Clearbit Alternative for B2B Data: 7 Platforms That Excel in Different Areas

Discover top Clearbit alternatives for B2B data that offer unique strengths across various business needs

Blogby JanMay 27, 2025

Sales teams today face an evolving data enrichment landscape where different platforms excel in specific areas of B2B intelligence. While Clearbit has established itself as a known player in API-first real-time data enrichment, the market now offers specialized alternatives that address distinct business requirements around API integration, implementation approach, geographic coverage, and workflow integration.

The opportunity: Modern revenue teams are discovering that Clearbit alternatives often provide superior results for specific use cases, whether that's simplified implementation, enhanced international coverage, or integrated sales engagement capabilities. Rather than viewing these as replacements, successful organizations are evaluating which platform best aligns with their unique requirements for contact verification, data sourcing, and technical implementation.

This analysis examines seven leading platforms that complement or serve as alternatives to Clearbit's approach. Each solution brings distinct strengths to different aspects of B2B data enrichment, from multi-source aggregation to specialized compliance frameworks and API integration capabilities.

By understanding how these platforms differentiate themselves, you'll be equipped to make strategic decisions about which data enrichment approach delivers optimal results for your specific sales methodology, target markets, and technical requirements.

Evolving B2B Data Enrichment Options

The data enrichment market has matured into distinct segments, each addressing specific business needs and implementation preferences. Understanding these market dynamics helps identify which platforms complement existing strategies or provide alternative approaches to B2B intelligence gathering.

Technical implementation preferences have created two primary market segments. API-first platforms like Clearbit excel for organizations with strong technical capabilities who need deep system integration and real-time data enrichment capabilities. Interface-first platforms serve teams requiring immediate access through web applications and browser extensions, unlike complex API integration, enabling rapid deployment without technical overhead.

Data sourcing methodologies represent another key differentiation. Single-source providers maintain proprietary databases with consistent data standards and quality controls. Multi-source aggregators combine data from numerous providers through waterfall enrichment approaches to maximize coverage and accuracy.

Geographic and industry specialization has become increasingly important as sales teams target specific markets. Some platforms excel in North American coverage, others provide superior international data, and specialized providers focus on particular industries or professional networks.

API integration complexity requirements vary significantly between organizations. Enterprise teams with mature tech stacks often prefer sophisticated API integration capabilities that embed data enrichment directly into existing workflows. Growing organizations typically prioritize platforms that provide immediate value through simple integrations and intuitive interfaces.

Compliance and privacy frameworks have emerged as critical selection criteria for global organizations. Platforms specializing in GDPR compliance, consent management, and regional data handling serve organizations operating across multiple jurisdictions with varying regulatory requirements.

The most effective data enrichment strategies leverage the strengths of different platforms for specific use cases rather than seeking universal solutions. Understanding these distinct approaches enables more strategic technology investments that deliver measurable improvements in prospecting effectiveness and team productivity.

Strategic Framework: Evaluating Data Enrichment Platforms

Before examining specific alternatives, establishing clear evaluation criteria helps identify which platforms deliver the capabilities your team needs while aligning with operational requirements and strategic objectives.

Implementation and Integration Approach

Technical Resource Requirements significantly impact platform selection and time-to-value. API-first solutions provide maximum flexibility and customization possibilities but require development resources for optimal implementation. Interface-first platforms offer immediate functionality through web applications and browser extensions, enabling teams to begin prospecting within minutes.

Workflow Integration Philosophy affects long-term adoption and efficiency. Some platforms enhance existing processes through seamless CRM integration and familiar user interfaces. Others provide comprehensive standalone environments that may require teams to adopt new primary workflows for prospect research and data enrichment.

Scalability and Flexibility considerations impact growth planning. Enterprise-focused platforms often include sophisticated customization options but require substantial commitments. Growth-stage solutions typically offer more flexible scaling that aligns with team expansion and evolving requirements.

Data Coverage and Quality Standards

Source Diversity and Verification approaches influence data accuracy and coverage. Single-source providers maintain consistent quality standards through proprietary collection methodologies. Multi-source aggregators access broader data pools while implementing contact verification processes to ensure reliability.

Geographic and Industry Specialization affects targeting precision. Global platforms provide broad coverage but may have gaps in specific regions or professional networks. Specialized providers often deliver superior accuracy in their focus areas while having limitations elsewhere.

