Buying Signals for B2B Sales Teams: Modern Guide to Signal-Based Selling

How B2B Sales Teams Can Decode and Act on Buying Signals to Close More Deals

Blogby JanJune 25, 2025

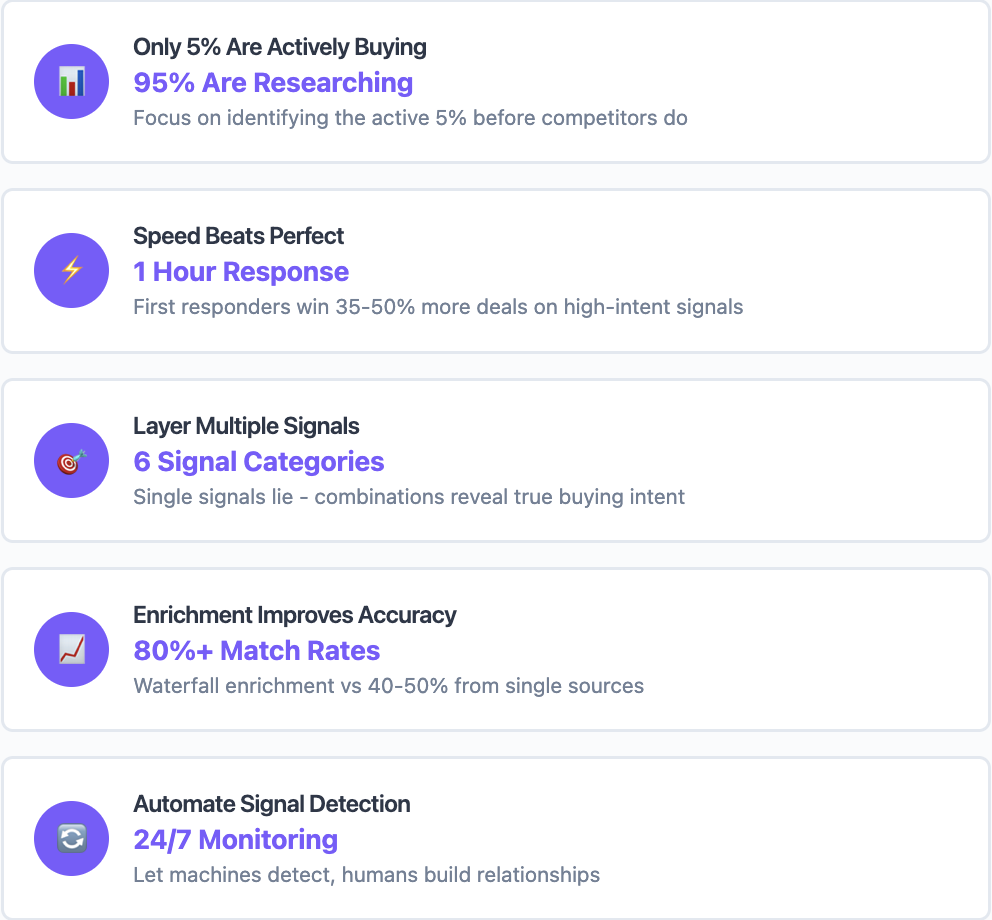

Only 5% of your target market is actively buying at any given moment. The other 95%? They're researching, comparing, or not even aware they have a problem yet.

This creates a massive challenge for B2B sales teams: How do you identify that crucial 5% before your competitors do?

The answer lies in buying signals - digital breadcrumbs that reveal when prospects are moving from passive interest to active evaluation. But here's the catch: most sales teams are still using outdated methods to identify and act on these signals, missing out on prime opportunities while chasing cold leads.

This guide breaks down exactly how modern B2B sales teams can identify, interpret, and act on buying signals to build stronger pipelines and close more deals.

What Are B2B Buying Signals in Today's Market?

Buying signals are observable actions or changes that indicate a prospect's readiness to purchase. Think of them as digital body language - every click, search, download, and interaction tells a story about where someone is in their buying journey.

But buying signals in 2025 look nothing like they did even five years ago. The average B2B buying committee now includes 9 decision-makers, and they complete 57-70% of their research before ever talking to sales.

How Digital Buying Signals Have Changed Over Time

Gone are the days when a downloaded whitepaper meant a hot lead. Today's buyers leave traces across dozens of touchpoints:

- Anonymous website visits from target accounts

- Technographic changes in their tech stack

- Social media engagement with competitor content

- Job postings that reveal growth plans

- Funding announcements indicating budget availability

The challenge isn't finding signals anymore - it's making sense of them. With buyers interacting across multiple channels and platforms, sales teams need sophisticated ways to capture, analyze, and act on these dispersed data points.

