est.): Freemium plan available. Paid plans range from $49-$149 per user/month (billed annually), with custom enterprise options.

- Best Use Cases:

- Organizations seeking to consolidate sales intelligence and engagement tools.

- Teams needing immediate outreach capabilities alongside data access.

- Small to mid-size enterprises preferring unified platform approaches.

- Companies prioritizing cost efficiency over specialized functionality.

- Comparison to Cognism: Apollo.io offers integrated engagement features, while Cognism focuses on data quality and compliance, particularly in Europe.

4. Lead411: The Trigger-Based Intelligence Platform

Lead411 focuses on providing timely and accurate contact data, emphasizing trigger events and intent signals to help sales teams connect with prospects at the right time.- Strategic Positioning:

- Primary Market: Sales teams focused on trigger-based selling and identifying timely opportunities.

- Core Value Proposition: Accurate contact data with robust trigger events and intent signals.

- Competitive Advantage: Strong focus on trigger events and timely intelligence vs. Cognism's broader data approach.

- Key Differentiators:

- Comprehensive trigger event tracking, including company changes and news.

- Intent data identifying companies actively researching solutions.

- Direct dial phone numbers and verified email addresses.

- Integration with CRM and sales engagement platforms.

- Pricing (Est.): Free trial available. "Basic Plus Unlimited" plan costs $99 per user/month, with Enterprise plans requiring a custom quote.

- Best Use Cases:

- Teams practicing trigger-based selling and seeking timely opportunities through intent data platforms

- Organizations needing accurate contact data with intent signals.

- Sales professionals focused on connecting with prospects at the right time.

- Comparison to Cognism: Lead411 emphasizes trigger events and timely intelligence, while Cognism focuses on European data quality and compliance.

5. Vainu: The Nordic Data Specialist

Vainu specializes in providing comprehensive and accurate data for Nordic and Northern European markets. It's a strong choice for organizations targeting those regions.- Strategic Positioning:

- Primary Market: Organizations targeting Nordic and Northern European markets.

- Core Value Proposition: Unparalleled data coverage and accuracy in Nordic and Northern European regions.

- Competitive Advantage: Deep regional expertise and data quality in the Nordic region vs. Cognism's broader European focus.

- Key Differentiators:

- Superior data coverage and accuracy in Nordic and Northern European markets.

- Direct connections to official Nordic business registries.

- Strong company scoring and Nordic-specific insights.

- Integration with CRM and sales engagement platforms.

- Pricing (Est.): Starts from approximately $3,677 annually. Custom pricing available.

- Best Use Cases:

- Organizations with a strong focus on Nordic and Northern European markets.

- Teams needing accurate and comprehensive data for those regions.

- Companies seeking local expertise and insights for the Nordic market.

- Comparison to Cognism: Vainu offers deeper regional expertise in the Nordic region, while Cognism focuses on broader European coverage.

6. Clearbit: The API-First Data Enrichment Specialist

Clearbit focuses on providing real-time data enrichment through APIs. It's a strong choice for organizations with mature tech stacks that want to seamlessly integrate data into their existing systems.- Strategic Positioning:

- Primary Market: Marketing and sales operations teams with mature tech stacks and development resources.

- Core Value Proposition: Real-time B2B data enrichment and visitor identification for personalized experiences.

- Competitive Advantage: API-first, automated enrichment and website visitor insights vs. Cognism's data-focused approach.

- Key Differentiators:

- Robust APIs for integrating data directly into CRMs, marketing automation, and custom apps.

- Real-time data enrichment on inbound leads and website visitors.

- Reveal feature for identifying anonymous website visitors.

- Focus on marketing and sales operations automation.

- Pricing (Est.): Pricing is volume-based and tailored, starting around $1,000/month for smaller teams for Prospector. Enrichment plans may start lower ($99/month).

- Best Use Cases:

- Organizations automating lead scoring, routing, and personalization based on real-time data.

- Teams enriching existing CRM records and marketing databases.

- Companies prioritizing data integration into their existing workflow over a new platform.

- Comparison to Cognism: Clearbit focuses on API-first data enrichment, while Cognism provides a more traditional data platform with a focus on European data and compliance.

7. LinkedIn Sales Navigator: The Relationship Intelligence Engine

LinkedIn Sales Navigator leverages the vast professional network of LinkedIn to provide relationship-based intelligence. It's a strong choice for sales teams focused on social selling and building relationships.- Strategic Positioning:

- Primary Market: Sales professionals and teams focused on social selling, relationship building, and leveraging existing networks.

- Core Value Proposition: First-party professional network data with relationship mapping and insights for targeted engagement.

