How to Find Leads Not Available in Major Databases: Step-by-step guide

Find high-converting prospects databases miss — before your competitors do

Blogby JanAugust 15, 2025

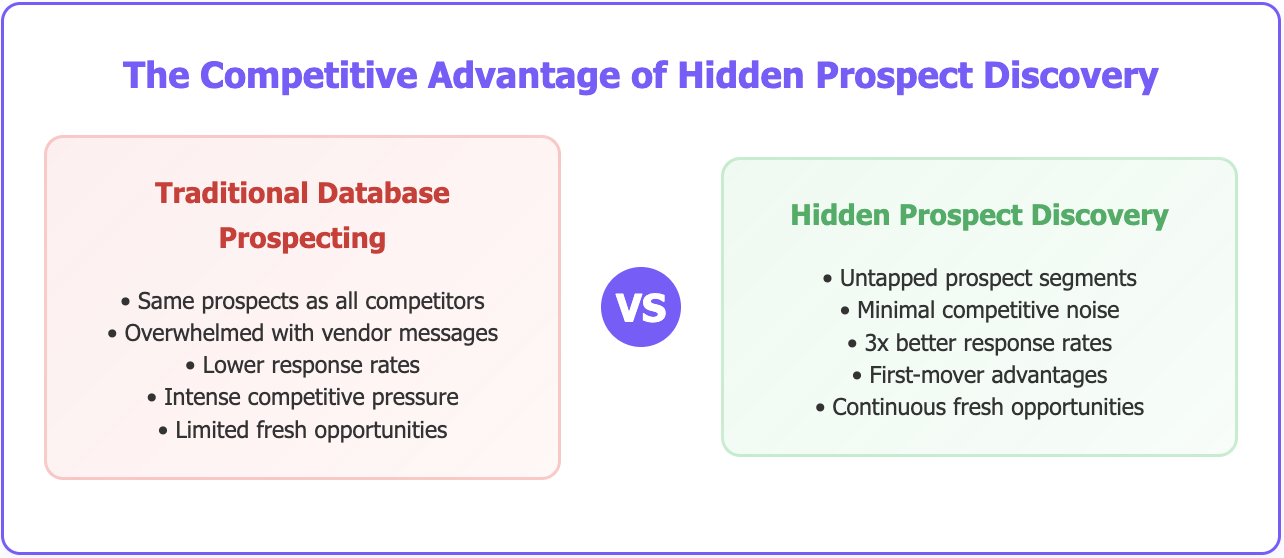

Most sales teams waste months fighting over the same recycled prospect lists.

While you're competing with dozens of other vendors for the attention of prospects in Apollo's 275 million contacts or ZoomInfo's 321 million profiles, entire segments of high-converting decision-makers remain completely untouched by traditional prospecting efforts.

Here's what’s happening: 73% of sales teams report their best-converting prospects weren't found in traditional databases. These hidden prospects respond 3x better to outreach because they're not drowning in competitor messages every day.

The math is brutal but simple. If everyone's using the same databases, everyone's targeting the same people. Meanwhile, decision-makers at emerging companies, international subsidiaries, recently restructured organizations, and companies with non-standard roles are actively looking for solutions while receiving almost zero vendor outreach.

Think about it: while your competitors send the 47th LinkedIn message this month to the same VP of Sales at a well-known company, the head of revenue operations at a fast-growing startup hasn't received a single relevant vendor message because they don't show up in standard title searches.