Why Traditional Lead Scoring Falls Short

Most companies still rely on basic lead scoring: assign points for actions, add them up, and pass "qualified" leads to sales. This approach has three fundamental flaws:

First, it treats all signals equally. A pricing page visit carries the same weight whether it's from a startup intern or an enterprise decision-maker.

Second, it ignores context. Someone downloading your comparison guide while using a competitor's solution sends a very different signal than someone just starting their research.

Third, it's reactive rather than predictive. By the time traditional scoring identifies a "hot lead," they've often already engaged with competitors or made preliminary decisions.

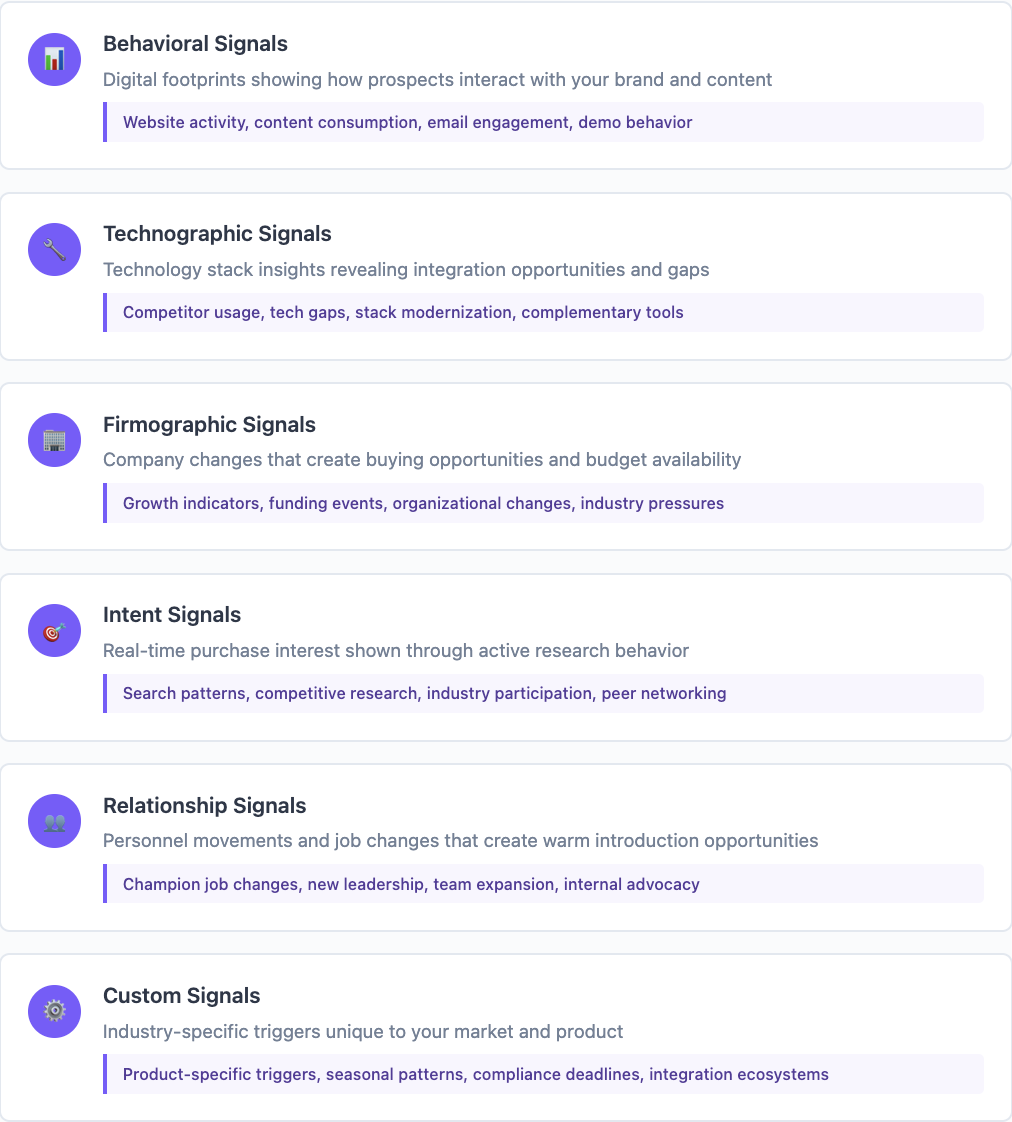

6 Categories of B2B Buying Signals That Actually Matter

Not all signals are created equal. Understanding different signal categories helps you prioritize outreach and tailor your approach. Here's what modern B2B sales teams should track:

Behavioral Signals: Digital Footprints That Reveal Intent

Behavioral signals show how prospects interact with your brand and content. These first-party signals are goldmines for understanding interest levels and pain points.

Key behavioral signals include:

Website activity: Look beyond page views. Track dwell time on pricing pages, return visits to specific features, and navigation paths. A prospect who visits your pricing page three times in a week sends a stronger signal than someone who bounces after 30 seconds.

