Industry-Specific Prospecting: Build Lists by Sector

Why Prospecting Needs to Fit the Industry You’re Targeting

Blogby JanAugust 04, 2025

Sales teams burning through generic prospect lists while watching conversion rates flatline share one fatal flaw: they're using the same prospecting playbook for every industry. A cybersecurity startup and a dental practice operate in completely different digital ecosystems, yet most teams approach them identically.

The numbers tell the real story. Companies using industry-specific prospecting see up to 200% higher response rates compared to generic outreach, with personalized industry-focused emails generating 32% more responses than non-targeted campaigns. More importantly, deals close faster when prospects recognize you understand their specific sector challenges.

Research across 15+ industries shows that each sector leaves unique digital fingerprints. Tech companies cluster around LinkedIn and Crunchbase. Local businesses dominate Google My Business and industry directories. Healthcare providers appear in specialized licensing databases that don't exist for other sectors.

This guide breaks down exactly where to find prospects in each major industry, which data sources deliver the highest accuracy, and how to build lists that convert because they're built around real industry dynamics rather than generic business filters.

Why Generic Prospecting Creates Expensive Blind Spots

Most prospecting failures start with the same flawed assumption: all businesses are basically the same. Sales teams filter by company size and location, then wonder why their carefully crafted outreach gets ignored.

Different industries don't just have different needs - they exist in completely separate data universes. A B2B SaaS company typically maintains detailed LinkedIn profiles for 80% of employees, rich technographic data, and comprehensive funding histories. Meanwhile, a family-owned restaurant might have zero LinkedIn presence but detailed Google My Business profiles and strong local directory listings.

Using LinkedIn-heavy prospecting for restaurant owners is like metal detecting in a forest when the treasure is buried on the beach. The tool works fine - you're just searching in the wrong place entirely.

The missed opportunity costs compound quickly. The average sales team wastes 30+ hours monthly on manual list building, often ending up with incomplete data anyway. Marketing budgets get burned on campaigns targeting decision makers who don't exist in that industry's ecosystem. Deal velocity slows because you're solving generic problems instead of industry-specific pain points.

Sales teams report transformational results when matching prospecting strategies to industry realities. Response rates jump when outreach demonstrates genuine understanding of sector dynamics. Sales cycles compress by months when you're talking to the right people about challenges they actually face.

The Industry Data Ecosystem Map

Understanding where different industries maintain their strongest digital presence determines prospecting success. When defining your target market within any industry, the Pareto principle holds true: reaching 80% of your prospects is relatively simple. However, capturing the remaining 20% requires understanding these distinct ecosystem patterns.

LinkedIn-Present Businesses concentrate their professional identity on LinkedIn and related platforms. Professional services, B2B technology companies, and enterprise organizations invest heavily in LinkedIn presence because that's where clients discover them. Decision makers actively post thought leadership, companies maintain detailed pages, and employee data accuracy exceeds 85%.

For these businesses, your primary data sources should include:

- Professional databases with LinkedIn-sourced data

- Technology detection tools like BuiltWith or Wappalyzer

- Investment databases like Crunchbase or Owler

- Industry-specific professional directories

Local and Traditional Businesses tell a completely different story. Restaurants, contractors, medical practices, and retail stores often maintain minimal LinkedIn presence. Instead, they dominate Google My Business listings, Yelp profiles, industry-specific directories, and Chamber of Commerce databases. Their websites might be basic, but their local SEO presence is sophisticated because that's how customers find them.

For these businesses, focus on:

- Google Maps extractors

- Facebook business page data

- Industry-specific directories like Thomas Register for manufacturing

- Local listing aggregators

- State licensing databases for regulated industries

Funded startups exist in specialized ecosystems centered around funding databases. While growing companies might develop LinkedIn presence over time, the richest early-stage data lives in Crunchbase, AngelList, and PitchBook. These platforms track founding teams, investor networks, and growth metrics that traditional business databases miss entirely.

