Best Data Providers for Analysts and Investors

Navigating the top data sources to optimize investment analysis and decision-making today.

Blogby JanAugust 08, 2025

Your analyst team burns through 30+ hours weekly gathering data that should take minutes to collect. Portfolio managers spend entire mornings copying competitor financials from five different platforms. Research associates waste afternoons reconciling conflicting revenue numbers across subscriptions that cost more than most people's salaries.

The data provider explosion promised to solve information gaps but created expensive chaos instead. Modern investment analysis demands traditional financials plus ESG scores, social sentiment, satellite imagery, and real-time alternative signals. No single platform covers everything, forcing firms into subscription nightmares that strain budgets while leaving critical blind spots.

Markets punish slow decision-making ruthlessly. A delayed earnings revision costs opportunities. Missed regulatory filings create compliance headaches. Overlooked sentiment shifts trigger portfolio disasters. Yet most investment teams still juggle 6-8 different platforms, losing precious minutes switching between interfaces while competitors act on superior intelligence.

This guide reveals which platforms deliver genuine analytical edge versus expensive feature bloat, helping you build intelligent data infrastructure without redundancy or budget-killing subscriptions.

Why Fragmented Data Infrastructure Is Killing Your Returns

Most investment firms pick data providers like they're shopping for groceries - grabbing whatever looks good without considering how everything works together. This backwards approach creates expensive subscription stacks that actually slow analysis instead of accelerating it.

The math is brutal when you add up hidden costs. A typical mid-size fund runs 8-12 data subscriptions averaging $1,200 monthly each. But licensing fees are just the beginning. The real killer is analyst time wasted switching platforms, fixing data conflicts, and manually combining sources for basic research tasks.

Inconsistent data creates dangerous decision-making blind spots. Different providers calculate the same metrics using varying methodologies. Company X shows a 15 P/E ratio on Bloomberg but 18 on FactSet. Revenue growth rates differ between platforms. Even basic stock prices sometimes don't match, especially for international markets or after-hours trading.

Integration overhead destroys productivity instead of enhancing it. Each additional data source requires custom Excel plugins, API connections, or manual copy-paste workflows. Analysts spend 40% of their time wrestling with data instead of analyzing it. Meanwhile, opportunities disappear while teams struggle with technical problems that shouldn't exist.

The most successful investment teams treat data infrastructure as competitive weaponry, not operational overhead. They choose integrated solutions that combine extensive coverage with analytical speed, recognizing that information advantage creates sustainable returns.

What Matters When Choosing Investment Data?

Forget the feature comparison spreadsheets and marketing pitches. Real data selection comes down to practical factors that determine whether platforms help or hurt your investment process.

Coverage That Matches Your Investment Universe

Geographic and sector depth varies dramatically between providers. Platform A might excel with US large-caps but offer terrible emerging market coverage. Platform B could dominate European credit while lacking Asian equity fundamentals. Test coverage for your specific investment focus before committing to expensive subscriptions.

Asset class specialization beats broad mediocrity every time. Fixed income requires different data structures than equity screening. Options pricing needs real-time Greeks while fundamental analysis works fine with daily updates. Match provider strengths to your primary analytical needs rather than paying for universal coverage you'll never use.

Data Quality You Can Actually Trust

Source quality separates professional platforms from expensive aggregators. The best providers pull directly from exchanges, regulatory filings, and company reports. Secondary sources introduce errors and delays that compound into analytical disasters. Always verify data lineage before trusting important investment decisions to any platform.

Update timing must align with your strategy requirements. Day trading demands millisecond latency that costs 10x more than delayed feeds. Fundamental analysis might accept daily refreshes perfectly well. Don't pay for real-time data unless your strategy actually requires it - most don't.

Integration That Actually Works

API quality determines whether automation succeeds or fails. Well-documented REST APIs with solid client libraries enable systematic analysis and portfolio automation. Crappy APIs create technical debt that limits growth and requires expensive custom development to fix later.