Content consumption: The order matters. Someone who reads your beginner's guide, then implementation best practices, then ROI calculator is mapping out their buying journey. Tracking these sequences gives a better understanding of where prospects are in their evaluation.

Email engagement: Opens are vanity metrics. Track link clicks, and which specific links get clicked. A prospect who clicks on customer testimonials and case studies is seeking validation - prime time for social proof.

Demo and trial behavior: This includes monitoring feature usage during trials, support ticket topics, and which integrations they test. These behaviors reveal specific use cases and potential objections.

Technographic Signals

Technographic signals reveal what technologies companies currently use, providing crucial context for your outreach.

Critical technographic indicators:

Complementary technology adoption: If you sell marketing automation and a company just implemented a new CRM, they're likely evaluating related tools. Track their tech stack with BuildWith integration to identify integration opportunities.

Competitor usage: Companies using competitor tools present unique opportunities. Look for signals like support complaints on public forums, or contract renewal timelines.

Technology gaps: Sometimes what's missing matters more than what's present. A growing company without proper data infrastructure signals opportunity for data enrichment and automation tools.

Stack modernization indicators: Companies migrating from on-premise to cloud, or consolidating point solutions, actively seek new vendors. These transformation periods create natural entry points.

Firmographic Signals

Firmographic signals help you identify companies that match your ideal customer profile and are experiencing changes that create buying opportunities.

High-value firmographic signals:

Growth indicators: Headcount increases, office expansions, and geographic growth signal scaling challenges your solution might address. Companies growing 50%+ annually face different challenges than stable enterprises.

Funding events: Track funding rounds with Owler and PredictLeads beyond the announcement. The 90 days post-funding see the most vendor evaluations and budget allocations. New investors often push for operational improvements.

Organizational changes: Mergers, acquisitions, and restructuring create immediate needs for system consolidation, process standardization, and new tool evaluation.

Industry pressures: Regulatory changes, market disruptions, or competitive pressures force companies to adapt quickly. Companies in disrupted industries show 3x higher conversion rates when approached with relevant solutions.

Intent Signals (Real-Time Purchase Interest)

Intent signals indicate active research and evaluation behavior, often across third-party sites and platforms.

Powerful intent indicators:

Search behavior patterns: Companies researching "[your category] software," visiting review sites, or comparing vendors show clear purchase intent. Layer in search frequency and query evolution for deeper insights.

Competitive intelligence: Prospects researching your competitors, attending their webinars, or engaging with their content need compelling reasons to consider alternatives.

Industry participation: Companies presenting at conferences about challenges you solve, participating in relevant LinkedIn discussions, or joining industry initiatives signal investment in solving specific problems.

Peer networking: Decision-makers asking for vendor recommendations in private communities or scheduling calls with your customers indicate serious evaluation.

Relationship Signals (Job Changes and Personnel Movements)

Relationship signals tap into the power of human connections and career movements to identify opportunities.

Key relationship triggers:

Champion job changes: Monitor job changes through LinkedIn integration. When your champions switch companies, they bring institutional knowledge and often influence vendor decisions at their new organizations. These warm introductions convert 5x better than cold outreach.

New leadership appointments: New executives bring fresh perspectives and budgets. The first 100 days see the most strategic changes. CMOs replacing legacy systems, CTOs modernizing tech stacks, or CFOs seeking efficiency gains all present opportunities.

Team expansion signals: Track hiring patterns through job posting scrapers. Companies hiring data analysts need data tools. Growing sales teams require CRM expansion. Job postings reveal priorities before formal RFPs.

Internal advocacy: Multiple employees from the same company engaging with your content suggests internal discussions. These grassroots evaluations often bypass formal procurement processes.

Custom Signals (Industry-Specific Triggers)

Custom signals are unique indicators specific to your market, product, or sales process.

Examples of powerful custom signals:

Product-specific triggers: For data enrichment tools, look out for companies experiencing data quality issues, failed campaigns due to bad data, or publicly discussing personalization challenges.

Seasonal patterns: B2B software purchases follow predictable cycles. Q4 budget allocations, Q1 implementations, and mid-year reviews create natural evaluation periods.

Compliance deadlines: Regulatory changes create hard deadlines. Companies facing GDPR, SOC 2, or industry-specific compliance requirements actively seek solutions.

Integration ecosystems: Companies adopting platforms your product integrates with become natural prospects. A company implementing Salesforce needs compatible tools across their stack.