Enterprise corporations spread their data across multiple authoritative platforms. They maintain robust LinkedIn presence, appear in financial databases when public, show up in technographic tools, and often have rich website analytics. The challenge isn't finding them - it's efficiently aggregating their disparate data points into unified prospect profiles.

Understanding these ecosystem patterns changes everything about list building effectiveness. Stop forcing every industry into the same prospecting mold. Start where they naturally appear strongest, then expand systematically from there.

Building Lists for High-Growth Technology Companies

Technology startups operate in accelerated environments where traditional prospecting methods miss critical timing signals. These companies scale rapidly, pivot frequently, and make purchasing decisions in days rather than months. Effective tech startup prospecting requires tapping into growth momentum indicators that traditional databases completely ignore.

Consider targeting HR Directors at High-Growth Startups as an example. Many high-growth startups have just recently created dedicated HR positions, making them perfect prospects for HR technology solutions.

The Strategy:

- Begin with funding databases to identify startups that recently raised Series A or B funding

- Use LinkedIn-based tools to identify companies that have recently added HR leadership roles

- Add companies with active job listings showing rapid expansion

- Filter for companies between 50-250 employees (typically when formal HR roles emerge)

- Verify HR director information through company websites and LinkedIn

Using funding databases through platforms like Databar.ai's Crunchbase integration, you can identify companies that raised capital in the last 90 days, then layer additional criteria like team size, technology stack, or geographic focus.

Technology footprints reveal buying readiness with surgical precision. A startup using free tools like Gmail and Trello operates completely differently than one already invested in Google Workspace and Asana. The latter has established purchasing processes and budget allocated for business tools. Technology detection through BuiltWith integration identifies these readiness signals automatically.

Don't overlook founder backgrounds in technology sectors. Serial entrepreneurs with previous exits attract funding more easily and scale faster than first-time founders. LinkedIn data shows current roles, but combining it with Crunchbase reveals track records and success patterns. A founder who previously scaled and sold a company approaches vendor relationships very differently than someone building their first startup.

Speed is everything in startup prospecting. These companies move from evaluation to purchase in weeks, not quarters. Build your lists with real-time data sources and act immediately when identifying strong fits.

Healthcare and Medical Practice Prospecting

Healthcare prospecting requires navigating complex organizational structures and strict regulatory environments. Independent practices, hospital systems, and specialty clinics operate under different constraints and decision-making processes. Successful healthcare prospecting demands understanding both clinical workflows and business operations.

Consider the challenge of finding Dental Practices Not Currently Using Online Scheduling. This requires identifying a technological gap within a specific healthcare segment.

The Strategy:

- Start with healthcare provider databases filtered for dental practices

- Add practices from Google Maps data in target regions

- Test websites with AI to confirm absence of online booking features

- Extract office manager and dentist contact information

Professional licensing databases form the foundation of healthcare prospecting. Every healthcare provider maintains licenses that are publicly searchable through state medical boards, nursing registries, and specialty certification bodies. This provides accurate, updated practitioner data showing who practices where and in what specialties - intelligence unavailable through general business databases.

Practice size and organizational structure determines your entire approach. Solo practitioners make quick decisions but have limited budgets. Group practices involve more complex decision-making but offer larger revenue opportunities. Hospital systems require enterprise sales approaches with longer cycles but massive potential deals. NPI (National Provider Identifier) databases reveal practice structures and organizational affiliations.

Insurance acceptance patterns indicate both financial health and patient volume. Practices accepting diverse insurance plans typically maintain steady revenue streams and established operations. Those primarily serving cash-pay patients operate in different economic realities with unique budget cycles.

Technology adoption in healthcare follows predictable patterns based on practice size and specialty. Practices already using electronic health records are significantly more likely to adopt additional digital solutions. Those still operating on paper systems face much larger implementation hurdles. Website analysis and technology detection tools reveal current digital maturity levels.

Professional Services Firm Intelligence

Law firms, accounting practices, consulting companies, and marketing agencies share common prospecting dynamics that generic approaches completely miss. These knowledge-based businesses maintain strong professional networks but reaching actual decision makers requires understanding partnership structures and business development cycles.