The Problem with Database-Only Prospecting

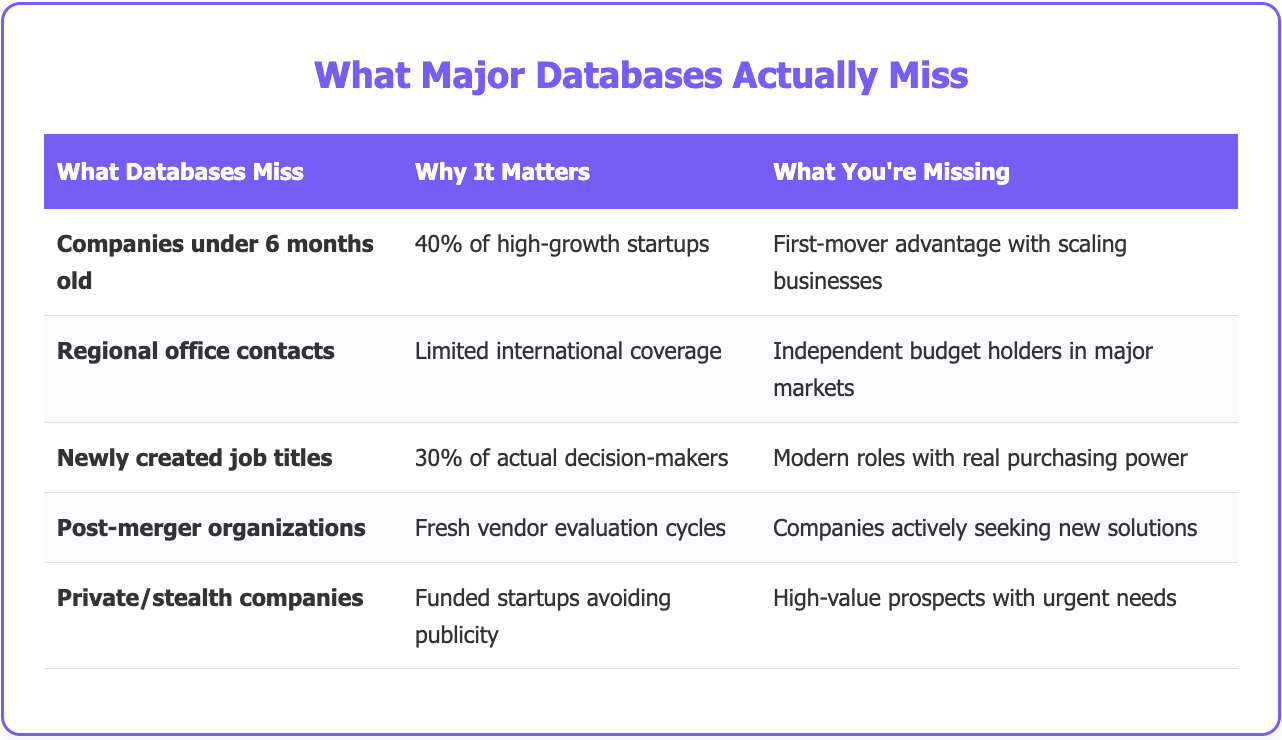

Most prospecting platforms work great for what they're designed to capture: established companies with public information and standardized job titles. But their data collection methods create predictable gaps that smart teams exploit for competitive advantage.

Why Databases Miss So Many Good Prospects

Major platforms collect information from public sources, regulatory filings, and social media profiles. This works perfectly for capturing established companies with substantial online presence, but it systematically misses private organizations, newly formed businesses, and international entities with limited digital footprints.

Geographic coverage tells the story clearly. While databases provide solid coverage in North American markets, representation in emerging economies, regional markets, and international subsidiaries drops significantly. A tech company targeting European markets through US-focused databases might reach only 60-70% of relevant prospects.

We've worked with teams who discovered their "comprehensive" database searches were missing entire countries where their ideal customers operated large regional offices with independent technology budgets.

The Timing Problem Nobody Talks About

Traditional data collection cycles create 3-6 month delays behind organizational changes. New hires, departmental restructures, and role changes create timing windows where decision-makers exist but haven't been captured in searches yet.

By the time these prospects appear in databases, they've often already established vendor preferences or completed evaluation processes. We've seen prospects go from "never heard of this category" to "signed with a competitor" in the time it takes databases to capture their new role.

Job Titles Are Becoming Meaningless

Modern organizations create specialized roles that don't fit traditional database categories. Positions like "Revenue Operations Specialist," "Customer Success Engineer," or "Growth Marketing Lead" often have more purchasing authority than obvious titles, but standard searches miss them entirely.

Database providers focus on job titles that appear frequently across their data sources. Unique positions with substantial influence get overlooked because they don't fit standard categorization schemes. The head of revenue operations might control the entire sales tool budget, but database searches for "sales decision-makers" won't find them.