Data Freshness and Update Frequency impact campaign effectiveness. Real-time enrichment provides current information but typically costs more per record. Batch processing offers cost efficiency for large-scale prospecting while requiring planning around update cycles.

Business Model and Cost Structure

Pricing Model Alignment affects budget predictability and cost efficiency. Subscription-based platforms provide stable monthly costs but may include unused capacity. Credit-based systems offer usage flexibility but require monitoring to prevent budget overruns.

Total Cost of Ownership includes implementation expenses, training requirements, and ongoing maintenance. Simple platforms may have higher per-record costs but lower total investment, while sophisticated solutions offer better unit economics but require substantial setup investments.

Top 7 Clearbit Alternatives: Strategic Analysis

1. Databar.ai: The Multi-Source Enterprise Intelligence Platform

Databar.ai has positioned itself as a leading data enrichment platform that provides access to 90+ specialized data providers through a unified interface. This approach addresses the complexity of managing multiple vendor relationships while maximizing data coverage across different industries and geographic markets.

Strategic Positioning:

- Primary Market: GTM, sales and marketing teams requiring diverse, high-quality data sources and automation

- Core Value Proposition: Broad data coverage through multi-source aggregation with intuitive workflows

- Competitive Advantage: Data source diversity and workflow flexibility for complex prospecting requirements including ai agents for research,analysis and personalization

Key Differentiators: Databar's multi-source architecture can automatically query multiple data providers to maximize contact discovery rates.This waterfall enrichment approach typically achieves 80-90% email discovery success compared to 40-50% from single-provider platforms, directly improving campaign effectiveness through superior contact discovery.

The platform's AI-powered research agent extends beyond basic contact lookup to extract insights from websites, social profiles, and business publications. This capability particularly benefits teams researching emerging companies or specialized industries that traditional databases may not cover.

The platform is optimized for building custom data enrichment processes without coding requirements. GTM teams can create sophisticated enrichment sequences that combine multiple data sources, apply validation rules, and route results based on prospect characteristics.

Transparent credit-based pricing provides cost predictability while avoiding large minimum commitments typical of enterprise platforms. Organizations pay for successful data enrichment rather than seat-based subscriptions that may include unused capacity.

Best Use Cases:

- Organizations seeking data access from multiple providers through enrichment platforms without needing multiple subscriptions

- Organizations requiring specialized regional data coverage

- Teams targeting niche industries with specific data requirements

- Sales operations building custom prospecting workflows

Implementation Considerations: Databar offers guided setup processes that deliver value within hours. The platform suits organizations that view data enrichment as a strategic capability and are looking to develop flexible, evolving, and automated approaches.

2. ZoomInfo: The Enterprise Data Intelligence Leader

ZoomInfo maintains its position as a comprehensive B2B data enrichment platform, offering extensive databases with sophisticated organizational mapping and intent data capabilities that serve enterprise sales strategies requiring deep account insights.

Strategic Positioning:

- Primary Market: Large enterprises requiring comprehensive B2B contact and company intelligence

- Core Value Proposition: Extensive database depth with advanced intent signals and organizational mapping

- Competitive Advantage: Data breadth and enterprise-grade features for complex sales strategies

Key Differentiators: ZoomInfo's proprietary database contains verified information on over 100 million professionals and 14 million companies, with particularly strong coverage in North American markets. The platform's data collection methodology combines web crawling, email signatures, and user-contributed information with robust contact verification.

Advanced intent data capabilities identify companies actively researching relevant solutions through content consumption tracking across business publications. This functionality enables sales teams to prioritize outreach based on buying signals rather than demographic targeting alone.

Organizational mapping features provide detailed company hierarchies showing reporting relationships and decision-making structures. Enterprise sales teams use this intelligence to identify stakeholders involved in complex purchasing decisions.

Technographic intelligence reveals technology stacks used by target companies, enabling precise targeting for technology vendors and informed conversation starters for sales representatives.

Best Use Cases:

- Enterprise sales teams requiring comprehensive organizational intelligence

- Account-based marketing strategies targeting large organizations

- Technology vendors needing detailed technographic insights

- Teams with substantial budgets prioritizing data depth

Implementation Considerations: ZoomInfo delivers maximum value when integrated with sophisticated CRM and marketing automation systems, typically requiring dedicated sales operations support for API integration.