Excel integration still matters more than most platforms admit. Native plugins consistently outperform web-based data connections. Verify compatibility with your Excel version and typical analysis volumes. Plugin reliability often determines daily productivity more than raw data coverage.

Complete Analysis of Leading Investment Data Providers

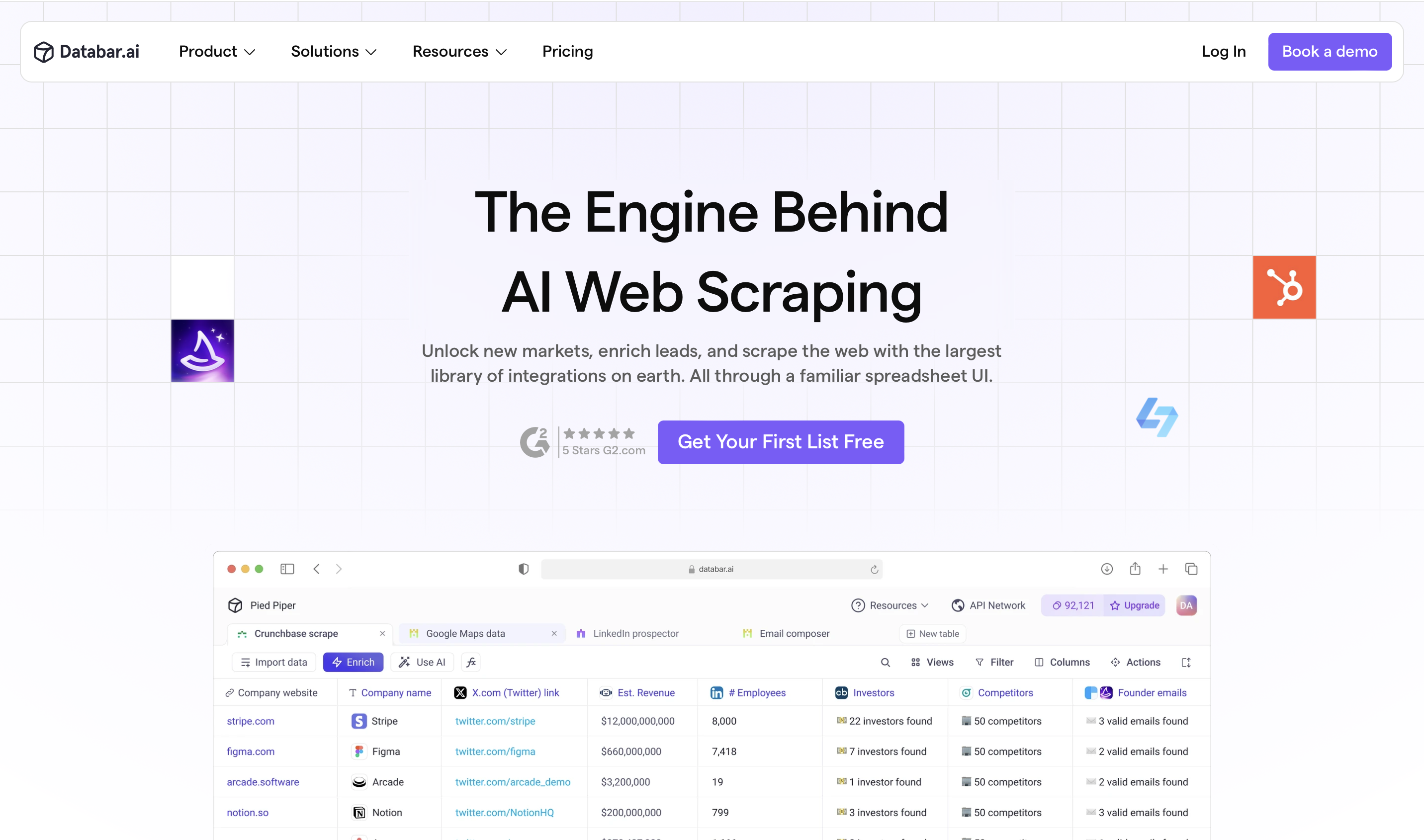

1. Databar.ai

We created Databar.ai because we got tired of paying Bloomberg $$$ annually while still needing five other subscriptions to get complete investment intelligence. The traditional approach forces impossible choices: extensive coverage at enterprise prices, or fragmented point solutions that leave critical gaps.