- Competitive Advantage: Deep professional network insights and relationship-driven outreach vs. Cognism's broader contact data.

- Key Differentiators:

- Access to LinkedIn's unique, self-reported professional data.

- Advanced search filters based on connections, groups, and job changes.

- InMail capabilities for direct communication within LinkedIn.

- Lead recommendations and account alerts.

- Integration with the broader Microsoft ecosystem.

- Pricing (Est.): Sales Navigator Core starts at $99.99/month, or $79.99/month billed annually. Teams plans are custom.

- Best Use Cases:

- Sales teams with complex, long sales cycles benefiting from warm introductions.

- Professionals focused on social selling and building rapport.

- Account-based strategies that prioritize understanding organizational structures and key relationships.

- Comparison to Cognism: LinkedIn Sales Navigator focuses on relationship-based intelligence, while Cognism provides broader contact data with a European focus.

8. Outreach.io: The Enterprise Sales Engagement Leader

Outreach.io is a leading sales engagement platform that offers advanced automation, analytics, and workflow orchestration. It focuses on optimizing the entire sales cycle, not just prospecting.- Strategic Positioning:

- Primary Market: Enterprise sales organizations requiring sophisticated multi-channel engagement, workflow automation, and revenue intelligence.

- Core Value Proposition: End-to-end sales execution platform for predictable pipeline generation and deal closure.

- Competitive Advantage: Deeper sales engagement automation, advanced analytics, and revenue intelligence vs. Cognism's data-focused approach.

- Key Differentiators:

- Highly customizable multi-channel sequences (email, calls, social).

- Advanced A/B testing and performance analytics for sequences.

- Conversation intelligence for call analysis and coaching.

- Robust Salesforce integration and CRM sync.

- AI-powered insights for deal progression and forecasting.

- Pricing (Est.): Varies widely based on number of users and features, often $40,000+ annually for enterprise deployments. Offers modular pricing (e.g., Engage, Deal, Meet, Optimize).

- Best Use Cases:

- Large sales teams needing to standardize and scale complex outreach processes.

- Organizations focused on optimizing sales representative productivity and coaching.

- Teams requiring deep analytics to understand engagement effectiveness.

- Comparison to Cognism: Outreach.io focuses on sales engagement automation, while Cognism provides data and compliance expertise, particularly in Europe.

9. Salesloft: The Holistic Sales Engagement Platform

Similar to Outreach, Salesloft is a leading sales engagement platform (SEP) known for its comprehensive capabilities in orchestrating buyer journeys across multiple channels.- Strategic Positioning:

- Primary Market: High-growth and enterprise sales teams focused on optimizing every touchpoint in the sales cycle.

- Core Value Proposition: A unified platform for sales engagement, forecasting, and coaching.

- Competitive Advantage: Enterprise-grade engagement, robust dialer, deep analytics, and coaching tools vs. Cognism's data-centric approach.

- Key Differentiators:

- Advanced cadence builder with conditional logic and personalization at scale.

- Comprehensive calling features, including local presence and transcription.

- Robust analytics and reporting on engagement, pipeline, and team performance.

- Conversation intelligence for sales call analysis.

- Deep CRM integrations and a marketplace of complementary tools.

- Pricing (Est.): Tiered plans (e.g., Essentials, Advanced, Premier) ranging from roughly $140-$180 per user/month, typically with annual commitments. Enterprise plans require custom quotes, often starting at $20,000+ annually.

- Best Use Cases:

- Sales development teams managing high-volume outbound campaigns.

- Account executives needing to manage complex multi-touch sales cycles.

- Sales leaders focused on improving team performance through coaching and analytics.

- Comparison to Cognism: Salesloft is a sales engagement platform, while Cognism is primarily a data provider with a strong focus on European compliance.