Where Your Actual Buyers Are Hiding

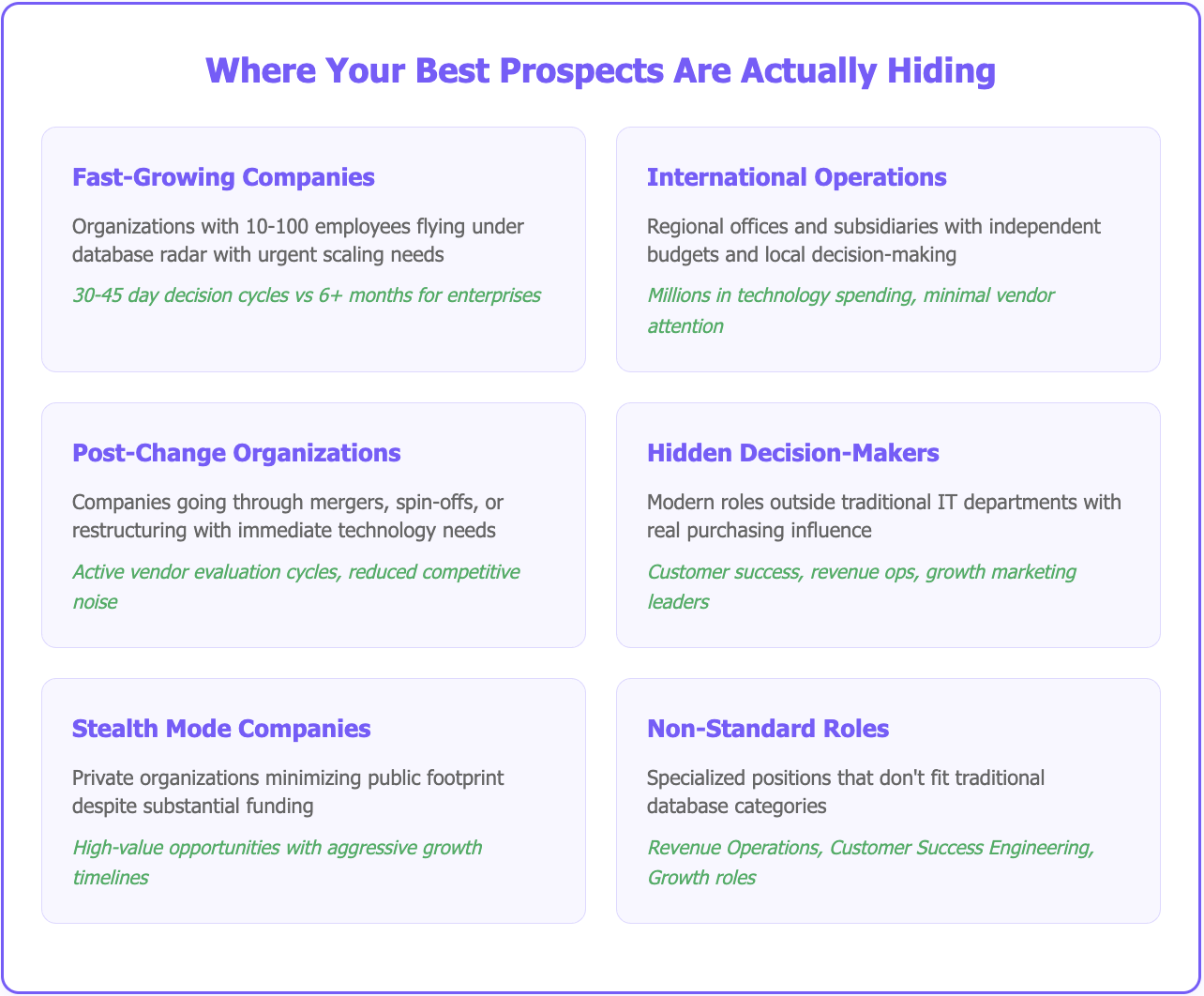

Fast-Growing Companies Flying Under the Radar

Organizations with 10-100 employees represent some of the highest-opportunity prospects because they have urgent scaling needs, fast decision-making, and flexible budgets. Many of these companies operate below the thresholds that databases prioritize for comprehensive coverage.

These companies often evaluate and implement solutions within weeks rather than months. Decision-makers are typically more accessible, have direct budget authority, and face immediate pressure to solve problems that support rapid growth.

We've seen teams close deals with emerging companies in 30-45 days that would take 6+ months with established enterprises, simply because the decision-making process is streamlined and there's less competitive noise.

International Operations With Independent Budgets

While databases capture headquarters information well, regional offices and international subsidiaries often operate with separate budgets, different pain points, and local decision-making authority. These subsidiaries frequently have substantial technology budgets but receive minimal vendor attention.

A software company might have complete database coverage for their Silicon Valley headquarters but almost zero representation for their London, Singapore, or São Paulo offices that each operate with millions in technology spending.

Regional operations face unique challenges that require localized solutions, creating opportunities for vendors who can reach them with relevant messaging. Plus, international prospects often have less vendor fatigue than their US counterparts.

Companies Going Through Major Changes

Spin-offs, mergers, and acquisitions create entirely new decision-making structures, budget allocations, and vendor relationships that databases can't capture for months. These organizational transitions trigger immediate technology evaluation cycles as new entities establish independent operations or integrate systems.