Our approach is fundamentally different. Instead of building another expensive terminal, we aggregate 90+ specialized data providers into a unified intelligence platform. This eliminates the traditional trade-off between budget constraints and analytical completeness that frustrates investment teams.

What makes our platform unique for investment analysis:

Multi-source intelligence aggregation delivers complete company profiles impossible to achieve manually. When researching investment opportunities, our system simultaneously queries financial databases, news sources, and alternative data providers. You get traditional metrics combined with web traffic patterns, social sentiment analysis, and competitive intelligence - all structured for immediate analysis.

Investment-focused integrations that actually work:

- Real-time Crunchbase data for private company funding and valuation tracking

- SEC filing analysis with natural language processing for rapid insight extraction

- Social sentiment monitoring across platforms for market timing signals

- Competitive intelligence from web presence and hiring pattern analysis

- Industry-specific research capabilities for sector comparison and analysis

AI research that understands investment context. Ask questions like "find renewable energy companies with accelerating revenue growth and recent executive changes" and get structured, analyzed results with supporting data sources. Our AI understands investment relationships, not just keyword matching.

Workflow automation that eliminates repetitive research. Set up monitoring for portfolio companies, competitive landscapes, or investment themes. When material changes happen - earnings surprises, management transitions, regulatory filings - you get compiled intelligence reports with analytical summaries automatically.

Our users consistently save 15-20 hours weekly on research while accessing data breadth that previously required multiple expensive subscriptions. Transparent pricing starts at $39/month and scales with usage instead of forcing enterprise commitments nobody wants.

This comprehensive approach represents what the best B2B data enrichment tools in 2025 provide: integrated data collection and analysis that eliminates subscription chaos.

Best for: Boutique investment managers who need institutional-quality intelligence without enterprise pricing complexity, independent analysts, family offices, and any team tired of subscription chaos.

2. Bloomberg Terminal

Bloomberg Terminal remains the 800-pound gorilla through extensive coverage and integration depth that creates genuine network effects. Despite the $2,000+ monthly cost per seat, many institutional environments can't function without it.

Bloomberg's real strength isn't data - it's workflow integration. The platform combines live market feeds with news, research, analytics, and communication tools in unified workflows that work seamlessly. Proprietary functions like PORT for portfolio analytics and GRAB for data extraction provide capabilities you literally cannot get anywhere else.

Fixed income and derivatives coverage is genuinely irreplaceable. Bond pricing, yield curve construction, and complex derivatives valuation rely on Bloomberg's institutional relationships and data quality standards. For credit analysts and structured product specialists, Bloomberg often justifies its cost despite budget constraints.

The chat system creates communication advantages in institutional trading. Bloomberg messages between traders, analysts, and clients facilitate deal flow and market intelligence that extends far beyond pure data access.

Best for: Large institutional trading desks that can absorb the cost, fixed income specialists who need the coverage, firms with established Bloomberg workflows where switching costs exceed subscription savings.

Pricing: $2,000-2,500/month per terminal with volume discounts that rarely satisfy budget expectations.

3. Refinitiv Eikon

Refinitiv Eikon uses Thomson Reuters' decades of financial data heritage with modern platform delivery. The system provides extensive market coverage with more flexible pricing than Bloomberg, though integration depth doesn't quite match.

News integration represents Eikon's strongest differentiator. Reuters news feeds integrate directly with market data, enabling rapid reaction to breaking developments that move markets. Natural language processing highlights relevant stories for portfolio positions automatically, reducing information overload that destroys productivity.

