Y Combinator Companies List: 4,400+ YC Startup Database for Business Development [Free Download]

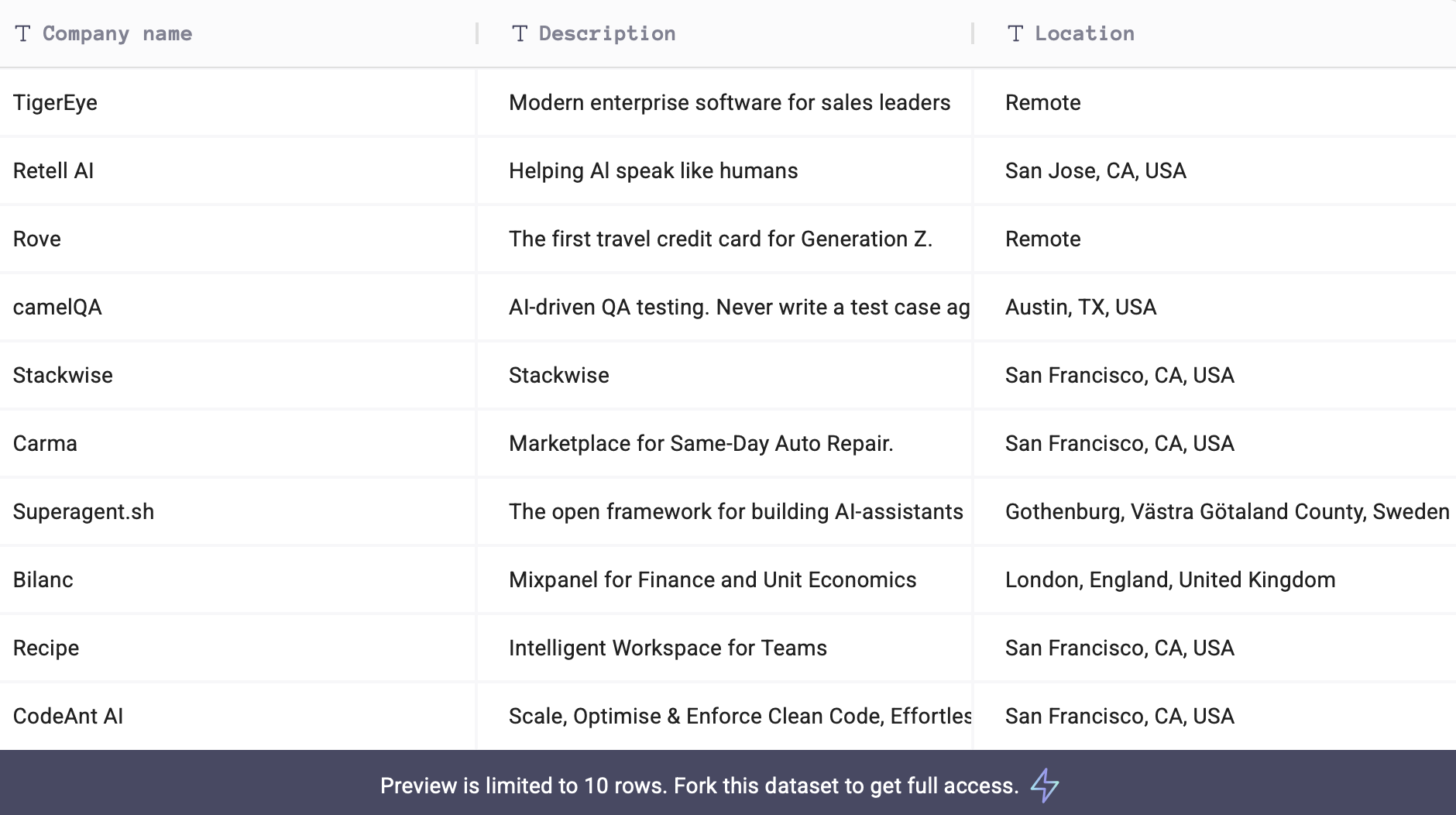

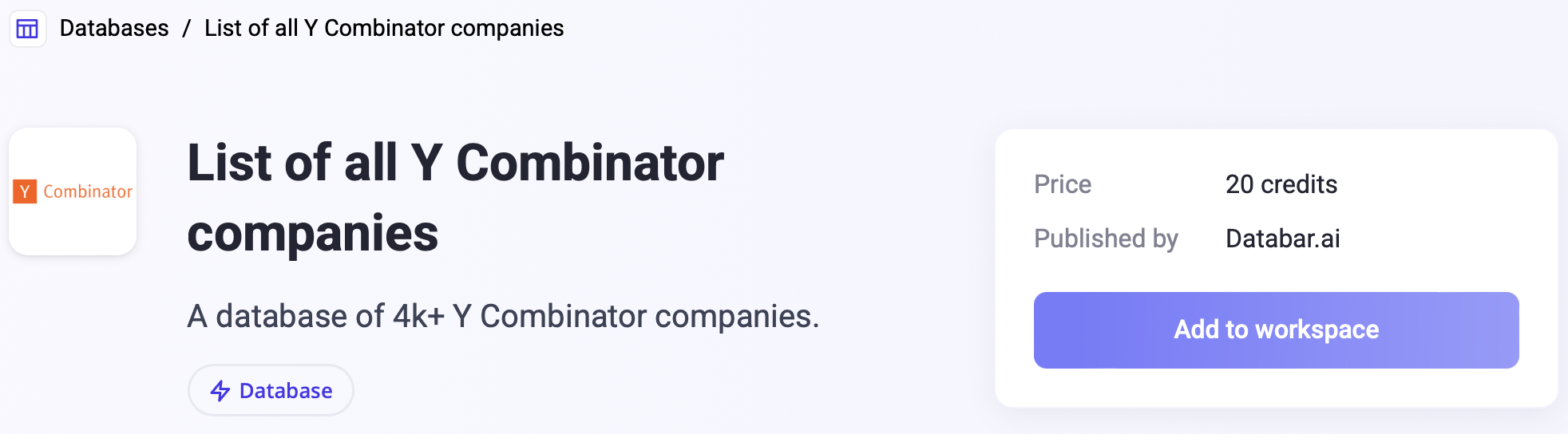

Access 4,400+ Y Combinator Startups

Blogby JanJune 28, 2025

Y Combinator has funded over 4,400 companies since 2005, with a combined valuation exceeding $600 billion. These aren't just any startups—they're pre-vetted, well-funded, growth-focused companies with the budget and authority to make fast purchasing decisions.

Whether you're looking for new customers, strategic partnerships, or top talent, our comprehensive YC startup database gives you direct access to the most promising companies in the startup ecosystem. It's your gateway to connecting with the future unicorns of Silicon Valley and beyond.

➤ Download the complete Y Combinator companies list here

Why Y Combinator Companies Are Sales and Partnership Gold

Y Combinator companies aren't typical startups struggling for survival. They've been through the most prestigious accelerator program in the world, which means they've already proven their potential to experienced investors who see thousands of pitches annually.

The numbers tell the story clearly. YC alumni companies have typically a higher survival rate compared to non-accelerated startups. They raise follow-on funding more frequently. Most importantly for business development, they spend more on external tools and services in their first two years post-YC.

This happens because Y Combinator teaches companies to focus on growth. They're explicitly encouraged to spend money on tools, services, and partnerships that accelerate their trajectory. Unlike bootstrap startups that pinch every penny, YC companies have both the funding and the mindset to invest in solutions that drive results.

The Y Combinator network effect creates additional opportunities. Alumni actively help each other through referrals, partnerships, and knowledge sharing. Landing one YC customer often opens doors to several others through warm introductions and word-of-mouth recommendations.

What Makes YC Alumni Different From Regular Startups

The Funding Advantage

Y Combinator companies enter the program with initial funding and typically raise significant rounds shortly after graduation. The average YC company raises $2.3 million within 18 months of completing the program, with many securing much larger rounds.

This funding advantage means several critical things for business development. They have budget allocated specifically for growth initiatives and tool adoption. They can make purchasing decisions quickly without lengthy approval processes. They're actively looking for solutions that help them scale rapidly rather than just survive.

