SaaS GTM Strategy: Data Enrichment Approaches for Product-Led Growth

Driving Smarter GTM Decisions with Comprehensive Data Enrichment for Product-Led SaaS

Blogby JanAugust 09, 2025

Your product is doing the heavy lifting. Users sign up, explore features, and some eventually convert to paid plans. But here's what most product-led SaaS companies discover after a few months: you're flying blind on the most important decisions.

You know someone from "ABC Corp" is using your free plan heavily, but you don't know if ABC Corp has 50 employees or 5,000. You can see which features drive engagement, but you can't tell if your power users work at companies that match your ideal customer profile. Your sales team gets a notification about a product-qualified lead, but they have no context about the company, industry, or stakeholders involved.

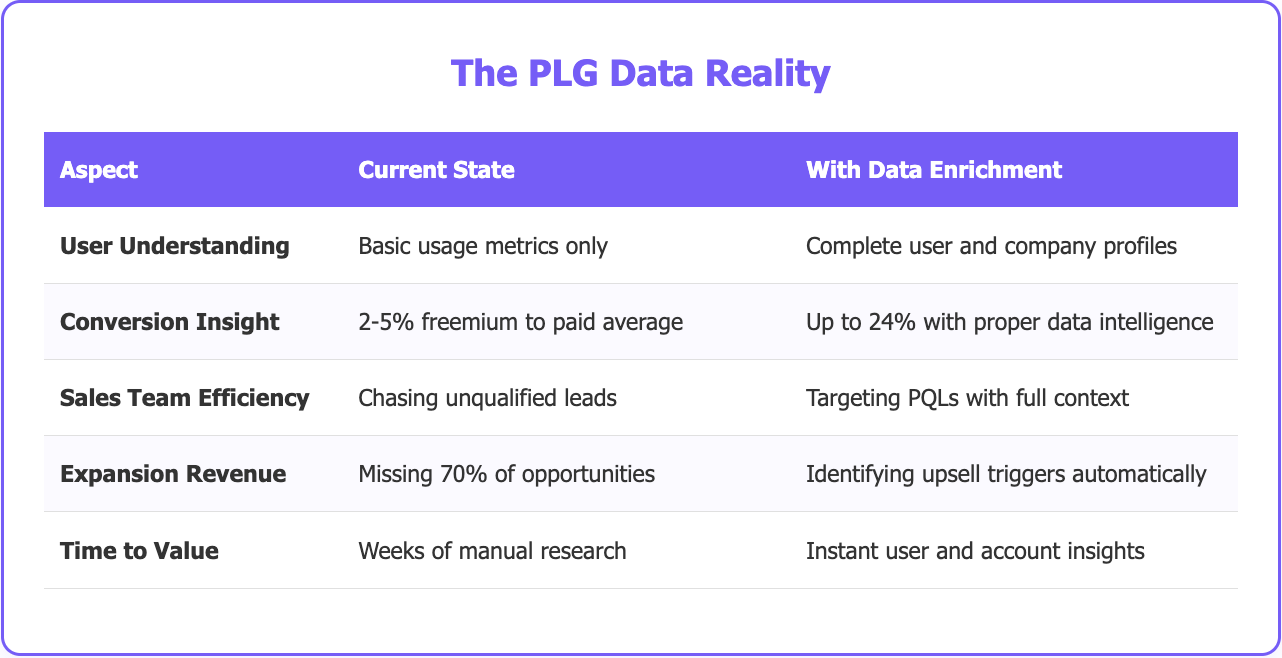

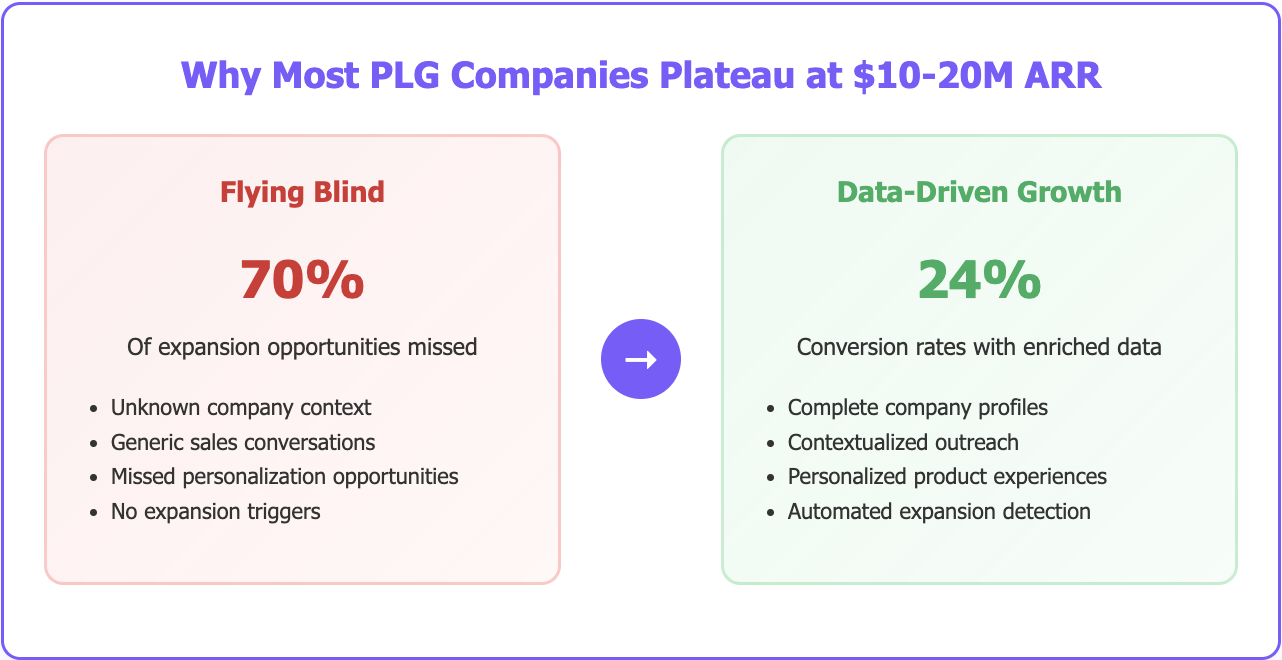

This data gap is why many product-led companies plateau around $10-20M ARR. The product got them there, but scaling further requires understanding not just what users do in your product, but who they are, where they work, and what makes them likely to buy more.

The Blind Spots That Kill PLG Growth

Product-led growth feels magical in the early days. Users discover your product, sign up without talking to sales, and start getting value immediately. Conversion happens naturally. Growth feels organic and sustainable.

Then reality hits. The easy wins are captured. Growth slows. Conversion rates plateau. Your sales team struggles to have meaningful conversations with product-qualified leads because they lack context about prospects and their companies.

Consider a typical scenario: Your analytics show that someone at a tech company has been using your project management tool heavily for three weeks. They've created multiple projects, invited team members, and explored advanced features. Your lead scoring algorithm flags them as highly engaged.

But your sales rep has no idea if this person works at a 10-person startup or a 10,000-person enterprise. They don't know the company's industry, funding status, or technology stack. They can't tell if other team members are already using competing tools. The conversation becomes generic: "I see you've been using our product. Would you like to upgrade?"