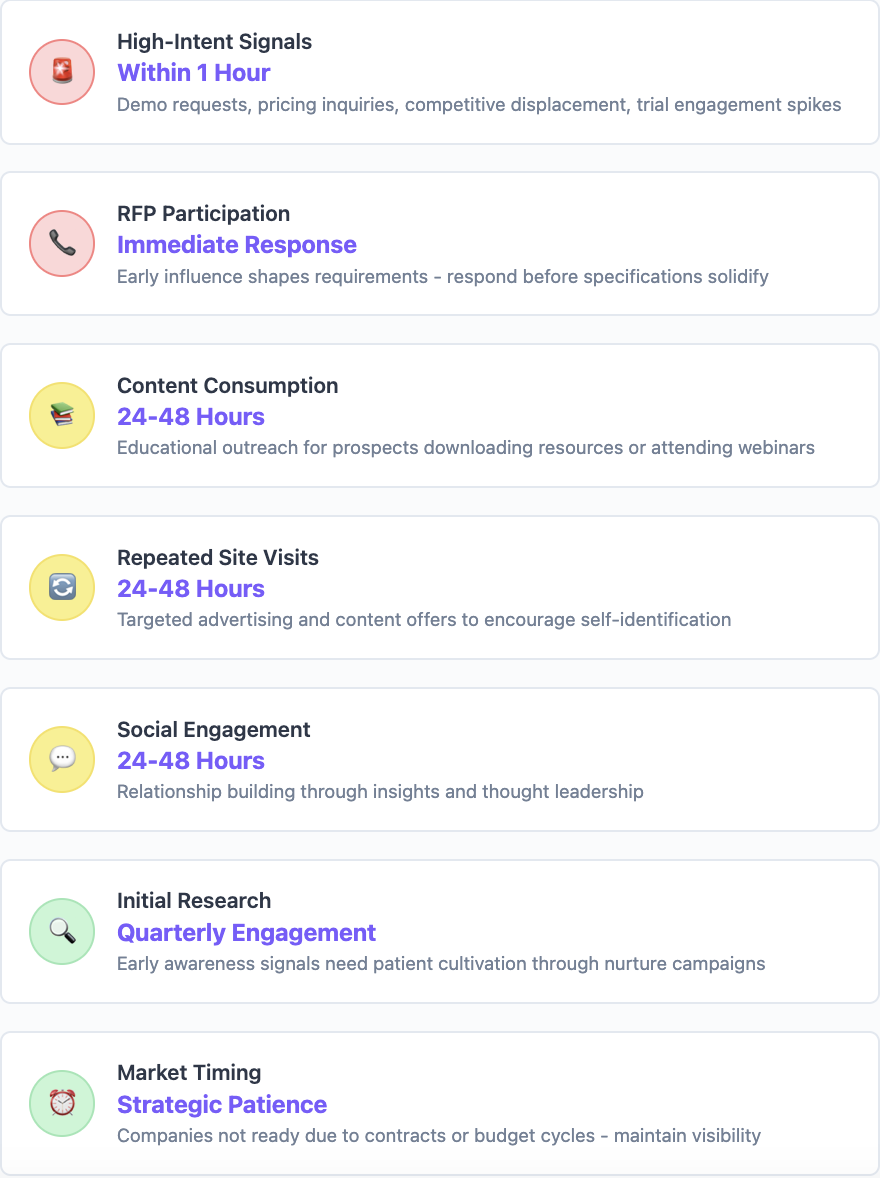

When to Act on Different Buying Signals

Timing can make or break your outreach. Different signals require different response strategies and timelines.

High-Intent Signals That Demand Immediate Action

Respond within 1 hour for these critical signals:

Demo requests and pricing inquiries: Speed matters. First responders win 35-50% more deals. These prospects have self-identified as in-market and are actively evaluating options.

Competitive displacement: When prospects experience public failures with competitors, explore alternatives on review sites, or ask about migration processes, strike while dissatisfaction is high.

Trial engagement spikes: Prospects who suddenly increase trial usage, invite team members, or test advanced features are building internal consensus. Proactive outreach during this phase prevents stalls.

RFP participation: While RFPs seem late-stage, early influence shapes requirements. Respond immediately to position your solution favorably before specifications solidify.

Speed-to-lead best practices:

- Automate alert systems for high-intent signals

- Create response templates that personalize quickly

- Establish clear ownership rules to prevent delays

- Track response times and conversion rates by signal type

Medium-Intent Signals for Nurturing Campaigns

Engage within 24-48 hours with educational, value-driven outreach:

Content consumption patterns: Prospects downloading multiple resources or attending webinars need nurturing, not hard sells. Map content to buying stages and provide logical next steps.

Repeated site visits: Identify anonymous companies visiting repeatedly to show interest without direct contact readiness. Use targeted advertising and content offers to encourage self-identification.

Social engagement: Prospects following your company, engaging with posts, or joining discussions need relationship building. Share relevant insights and establish thought leadership before pitching.