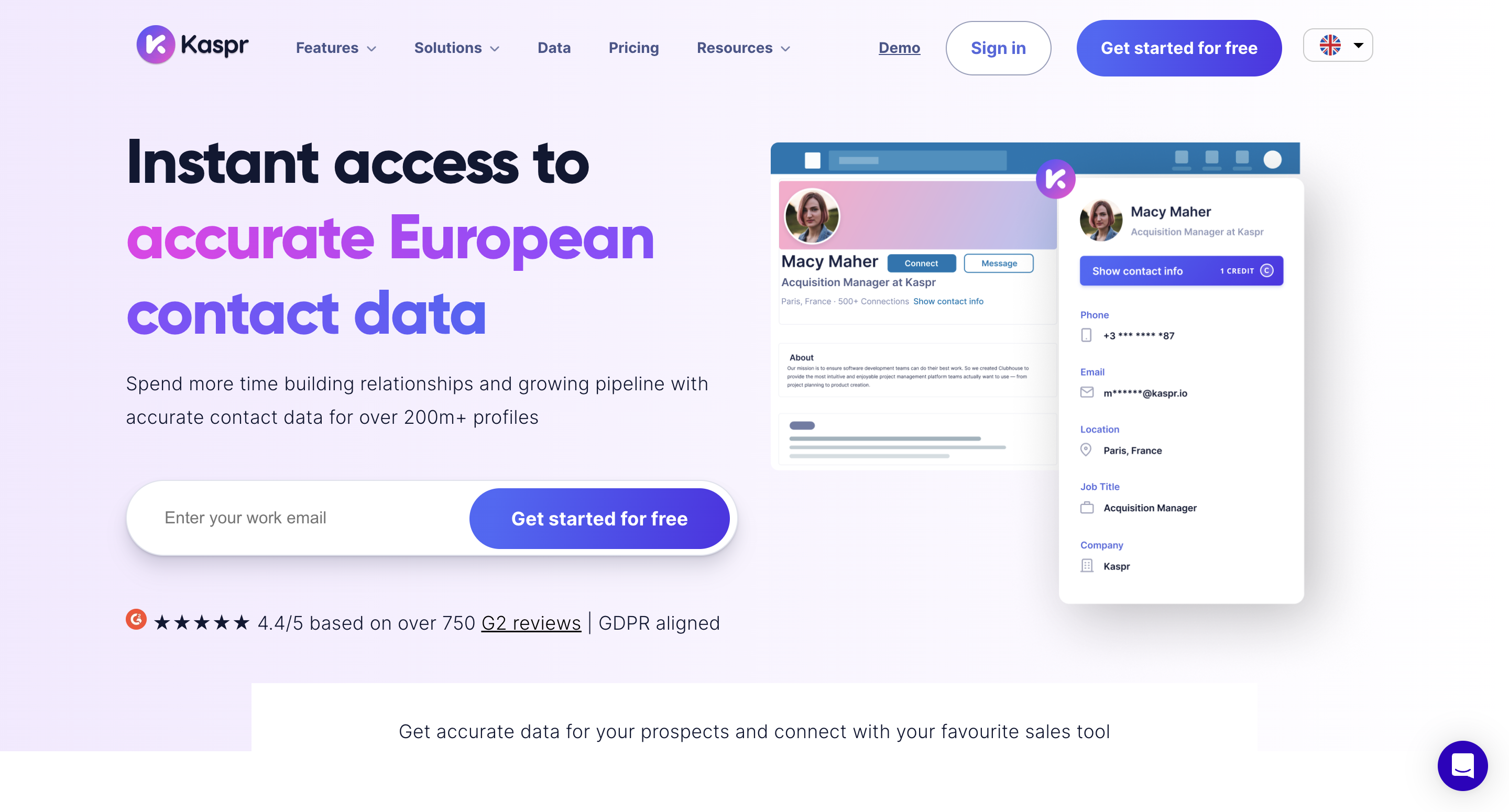

10. Kaspr: The GDPR-Compliant LinkedIn Prospecting Tool

Kaspr positions itself as a privacy-first contact intelligence platform, specializing in verified B2B contact data with built-in GDPR compliance, particularly for European markets.- Strategic Positioning:

- Primary Market: European enterprises and global companies prioritizing privacy-compliant prospecting and LinkedIn-based outreach.

- Core Value Proposition: Verified contact discovery directly from LinkedIn with comprehensive privacy compliance.

- Competitive Advantage: Strong GDPR compliance and LinkedIn-native contact verification vs. Cognism's broader data approach.

- Key Differentiators:

- GDPR-native architecture ensuring compliant data collection and processing.

- LinkedIn Chrome extension for easy prospecting directly from profiles.

- Verified email addresses and phone numbers.

- Integration with CRMs and sales tools.

- Pricing (Est.): Freemium plan available. Paid plans start from $49-$65 per user/month (Starter), with Business ($79-$99/month) and Organization ($99-$102/month) tiers available.

- Best Use Cases:

- Sales teams focused on LinkedIn prospecting, especially in Europe.

- Organizations prioritizing GDPR compliance in their lead generation efforts.

- Individual sales professionals or small teams needing a cost-effective solution for contact finding.

- Comparison to Cognism: Kaspr offers similar GDPR compliance and a strong LinkedIn integration, often at a lower price point for individual users or small teams, while Cognism provides broader database access.