This is where data enrichment transforms product-led growth from a good strategy into a great business.

Why Your Product Needs a Data Upgrade

Traditional sales-led companies expect to gather information during discovery calls. Sales reps ask questions about company size, budget, timeline, and decision-making process. The qualification happens through conversation. (Even in this scenario, an enriched profile provides a head start and many points to discuss)

Product-led companies don't get this luxury. Users interact with your product before talking to anyone from your company. By the time a sales conversation happens, you've already missed the opportunity to understand context that could make or break the deal.

The data gap creates multiple problems:

Users who would be perfect customers churn because you don't recognize their potential early enough. You can't personalize their product experience based on company size or industry needs.

Sales conversations start from zero context, making reps sound unprepared and generic. Instead of "I noticed your engineering team has been collaborating on the mobile app project," they say "Tell me about your business."

Marketing campaigns treat all users the same, missing opportunities to segment messaging by company type, industry, or role. A startup founder and enterprise IT manager need completely different approaches.

Product development decisions lack business context. You might optimize features that appeal to small companies while your revenue comes from enterprises, or vice versa.

Expansion opportunities disappear because you can't identify accounts with high growth potential or users who might influence larger purchases.

Data Enrichment: Beyond Basic User Profiles

Data enrichment in product-led growth means automatically appending detailed information about users and their companies to enhance every aspect of your go-to-market strategy. Instead of seeing "john@abccorp.com" in your CRM, you see John Smith, Senior Engineering Manager at ABC Corp, a 500-person fintech company in New York with $50M in funding that uses Salesforce, Slack, and AWS.

This isn't just about having more data fields. It's about transforming your understanding of who uses your product and why, enabling smarter decisions across product development, marketing, sales, and customer success.