Microsoft partnership enhances analytical workflows. Deep Excel integration and Microsoft Teams connectivity reduce learning curves for analysts comfortable with Office environments. This compatibility advantage appeals to firms prioritizing existing workflow preservation over platform switching.

The platform's screening capabilities work well for fundamental analysis across global markets. Advanced filters enable complex multi-criteria searches while maintaining reasonable response times even with large datasets.

Best for: Firms prioritizing news integration over pure data breadth, existing Thomson Reuters relationships, teams seeking Bloomberg alternatives with familiar interfaces.

Pricing: $1,500-1,800/month with customization options that add cost quickly.

4. FactSet

FactSet differentiates through superior workflow integration and customization capabilities that adapt to firm-specific processes rather than forcing standardized approaches. This flexibility appeals to sophisticated investment teams with unique analytical requirements.

Multi-asset coverage includes equities, fixed income, and alternatives with consistent interfaces that reduce training overhead for teams managing diverse strategies. The learning curve stays manageable even when covering multiple asset classes simultaneously.

Partnership ecosystem continuously expands capabilities. Third-party data feeds integrate natively, creating centralized research hubs that eliminate platform switching. Custom dashboard creation enables personalized information displays for different roles and analytical focuses.

FactSet's commitment to client-specific customization sets it apart from standardized platforms. Complex workflows that other solutions cannot accommodate often find homes on FactSet's flexible architecture.

Best for: Multi-strategy investment funds with diverse analytical needs, firms requiring extensive customization, teams with complex workflows that standardized platforms cannot support effectively.

Pricing: $1,800-2,200/month depending on customization complexity and feature requirements.

5. PitchBook

PitchBook dominates private company intelligence, tracking venture capital, private equity, and M&A activity extensively. For investment strategies involving private markets, it often represents the only viable solution with institutional-quality coverage.

Funding round tracking and valuation analysis provide unique insights unavailable through public market data sources. Proprietary research augments raw transaction data with sector analysis and trend identification that accelerates due diligence processes.

Visualization capabilities make complex ownership structures understandable. Interactive charts display funding histories, investor networks, and competitive landscapes with relationship mapping that would take hours to construct manually. This visual approach significantly accelerates private market analysis.

Institutional relationships provide access to transaction data unavailable through public sources. Direct reporting from private equity firms and venture capital funds ensures coverage accuracy and timeliness that secondary sources cannot match.

Best for: Venture capital firms, private equity funds, investment banks focusing on private market transactions, analysts requiring extensive private company intelligence for strategic decisions.

Pricing: $1,200-1,500/month for professional access with additional costs for premium features.

6. Crunchbase

Crunchbase provides extensive startup and private company data that's become essential for technology investment analysis. The platform tracks funding rounds, company developments, and market trends across the global startup ecosystem.

Funding data accuracy and timeliness makes Crunchbase the go-to source for venture capital and growth equity analysis. Real-time funding announcements, valuation tracking, and investor relationship mapping provide intelligence unavailable through traditional financial data sources.

Company discovery capabilities help identify investment opportunities before they become widely known. Advanced filtering enables searches based on funding stage, growth metrics, technology focus, and geographic criteria that surface relevant prospects efficiently.

People and organization tracking reveals management changes, advisory relationships, and team expansion patterns that indicate company trajectory and potential investment readiness. This human intelligence supplements financial metrics with operational insights.

Best for: Venture capital firms, growth equity investors, corporate development teams, analysts focusing on technology and startup sectors requiring extensive private company intelligence.

Pricing: Professional plans start at $29/month for basic access, with enterprise pricing for extensive coverage and API access.

> Start using Crunchbase inside Databar.ai now >

7. Owler

Owler specializes in competitive intelligence and company tracking that supplements traditional financial analysis with market positioning and competitive dynamics insights essential for investment decision-making.

Competitive landscape analysis identifies market relationships and positioning that pure financial data cannot reveal. Automated competitor identification and tracking helps analysts understand market dynamics and competitive threats affecting investment targets.