Event participation: Webinar attendees and conference booth visitors require thoughtful follow-up. Reference specific sessions, share related resources, and offer consultative conversations.

Nurturing best practices:

- Develop signal-specific email sequences

- Use progressive profiling to gather information gradually

- Provide value in every interaction

- Monitor engagement to identify acceleration opportunities

Low-Intent Signals for Long-Term Engagement

Monitor and engage quarterly with these early-stage signals:

Initial research behaviors: First-time visitors, single content downloads, or broad keyword searches indicate early awareness. Add to nurture campaigns and provide educational resources.

Passive monitoring: Companies added to target account lists but showing minimal engagement need patient cultivation. Use account-based advertising and executive outreach to build awareness.

Network effects: Employees from target accounts connecting on LinkedIn or following your company create future opportunities. Build relationships without immediate sales pressure.

Market timing: Companies not ready due to contracts, budget cycles, or priorities require strategic patience. Maintain visibility and be ready when circumstances change.

Building Your Signal-Based Sales Process

Successful signal-based selling requires more than just data - it demands systematic processes that turn insights into action.

Setting Up Signal Detection Systems

The foundation of effective signal detection isn't complex technology - it's smart data architecture. Start by connecting your enrichment tools with your existing tech stack. When your CRM talks to your marketing automation platform, which talks to your sales engagement tools, you create a unified view that captures every signal without gaps.

But here's what most teams miss: not every signal deserves the same attention. A demo request from an enterprise account hitting all your ICP criteria? That's a drop-everything moment. A single whitepaper download from a company half your typical size? Add it to the nurture queue.

The key is developing your own signal taxonomy. What behaviors correlate with closed deals in YOUR business? Track signal-to-opportunity conversion rates. You might discover that companies viewing your integration page convert 3x better than those hitting pricing first. That insight alone could reshape your entire outreach strategy.

Pro tip: Set up smart routing from day one. High-priority signals should trigger instant notifications to territory owners. Everything else can flow into daily digests. Your reps will thank you for not flooding their inbox with noise.

Creating Response Playbooks for Each Signal Type

Consistency beats creativity in sales response. But that doesn't mean sending the same boring template to everyone.

Think of playbooks as recipes, not scripts. For high-intent signals, your recipe might include: immediate phone call (within 1 hour), personalized email referencing their specific action, LinkedIn connection with a relevant insight, and a calendar link for easy scheduling. The key? Reference their behavior naturally - "I noticed you were exploring our Salesforce integration" beats "I see you visited our website."

Medium-intent signals need a different flavor. These prospects aren't ready for a sales conversation, but they're curious. Your playbook here focuses on value delivery. Share a relevant case study. Offer a tactical guide. Invite them to an upcoming webinar. Build trust before you build pipeline.The best results happen when you document what works.

Timing Your Outreach for Maximum Impact

Perfect timing multiplies your chances of success:

Day and time optimization: B2B response rates peak Tuesday-Thursday, 10-11 AM and 2-3 PM recipient time. Adjust for time zones and industry patterns.

Buying cycle alignment: Map signals to buying stages. Early-stage signals need education. Late-stage signals need differentiation and urgency.

Contextual timing: Consider external factors. Reach out after positive company news, before budget deadlines, or during industry events when topics are top-of-mind.

Competitive dynamics: When prospects evaluate multiple vendors simultaneously, speed and relevance win. Monitor competitive signals and position accordingly.

Data Enrichment: The Foundation of Signal Intelligence

Raw signals without context are just noise. Imagine knowing someone visited your pricing page, but not knowing if they're a Fortune 500 company or a 10-person startup. That's the difference between raw signals and enriched intelligence.