Recently restructured organizations represent particularly valuable opportunities because they need to establish new vendor relationships quickly. Traditional database searches miss these prospects during the critical window when they're actively evaluating solutions and haven't been overwhelmed with vendor outreach yet.

The Hidden Decision-Makers in Plain Sight

Modern purchasing involves stakeholders outside traditional IT and operations departments. Marketing teams buying sales tools, HR departments purchasing operational software, and finance groups investing in customer-facing technologies represent opportunities that title-based searches miss.

The head of customer success at a SaaS company might have more influence over sales tool selection than the VP of Sales, but database searches focused on traditional sales titles won't identify these relationships. Understanding these evolving influence patterns requires different research approaches.

Stealth Mode Companies With Serious Budgets

Organizations that minimize their public footprint intentionally—stealth-mode startups, highly private companies—may have limited database representation despite substantial funding and aggressive growth timelines. These companies often represent incredibly high-value opportunities for vendors who can reach them early.

Patent filings, regulatory submissions, and industry network analysis often reveal these organizations months before they appear in commercial databases. Early contact with these prospects creates massive competitive advantages.

Finding Prospects the Smart Way

Going Where Your Ideal Customers Actually Spend Time

Instead of relying on pre-collected database information, smart teams research where their ideal customers naturally congregate online. Industry forums, association member directories, conference attendee lists, and specialized publications contain prospects that commercial databases often miss entirely.

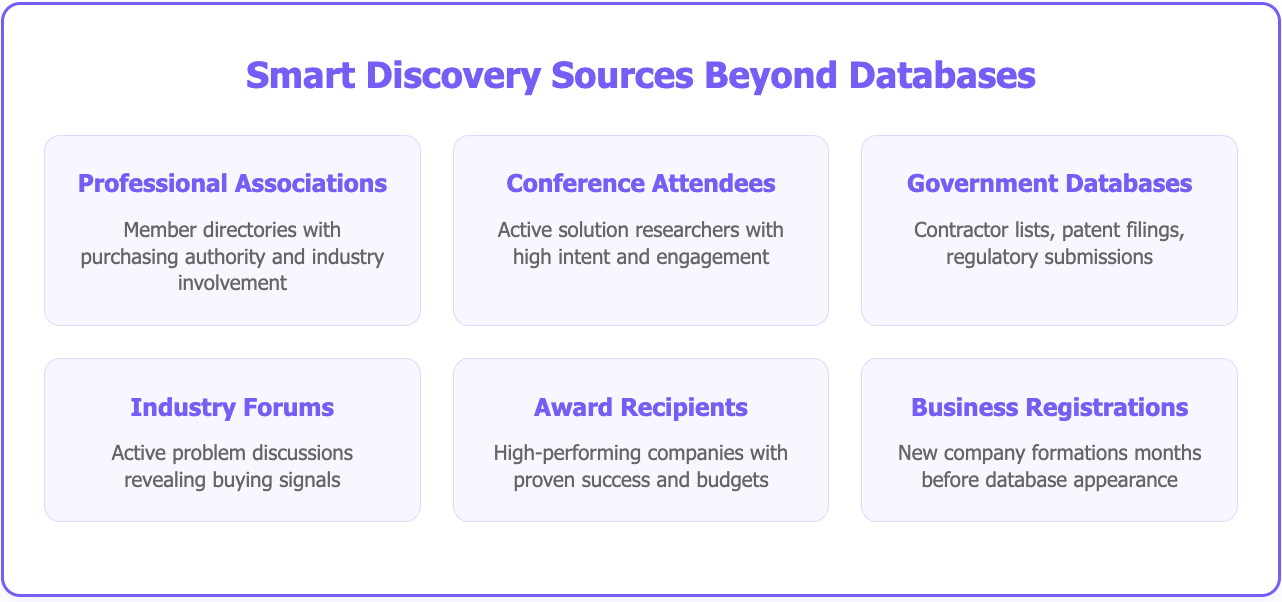

The best discovery sources we've found include:

Professional association member directories where decision-makers with real purchasing authority and budget responsibility participate actively in industry discussions and networking.

Conference and event attendee lists that reveal prospects actively researching solutions with much higher intent than random database searches could ever provide.

Government contractor databases containing organizations with dedicated technology budgets and specific procurement processes that operate outside typical commercial prospecting.

Patent filing databases showing companies with active innovation requiring supporting technology infrastructure and integration capabilities.