The funding also creates urgency around growth that benefits solution providers. YC companies face pressure from investors to show rapid progress, making them ideal customers for tools and services that demonstrate clear ROI and speed to value.

Network Effects and Connections

The Y Combinator alumni network is incredibly tight-knit and supportive. Companies actively share recommendations for tools, services, and partnerships that have worked well for them. Getting one YC customer often leads to referrals to other portfolio companies.

This network extends beyond just the companies themselves. YC partners, advisors, and investors maintain ongoing relationships with alumni. A positive experience with one company can lead to introductions throughout the broader ecosystem.

The demo day presentations and ongoing community events create natural opportunities for relationship building and business development that don't exist with typical startup targets.

Growth Mindset and Speed

YC companies are explicitly trained to prioritize speed and growth over everything else. This creates an ideal customer profile for B2B solutions because they're willing to invest in tools and services that accelerate their trajectory.

Unlike traditional companies that may take months to evaluate and implement solutions, YC alumni are trained to make fast decisions and iterate quickly. They understand that speed often matters more than finding the perfect solution.

This growth mindset also makes them excellent early adopters for new technologies and innovative approaches. They're more willing to try cutting-edge solutions that established companies might avoid due to risk aversion.

Technical Sophistication

Most Y Combinator companies are technology-focused, which means they have sophisticated understanding of technical solutions and integration requirements. They can implement complex tools more easily and extract more value from advanced features.

This technical sophistication also means they're comfortable with API integrations, data workflows, and automation—making them ideal customers for modern SaaS platforms and data tools like what we offer at Databar.ai.

➤ Get instant access to 4,400+ Y Combinator companies

The Business Value of Targeting YC Companies

Higher Budget Authority

YC startup database entries consistently show higher budget allocation for growth tools compared to typical startups. Fresh funding rounds mean they have capital specifically earmarked for scaling operations, acquiring customers, and implementing systems.

The average YC company spends a big percentage of their funding on external tools and services within the first year post-graduation. This represents significantly higher budget authority compared to bootstrap companies or traditional enterprises with lengthy procurement processes.

Budget authority also extends to decision-making speed. YC founders typically maintain direct control over purchasing decisions, eliminating the complex approval chains that slow down sales cycles with larger organizations.

Faster Decision Making

Y Combinator alumni are trained to make decisions quickly and iterate based on results. This translates directly into shorter sales cycles and faster implementation timelines for B2B solutions.

While enterprise sales cycles average 6-18 months, YC companies often make purchasing decisions within days or weeks when they see clear value proposition and ROI projections. They understand that speed often creates competitive advantage more than exhaustive evaluation processes.

The founder-led decision making means you're typically selling directly to the person with both budget authority and implementation responsibility, eliminating handoff delays and miscommunication issues.

Early Adopter Mentality

YC companies are inherently early adopters who understand the competitive advantage of implementing innovative solutions before their competitors. They're willing to work with newer vendors and cutting-edge technologies that established companies might consider too risky.

This early adopter mentality creates opportunities for solution providers to land reference customers, gather feedback for product development, and establish market position before competitors recognize emerging trends.

Early adoption also means they're more tolerant of initial implementation challenges and more willing to provide detailed feedback that helps improve products and services over time.

Enriching Your YC Company Data for Maximum Results

While our Y Combinator companies list provides comprehensive starting information, enriching this data with additional details dramatically improves outreach effectiveness and conversion rates.

Adding Decision Maker Contacts

Contact enrichment takes the basic company information and adds specific decision makers with verified email addresses, direct phone numbers, and LinkedIn profiles for personalized outreach.

Role-based targeting identifies the right people for your specific use case—CTOs for technical solutions, CMOs for marketing tools, CFOs for financial software, and founders for strategic partnerships.

Team growth tracking monitors when companies add new roles or expand teams, creating perfect timing opportunities for relevant tools and services.

Succession planning tracks when key personnel change roles, creating opportunities to re-engage accounts or follow champions to new companies.

