Signal-Based GTM: Turn Signals Into Pipeline

Detect buying intent and schedule meetings automatically

Blogby JanSeptember 08, 2025

Only 5% of your target market is actively buying at any given moment. The question is: Can you identify that 5% before your competitors do?

Traditional go-to-market strategies treat all prospects equally—same cold emails, same demo pitches, same follow-up sequences. But elite revenue teams have discovered something that changes everything: Signal-based GTM.

Instead of interrupting prospects with generic outreach, they listen for digital signals that indicate buying intent, then respond with perfectly timed, contextually relevant engagement.

The results speak for themselves: Companies using signal-based approaches report 67% higher response rates, 41% shorter sales cycles, and up to 3x improvement in pipeline quality compared to traditional cold outreach.

Here's what signal-based GTM really means: capturing and acting on digital behaviors that indicate someone is researching, evaluating, or preparing to purchase solutions like yours.

When someone visits your pricing page at 2 AM, downloads competitive comparison guides, or engages with your LinkedIn content multiple times—these aren't random activities. They're digital signals of buying intent.

Why Cold Outreach Is Dying and Signals Are Taking Over

Something fundamental shifted in B2B buying behavior that most revenue teams missed entirely.

Buyers now complete 67% of their purchase journey before engaging with sales. They research solutions independently, evaluate alternatives privately, and build consensus internally—all while remaining invisible to traditional sales prospecting.

This created the "dark funnel" problem: Your ideal customers are actively researching your category, but you have no visibility into their buying process until they explicitly raise their hand.

Signal-based GTM solves this by making the invisible visible. Instead of waiting for inbound leads or sending blind outreach, you identify prospects showing research behaviors that indicate purchase intent.

The Old Way vs. The Signal Way

Traditional GTM approach:

- Build target account lists based on firmographic criteria

- Send generic cold outreach to thousands of prospects

- Hope for 2% response rates

- Chase unqualified leads through lengthy sales processes

Signal-based GTM approach:

- Monitor digital touchpoints for buying intent signals

- Identify accounts showing research behaviors

- Send contextually relevant outreach based on specific signals

- Engage prospects when they're already in evaluation mode

Why Signals Beat Cold Outreach

Research from Gartner shows that prospects engaged through signal-based outreach are 3x more likely to respond and 2x more likely to advance through the sales process.

The mathematical advantage is clear: Instead of a 1-2% response rate from 1,000 cold prospects, signal-based teams achieve 5%+ response rates from 200 warm prospects showing buying intent.

But here's the real breakthrough: Signal-based GTM isn't just about better response rates. It's about reaching prospects exactly when they're most receptive to your message.

From Spray-and-Pray to Signal-First: GTM Evolution

The transformation from volume-based to signal-based GTM represents the biggest shift in B2B sales since the introduction of CRM systems.

The Volume Era (2010-2020)

During the "Predictable Revenue" era, success came from execution at scale:

- More calls, more emails, more demos

- Activity-based KPIs and volume metrics

- Broad targeting with generic messaging

- Success measured by pipeline volume, not quality

This approach worked when buyers were more responsive and markets were less saturated. But three factors made volume-based GTM increasingly ineffective:

Market Saturation: Average B2B buyers receive 100+ sales emails per week, making it nearly impossible to stand out with generic outreach.

Buyer Behavior Change: Modern buyers actively avoid sales conversations until late in their evaluation process, preferring self-service research.

Channel Fatigue: Email deliverability declined, social platforms became pay-to-play, and traditional prospecting channels lost effectiveness.