Local business registrations that capture new company formations months before they appear in any commercial database.

Industry award and recognition lists featuring high-performing companies with proven success and budgets for continued improvement and growth.

What Prospects Actually Say Online

Beyond LinkedIn's obvious prospects, platforms like Twitter, industry-specific forums, and professional communities contain active prospects discussing real challenges and evaluation criteria. Monitoring these conversations identifies buying signals months before prospects enter formal vendor evaluation processes.

Social intelligence reveals much stronger buying intent than demographic matching alone. Prospects posting about scaling challenges, engaging with industry content, and asking questions in professional forums represent higher-probability opportunities than contacts who simply match target criteria.

We've tracked prospects from initial problem recognition in forum posts to signed contracts, often reaching them during the "research phase" when they're most open to education and relationship building.

Public Information That Predicts Future Needs

Patent applications, regulatory filings, and government contract awards reveal organizational changes, technology investments, and expansion plans that predict purchasing needs 3-6 months in advance. These documents create timing advantages for teams that monitor them systematically.

Companies filing for new certifications, expanding into regulated markets, or winning government contracts often need supporting technology solutions within predictable timeframes. This intelligence enables proactive outreach before competitors recognize the opportunity.

Network Analysis for Warm Introductions

Companies working with specific consulting firms, technology partners, or service providers often need complementary solutions. Identifying these relationships enables warm introductions rather than cold outreach, dramatically improving conversion rates.

Technology adoption patterns create predictable needs. Organizations implementing marketing automation platforms frequently need sales engagement tools within 6-12 months. Companies using customer success software often require revenue operations solutions. Mapping these relationships predicts future purchasing with remarkable accuracy.