Start your free Databar.ai trial today

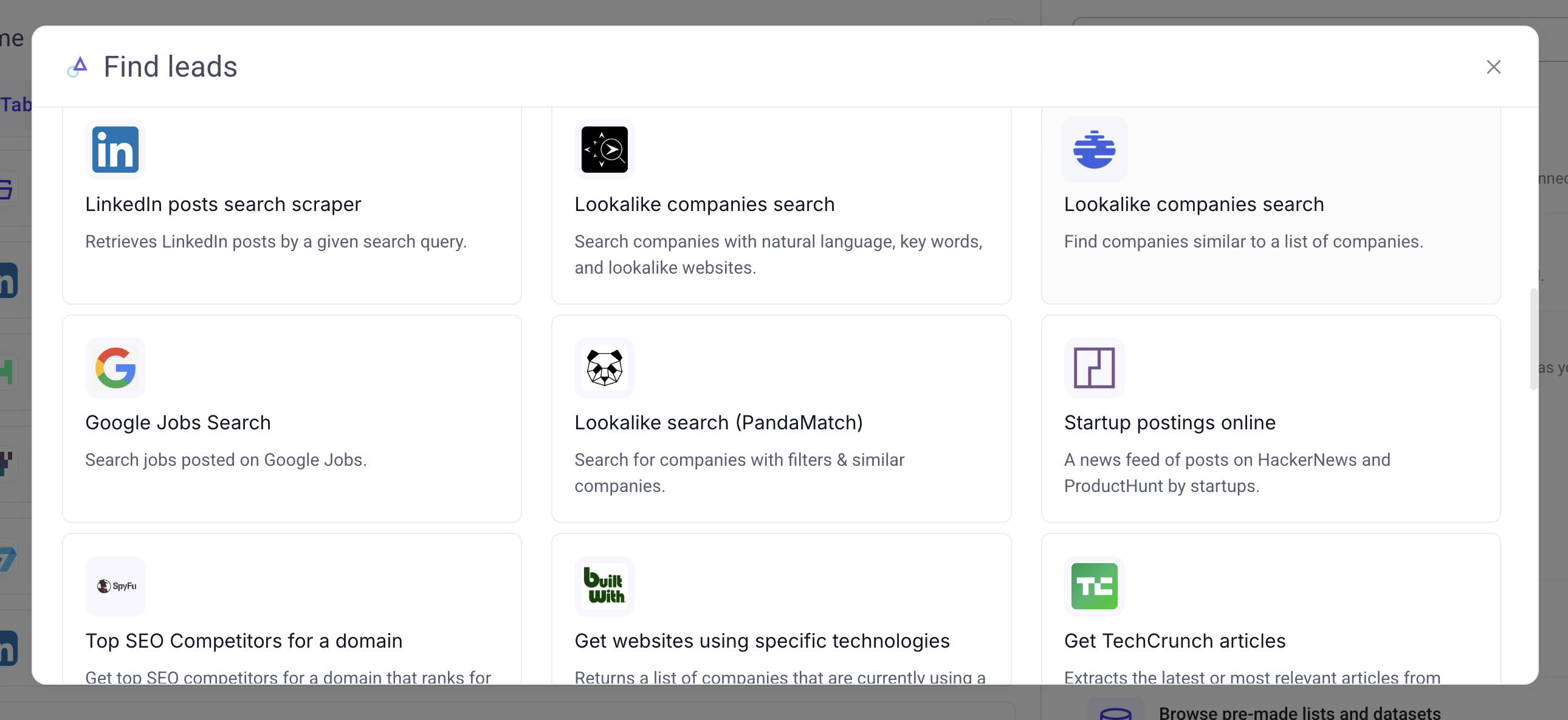

Combining Multiple Data Sources for Complete Pictures

Here's what most people get wrong about enrichment: they rely on one source and call it done. But data providers are like news sources - each has blind spots.

Take contact information. Provider A might have great email coverage for tech companies but miss traditional industries. Provider B excels at phone numbers but has outdated emails. Provider C has fresh data but limited coverage. The solution? Use all three.

Waterfall enrichment checks multiple sources automatically. First, it tries your primary provider. No luck? It moves to the secondary. Still missing? It keeps going. You only pay when it finds what you need.

This approach typically delivers 80+% match rates compared to 40-50% from single sources. For a 1,000-person prospect list, that's the difference between 400 and 800 contacts you can actually reach.

Automating Your Signal-Based Workflow

Manual signal monitoring doesn't scale - it works, but why would you when machines exist? The trick is knowing what to automate and what to keep human.