Data Quality Deep Dive: Where Cognism Competitors Excel

Beyond general platform comparisons, understanding specific data strengths helps identify which Cognism competitor best matches your exact requirements:

Regional Coverage Excellence

- North American Data Quality:

- Databar.ai provides quality North American data through multiple specialized providers.

- ZoomInfo maintains a comprehensive US and Canadian database.

- Apollo.io offers strong US coverage at more accessible price points.

- European Coverage Strengths:

- Cognism delivers excellent UK and Western European contact data.

- Vainu offers unmatched Nordic and Northern European information.

- Databar.ai connects to multiple European specialists through its platform.

- Global Market Coverage:

- Databar.ai achieves balanced global coverage through regional specialists.

- ZoomInfo offers comprehensive coverage of larger global enterprises.

- InsideView (often integrated via other platforms) provides strong multinational company intelligence.

- Emerging Market Data:

- Specialized providers in Databar.ai's ecosystem often offer stronger coverage in developing regions.

- Most proprietary database platforms show significant gaps in emerging markets.

- Local specialists often outperform global generalists in specific countries.

Data Type Specialization

Beyond regional and industry coverage, Cognism competitors excel in different data categories:

- Mobile Phone Excellence:

- Cognism maintains a strong reputation for European mobile numbers.

- Lusha (not in top 10, but a common alternative) offers quality direct dial and mobile data globally.

- Several specialized providers (accessible via Databar.ai) excel in specific regional mobile coverage.

- Email Verification Technology:

- Hunter.io and Snov.io lead in email pattern recognition and verification.

- Apollo.io delivers solid email deliverability at scale.

- Multi-source platforms often combine multiple verification technologies through email enrichment approaches.

- Company Intelligence Depth:

- Databar.ai provides superior organizational structure insights.

- ZoomInfo offers comprehensive firmographic data.

- Platforms vary significantly in private company coverage.

- Technographic Information:

- ZoomInfo offers advanced technology stack detection.

- BuiltWith (available through platforms like Databar.ai) specializes in web technologies.

- Technology coverage varies dramatically by platform and segment.

- Social Media Integration:

- LinkedIn-focused tools offer stronger professional network insights.

- Multi-source platforms often provide broader social coverage.

- Social data accuracy varies significantly across providers.

These specialized data strengths should guide platform selection based on the specific information types most critical to your sales process.

European data compliance remains important, but global reach shouldn't be compromised. In case you're wondering how we compare to other products when teams evaluate Cognism competitors, here's how we deliver worldwide coverage while maintaining data quality standards:

Our platform vs ZoomInfo - Global accessibility through multi-source providers vs enterprise implementation requirements that may require dedicated resources.

Databar.ai compared to Apollo.io - Worldwide data coverage through 90+ specialized providers vs integrated platform approaches with regional variations.

How we simplify vs Clay - Comparing workflow simplicity through ready-to-use interfaces and templates.

Our intelligence vs Lusha - Global intelligence through multi-source aggregation vs LinkedIn-focused contact discovery methodologies.

Databar.ai versus LinkedIn Sales Navigator - Complete data access across multiple contact and company data types versus professional network-based relationship insights within LinkedIn's ecosystem.

How we enhance vs Lead411 - Global database access through specialized regional providers versus trigger-based intelligence platforms with geographically focused coverage strengths.Selection Framework: Finding Your Ideal Cognism Competitor

Given the significant differences among sales intelligence platforms, follow this structured framework to identify your optimal Cognism competitor:

- Strategic Positioning:

-

Prioritize Your Must-Have Requirements & Create a Checklist:

Begin by clearly documenting your non-negotiable needs, prioritizing them from essential to nice-to-have. Consider your geographic focus, critical data types, industry requirements, compliance necessities, and essential integration needs.

-

Request Custom Data Samples & Conduct Verification:

Generic demonstrations rarely reveal true platform performance. Request samples using 50-100 of your actual target accounts. Independently check the results against known information and evaluate the efficiency for your most common prospecting tasks.

-

Schedule Focused Demonstrations & Evaluate Implementation:

Ask vendors to show specific workflows relevant to your use cases. Beyond features, consider the complete deployment picture: what resources are required for setup, how quickly can users become productive, and what ongoing administration will the platform demand?

-

Speak With Reference Customers & Assess Team Adoption:

Talk to organizations similar to yours about their real-world experience with each platform. The most powerful platform delivers no value if your team won't use it. Assess interface intuitiveness, workflow alignment with existing processes, mobile accessibility, and collaboration features.

-

Analyze Complete Value Equation & Contract Flexibility:

Look beyond the subscription cost to the total value delivered. Consider data quality in your specific segments, feature accessibility (included vs. premium add-ons), expected time efficiency gains, and the flexibility of the contract to adjust as your needs evolve.