How We Actually Find These Hidden Prospects

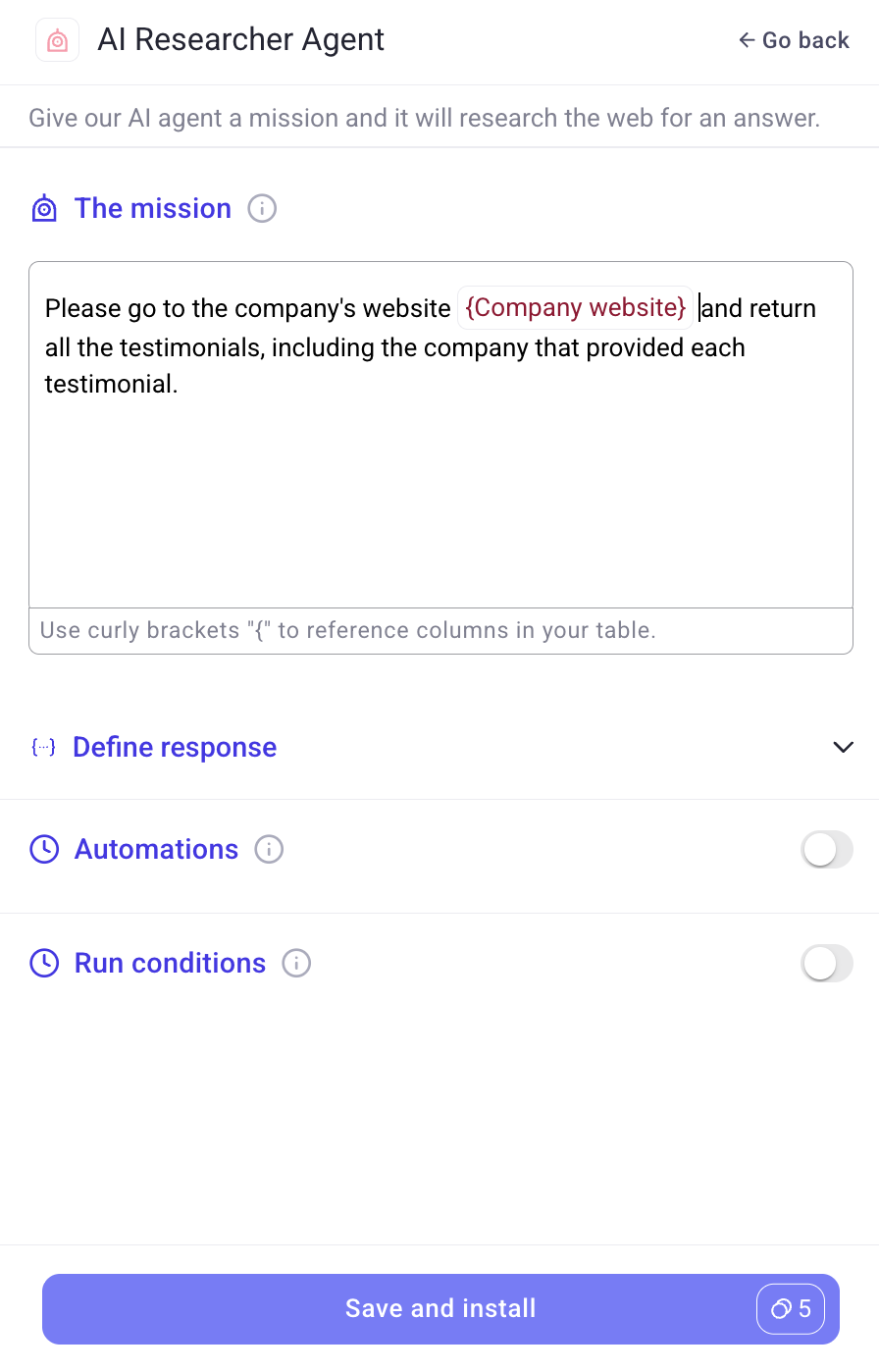

Traditional prospect discovery requires hours of manual research, multiple tool configurations, and time-consuming validation processes. Databar's AI research agent completely changes this game by accepting simple text requests and automatically gathering detailed prospect intelligence from any publicly available source.

Just Tell It What You Want in Plain English

Our AI research agent works like having a research assistant who never gets tired and can visit thousands of websites simultaneously. Once you have your list of target companies (discovered through the methods we covered above), you simply tell the agent what specific information you need:

- "For this list of fintech companies, find the contact information for their head of technology or CTO"

- "Research recent merger and acquisition activity for these SaaS companies and identify key decision-makers involved"

- "Find the email addresses and LinkedIn profiles of marketing leaders at these companies who joined in the last 6 months"

- "Check if any of these healthcare companies have posted job openings for marketing automation roles and get the hiring manager's contact info"

The AI research agent takes your company list, visits their websites and other public sources, analyzes the content, and extracts the specific information you requested about people, recent changes, and business contexts that traditional databases miss completely.

It Actually Visits Websites and Reads Everything

Unlike databases that rely on pre-collected information, our AI research agent conducts live analysis across multiple sources:

Company websites for recent announcements, leadership changes, strategic initiatives, technology implementations, and organizational developments that signal purchasing readiness.

News sources and industry publications for funding announcements, partnership developments, market expansion plans, and thought leadership that reveals business priorities and decision-maker perspectives.

Professional networks and forums where prospects discuss real challenges, share insights, and reveal buying signals through authentic conversations rather than polished marketing content.

Regulatory filings and patent databases for organizational changes, technology investments, and innovation activities that predict future technology needs with months of advance notice.

Conference and event platforms where prospects actively research solutions and engage with industry content, indicating much higher purchase intent than passive database contacts.

Putting the Pieces Together Automatically

The AI research agent doesn't just collect random information—it synthesizes findings from multiple sources to create comprehensive prospect profiles that include:

- Decision-making structure analysis to identify actual purchasing influencers beyond job titles that might be misleading

- Recent business development assessment to understand timing and urgency factors that affect purchasing decisions

- Technology gap identification based on company context, growth stage, and current tool limitations

- Optimal outreach timing discovery based on organizational changes, funding events, and publicly announced initiatives

Getting Fresh Information Every Time

Traditional databases often contain outdated information due to refresh cycles and data collection delays. Our AI research agent conducts real-time research, ensuring access to current information about prospects, including recent role changes, company developments, and market activities that affect purchasing decisions.

Working with All Your Other Tools

The AI research agent integrates seamlessly with Databar's 90+ data provider network, combining real-time research with comprehensive data enrichment from multiple sources. This provides both breadth and depth in prospect intelligence while maintaining efficiency.

Setting Up Your Discovery Process

Starting Simple and Scaling Smart

Effective prospect discovery starts with systematic approaches rather than random research efforts. Begin by mapping where your ideal customers actually spend time online—this varies significantly by industry and often surprises teams who assume LinkedIn is always the answer.

Professional associations offer particularly valuable prospects because membership implies industry involvement and often purchasing authority. Industry-specific groups maintain member directories that commercial databases rarely capture comprehensively, yet these members frequently influence or control technology purchasing decisions.

Getting Your Team on the Same Page

Create standard operating procedures for discovery methods, including search criteria, data validation steps, and enrichment processes. This systematization enables consistent results across team members rather than depending on individual research skills.