Information That Actually Moves the Needle

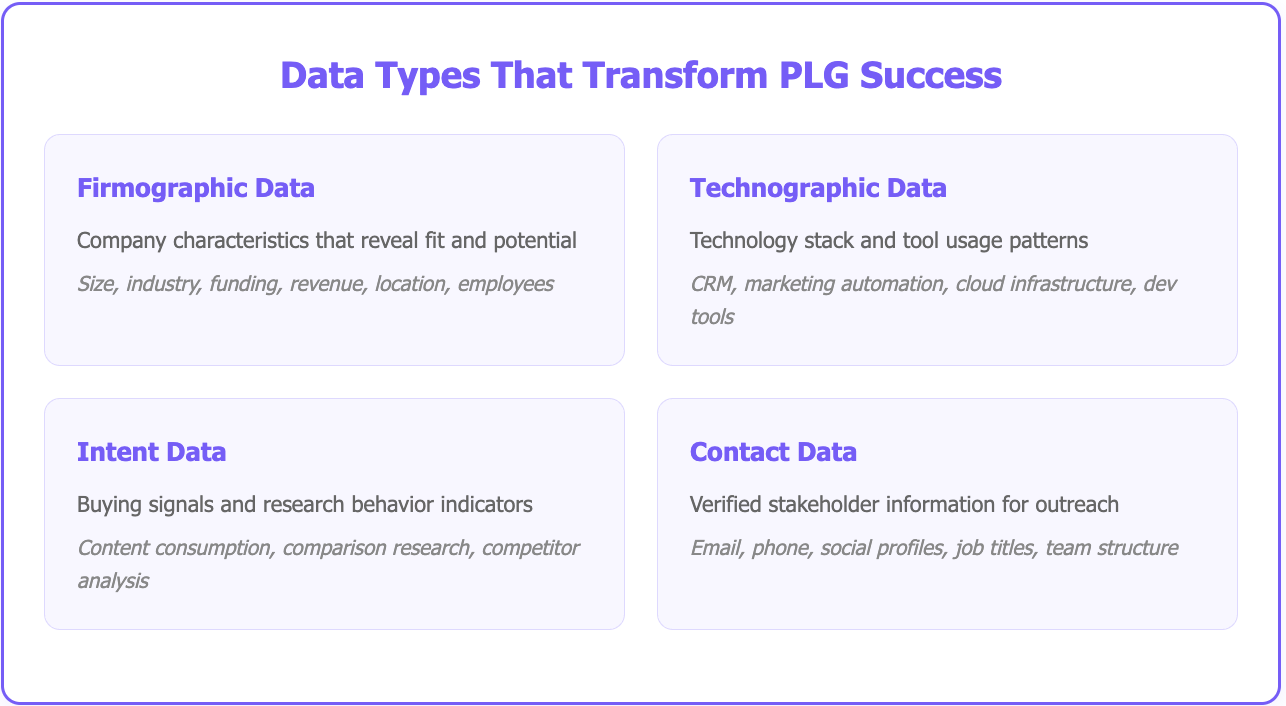

Firmographic data tells you about the companies behind your users. Company size, industry, funding history, annual revenue, headquarters location, and number of employees. This information helps you understand if users work at companies that match your ideal customer profile.

Technographic data reveals what tools and systems companies already use. Their CRM platform, marketing automation tools, cloud infrastructure, and development stack. This context helps predict integration needs, competitive situations, and likelihood to adopt new tools.

Intent data shows buying signals from companies engaging with content about your product category. Which companies are researching solutions like yours, reading comparison articles, or downloading relevant resources. This information helps prioritize outreach timing.

Contact data provides verified email addresses, phone numbers, and social media profiles for key stakeholders at target companies. Instead of guessing who makes decisions, you know exactly who to contact and how to reach them.

Behavioral data tracks how different user types interact with your product. Engineers use different features than marketers. Startup teams have different usage patterns than enterprise departments. Understanding these patterns helps optimize experiences for each segment.

When Data Starts Changing Conversations

With comprehensive data enrichment, your entire go-to-market approach becomes more intelligent and effective:

Product experience personalization based on company context. Enterprise users see security and compliance features prominently. Startup teams see collaboration and speed optimization tools. Marketing teams see campaign management features while engineering teams see technical integration options.

Lead qualification becomes automatic and accurate. Instead of waiting for sales conversations to determine fit, you can instantly assess whether new users work at companies that match your target market.

Sales conversations start with full context. Reps know company size, industry challenges, technology stack, and team structure before the first call. They can reference specific use cases and competitive situations immediately.

Marketing campaigns target specific segments with relevant messaging. Enterprise campaigns emphasize security and scalability. SMB campaigns focus on ease of use and quick setup. Industry-specific campaigns address particular pain points and use cases.

Customer success proactively identifies expansion opportunities. Account managers know when companies are growing, hiring, or launching new projects that could benefit from additional features or seats.

Getting Your Data House in Order

Before You Add More Data

Most product-led companies begin with basic user data: email addresses, usage patterns, and engagement metrics. Building a comprehensive data enrichment system requires connecting this foundation with external data sources and internal intelligence.

Identify your data gaps by examining current user profiles. What information would help your sales team have better conversations? Which data points would improve product personalization? What context would help customer success identify expansion opportunities?

Map your ideal customer profile in detail. Beyond basic demographics like company size and industry, consider technology usage, growth stage, team structure, and buying behavior patterns. The more specific your ICP, the better you can use enrichment data to identify and prioritize similar prospects.

Audit your current data quality before adding new sources. Clean existing records, standardize formats, and establish data governance processes. Poor quality existing data will undermine enrichment efforts.

Choose enrichment timing based on user behavior and business needs. Some companies enrich all new signups immediately. Others wait for engagement signals before investing in data collection. Consider enriching high-value accounts more comprehensively than casual trial users.