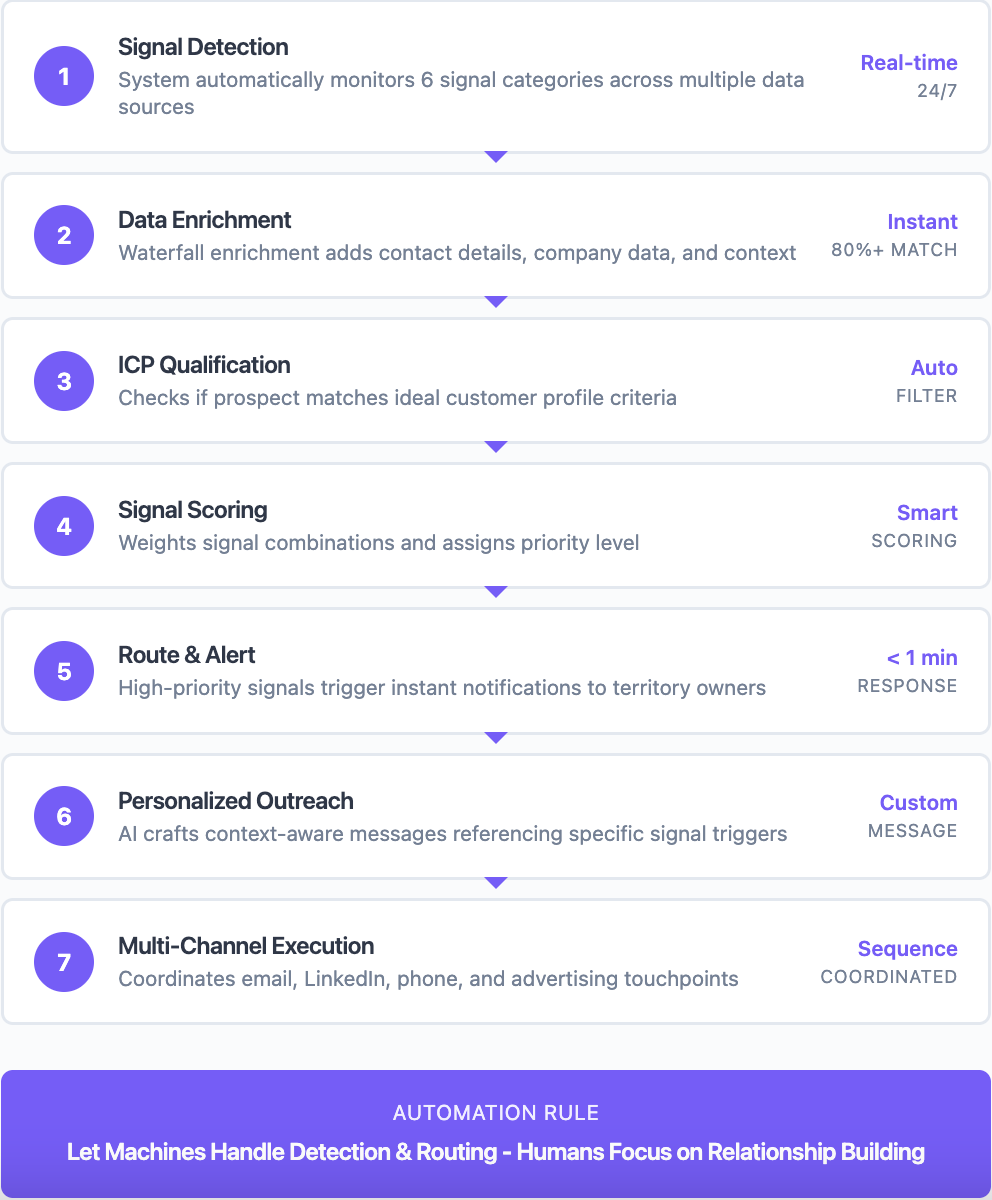

From Signal Detection to Personalized Outreach

Automation should handle the mundane so humans can be human. Machines excel at detecting signals, enriching data, and triggering workflows. Humans excel at building relationships and closing deals.

Here's an exemplary workflow that works: Your system detects a pricing page visit from a target account. It automatically enriches the visitor data - company size, technology stack, recent news. It checks if they match your ICP criteria. If yes, it creates a task for the account owner with all relevant context. Next, the system then crafts a personalized message referencing the prospect's specific situation.

The key is the handoff. Too much automation feels robotic. Too little wastes time. Find the sweet spot where automation enhances human connection rather than replacing it.

Multi-Channel Response Strategies

Different signals call for different channels, and smart orchestration means knowing when to use each one.

Email for nurturing signals:

- Content downloads → educational email series

- Webinar attendance → relevant resource sharing

- Multiple page visits → targeted offers

LinkedIn for relationship signals:

- Job changes → congratulations and reconnection

- Company growth → expansion conversations

- Competitive research → differentiation messaging

Phone for high-intent signals:

- Pricing page visits → consultative calls

- Demo requests → immediate scheduling

- Trial engagement → success check-ins

Advertising for account-level signals:

- Anonymous company visits → retargeting campaigns

- Target account lists → ABM advertising

- Competitive accounts → displacement messaging

Coordinate channels for maximum impact. A prospect receiving relevant LinkedIn messages, targeted ads, and personalized emails feels surrounded by value, not stalked by sales.

Measuring Signal-to-Pipeline Conversion

If you're not measuring signal performance, you're flying blind. But most teams track vanity metrics that don't drive decisions.

Skip the basics like "number of signals detected." Instead, focus on what matters: which signals actually predict pipeline? Track signal-to-opportunity conversion rates. If funding announcements convert at 5% but website visits convert at 2%, you know where to focus.

One metric most teams miss: time from signal to first action. The faster you respond, the higher your conversion rates. But how fast is fast enough? Track it and find out. You might discover that responding in 1 hour vs. 24 hours doubles your success rate.

Also measure signal combinations. Maybe website visits alone mean little, but website visits + competitor comparison = hot opportunity. These patterns hide in your data. Find them.

Common Mistakes When Using Buying Signals

Even sophisticated sales teams fall into these traps. Avoid them to maximize your signal intelligence ROI.