The Signal Era (2022-Present)

Signal-based GTM flips the equation from interruption to invitation:

Quality Over Quantity: Fewer, better-targeted touchpoints with higher conversion rates Context Over Content: Messages triggered by specific behaviors rather than demographic characteristics

Timing Over Territory: Reaching prospects when they're actively researching rather than randomly interrupting

Intelligence Over Intuition: Data-driven engagement based on digital signals rather than gut feeling

The Compound Effect of Signal-Based GTM

Teams implementing signal-based approaches report cascading improvements across their entire revenue process:

Higher Response Rates: 5%+ vs. 1-2% for cold outreach

Shorter Sales Cycles: Prospects are already in evaluation mode when engaged

Better Pipeline Quality: Higher conversion rates from initial response to closed-won

Improved Team Efficiency: Sales teams focus on warm prospects instead of cold prospecting

Enhanced Customer Experience: Buyers receive relevant, timely information instead of interruptions

The Four-Layer Signal Intelligence Stack

Elite revenue teams structure their signal-based GTM around four interconnected layers that capture, analyze, and act on buying intent signals.

Layer 1: Signal Collection Infrastructure

Website and Content Engagement: Track page visits, content downloads, demo requests, pricing page views, and time spent on specific sections. Use tools like Google Analytics 4, Hotjar, or specialized intent platforms.

Product Usage Signals: For PLG companies, monitor trial sign-ups, feature adoption, usage thresholds, and engagement patterns that indicate expansion or conversion readiness.