The Tech That Makes It All Work

Modern data enrichment requires connecting multiple sources and systems to create comprehensive user and company profiles.

Customer data platforms serve as the central hub for collecting, storing, and activating enriched data. CDPs can integrate with your product analytics, CRM, marketing automation, and other tools to create unified profiles.

Enrichment APIs provide real-time data appending capabilities. When new users sign up, APIs can instantly add company information, contact details, and technographic data to user records.

Intent data providers track buying signals and content engagement across the web. These systems identify companies actively researching solutions in your category, helping prioritize outreach and personalize messaging.

Integration platforms connect enrichment data with operational systems. Marketing automation platforms use enriched data for segmentation and personalization. CRM systems provide sales teams with complete prospect context. Customer success platforms identify expansion opportunities.

At Databar.ai, we've seen product-led companies transform their growth trajectories by implementing comprehensive data enrichment. Our platform connects 90+ data providers to deliver complete user and company profiles that enable smarter GTM decisions across product, marketing, sales, and customer success teams.

Making Your Team Actually Use the Data

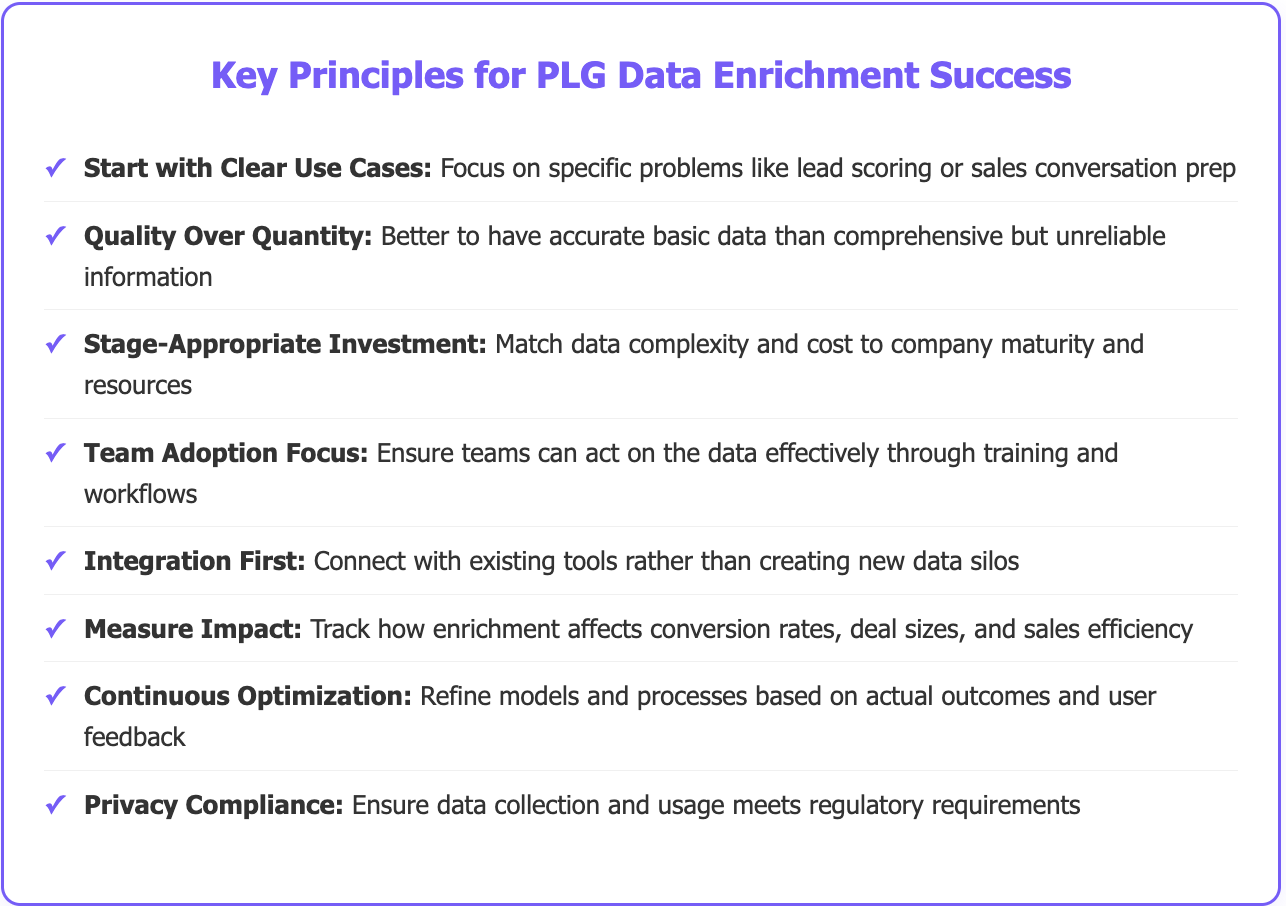

Having data is only valuable if your teams can act on it effectively. Successful PLG companies build operational processes around enriched data to drive better outcomes.