For targeting Commercial Real Estate Brokers in Texas, the challenge is identifying active commercial brokers who aren't part of major national firms and regularly engage with new service providers.

The Strategy:

- Begin with professional databases filtering for real estate roles in Texas

- Supplement with local real estate association membership lists

- Add brokers who have recently listed commercial properties on platforms like LoopNet

- Use AI to extract broker contact information from brokerage websites

- Clean and verify emails using validation tools

Professional services firms signal their expertise through client portfolios and thought leadership. A law firm's practice areas, an agency's case studies, or a consultancy's published research reveals exactly what they do and for whom they do it. Web scraping through Databar.ai's AI agent can automatically capture these capability signals from firm websites.

Partnership structures dramatically influence purchasing decisions in professional services. Unlike corporations with clear hierarchies, professional firms often require partner consensus for major technology investments. LinkedIn data reveals partnership structures, tenure levels, and committee leadership roles.

Growth signals in professional services are subtle but extremely meaningful. New office openings, lateral partner acquisitions, and practice area launches indicate expansion phases and budget availability. Legal directories, accounting association publications, and consulting industry news track these movements systematically.

Revenue per professional serves as the key performance metric for professional services. A 50-attorney law firm billing $1.2 million per attorney operates in completely different economic realities than one billing $400,000 per attorney. Bar associations, CPA societies, and consulting directories often publish these benchmarks.

Competitive intelligence drives most professional services purchasing decisions. These firms obsess over peer performance and best practices. If three similar firms adopt a particular solution, others follow quickly to maintain competitive parity.

E-commerce and Retail Technology Targeting

E-commerce businesses leave incredibly rich digital footprints that make them ideal for data-driven prospecting approaches. Unlike traditional retail where operations happen behind closed doors, every aspect of e-commerce business happens online and creates trackable data points.

Platform detection forms the foundation of effective e-commerce prospecting. Whether an online store runs on Shopify, WooCommerce, Magento, or custom platforms reveals their technical sophistication, budget levels, and operational needs. Specific e-commerce databases like Store Leads and technology detection tools identify not just the platform but payment processors, marketing automation tools, and inventory management systems.

Traffic and revenue estimates separate serious businesses from hobby projects. SimilarWeb, Ahrefs, and similar analytics tools provide visitor data and trend analysis. Combine traffic patterns with average order values scraped from product pages to estimate monthly revenue. Focus prospecting on stores showing consistent traffic growth and meaningful revenue generation.

Product catalog complexity indicates operational maturity and technology needs. A store managing 50 products has completely different requirements than one handling 50,000 SKUs across multiple categories. Automated web scraping extracts catalog data including product counts, category structures, and pricing strategies. Complex catalogs suggest established operations worth targeting with sophisticated solutions.

Technology stack analysis reveals specific pain points and immediate opportunities. E-commerce stores using basic email tools despite high traffic volumes are prime targets for marketing automation platforms. Those lacking inventory management systems while scaling rapidly need operational technology urgently.

Marketplace presence adds another crucial dimension to e-commerce prospecting. Stores selling simultaneously on Amazon, eBay, Etsy, and their own sites face multi-channel complexity that creates urgent needs for unified management solutions.

Industry-Specific List Building Best Practices

Building truly effective industry-specific prospect lists requires following strategic principles that maximize coverage while maintaining quality. Based on successful implementations across various sectors, here are the essential rules:

