LinkedIn Sales Navigator List Building Guide

How to Maximize LinkedIn Sales Navigator for Prospecting and Revenue Growth

Blogby JanJuly 04, 2025

Building lists from LinkedIn Sales Navigator should be the easiest part of prospecting. After all, you're paying for the world's largest professional database. Yet most sales teams extract maybe 15-20% of the value from their Sales Navigator subscription.

Here's why: they treat it like a fancy LinkedIn search bar instead of the sophisticated prospecting engine it actually is. They run basic searches, manually copy-paste results, and wonder why their lists feel generic despite having access to millions of profiles.

The difference between average results and exceptional ones comes down to understanding the platform's hidden capabilities and using the right extraction methods. The teams crushing their quotas aren't just better at searching - they're better at systematically extracting and enriching Sales Navigator data.

Let me show you exactly how to turn Sales Navigator from an expensive contact database into a revenue-generating machine.

The Real Problem with Sales Navigator List Building

Sales Navigator promises precise targeting with 40+ advanced filters. Sounds great until you realize you can only export 2,500 results at a time, and even then, you're missing crucial data like verified emails and direct phone numbers.

Think about what happens in practice. You spend 30 minutes crafting the perfect search using boolean operators, industry filters, and seniority levels. You find 8,000 potential prospects. Then reality hits - you can only see the first 2,500, and exporting them requires tedious manual work or expensive third-party tools that barely scratch the surface.

Even worse, the data you do extract is incomplete. You get names, titles, and company information, but no direct contact details. Your SDRs then waste hours hunting for emails, often finding outdated information or generic company addresses that go straight to spam folders.

This creates a cascade of inefficiencies. Sales teams spend more time on data management than selling. Marketing can't properly segment lists because the data is shallow. Revenue operations can't accurately forecast because they don't know if they're working with 2,500 real prospects or just LinkedIn profiles.

The solution isn't to abandon Sales Navigator - it's to understand how to extract its full value. The platform contains incredibly rich data, but accessing it requires knowing exactly which filters matter, how to chain searches for comprehensive coverage, and most importantly, how to enrich the data you export.