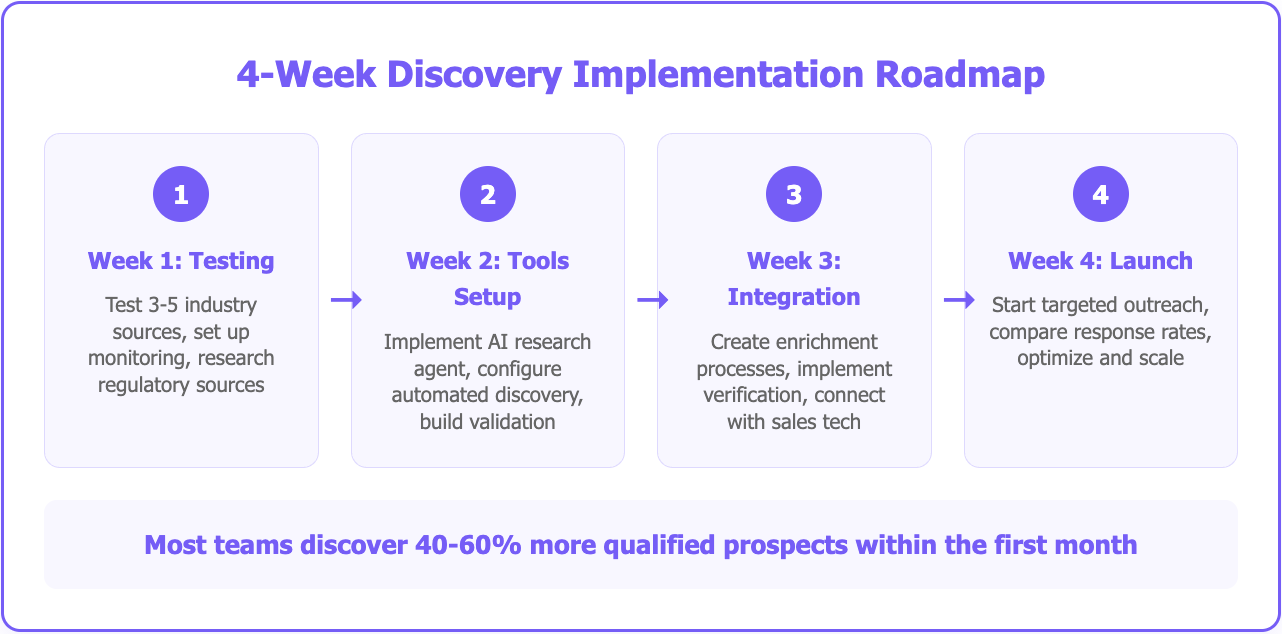

Rolling Out Discovery in Four Weeks

Step 1: Testing What Actually Works

- Test 3-5 industry-specific sources for prospect volume and quality

- Set up monitoring for industry keywords and competitor mentions

- Research regulatory sources relevant to your industry for organizational changes

- Document successful patterns for systematic replication

Step 2: Getting the Tools Working Together

- Implement Databar's AI research agent with automated prospect discovery

- Configure real-time prospect identification based on your criteria

- Set up organizational change monitoring and alerts

- Build validation processes to ensure prospect quality

Step 3: Making Everything Flow Smoothly

- Create systematic enrichment processes for discovered prospects

- Implement contact verification and company intelligence workflows

- Connect discovery tools with existing sales technology

- Test efficiency and data quality across different prospect types

Step 4: Launching and Optimizing

- Start targeted outreach to database-hidden prospects

- Compare response rates versus traditional database prospects

- Optimize messaging for non-database prospect characteristics

- Scale successful approaches and refine criteria based on results

Most teams discover 40-60% more qualified prospects within the first month while reducing competitive overlap by 70%.

Reaching Prospects Who Haven't Heard from Everyone Else

Why Hidden Prospects Need Different Messages

Educational and consultative approaches work much better than product pitches. These prospects often appreciate vendors who help them understand their challenges and available solutions rather than immediately pushing for meetings or demonstrations.

Taking Advantage of Perfect Timing

Database-hidden prospects often haven't begun formal vendor evaluation processes, creating opportunities to shape requirements and establish preferred vendor status before competitors appear. They might have longer consideration cycles but face less competitive pressure, allowing for thorough relationship development.