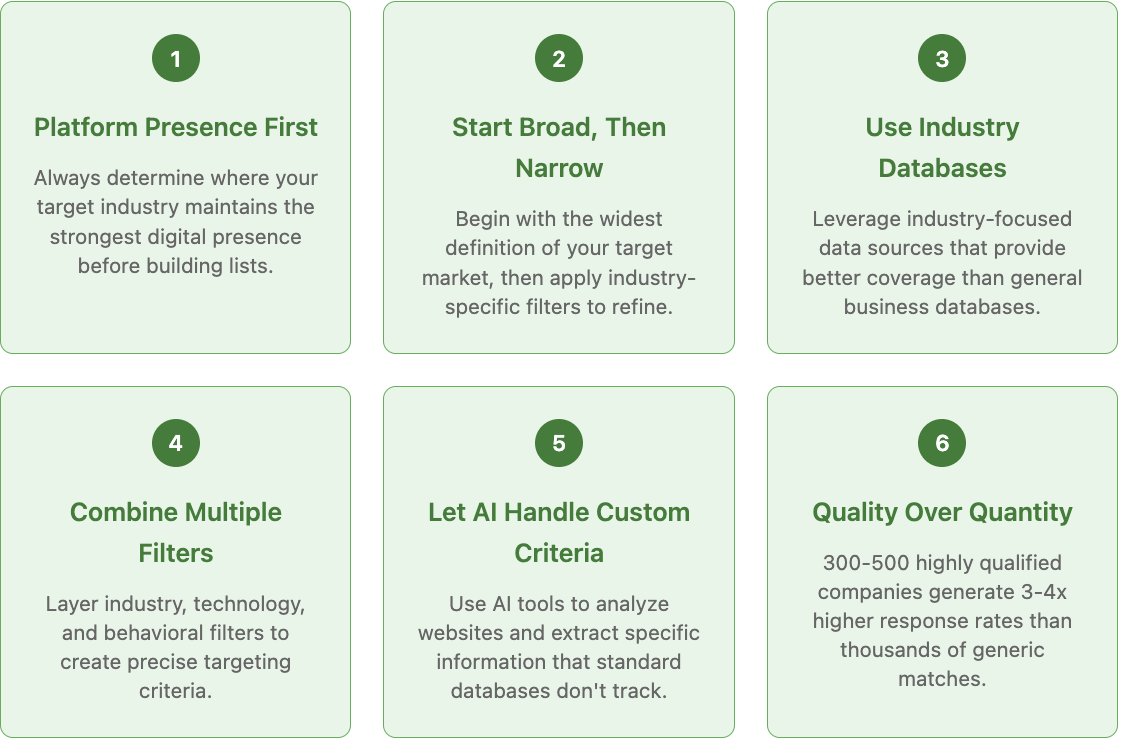

1. Determine Platform Presence First: Always start by asking: "Where do these businesses and decision-makers have a digital presence?" This fundamental question determines your entire data collection strategy. Run small test searches across different platforms before committing to a full data collection strategy. If 8 out of 10 test searches yield results on a particular platform, that's your primary source.

2. Start with the Broadest Possible List: Begin with the widest definition of your target market, then narrow down. Cast a wide net using broad industry codes or categories, then apply filters to refine. For example, when targeting healthcare technology, start with all healthcare providers and all technology companies, then find the intersection.

3. Use Industry-Specific Databases Where Possible: Industry-focused data sources often provide better coverage and more accurate information than general business databases. Look beyond the obvious sources for industry association member lists, conference attendee directories, regulatory filings, and certification body member directories.

4. Combine Technology and Industry Filters: When targeting businesses based on both industry and technology use, always use both filters to refine your list. Start with the broader filter (usually industry) to create your initial pool, then apply technology filters for more precise targeting.

5. Let AI Handle Custom Criteria: For criteria that standard databases don't track, use AI tools to analyze websites and extract specific information like service offerings, pricing indicators, or specialty mentions. Always validate AI extractions with sample checks to confirm accuracy.

Your Industry-Specific Prospecting Playbook

Building truly effective industry-specific prospect lists requires combining deep sector knowledge with comprehensive data integration. Modern prospecting succeeds by understanding not just where to find companies, but why they buy, when they buy, and who actually makes decisions.

Start by mapping your target industry's digital ecosystem. Test small sample searches across different data sources to identify which platforms provide the richest coverage for your specific sector. For B2B software companies, LinkedIn might provide 85% coverage. For local contractors, Google My Business and licensing databases might be more comprehensive.