3. Apollo.io: The Integrated Sales Intelligence Platform

Apollo.io combines comprehensive B2B data enrichment with native sales engagement capabilities, providing a unified platform that eliminates the need for separate data and outreach tools while maintaining competitive data quality standards.

Strategic Positioning:

- Primary Market: Sales teams seeking combined data access and engagement capabilities

- Core Value Proposition: Unified platform eliminating separate data and outreach tool requirements

- Competitive Advantage: Integrated engagement functionality with comprehensive database access

Key Differentiators: Apollo's combined approach enables seamless workflows from prospect identification through engagement execution. Teams can research contacts, verify email addresses through contact verification, and launch personalized sequences without transferring data between platforms.

Large proprietary database includes over 275 million contacts with strong technographic coverage. The platform's data collection emphasizes technology usage patterns, making it valuable for software vendors and teams selling to technical audiences.

Native email sequencing provides sophisticated automation capabilities including A/B testing, dynamic personalization, and engagement tracking. These features eliminate the need for separate sales engagement platforms in many implementations.

Chrome extension enables instant prospect research while browsing LinkedIn, company websites, or other sources without leaving primary research environments.

Best Use Cases:

- Small to mid-size sales teams seeking unified data and engagement tools

- Organizations wanting to consolidate vendor relationships

- Teams prioritizing operational simplicity over specialized capabilities

- Technology vendors requiring strong technographic intelligence

Implementation Considerations: Apollo offers immediate value through intuitive interfaces requiring minimal training, working best for teams seeking simplified vendor management with basic API integration needs.

➔ Check out how Databar.ai compares to Apollo.io in this detailed review.

4. Cognism: The Compliance-Focused Global Data Provider

Cognism has established itself as a leading choice for organizations requiring verified, compliant B2B data enrichment with particular strength in European markets and comprehensive regulatory compliance frameworks.

Strategic Positioning:

- Primary Market: Global enterprises with European operations requiring GDPR-compliant data

- Core Value Proposition: Verified, compliant global data with superior European coverage

- Competitive Advantage: Regulatory compliance expertise and international data quality

Key Differentiators: Cognism's compliance-first architecture ensures all data collection and processing meets GDPR requirements through documented consent mechanisms and regular auditing processes. This approach particularly benefits organizations operating in regulated industries requiring thorough contact verification.

Diamond Data verification includes manually verified mobile phone numbers with exceptional accuracy rates. Human verification teams confirm contact details through multiple touchpoints, resulting in higher connection rates for outbound calling campaigns.

Superior European coverage addresses geographic market requirements through specialized data collection targeting European business networks and professional communities.

Real-time compliance monitoring tracks data usage permissions and consent status automatically, enabling organizations to demonstrate regulatory compliance through detailed audit trails.

Best Use Cases:

- Global enterprises with significant European operations

- Organizations in regulated industries requiring compliance documentation

- Teams prioritizing direct phone outreach with verified mobile numbers

- Companies expanding into international markets

Implementation Considerations: Cognism typically involves privacy and compliance teams in implementation planning and delivers maximum value for organizations where regulatory risk management justifies investment in comprehensive API integration.

5. Hunter.io: The Email Discovery Specialist

Hunter.io focuses exclusively on email discovery and verification, providing a streamlined solution for teams primarily needing reliable email addresses with simple implementation and transparent pricing.

Strategic Positioning:

- Primary Market: Teams focused primarily on email outreach requiring reliable email discovery

- Core Value Proposition: Specialized email finding and verification with usage-based pricing

- Competitive Advantage: Email specialization and implementation simplicity

Key Differentiators: Hunter's domain-based search methodology identifies email patterns within organizations and applies machine learning to generate probable email addresses with confidence scoring. This approach often discovers contacts not available through traditional database providers.

Real-time verification checks email deliverability using multiple validation techniques including SMTP verification, domain validation, and historical bounce tracking for higher deliverability rates through comprehensive contact verification.

Browser extension enables instant email discovery while browsing company websites, LinkedIn profiles, or other online sources without switching between tools.

API flexibility provides simple API integration options for teams needing to embed email discovery into existing workflows without complex enterprise platform requirements.