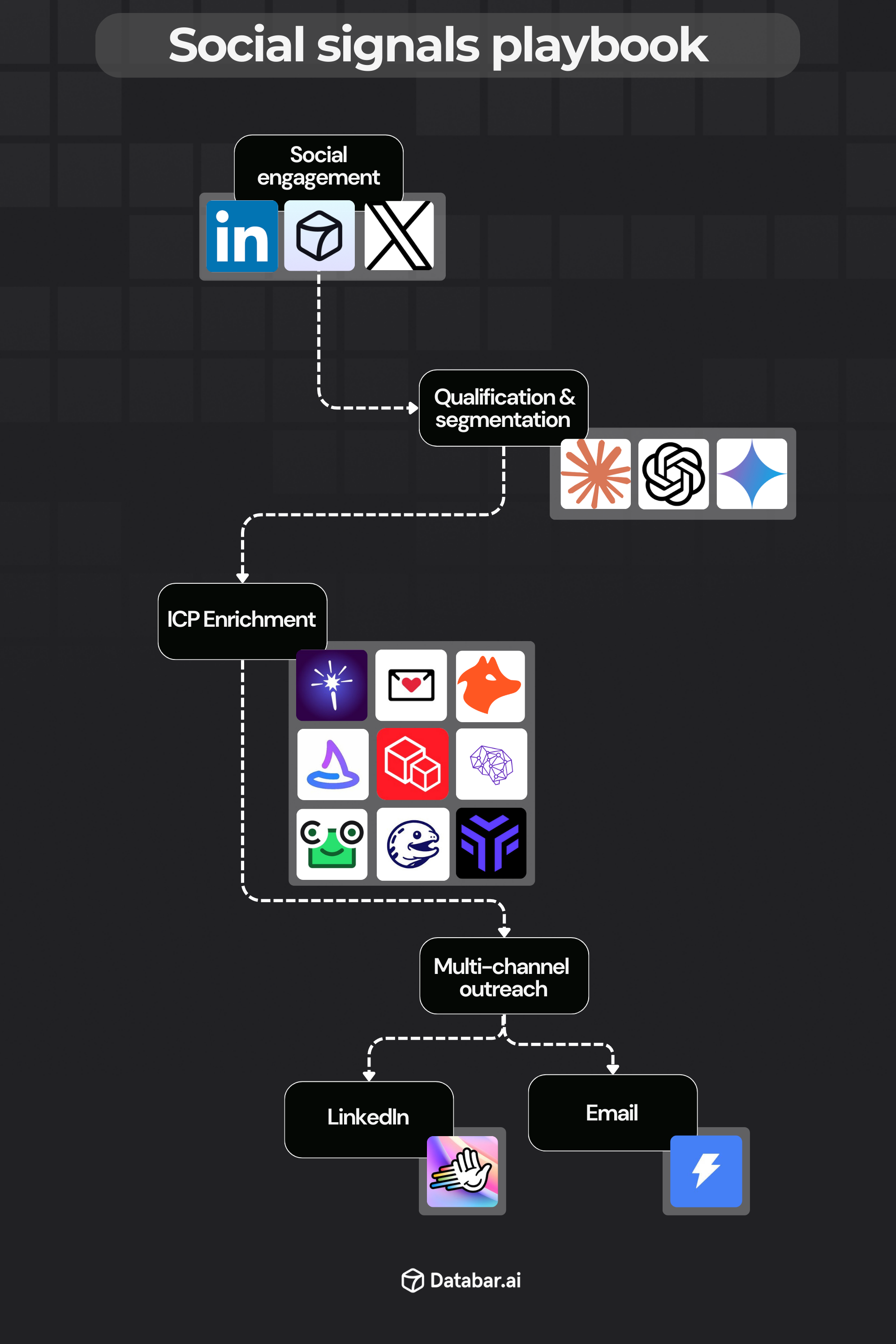

Social and Content Signals: Track LinkedIn engagement, content shares, comment activity, and social mentions that indicate interest or evaluation behavior.

Third-Party Intent Data: Leverage platforms like Bombora, G2, or TechTarget to identify accounts researching your category through external channels.

Layer 2: Signal Processing and Enrichment

Identity Resolution: Connect anonymous website visitors to known accounts and contacts using Databar's enrichment capabilities, which instantly reveals which companies are visiting your site and enriches them with comprehensive contact data.

Account Intelligence: Databar automatically enriches identified accounts with firmographic data, technology stack information, recent news, and buying committee details from 90+ data providers without manual research.

Signal Scoring: Weight different signals based on historical conversion data to create composite intent scores that predict buying likelihood using Databar's AI-powered scoring models.

Timeline Analysis: Track signal frequency and intensity over time to identify accounts moving from awareness to evaluation.

Layer 3: Signal Analysis and Prioritization

Multi-Touch Attribution: Understand which combination of signals most accurately predicts buying intent and successful deals using Databar's advanced analytics capabilities.

Account-Level Aggregation: Combine individual signals into account-level intent scores that consider multiple stakeholders and touchpoints through Databar's intelligent account mapping.

Competitive Intelligence: Identify accounts researching alternatives to understand competitive positioning and urgency.

Buying Stage Classification: Categorize accounts by evaluation stage (early research, active evaluation, vendor selection) based on signal patterns analyzed by Databar's AI.

Layer 4: Action and Automation

Trigger-Based Outreach: Automatically initiate personalized sequences when specific signal thresholds are met.

Sales Alert Systems: Notify account owners immediately when high-intent signals occur.

Cross-Channel Orchestration: Coordinate email, LinkedIn, phone, and advertising touchpoints based on signal data.

Feedback Loop Integration: Track conversion outcomes to refine signal scoring and improve automation accuracy.

First-Party vs. Third-Party: Building Your Signal Foundation

Understanding the difference between first-party and third-party signals determines your signal-based GTM strategy and technology requirements.

First-Party Signal Advantages

Higher Accuracy: Direct interactions with your brand provide more reliable intent indication than inferred third-party data.

Real-Time Availability: Immediate access to engagement data without delays or data processing lag.

Cost Efficiency: No ongoing subscription costs for external intent data providers.

Deeper Context: Rich behavioral data including content preferences, feature interests, and engagement patterns.

First-Party Signal Sources

Website Analytics: Page views, session duration, content downloads, form submissions, and conversion events tracked through your marketing automation platform.

Email Engagement: Open rates, click-through rates, link preferences, and email forward behavior that indicates sharing with colleagues.

Content Consumption: Webinar attendance, ebook downloads, case study views, and video engagement that shows evaluation progress.

Product Interactions: For product-led growth companies, trial usage, feature adoption, and in-app behavior that predicts conversion or expansion.