Over-Relying on Single Signal Types

The biggest mistake? Treating individual signals as definitive buying indicators.

Why single signals fail:

- Context matters: A funding round means nothing if they just renewed with your competitor

- Correlation isn't causation: Website visits might indicate research for a blog post, not purchase intent

- Timing varies: Some signals indicate immediate need, others suggest future opportunity

The solution: Layer multiple signal types for confirmation. Look for signal clusters that reinforce each other. A company with new leadership + competitive research + increased website activity presents a stronger opportunity than any signal alone.

Poor Timing and Generic Messaging

Speed without relevance wastes opportunities.

Common timing mistakes:

- Responding too quickly with generic templates

- Waiting too long and losing momentum

- Ignoring time zones and business hours

- Failing to consider prospect context

Messaging failures:

- "I see you visited our website" (creepy and vague)

- "Do you have 15 minutes to chat?" (no value proposition)

- "Following up on my previous email" (assumes they care)

- "I'd love to show you a demo" (premature for early signals)

Better approaches:

- Reference specific actions naturally

- Lead with relevant insights or value

- Align messaging to signal intent

- Provide clear next steps

Ignoring Signal Context and Combinations

Signals don't exist in isolation. Context changes everything.

Context considerations:

- Company situation: A growing company visiting pricing pages differs from a downsizing one

- Competitive dynamics: Engagement while using a competitor requires different messaging

- Historical patterns: First-time visitors need education, returning visitors need progression

- Market timing: Budget seasons, compliance deadlines, and industry events affect readiness

Combination analysis:

- High-intent action + poor firmographic fit = disqualify

- Multiple stakeholders + repeated engagement = expand outreach

- Technical research + business case content = approaching decision

- Competitive comparison + team involvement = active evaluation

Build scoring models that weight signal combinations, not just individual actions.

FAQs About B2B Buying Signals

Q: How many signals should we track before reaching out?

Quality beats quantity. One high-intent signal (demo request, pricing inquiry) warrants immediate outreach. For medium-intent signals, look for 2-3 reinforcing indicators.

Q: What's the ideal response time for different signals?

High-intent signals: Within 1 hour during business hours. Medium-intent: Within 24-48 hours. Low-intent: Add to nurture campaigns for consistent touch points. Speed matters most when prospects actively evaluate options.

Q: How do we avoid seeming creepy when referencing signals?

Never mention tracking or monitoring. Reference actions naturally: "I noticed your team is growing rapidly" not "I saw you posted 5 job openings." Focus on how you can help with implied challenges rather than listing observed behaviors.

Q: Should we score all signals equally?

Absolutely not. Weight signals based on correlation with closed deals. Demo requests might score 50 points while whitepaper downloads score 5. Test and refine scoring based on your specific sales cycle and customer journey.

Q: How do we handle false positive signals?

Build in verification steps. Confirm company fit before extensive personalization. Use progressive profiling to validate interest. Track false positive rates by signal type and adjust monitoring accordingly.

Q: What enrichment data provides the best signal context?

Start with contact data (email, phone, LinkedIn), add company intelligence (size, growth, technology), then layer behavioral insights. The combination reveals both capability and intent to purchase.

Turn Buying Signals into Pipeline

Identifying buying signals is only half the battle. The real challenge? Enriching those signals with context, prioritizing the right opportunities, and executing personalized outreach at scale.

For sales teams ready to move beyond manual signal tracking to intelligent automation, Databar.ai offers a game-changing approach. Our platform combines 90+ data providers to enrich every signal with the context you need to win.

See how Databar.ai improves your signal-based selling:

✓ Capture signals from multiple sources - company news, job openings, funding rounds, and more

✓ Enrich with waterfall accuracy - 80%+ match rates vs 40-50% from single providers

✓ Build complete prospect profiles - contact details, company data, technographics in one view

✓ Automate personalized outreach - AI-powered messaging based on signal combinations

✓ Access 90+ data sources - no more juggling multiple subscriptions

Stop missing high-intent opportunities while chasing cold leads. Start your free Databar.ai trial and turn buying signals into booked meetings in minutes.

Related articles

How to Automate GTM Research with Claude Code

How Claude Code Cuts Weeks of GTM Research into Hours Without Sacrificing Depth

by Jan, February 20, 2026

Best MCP Servers for Sales Teams in 2026

How MCP servers are turning AI into a hands-on sales assistant that gets real work done

by Jan, February 20, 2026

How to Scrape Google Maps and Find Business Owners with Claude Code

A Step-by-Step Guide on How to Find Business Leads and Owner Emails From Google Maps with Claude Code

by Jan, February 19, 2026

Cold Email in 2026: How Claude Code Is Changing Outbound Strategy

How smarter, faster testing is breathing new life into cold email outreach

by Jan, February 18, 2026