Best Use Cases:

- Teams prioritizing email outreach over other communication channels

- Organizations needing simple integration with existing tools

- Small businesses requiring cost-effective contact discovery

- Sales representatives focusing on individual prospect research

Implementation Considerations: Hunter requires minimal setup and delivers immediate value through browser extensions and simple API integration, suiting teams prioritizing simplicity and cost efficiency.

➔ Take advantage of Hunter.io’s native integration in Databar.ai today.

6. Lusha: The LinkedIn-Native Contact Intelligence Platform

Lusha specializes in contact discovery directly within LinkedIn and Sales Navigator, providing seamless integration for social selling workflows with strong European market coverage and GDPR compliance.

Strategic Positioning:

- Primary Market: Sales professionals practicing LinkedIn-based social selling

- Core Value Proposition: Verified contact discovery directly within LinkedIn with compliance

- Competitive Advantage: Native LinkedIn integration and European market specialization

Key Differentiators: Lusha's LinkedIn extension provides instant contact discovery without leaving LinkedIn profiles or Sales Navigator searches, eliminating workflow disruption between prospecting and data enrichment activities.

Strong European coverage includes verified mobile phone numbers and email addresses for professionals in markets where many platforms have limited data availability, backed by robust contact verification processes.

GDPR-compliant architecture ensures all data collection meets European privacy requirements through documented consent mechanisms for organizations operating in regulated markets.

Team collaboration features enable contact sharing and usage tracking across sales teams with management visibility into prospecting activity and credit utilization.

Best Use Cases:

- Sales professionals focused primarily on LinkedIn prospecting

- Teams requiring GDPR-compliant contact discovery

- Organizations with significant European market exposure

- Small to mid-size sales teams seeking effective contact intelligence

Implementation Considerations: Lusha offers immediate functionality through browser extensions requiring minimal technical setup, working best for teams whose prospecting centers around LinkedIn workflows without complex API integration needs.

7. UpLead: The Accuracy-Guaranteed Data Provider

UpLead differentiates itself through industry-leading accuracy guarantees and real-time data enrichment, providing a quality-focused alternative that emphasizes data reliability over database breadth.

Strategic Positioning:

- Primary Market: Teams prioritizing data accuracy over database size

- Core Value Proposition: 95% accuracy guarantee with real-time verification

- Competitive Advantage: Accuracy guarantee and quality focus

Key Differentiators: UpLead's 95% accuracy guarantee backs contact information with replacement credits for invalid data, reducing wasted outreach efforts and improving campaign ROI through higher connection rates via superior contact verification.

Real-time verification confirms contact details during enrichment using multiple validation techniques, providing confidence scores and verification status for informed outreach prioritization decisions.

Advanced filtering capabilities enable precise targeting through over 50 search criteria including technology usage, company growth indicators, and recent business events for improved prospect qualification.

Flexible credit system allows organizations to purchase data enrichment based on actual needs rather than committing to large monthly subscriptions, paying only for verified, accurate contacts.

Best Use Cases:

- Teams where contact accuracy directly impacts revenue outcomes

- Organizations with limited outreach capacity requiring high-quality prospects

- Sales representatives focusing on quality over quantity in prospecting

- Companies seeking predictable data costs through credit-based consumption

Implementation Considerations: UpLead provides immediate functionality through web interfaces and browser extensions, suiting teams willing to invest in guaranteed data accuracy with optional API integration capabilities.

➔ Get going with Uplead inside Databar.ai now with our native integration.