Lead scoring algorithms incorporate enrichment data to identify product-qualified leads more accurately. Users from target companies who match your ICP and show strong engagement signals receive higher priority than casual users from less relevant organizations.

Automated workflows trigger personalized experiences based on enriched data. Enterprise users automatically see enterprise-focused onboarding sequences. Users from competitive tool environments receive migration guides and switching incentives.

Sales routing directs qualified leads to appropriate team members based on company characteristics. Enterprise accounts go to senior reps with relevant experience. SMB leads route to inside sales teams optimized for volume and velocity.

Customer success playbooks customize based on company context and expansion potential. High-growth companies receive proactive expansion conversations. Enterprise accounts get dedicated success management. SMB customers rely more on self-service resources and community support.

Different Stages, Different Data Needs

When You're Still Finding Your Way (Pre-$1M ARR)

Early-stage product-led companies often resist data enrichment, viewing it as premature optimization. But basic enrichment can dramatically improve even early-stage outcomes by helping teams understand who uses their product and why.

Focus on company size and industry to understand your early user base. Are you attracting startups or enterprises? Which industries show the strongest engagement? This context helps prioritize feature development and marketing positioning.

Track technology stack information to understand integration needs and competitive situations. Users migrating from specific tools need different onboarding experiences than those starting fresh.

Monitor engagement patterns by company type to identify optimal user profiles. If enterprise users have higher retention but startups convert faster, you can optimize different parts of your funnel for different segments.

Start simple with basic enrichment that doesn't require complex infrastructure. Tools like Databar.ai provide enrichment capabilities that can be implemented quickly without major engineering resources.

The Growth Phase Crunch ($1M-$10M ARR)

Growth-stage companies have proven product-market fit and need to optimize their go-to-market efficiency. Data enrichment becomes crucial for scaling without proportionally increasing operational complexity.

Implement comprehensive lead scoring that combines behavioral signals with firmographic data. Users showing high engagement at target companies receive immediate sales attention, while casual users from less relevant organizations enter nurturing sequences.

Launch account-based experiences for high-value prospects. Users from enterprise accounts see different features, messaging, and support options than SMB users. Personalization increases conversion rates and average deal sizes.

Build predictive models to identify expansion opportunities before they become obvious. Companies hiring rapidly, receiving funding, or launching new products often need additional seats or premium features.

Optimize pricing and packaging based on company characteristics. Startups might need usage-based pricing while enterprises prefer annual contracts. Different industries have different budget cycles and procurement requirements.

Playing in the Big Leagues ($10M+ ARR)

Mature product-led companies use sophisticated data enrichment to optimize every aspect of their go-to-market motion. The focus shifts from growth at any cost to efficient, profitable growth.

Advanced segmentation based on multiple data dimensions enables highly targeted experiences. Company size, industry, technology stack, growth stage, and geographic location all influence optimal product experiences and go-to-market approaches.

Predictive analytics identify which free users are most likely to convert and what factors drive expansion revenue. Machine learning models trained on enriched data can predict customer lifetime value and optimal engagement strategies.

Competitive intelligence helps win deals against specific competitors by understanding which tools target companies currently use and what motivates switching decisions.

Market expansion strategies rely on data to identify new segments, geographies, or use cases with high potential. Enrichment data reveals patterns in successful customers that can guide expansion decisions.