Company news and development tracking provides curated intelligence feeds for portfolio companies and investment prospects. Automated alerts highlight significant developments, management changes, and market events that could affect investment thesis and valuation assumptions.

Revenue and employee growth estimates supplement public financial data with proprietary analytics that help evaluate private company performance and growth trajectory. These estimates provide valuable benchmarking data for comparative analysis across similar companies.

Best for: Investment analysts requiring competitive intelligence, due diligence teams evaluating market positioning, portfolio managers tracking competitive dynamics affecting holdings.

Pricing: Professional access starts at $15/month per user with enterprise options for extensive coverage and advanced features.

> Get started with Owler inside Databar.ai here >

8. PredictLeads

PredictLeads provides alternative data insights focused on company behavior patterns, technology adoption, and business development activities that offer forward-looking indicators for investment analysis.

Technology adoption tracking identifies companies implementing specific software, hardware, or business systems that indicate growth phases, operational changes, or strategic shifts relevant to investment timing and valuation analysis.

Business development activity monitoring tracks partnership announcements, vendor relationships, and strategic initiatives that provide insights into company growth strategies and market positioning before these developments appear in financial statements.

Intent data and behavioral signals help identify companies showing buying patterns or business expansion activities that correlate with revenue growth and investment opportunities. These leading indicators supplement traditional financial analysis with operational intelligence.

Best for: Growth equity investors, technology-focused funds, analysts incorporating alternative data signals into investment processes, teams requiring forward-looking operational indicators.

Pricing: Subscription plans start at $199/month with custom enterprise pricing for extensive data access and API integration.

> Try out PredictLeads inside Databar.ai now >

9. S&P Capital IQ

S&P Capital IQ specializes in deep fundamental company analysis with exceptional strength in financial modeling and peer comparison capabilities. The platform's Excel integration makes it particularly popular among equity research analysts.

Document search functionality excels at surfacing relevant regulatory filings and management communications across thousands of documents quickly. Advanced search operators help analysts locate specific disclosures that would take hours to find manually. Integration with S&P's credit ratings provides unique analytical perspectives.

Financial modeling tools standardize statements across companies and geographies, enabling accurate peer comparison despite different accounting standards. Automated ratio calculations and trend analysis accelerate fundamental research that forms the backbone of equity analysis.

Private company coverage supplements public market analysis for complete sector understanding. This dual coverage supports investment banking, M&A analysis, and market research requiring complete industry perspectives.

Best for: Fundamental equity analysts who live in Excel, investment banking teams requiring detailed modeling capabilities, credit researchers needing extensive fundamental analysis tools.

Pricing: $1,700-2,000/month with advanced modeling features adding cost.

10. Morningstar Direct

Morningstar Direct specializes in mutual fund and ETF analysis with industry-standard ratings that have become benchmarks for performance evaluation. The platform's sustainability integration addresses growing ESG investment requirements effectively.

Portfolio analysis tools excel at performance attribution and style analysis that help explain fund performance drivers. Morningstar's proprietary methodology for fund categorization has become industry standard for performance comparison and benchmark selection across global markets.

ESG integration reflects evolving investment priorities as institutional investors incorporate sustainability factors into investment processes. ESG ratings and factor analysis combine with traditional metrics for extensive fund evaluation that satisfies modern investment mandates.

Cost-effectiveness makes professional fund analysis accessible to smaller advisory firms that cannot justify Bloomberg-level expenses. Focused functionality serves fund analysts well without overwhelming them with unused features.

Best for: Wealth management firms, registered investment advisors, fund analysts specializing in mutual fund and ETF research, teams emphasizing ESG integration in investment processes.

Pricing: $900-1,200/month depending on coverage requirements and ESG feature access.

11. YCharts

YCharts democratizes financial data access through superior visualization capabilities and reasonable pricing that opens professional analysis to smaller firms. The platform emphasizes usability and chart creation over extensive coverage breadth.