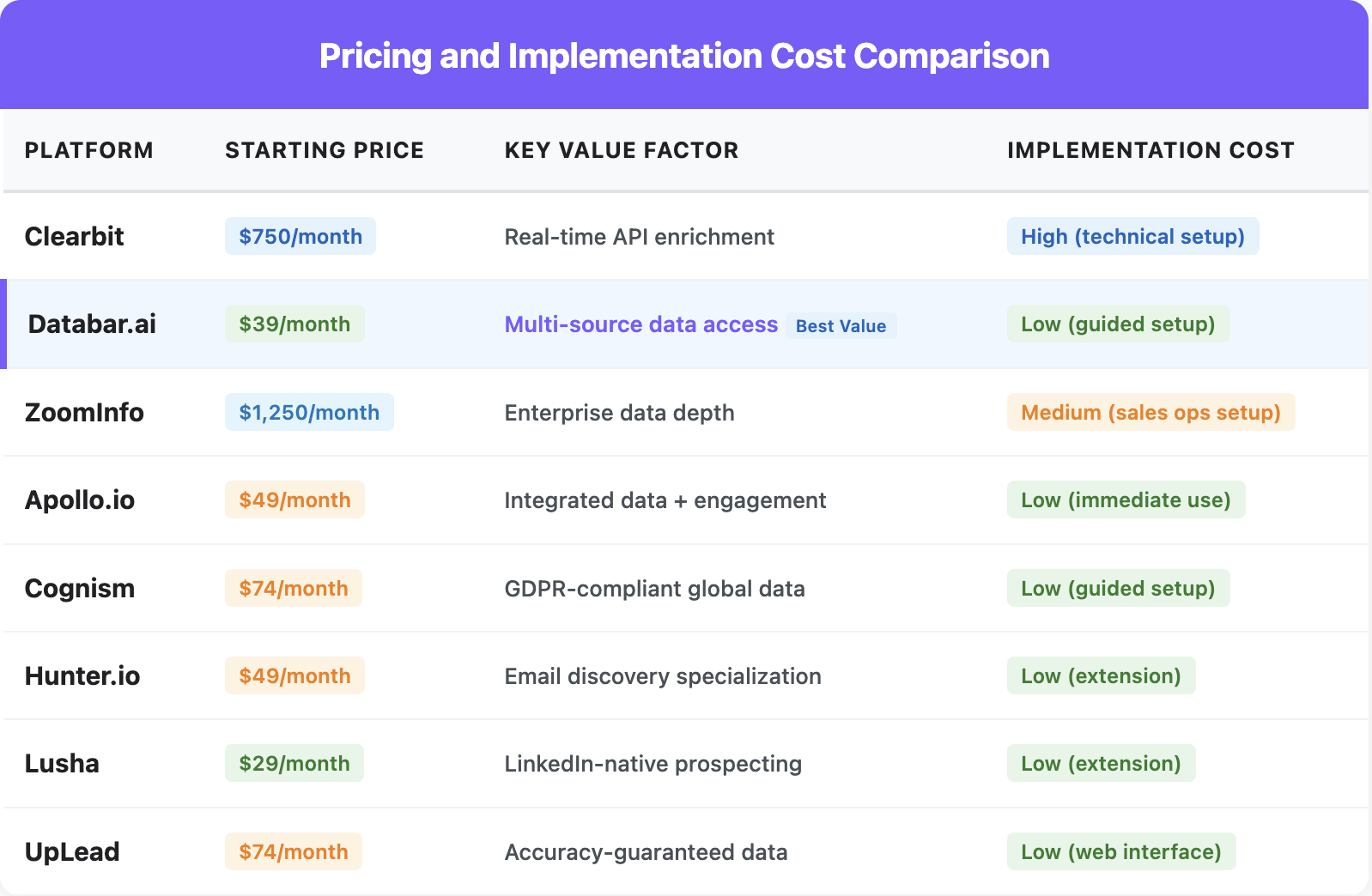

Pricing Analysis: Understanding Cost Structures

Understanding the investment required for different data enrichment platforms helps teams make informed budget decisions while considering total value delivery rather than just monthly costs.

API-first solutions often present implementation considerations for many teams. In case you're wondering how we compare to other products when evaluating Clearbit alternatives, understanding different accessibility approaches becomes valuable. Here's how our interface-first methodology addresses various implementation preferences:

Evaluating our workflows vs Clay reveals how both platforms compare while serving data enrichment requirements through ready-to-use workflows and customizable automation. The distinction becomes apparent when comparing Databar.ai's accessibility vs SignalHire, where our multi-source intelligence provides broader data coverage than contact-focused solutions. For development teams, how our interface compares to DropContact demonstrates how our comprehensive approach offers alternatives to email-specialized platforms. Additionally, our implementation vs Lusha showcases how our multi-provider access delivers enhanced coverage compared to LinkedIn-native contact discovery methodologies.

Value Consideration Factors:

Organizations should evaluate platforms based on total value delivery rather than just subscription costs. This includes implementation speed, training requirements, data quality impact on campaign effectiveness, and long-term scalability alignment with growth plans.