Real Ways Data Improves Your Numbers

Getting More People to Actually Pay

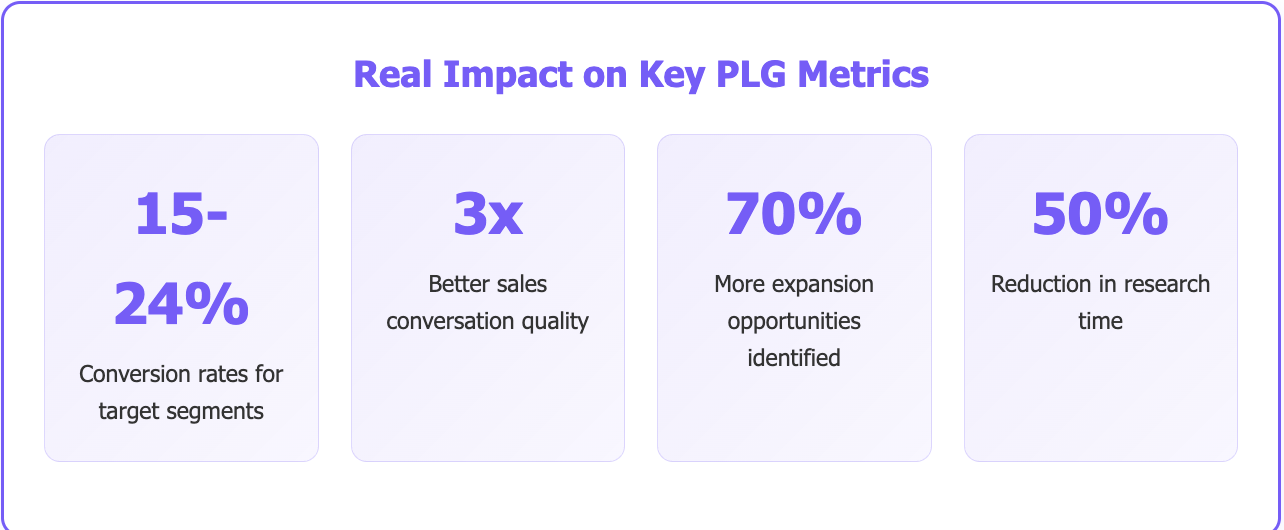

The average free-to-paid conversion rate across SaaS companies is 2-5%, but companies with strong data enrichment often see rates of 15-24% for their target segments. The key is understanding which free users have the highest conversion potential and engaging them appropriately.

Company size-based nurturing recognizes that startups and enterprises have different conversion patterns. Startups often convert quickly based on immediate pain points, while enterprises require longer evaluation periods and more comprehensive feature demonstrations.

Industry-specific messaging addresses particular use cases and challenges. Healthcare companies need HIPAA compliance information. Financial services require security certifications. Manufacturing companies want integration capabilities with existing systems.

Role-based engagement personalizes the conversion journey for different stakeholders. Technical users want to understand APIs and integrations. Business users focus on ROI and workflow improvements. Executives need strategic context and competitive positioning.

Timing optimization based on company events and buying signals. Companies that just received funding, hired key personnel, or announced new products often have budget and urgency for new tools.

When Sales Reps Actually Sound Prepared

Product-qualified leads often enter sales conversations with much higher intent than traditional marketing-qualified leads, but sales teams need context to capitalize on this advantage.

Pre-call research automation provides sales reps with complete company profiles, recent news, funding history, technology stack, and competitive landscape before initial conversations. Reps can reference specific use cases and demonstrate relevant features immediately.

Stakeholder mapping identifies key decision-makers and influencers at target accounts. Instead of speaking only with initial contacts, reps can engage entire buying committees with appropriate messaging for each role.

Competitive positioning helps reps address specific competitor situations. If prospects currently use a particular tool, reps can immediately highlight differentiation points and migration benefits.

Custom demo scenarios based on company characteristics and industry context. Enterprise software companies see different demo flows than e-commerce businesses, even for the same core product functionality.

Finding Money You Already Have

Product-led companies often struggle to identify expansion opportunities because they lack visibility into company growth, organizational changes, and budget cycles.

Growth signal monitoring tracks hiring patterns, funding announcements, new office locations, and product launches that might indicate expansion opportunities. Companies in growth mode often need additional seats, features, or usage capacity.

Usage pattern analysis combined with company data reveals accounts approaching limits or needing additional functionality. A growing marketing team using basic features might benefit from advanced automation capabilities.

Organizational mapping identifies new departments or teams that could benefit from your product. If engineering teams love your tool, data enrichment can help identify marketing, sales, or operations teams at the same company who might have relevant use cases.

Renewal optimization predicts which accounts might churn based on usage patterns and company context. Teams can proactively address concerns and demonstrate additional value before renewal conversations.

Making Your Product Feel Custom

Modern SaaS products adapt their interface, messaging, and functionality based on user context. Data enrichment enables much more sophisticated personalization than basic behavioral tracking alone.

Feature prioritization shows relevant capabilities based on company size and industry. Enterprise users see security and compliance features prominently, while SMB users focus on ease-of-use and quick setup tools.

Integration recommendations based on technology stack data. Users from Salesforce-heavy organizations see CRM integration options immediately. Google Workspace users see relevant productivity integrations first.

Content personalization in help documentation, feature announcements, and educational materials. Different industries have different terminology, compliance requirements, and typical use cases.

Onboarding customization guides new users through setup processes optimized for their company context. Enterprise onboarding includes security configuration and admin controls. SMB onboarding focuses on quick wins and immediate value demonstration.

Next-Level Tricks for Data Pros

Smart Algorithms That Actually Work

Basic lead scoring combines behavioral signals with firmographic data to identify sales-ready prospects. Advanced models use machine learning to continuously improve scoring accuracy based on actual conversion outcomes.

Historical analysis identifies patterns in users who convert to paid plans or become high-value customers. These patterns often include subtle combinations of behavioral and firmographic characteristics that wouldn't be obvious through manual analysis.

Dynamic scoring adjusts lead scores based on changing circumstances. Users from companies that just received funding might receive higher scores temporarily. Seasonal businesses might have different scoring algorithms during peak periods.

Negative indicators help identify users unlikely to convert, allowing teams to focus resources on higher-potential prospects. Users from companies with competitive tools, restrictive IT policies, or inconsistent budget cycles might receive lower priority.

Multi-modal scoring considers different conversion pathways for different user types. Technical users might show different engagement patterns than business users, requiring separate scoring algorithms for optimal accuracy.

Catching People When They're Ready to Buy

Advanced PLG companies monitor buying signals across the web to identify accounts showing interest in their product category, enabling proactive engagement with high-intent prospects.