Professional-quality chart generation accelerates client communication and internal presentation preparation. Interactive visualizations enable rapid exploration of relationships between metrics and time periods that would require manual Excel work on other platforms.

Fundamental data coverage includes most public companies with essential metrics sufficient for standard equity research and portfolio analysis. While not matching Bloomberg's depth, coverage meets requirements for most fundamental analysis workflows without overwhelming complexity.

Affordable pricing structure makes professional data accessible to independent advisors and smaller investment firms previously priced out of quality financial data platforms. This democratization enables sophisticated analysis at previously impossible price points.

Best for: Independent financial advisors working with individual clients, smaller investment firms with limited data budgets, analysts prioritizing visualization and presentation capabilities over extensive coverage.

Pricing: $200-400/month with feature tiers that scale reasonably with firm growth.

Building Smart Data Infrastructure

Creating effective investment data infrastructure requires strategic thinking beyond platform feature comparisons. The right combination balances extensive coverage against budget realities while optimizing daily workflow efficiency.

Boutique Firm Strategy (Under $500M AUM)

Start smart with unified platforms like Databar.ai that provide broad market coverage through aggregated premium sources. Add visualization tools like YCharts for client presentations and fundamental analysis capabilities. This combination delivers 80% of institutional platform functionality at under $300/month total cost.

Scale intelligently as assets under management and strategy complexity grow. Add alternative data sources when systematic signals become relevant to investment performance. Incorporate specialized platforms only when analytical edge clearly justifies additional subscription costs.

Fundamental Analysis Focus

Combine deep research capabilities with extensive document analysis tools. S&P Capital IQ for fundamental data and financial modeling, supplemented by AlphaSense for qualitative research synthesis. Add extensive data enrichment for competitive intelligence and market context analysis.

Budget $3,000-3,500/month per analyst for extensive fundamental research capabilities. This investment provides analytical depth that exceeds single-platform approaches while maintaining cost efficiency compared to Bloomberg-only strategies that many firms default to unnecessarily.

This approach works particularly well when integrated with CRM enrichment tools that move the revenue needle for client relationship management.

Multi-Strategy Investment Operations

Maintain strategic platform diversity to support different analytical approaches effectively. Bloomberg Terminal for trading and real-time market operations, specialized platforms like PitchBook for private market intelligence, and advanced research tools for deal sourcing and competitive analysis.

Plan $4,000-5,000/month per senior analyst for extensive coverage across asset classes and investment strategies. This investment level enables sophisticated analysis without workflow compromises or dangerous analytical blind spots.

Quantitative and Systematic Strategies

Prioritize API-accessible platforms with clean data formats and reliable delivery mechanisms that support automated analysis. Focus on normalized datasets rather than human-interface platforms designed for discretionary research workflows.

Combine core market data APIs with specialized alternative data sources based on systematic strategy requirements. Budget varies dramatically based on data consumption patterns, ranging from $500/month for basic strategies to $5,000+/month for complex multi-signal systematic approaches.

This systematic approach aligns with how best waterfall enrichment tools for B2B sales teams aggregate multiple data sources for complete intelligence.

Integration Realities Nobody Talks About

Data quality becomes meaningless without smooth integration into actual investment workflows. These practical factors determine whether expensive subscriptions help or hurt your analytical productivity.

Excel Integration That Actually Works

Plugin reliability determines daily frustration levels more than raw data quality or coverage breadth claims. Native Excel plugins consistently outperform web-based connections for analytical workflows that most investment professionals rely on heavily.

Verify compatibility thoroughly with your specific Excel version and typical data volume requirements before committing to annual subscriptions. Plugin failures during critical analysis periods create productivity disasters that expensive platforms should prevent, not cause.

API Development Realities

Documentation quality determines integration success more than marketing promises about API capabilities. Well-documented REST APIs with extensive client libraries accelerate custom development significantly while poor documentation creates expensive technical debt.

Rate limiting policies affect systematic viability despite marketing claims about API access. Understand actual usage restrictions before building analytical processes that depend on high-frequency data access that may not actually be available.