Finding Current Technology Stack

Technographic data reveals what tools and platforms YC companies currently use, enabling precise targeting based on compatibility and replacement opportunities.

Integration opportunities become clear when you understand their current systems and can position your solution as a natural addition to their existing workflow.

Migration timing can be predicted by analyzing technology adoption patterns and identifying companies likely to outgrow their current solutions.

Budget indicators emerge from understanding their current tool spending and identifying areas where they might need more sophisticated solutions.

Tracking Funding Updates

Funding round monitoring alerts you to companies that just raised capital and have fresh budget for new initiatives and tool adoption.

Growth stage transitions create natural opportunities for more sophisticated solutions as companies scale from startup to growth stage operations.

Investor connections can provide warm introduction opportunities when you share investors or advisory relationships with target companies.

Valuation tracking helps prioritize accounts based on their ability to afford enterprise-level solutions and services.

Monitoring Growth Signals

Hiring patterns indicate growth trajectory and budget availability—companies adding team members rapidly likely need supporting tools and infrastructure.

News and announcements about partnerships, customer wins, or product launches create natural conversation starters and demonstrate company momentum.

Website traffic growth suggests increasing demand for their product and potential need for scaling tools and services.

Social media activity provides insights into company culture, priorities, and current challenges that can inform personalized outreach approaches.

Common Mistakes When Targeting YC Companies

Generic mass outreach fails miserably with Y Combinator companies because they receive hundreds of generic sales emails daily and have developed sophisticated filters for identifying irrelevant communications.

Underestimating decision speed leads to missed opportunities. YC companies often make decisions within days or weeks, so slow follow-up or lengthy sales processes result in lost deals to faster competitors.

Focusing solely on cost misses the mark entirely. YC companies prioritize growth and speed over cost optimization, so value propositions should emphasize acceleration rather than savings.

Ignoring the network effect means missing referral opportunities. Treating each YC company as an isolated prospect rather than part of a connected ecosystem limits your long-term growth potential.

Overselling to early-stage companies can backfire when solutions are too advanced or expensive for their current needs. Match your offering complexity to their growth stage and requirements.

Neglecting founder relationships in favor of talking only to functional executives misses the centralized decision-making power that characterizes most YC companies.

How to Keep Your YC Database Updated

Y Combinator companies evolve rapidly, with frequent funding rounds, team changes, and business model pivots that affect their relevance and contact information for business development purposes.

Quarterly updates from official YC sources ensure you're tracking new batch additions and major company developments that affect their growth stage and funding status.

Funding round monitoring through investment tracking services alerts you to companies that just raised capital and have fresh budget for new initiatives and tool adoption.

Contact verification should happen before every major outreach campaign to ensure email deliverability and avoid bounces that damage your sender reputation.

Growth signal tracking monitors hiring patterns, product launches, and partnership announcements that indicate optimal timing for outreach and engagement.

Acquisition and exit tracking helps you follow successful founders to their next ventures and maintain relationships throughout their entrepreneurial journeys.

➤ Get instant access to 4,400+ Y Combinator companies

FAQs About Y Combinator Companies Lists

Q: How often is the YC companies database updated? We update our Y Combinator companies list quarterly with new batch additions, funding round information, and contact verification. Major company changes like acquisitions or significant pivots are updated within 30 days of public announcement.

Q: Can I use this list for cold email outreach? Yes! However, always respect opt-out requests and follow CAN-SPAM compliance guidelines. Focus on value-driven messaging rather than generic sales pitches.

Q: How do I prioritize which YC companies to target first? Start with companies that recently raised funding rounds, as they have fresh capital for new initiatives. Focus on companies in your target industry or those using complementary technologies. Prioritize companies in growth stages that match your solution complexity.

Q: Can I get updated contact information for specific companies? Yes, we offer contact enrichment services that can provide detailed decision-maker information for specific YC companies in your target list. This includes verified emails, phone numbers, and LinkedIn profiles for key personnel.

Related articles

Claude Code for GTM Engineers: The Practical Guide to Building Campaigns in 2026

How GTM engineers can save time and boost accuracy with Claude Code

by Jan, February 25, 2026

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026