-

Common Questions About Cognism Competitors

Which Cognism competitor has the best data accuracy?

Data accuracy varies significantly by region, industry, and data type. ZoomInfo typically shows good accuracy in North America, while Cognism demonstrates stronger European data, particularly for mobile numbers. For global operations, multi-source platforms like Databar.ai often deliver more consistent quality across regions by accessing specialized providers for different markets. Rather than seeking universal accuracy claims, test each platform with your specific target accounts to determine which performs best for your needs.

How do Cognism competitors compare for mobile phone data?

While Cognism has built a strong reputation for European mobile data, several competitors now offer comparable mobile coverage through different approaches. Platforms like Databar.ai access specialized mobile data providers through their multi-source ecosystem, while others like Lusha have invested heavily in direct dial collection. For US mobile numbers, ZoomInfo typically delivers strong results, while European mobile data remains a Cognism strength. The optimal choice depends on your specific target regions and contact method priorities.

Which Cognism competitors offer the most flexible pricing?

Pricing flexibility varies significantly among sales intelligence platforms. Apollo.io offers accessible entry points with its freemium model and transparent tiered pricing. Databar.ai provides consumption-based options where you pay for specific data operations rather than fixed seats. Kaspr and Lusha also offer credit-based systems for teams with irregular usage patterns. In contrast, enterprise platforms like ZoomInfo typically require more substantial commitments with annual contracts. The best pricing model depends on your organization's size, usage patterns, and budget predictability.

How do compliance capabilities compare among Cognism competitors?

Compliance features vary dramatically between platforms. Cognism offers strong GDPR documentation, particularly valuable for European operations. Databar.ai provides multi-framework support covering various regional regulations through its diverse provider network. ZoomInfo delivers comprehensive enterprise compliance features, though at premium price points. Organizations with strict regulatory requirements should evaluate documentation depth, consent management capabilities, and specific regional compliance features rather than general privacy claims.

Making Your Decision: Next Steps in Evaluating Cognism Competitors

After reviewing this comprehensive analysis of Cognism competitors, follow these practical steps to move forward with your evaluation:

- Create Your Requirements Checklist: Document your specific needs, prioritizing must-have versus nice-to-have features.

- Request Custom Data Samples: Provide each potential provider with a sample of your target accounts for testing.

- Schedule Focused Demonstrations: Ask vendors to show specific workflows relevant to your use cases.

- Speak With Reference Customers: Talk to organizations similar to yours about their experience with each platform.

- Conduct Team Testing: Have actual users try each platform for common tasks and provide feedback.

- Request Complete Pricing: Get full cost details including all potential fees beyond base subscription.

- Evaluate Implementation Resources: Understand what support each vendor provides during onboarding.

- Consider Growth Compatibility: Assess how each platform will scale with your evolving needs.

Following this structured approach will help you identify which Cognism competitor truly delivers the best value for your specific requirements.

Conclusion: Selecting Your Optimal Sales Intelligence Solution

The diverse ecosystem of Cognism competitors offers specialized strengths for different prospecting needs. While Cognism excels in European mobile coverage and compliance documentation, alternatives like Databar.ai, ZoomInfo, and Apollo.io each provide distinct advantages for different use cases, target regions, and sales methodologies.

At Databar.ai, we've reimagined sales intelligence with our multi-source platform connecting users to over 90 premium data providers through a single, intuitive interface. Rather than limiting you to a single database with inevitable coverage gaps, our approach gives you access to specialized providers for different regions, industries, and data types—often delivering superior match rates and fresher data than single-source alternatives.

Our customizable workflows adapt to your specific processes rather than forcing standardized approaches, while our transparent consumption model ensures you only pay for the data operations you actually perform. The result is a more flexible, comprehensive approach to sales intelligence that many teams find delivers superior value compared to traditional single-source platforms like Cognism.

Ready to explore how our multi-source approach compares to Cognism for your specific requirements? Start your free trial today to experience our platform firsthand and see the difference our unique approach makes for your prospecting effectiveness.

Related articles

Context Engineering for GTM Teams: The Complete Guide

Turn Your GTM Approach with AI That Knows Your Audience and Plays by Your Rules

by Jan, February 27, 2026

How to Build Claude Code Skills for GTM (With Templates)

Master GTM Automation with Step-by-Step Claude Code Skill Templates

by Jan, February 26, 2026

Claude Code for GTM Engineers: The Practical Guide to Building Campaigns in 2026

How GTM engineers can save time and boost accuracy with Claude Code

by Jan, February 25, 2026

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026