Content consumption tracking identifies companies reading articles, downloading resources, and engaging with content about your product category. This behavior often precedes active evaluation and purchasing decisions.

Competitive research monitoring reveals accounts comparing solutions, reading reviews, and researching implementation approaches. These signals suggest active buying processes where timely engagement can influence decisions.

Technology changes like new hiring, funding announcements, or infrastructure migrations often create buying opportunities for relevant tools. Intent data can identify these triggering events automatically.

Engagement scoring prioritizes accounts based on intensity and recency of buying signals. Companies showing consistent, recent interest receive higher priority than those with sporadic or older engagement.

Finding Customers You Didn't Know Existed

Mature companies use enrichment data to identify and develop entirely new customer segments that weren't obvious from basic usage analytics.

Look-alike modeling finds companies similar to existing high-value customers based on dozens of characteristics. These models often reveal expansion opportunities in adjacent industries or company sizes.

Behavioral cohort analysis combined with firmographic data reveals optimal customer profiles for different use cases. The same product might serve distinct segments with different needs, conversion patterns, and expansion potential.

Geographic expansion strategies use data to identify regions or countries where your product might find strong adoption based on technology adoption patterns, regulatory environment, and competitive landscape.

Partnership identification leverages enrichment data to find companies that integrate with, sell to, or serve similar markets as your existing customers, creating potential partnership opportunities.

What Your Team Actually Needs to Know

The difference between data enrichment success and failure often comes down to how well your team understands and uses the information you're collecting. Having perfect data means nothing if nobody knows what to do with it.

Getting Your Sales Team On Board

Sales reps are often skeptical of new data sources, especially if they've been burned by inaccurate information in the past. The key is showing immediate value rather than overwhelming them with features.

Start with one clear use case that solves an obvious problem. If reps struggle with cold outreach, show them how company data helps personalize opening messages. If discovery calls feel repetitive, demonstrate how technographic information guides better questions.

Make it part of their existing workflow rather than adding new steps. If reps already check CRM records before calls, enrich those records automatically. If they use email templates, integrate company-specific variables that populate automatically.

Share success stories from early adopters who see improved results. Nothing convinces sales teams like hearing how enriched data helped close specific deals or shorten sales cycles.

Provide fallback options for when data isn't available or accurate. Teams need confidence that enrichment enhances their existing process rather than replacing proven techniques.

Training Marketing on Data-Driven Campaigns

Marketing teams often get excited about segmentation possibilities but struggle to translate enriched data into effective campaigns.

Connect data points to campaign outcomes by showing how company size affects email open rates or how industry influences content preferences. Abstract data becomes actionable when tied to performance metrics.

Start with simple segmentation before attempting sophisticated personalization. Split campaigns by company size or industry before trying to personalize by technology stack or growth stage.

Test and iterate rather than expecting perfect campaigns immediately. Use A/B testing to determine which data points most influence campaign performance for your specific audience.

Document what works so successful approaches can be replicated across different campaigns and team members. Create playbooks that connect specific data insights to proven campaign tactics.

Helping Customer Success Find Growth Opportunities

Customer success teams have the most direct relationship with users but often lack systematic approaches to identifying expansion opportunities using enriched data.

Create expansion trigger alerts based on company changes like funding announcements, hiring sprees, or new office openings. These signals often indicate readiness for additional seats or features.

Map usage patterns to company characteristics to identify accounts with potential for higher-tier plans. Companies showing specific usage behaviors often benefit from premium features or additional modules.

Track competitive intelligence to identify accounts using multiple tools in your category. These situations often present consolidation opportunities or chances to demonstrate superior integration capabilities.

Monitor contract timing combined with company growth signals to optimize renewal and expansion conversations. Timing outreach around budget cycles and growth phases improves success rates significantly.