Third-Party Signal Intelligence

Market Research Signals: Intent data from review sites, industry publications, and research platforms that indicate category evaluation.

Competitive Intelligence: Monitoring prospects' interactions with competitors through external platforms and content syndication networks.

Social Professional Networks: LinkedIn engagement, job posting analysis, and professional network activity that indicates organizational changes.

News and Events: Company announcements, funding rounds, leadership changes, and industry events that create buying urgency.

The Hybrid Approach

Most successful signal-based GTM strategies combine first-party depth with third-party breadth:

Use first-party signals for high-accuracy, immediate action when prospects engage directly with your brand.

Use third-party signals for early identification of accounts entering evaluation mode before they've engaged with your brand directly.

Combine both for complete coverage that captures prospects throughout their entire buying journey, from initial research to vendor selection.

Automation Playbooks That Scale Signal-Based Outreach

The real power of signal-based GTM comes from automation that responds to signals instantly, consistently, and at scale.

Here are proven playbooks inspired by the highest-performing revenue teams:

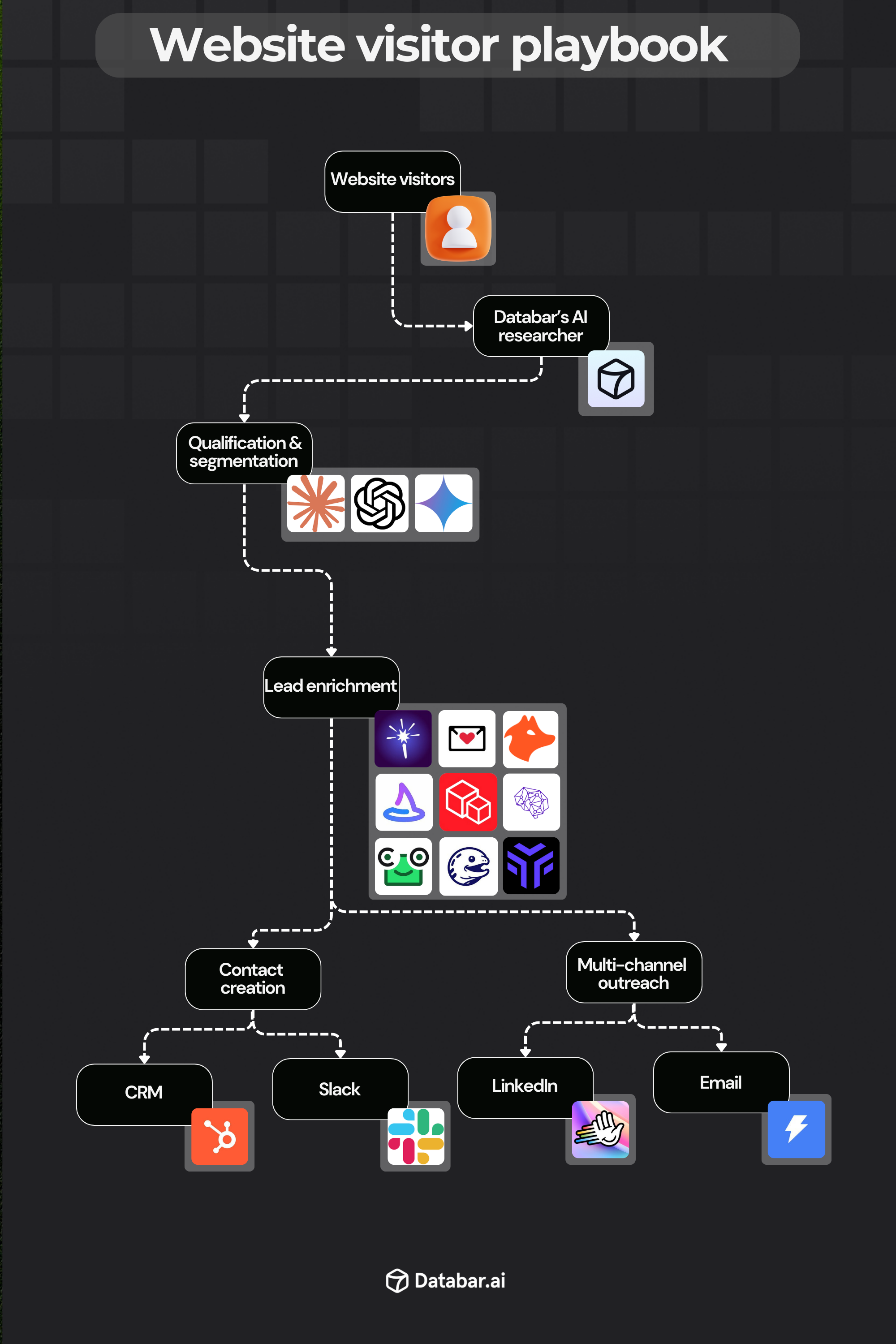

Playbook 1: The Anonymous Visitor Conversion Engine

Signal Trigger: Anonymous website visitors from target accounts viewing pricing or product pages

Automation Sequence:

- Instant Identification: Use visitor identification tools to connect IP addresses to company records

- Account Enrichment: Automatically enrich company data with decision-maker contacts and firmographic information

- Decision-Maker Mapping: Identify key stakeholders likely to be involved in purchase decisions

- Multi-Channel Engagement: Launch coordinated LinkedIn connection requests, personalized emails, and targeted advertising

- Contextual Messaging: Reference specific pages visited and company-specific use cases

Playbook 2: The Content Engagement Accelerator

Signal Trigger: Multiple content downloads or webinar attendance from the same account

Automation Sequence:

- Engagement Scoring: Track cumulative content consumption across account stakeholders

- Topic Analysis: Identify content themes showing evaluation focus (security, integration, ROI)