Platforms requiring extensive API integration may have higher total costs despite competitive monthly pricing, while solutions offering immediate functionality enable faster revenue impact through reduced time-to-value.

Strategic Decision Framework: Selecting the Right Platform

When evaluating data enrichment platforms, focus on these strategic factors to identify solutions that align with your specific requirements and operational context.

Choose Databar.ai when:

Multi-source data accuracy is essential for your prospecting success. Databar's access to 90+ specialized providers typically delivers higher contact discovery rates through advanced data coverage across different industries and geographic markets with superior contact verification.

Implementation simplicity and speed matter for your timeline. Teams can begin productive prospecting within minutes using Databar's intuitive interface without requiring extensive technical setup or API integration resources.

Global market coverage is important for your strategy. Databar's specialized providers and ai reaserch agent deliver superior international data quality compared to platforms with primarily domestic focus.

Flexible pricing and cost predictability influence your decision. Databar's transparent credit-based model provides usage flexibility while avoiding large upfront commitments or surprise overages.

Implementation Best Practices for Optimal Results

Successful data enrichment platform implementation requires strategic planning and systematic execution to ensure optimal adoption, data quality, and return on investment.

Pre-Implementation Assessment

Evaluate current data workflows to understand actual requirements versus perceived needs. Many organizations discover opportunities for improvement through focused platforms that address specific use cases more effectively than comprehensive solutions.

Define clear success metrics beyond cost considerations. Establish measurable KPIs for data quality, user adoption, campaign effectiveness, and productivity improvements to objectively assess implementation success.

Involve stakeholders across functions in evaluation processes. Sales representatives, marketing teams, and operations staff often have different priorities requiring balanced consideration during platform selection.

Technical Integration Planning

Design integration roadmaps that prioritize high-impact connections first. Focus on CRM synchronization and primary workflow integration with marketing automation tools before implementing advanced features or secondary system API integration.

Establish data quality benchmarks using known contacts and companies to compare accuracy across platforms. Test email deliverability, phone number accuracy, and company information completeness through contact verification during evaluation periods.

Plan parallel operations during transition periods to minimize disruption. Run new platforms alongside existing solutions until teams achieve proficiency and data quality meets established standards.

User Adoption Strategy

Develop targeted training programs addressing different user needs and skill levels. Sales development representatives require different platform knowledge than marketing specialists or sales operations analysts managing API integration.

Create champion networks to accelerate adoption and provide peer support. Early adopters can identify workflow optimizations and troubleshoot common challenges before broader team implementation.

Monitor usage patterns and provide ongoing support based on actual utilization data. Teams often discover new use cases or encounter unexpected challenges requiring additional training or process adjustments.

What's Next for B2B Data Intelligence

The B2B data enrichment environment continues evolving toward specialized solutions that address specific business requirements rather than universal platforms attempting to serve all use cases. Organizations achieving the best results strategically combine platforms based on distinct strengths rather than seeking single-source solutions.

Emerging trends include increased focus on data privacy compliance, AI-powered research capabilities, and real-time verification processes. Platforms that anticipate these developments while maintaining core data quality standards will deliver sustainable competitive advantages for their users.

Integration sophistication continues advancing as organizations demand seamless data flow between systems without manual intervention. The most successful platforms will be those that enhance existing workflows through sophisticated API integration rather than requiring teams to adopt entirely new processes.

For organizations seeking comprehensive data enrichment without technical complexity, Databar.ai provides access to the same premium data sources that enterprise teams rely on through workflows that sales representatives can master quickly. The platform's multi-source approach addresses coverage gaps while maintaining data quality standards that drive measurable improvements in prospecting effectiveness through superior contact verification.

Ready to explore your options? Start your free Databar trial and discover how access to 90+ data providers can enhance your prospecting results while simplifying your workflow requirements.

Related articles

How to Build Claude Code Skills for GTM (With Templates)

Master GTM Automation with Step-by-Step Claude Code Skill Templates

by Jan, February 26, 2026

Claude Code for GTM Engineers: The Practical Guide to Building Campaigns in 2026

How GTM engineers can save time and boost accuracy with Claude Code

by Jan, February 25, 2026

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026