Layer industry-specific buying signals that indicate genuine purchasing readiness. Healthcare practices implementing new EHR systems need supporting technology. Manufacturing companies opening new facilities have allocated budgets. Funded startups have immediate growth pressures. These signals matter more than generic firmographic data.

Use integrated platforms like Databar.ai's comprehensive enrichment tools to combine multiple data sources without technical complexity. Access 90+ specialized databases through unified workflows, build complex industry filters without coding requirements, and maintain data freshness automatically across all sources.

Most importantly, let genuine industry expertise guide your prospecting strategy. The most effective lists combine comprehensive data with authentic understanding of sector dynamics, competitive pressures, and operational realities. This combination of insight and intelligence creates the precision targeting that separates exceptional sales performance from mediocre results.

In the end, the goal isn't perfection but practicality: a good-enough list that you can start working today will generate more revenue than a perfect one that takes months to build.

FAQ

How do I determine which data sources work best for my target industry? Run comparison tests using 20-30 known companies in your target sector across different data platforms. Track which sources provide the highest match rates and most complete contact information. For example, if LinkedIn captures 90% of your test companies with rich profiles but industry directories only show 40%, prioritize LinkedIn-based prospecting. Databar.ai's multi-source approach lets you test multiple databases simultaneously to identify the most effective combination.

What's the optimal size for an industry-specific prospect list? Quality dramatically outperforms quantity in industry-specific prospecting. Start with 300-500 highly qualified companies that meet multiple sector-specific criteria rather than thousands of generic matches. A smaller list where every company represents a genuine fit typically generates 3-4x higher response rates than larger generic lists. You can always expand after proving success with the initial targeted segment.

How do I find accurate revenue data when many companies don't publish financial information? Combine multiple revenue indicators for reliable estimates. Employee count, office locations, technology spending patterns, and hiring velocity all correlate strongly with revenue levels. Tools like Owler provide algorithmic revenue estimates based on these signals. For public companies, SEC filings give precise figures. For private companies, triangulate between multiple estimation sources for accuracy.

Should I create separate prospect lists for different subsectors within the same industry? Absolutely, especially in diverse industries with distinct subsector needs. A payments fintech operates completely differently than a wealth management startup despite both being "fintech." Create targeted lists with tailored qualification criteria, customized messaging, and sector-specific pain points. This subsector segmentation typically doubles response rates compared to generic industry-wide outreach approaches.

How frequently should I refresh industry-specific prospect lists? Refresh frequency depends on industry velocity and change patterns. Fast-moving sectors like technology startups need monthly updates to capture new funding rounds and company formations. Stable industries like manufacturing might only require quarterly refreshes unless major regulatory changes occur. Set up automated monitoring to flag significant changes like leadership transitions, funding events, or technology adoptions regardless of scheduled refresh cycles.

What if my target industry has minimal online presence? Focus on industry-specific directories, professional associations, and regulatory databases rather than general business platforms. Many traditional industries maintain rich data in specialized sources - state licensing boards for contractors, medical directories for healthcare, or trade association member lists for manufacturing. Use AI-powered web scraping tools to extract contact information from company websites and combine multiple specialized sources to build comprehensive profiles.

Related articles

MCP vs. SDK vs. API: When to Use Which for GTM Workflows

When to Use MCP: Best for Exploratory and Conversational Workflows

by Jan, March 06, 2026

Claude Cowork for GTM: What Sales and RevOps Teams Need to Know

How Claude Cowork Simplifies Sales and Revenue Operations

by Jan, March 05, 2026

250+ Hours of Claude Code for GTM: Here's What We Learned

What 250+ Hours Building an Claude Code Powered GTM Campaign Taught Us About Automation and Accuracy

by Jan, March 04, 2026

Contextual ICP Scoring with Claude Code: Why Employee Count and Tech Stack Aren't Enough Anymore

Get deeper insights and better conversion rates by moving beyond simple filters to dynamic ICP scoring powered by AI

by Jan, March 03, 2026