- Stakeholder Identification: Map content consumption to specific roles and buying influence

- Progressive Engagement: Deliver increasingly specific content based on demonstrated interests

- Sales Handoff: Alert account executives when engagement scores reach qualified thresholds

Playbook 3: The Competitive Displacement Sequence

Signal Trigger: Third-party intent data showing research of competitive alternatives

Automation Sequence:

- Competitive Intelligence: Identify which competitors prospects are researching

- Positioning Content: Deliver comparison content highlighting your advantages

- Customer Proof: Share relevant case studies from competitive wins

- Urgency Creation: Reference limited-time incentives or implementation timelines

- Executive Engagement: Involve leadership for high-value competitive situations

Playbook 4: The Product Signal Pipeline

Signal Trigger: Trial users hitting usage thresholds or exploring premium features

Automation Sequence:

- Usage Analysis: Track feature adoption and engagement depth

- Expansion Identification: Flag accounts showing interest in advanced capabilities

- Success Metrics: Calculate ROI and value demonstration based on current usage

- Educational Content: Deliver advanced use case content and training resources

- Sales Acceleration: Connect high-usage accounts with specialized sales resources

How Databar Powers Signal-Based Automation

Modern signal-based GTM requires seamless integration between signal collection and action activation. Databar automates this entire workflow:

AI-Powered Scoring: Uses AI to analyze engagement patterns and predict buying intent, automatically scoring accounts based on behavior and fit.

Automated Enrichment: Continuously updates account and contact records with fresh data, ensuring your signal-based outreach always uses current, accurate information.

Trigger-Based Activation: Integrates with your existing sales and marketing tools to automatically launch personalized sequences when signal thresholds are met.

This automated approach transforms anonymous traffic into warm conversations without manual research or data entry, enabling signal-based GTM at scale.

Signal Scoring: The Proven Framework

Not all signals carry equal predictive value. Elite revenue teams use sophisticated scoring frameworks to prioritize accounts and automate engagement decisions.