Your First 90 Days with Data Enrichment

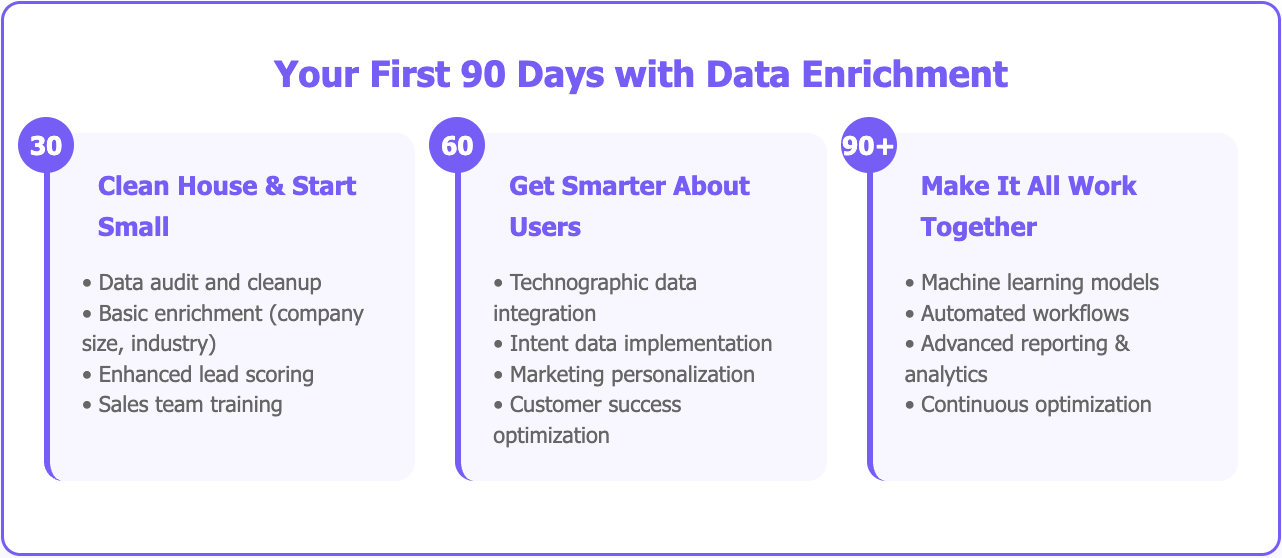

1: Clean House and Start Small

Data audit and cleanup of existing user and company records. Establish data quality baselines and governance processes before adding new data sources.

Basic enrichment implementation for company size, industry, and contact information. Start with high-impact, low-complexity data points that provide immediate value to sales and marketing teams.

Lead scoring enhancement using firmographic data to improve qualification accuracy. Focus on identifying users at target companies who show strong engagement signals.

Sales team training on using enriched data for prospect research and conversation preparation. Ensure teams understand what information is available and how to incorporate it effectively.

2: Get Smarter About Your Users

Technographic data integration to understand prospect technology stacks and competitive situations. This information enables more sophisticated sales positioning and marketing messaging.

Intent data implementation to identify companies showing buying signals and prioritize outreach timing. Focus on high-value accounts showing recent interest in your product category.

Marketing personalization based on enrichment data. Implement email segmentation, content recommendations, and website personalization using company and role-based data.

Customer success optimization using enrichment data to identify expansion opportunities and prioritize account management activities.

Beyond 90 Days: Making It All Work Together

Machine learning models for lead scoring, churn prediction, and expansion opportunity identification. Use historical data and enrichment information to build predictive capabilities.

Automated workflows that trigger personalized experiences based on enrichment data. Implement dynamic onboarding, feature recommendations, and engagement campaigns.

Advanced reporting and analytics that combine product usage data with enrichment information to provide comprehensive business intelligence across all go-to-market functions.

Continuous optimization processes to refine models, update data sources, and improve team utilization of enriched data.

The companies winning in product-led growth aren't just building better products — they're building better understanding of who uses those products and why. Data enrichment transforms PLG from a promising strategy into a competitive advantage that scales efficiently and drives sustainable growth.

Your product will always be the foundation of your growth engine. But with comprehensive data enrichment, that foundation supports much more sophisticated and effective go-to-market strategies that drive results across every team and every stage of the customer journey.

Frequently Asked Questions

What's the difference between data enrichment and lead generation in PLG?

Data enrichment enhances existing user records with additional company and contact information, while lead generation focuses on acquiring new prospects. In PLG, enrichment helps you better understand and convert users who already discovered your product, rather than finding new people to target. The focus shifts from quantity of leads to quality of understanding about existing users.

How much should early-stage PLG companies invest in data enrichment?

Start with basic company size and industry data, which usually costs $50-200 per month for most early-stage volumes. This provides immediate value for sales conversations and marketing segmentation without major infrastructure investment. Advanced enrichment can wait until you have consistent conversion patterns and dedicated sales resources to act on the additional data.

Does data enrichment work with freemium models or only paid trials?

Data enrichment works with both models but provides different value. Freemium products benefit from understanding which free users work at target companies and have expansion potential. Paid trial products can optimize conversion by personalizing experiences based on company context. The key is matching enrichment investment to user value and conversion potential.

How does data enrichment integrate with existing PLG tools and analytics?

Modern enrichment platforms integrate with popular PLG tools like Mixpanel, Amplitude, HubSpot, and Salesforce through APIs and pre-built connectors. The enriched data flows into your existing workflows rather than replacing current tools. Focus on platforms that can push data to multiple systems rather than creating new silos.

What's the biggest mistake PLG companies make with data enrichment?

Collecting too much data without clear use cases. Companies often enrich every user record with dozens of data points but don't train teams to use the information effectively. Start with specific use cases like lead scoring or sales conversation preparation, then expand based on proven value and team adoption.

How quickly can we expect to see results from implementing data enrichment?

Basic improvements in sales conversation quality happen within weeks of implementation. Quantifiable improvements in conversion rates and deal sizes typically appear within 2-3 months. More sophisticated applications like predictive analytics and advanced personalization show results within 6-12 months as models learn from historical data and user behavior patterns.

Related articles

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026