Compliance Requirements That Matter

Data licensing compliance requires tracking and retention policies that satisfy regulatory oversight without creating operational burden. Download limits, sharing restrictions, and audit trails help demonstrate compliance during regulatory examinations.

International regulatory requirements become increasingly complex as investment operations expand globally. Platforms supporting multiple regulatory frameworks reduce compliance burden while enabling international investment strategies.

Your Investment Data Victory Plan

Investment success increasingly depends on data infrastructure decisions that determine analytical capabilities, workflow efficiency, and competitive positioning in information-driven markets. The right platform combination enables superior insights while controlling costs and operational complexity.

Focus on strategic selection over extensive accumulation. Choose platforms that integrate smoothly with existing workflows, provide genuine analytical advantages, and scale efficiently with growing requirements. Avoid expensive subscriptions that duplicate existing capabilities or provide features you'll never actually use.

Whether you need advanced data extraction capabilities for alternative data collection or extensive market intelligence for fundamental analysis, smart data infrastructure changes information overload into sustainable competitive advantage.

The firms winning in 2025 aren't necessarily those with the biggest data budgets. They're the ones that have built intelligent, integrated systems that deliver actionable insights faster than their competitors. Make sure you're building that advantage now, before your market moves beyond your reach.

Frequently Asked Questions

What's the absolute minimum data setup for a new investment firm? Start with Databar.ai for extensive coverage at reasonable cost, then add specialized providers as investment strategies develop and justify additional expenses. Many successful boutique firms operated profitably for years using primarily this approach plus selective free sources for basic market data and regulatory filings.

How do alternative data sources actually differ from traditional financial information? Alternative data includes operational signals like web traffic patterns, hiring trends, satellite imagery analysis, and social media sentiment that provide forward-looking business insights unavailable in quarterly financial reports. These sources require different analytical approaches and validation methods compared to established financial metrics most analysts understand well.

Can I ditch expensive terminals completely and use only APIs? For systematic and quantitative strategies, absolutely. APIs provide better data access with superior automation at lower costs. But discretionary analysis requiring news integration, interactive charting, and exploratory research still benefits from terminal platforms optimized for human analytical workflows rather than systematic processing requirements.

Are free data sources actually useful for professional investment decisions? High-quality free sources like Federal Reserve Economic Data (FRED), SEC EDGAR filings, and basic Yahoo Finance data work well for educational purposes and basic analysis. However, they typically lack the accuracy, timeliness, and extensive coverage required for professional investment decisions and client reporting that regulatory standards demand.

Do I really need real-time data for fundamental analysis? Probably not. Daily closing prices and periodic financial updates work fine for most fundamental strategies focused on long-term value creation rather than short-term trading opportunities. Real-time data becomes essential primarily for active trading, risk management, and event-driven strategies where timing advantages create measurable performance differences.

Should we build custom data systems or just buy existing solutions? Buy standardized data like market prices, fundamental metrics, and regulatory filings from established providers who specialize in data quality and compliance. Build custom infrastructure only for proprietary analytics, unique processing requirements, or specialized alternative data that provides genuine competitive advantages rather than operational convenience.

Related articles

MCP vs. SDK vs. API: When to Use Which for GTM Workflows

When to Use MCP: Best for Exploratory and Conversational Workflows

by Jan, March 06, 2026

Claude Cowork for GTM: What Sales and RevOps Teams Need to Know

How Claude Cowork Simplifies Sales and Revenue Operations

by Jan, March 05, 2026

250+ Hours of Claude Code for GTM: Here's What We Learned

What 250+ Hours Building an Claude Code Powered GTM Campaign Taught Us About Automation and Accuracy

by Jan, March 04, 2026

Contextual ICP Scoring with Claude Code: Why Employee Count and Tech Stack Aren't Enough Anymore

Get deeper insights and better conversion rates by moving beyond simple filters to dynamic ICP scoring powered by AI

by Jan, March 03, 2026