Signal Weight Classification

High-Value Signals (100-150 points):

- Pricing page visits by decision-makers

- Demo requests or trial sign-ups

- Multiple stakeholder engagement

- Competitive comparison downloads

Medium-Value Signals (50-75 points):

- Product page visits

- Case study downloads

- Webinar attendance

- LinkedIn content engagement

Low-Value Signals (10-25 points):

- Blog post reading

- Email opens

- Social media follows

- Basic website visits

Time-Decay Scoring

Signal relevance decreases over time, requiring decay factors in scoring models:

Fresh Signals (0-7 days): Full point value

Recent Signals (8-30 days): 75% point value

Older Signals (31-90 days): 50% point value

Stale Signals (90+ days): 25% point value or removal

Account-Level Aggregation

Individual Contact Scores: Sum signals from each contact within target accounts Stakeholder Weighting: Apply multipliers based on buying influence (CEO 3x, VP 2x, Manager 1x)

Engagement Breadth: Bonus points for multiple stakeholders showing interest

Signal Diversity: Higher scores for accounts showing varied engagement types

Threshold-Based Actions

High Intent (200+ points): Immediate sales outreach with personalized messaging

Medium Intent (100-199 points): Automated nurture sequences with relevant content

Low Intent (50-99 points): General awareness campaigns and retargeting

No Intent (0-49 points): Exclude from active campaigns to avoid message fatigue

Getting Started With Signal-Based GTM

Signal-based GTM represents a significant shift from traditional volume-based outreach to intelligence-driven engagement.

Companies implementing signal-based approaches typically see meaningful improvements in response rates and sales efficiency. However, success requires careful planning, proper technology integration, and organizational commitment to new processes.

The transition from volume-based to signal-based GTM offers competitive advantages, but it's not a silver bullet. Teams need realistic expectations about implementation timelines, resource requirements, and the ongoing work required to maintain effective signal intelligence.

Signal-based GTM works best when organizations can identify genuine buying intent signals, act on them promptly with relevant messaging, and measure results to continuously improve their approach.

The core principle remains straightforward: instead of interrupting prospects with generic outreach, focus on engaging accounts that are already showing interest in your solution category. This approach requires more sophisticated processes but typically delivers better outcomes for both buyers and sellers.

Signal-based GTM won't eliminate the need for traditional sales skills or replace fundamental go-to-market strategy. Rather, it provides better intelligence about when and how to engage prospects who are already in evaluation mode.

Frequently Asked Questions

What's the difference between signal-based GTM and traditional lead scoring?

Traditional lead scoring typically focuses on demographic and firmographic characteristics (company size, industry, job title) to identify good-fit prospects. Signal-based GTM focuses on behavioral and intent signals (content consumption, website engagement, competitor research) to identify prospects who are actively evaluating solutions. The key difference is fit vs. timing—lead scoring finds good prospects, signal-based GTM finds prospects who are ready to buy now.

How do you prevent signal-based outreach from feeling automated or impersonal?

The key is using signals to create contextual relevance, not just trigger volume. Instead of generic "I saw you visited our website" messages, reference specific pages visited, content consumed, or research areas explored. For example: "I noticed you downloaded our security compliance guide—many [INDUSTRY] companies ask us about meeting SOC 2 requirements when evaluating solutions like ours." The signal provides context for genuine relevance.

What's the minimum technology stack needed to implement signal-based GTM?

At minimum, you need website analytics (Google Analytics), CRM integration, and marketing automation for basic signal collection and response. For more sophisticated approaches, add visitor identification tools, third-party intent data, and automation platforms that connect signals to multi-channel outreach. Many teams start with HubSpot or Salesforce plus one signal intelligence platform before expanding their stack.

Can signal-based GTM work for small companies without dedicated MarOps teams?

Yes, but start simple. Begin with website visitor identification and basic engagement tracking through your existing CRM. Use platforms like Databar that provide pre-built automations rather than trying to build custom signal-to-action workflows. Focus on 2-3 high-value signals rather than comprehensive signal intelligence. Many successful implementations start with just pricing page visits and content downloads.

Related articles

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026