Leading with Value Instead of Sales Pitches

Focus on educational outreach that prioritizes prospect success over immediate sales objectives:

- Share market trends and best practices relevant to their industry and situation

- Help prospects recognize challenges they might not have prioritized

- Explain how solution categories address potential needs without immediately pitching your specific product

- Provide tactical advice for evaluation processes regardless of vendor selection

Building Your Tech Stack for Discovery

What You Actually Need vs. What Tools Want to Sell You

Databar's AI research agent handles in-depth discovery through natural language requests and automated web analysis. This eliminates the need for multiple specialized tools while providing prospect intelligence that traditional databases miss entirely.

The AI research agent addresses most discovery requirements by accepting simple text prompts and conducting systematic research across multiple sources simultaneously. This approach combines the functionality of traditional web scraping tools, social monitoring platforms, and regulatory databases into one intuitive interface.

When Other Tools Actually Help

While Databar's AI research agent handles the majority of discovery needs efficiently, specific scenarios might benefit from specialized tools:

Web scraping tools like Octoparse provide value for extracting information from directory-style websites with consistent formatting, but this represents a small subset of total discovery needs compared to AI-powered research capabilities.

Making Everything Work Together

Zapier and N8N handle basic integrations between discovery tools and existing CRM systems, while more sophisticated platforms enable complex workflows for high-volume operations.

Your Complete Discovery Stack

- Discovery: Databar's AI research agent for natural language research and automated prospect identification

- Enrichment: Integrated data enrichment through Databar's 90+ provider network

- Integration: CRM connectors and email platform integration for seamless operation

- Analytics: Performance dashboards and ROI measurement for continuous improvement

Making Discovery a Competitive Advantage

Building Systems That Actually Scale

Create detailed workflows, tool configurations, and quality standards that any team member can execute consistently. This systematization prevents knowledge from being concentrated in individual contributors and enables scaling across larger teams.

Protecting Your Investment

Implement verification steps, enrichment requirements, and qualification criteria to maintain prospect database integrity. Comprehensive quality control protects discovery investments from being undermined by poorly targeted campaigns.

Automating What Makes Sense

Use Databar's AI research agent and workflow tools to systematize successful discovery patterns without proportional resource increases. Focus on automating proven processes rather than trying to automate everything immediately.

Getting Better Over Time

Monitor discovery effectiveness, conversion rates, and resource efficiency to identify improvement opportunities and scale successful approaches. Regular optimization ensures continued competitive advantages as markets and prospect behaviors evolve.

Teams implementing systematic discovery typically achieve 60-80% larger prospect databases while reducing competitive pressure and improving conversion rates, creating sustainable competitive advantages that compound over time.

Ready to find prospects your competitors don't even know exist? Databar's AI research agent makes advanced prospect discovery simple through natural language requests and automated intelligence gathering that goes beyond traditional database limitations.

Frequently Asked Questions

How do I know if prospects found outside databases are actually good quality?

Start with smaller discovery batches to test quality before scaling. Implement email verification, company research through multiple sources, and professional profile confirmation. Databar's comprehensive data enrichment includes built-in validation across 90+ providers to ensure prospect quality.

What legal stuff do I need to worry about with advanced prospect discovery?

Always respect website terms of service and data privacy regulations like GDPR and CCPA. Implement reasonable request rates, avoid accessing protected content, and document compliance efforts. For industry-specific requirements, consult legal counsel.

What's the biggest mistake teams make when starting this approach?

Trying to discover everything without quality controls or strategic focus. Start with targeted discovery using clear criteria, implement proper validation workflows, and scale gradually based on results. Teams that try to automate everything immediately often create poor-quality databases.

Can I replace traditional databases entirely with these methods?

No, use them together for maximum coverage. Traditional databases work well for established market segments while advanced discovery methods provide expansion opportunities and competitive advantage. The optimal approach combines both strategies for comprehensive market coverage.

Related articles

MCP vs. SDK vs. API: When to Use Which for GTM Workflows

When to Use MCP: Best for Exploratory and Conversational Workflows

by Jan, March 06, 2026

Claude Cowork for GTM: What Sales and RevOps Teams Need to Know

How Claude Cowork Simplifies Sales and Revenue Operations

by Jan, March 05, 2026

250+ Hours of Claude Code for GTM: Here's What We Learned

What 250+ Hours Building an Claude Code Powered GTM Campaign Taught Us About Automation and Accuracy

by Jan, March 04, 2026

Contextual ICP Scoring with Claude Code: Why Employee Count and Tech Stack Aren't Enough Anymore

Get deeper insights and better conversion rates by moving beyond simple filters to dynamic ICP scoring powered by AI

by Jan, March 03, 2026