Sales Navigator's Search Power

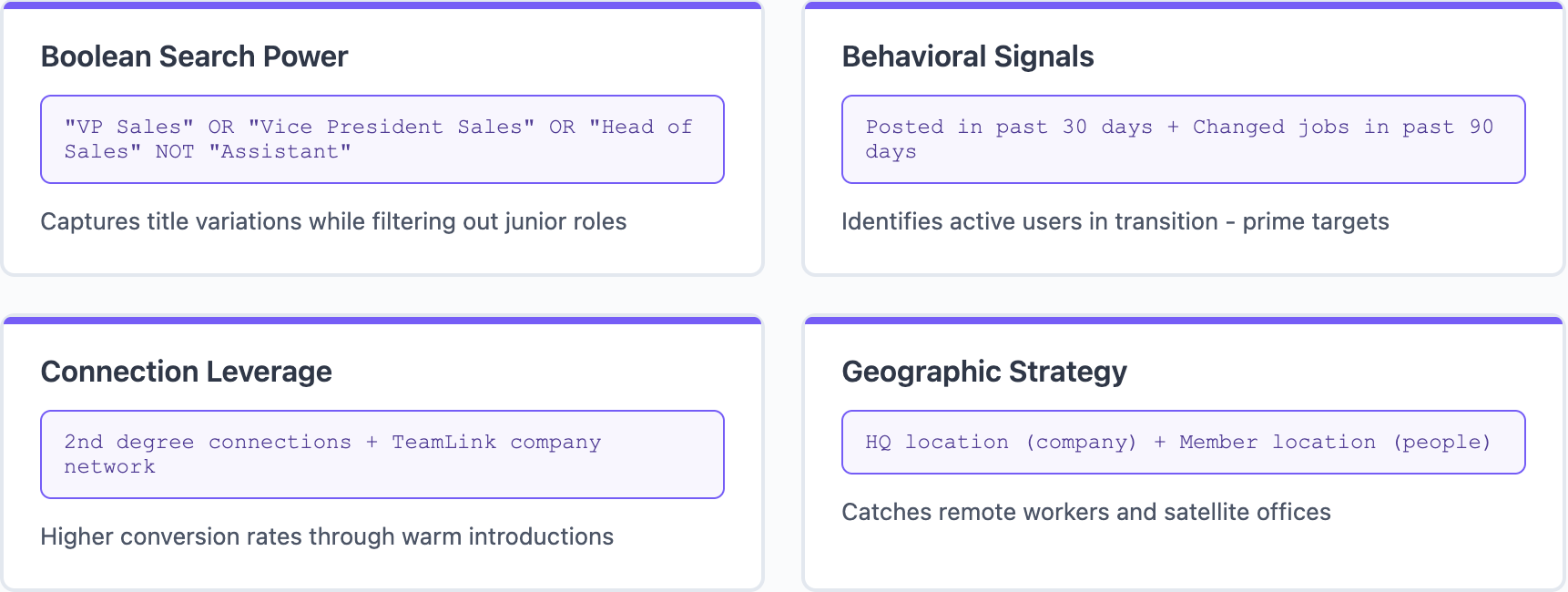

Most users barely scratch the surface of Sales Navigator's search capabilities. They use basic filters like geography and title, missing the sophisticated combinations that identify buyers ready to engage.

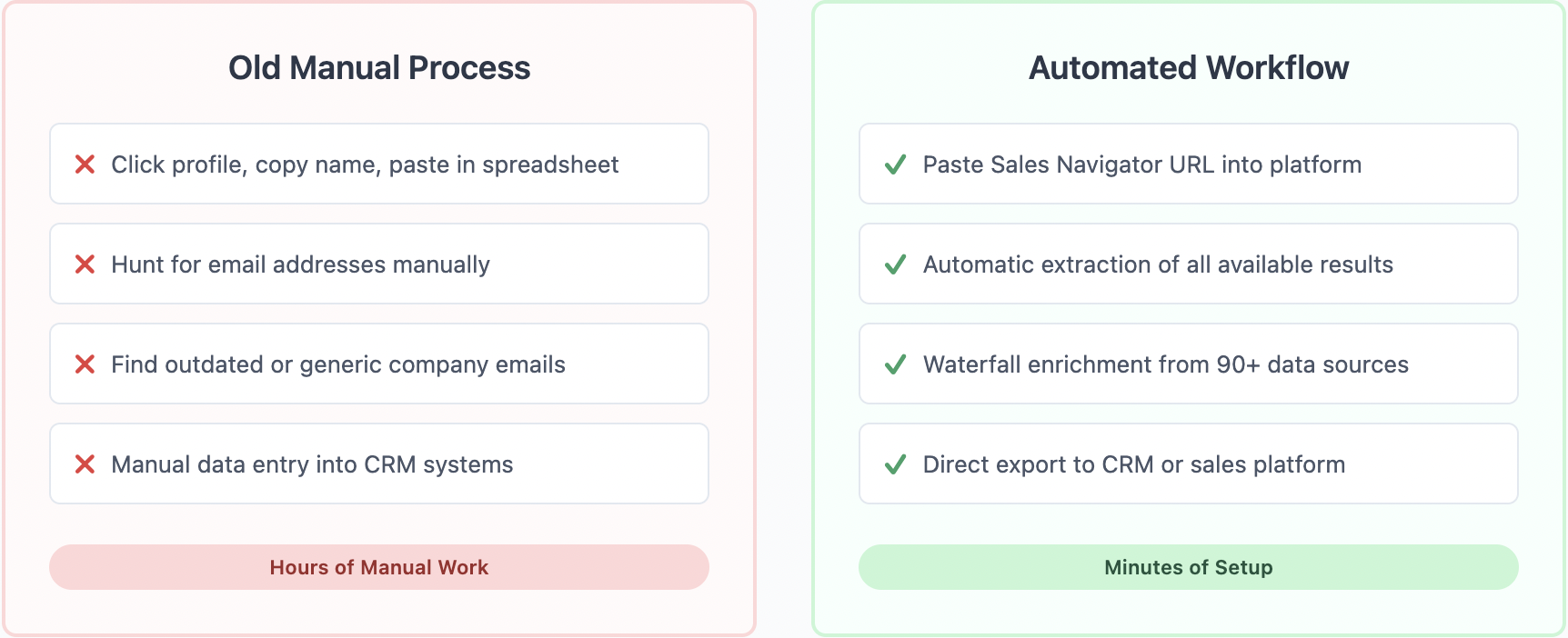

The power lies in combining behavioral signals with traditional firmographics. For instance, posted on LinkedIn in past 30 days plus changed jobs in past 90 days identifies active users in transition - prime targets for many solutions. These people are engaged on the platform and potentially looking to make their mark in new roles.

Boolean search transforms basic queries into precision instruments. Instead of searching for "VP Sales", try "VP Sales" OR "Vice President of Sales" OR "Head of Sales" OR "Sales Director" to capture title variations. Combine with NOT "Assistant" NOT "Associate" to filter out junior roles that might match your keywords.

The best results happen when you layer multiple advanced filters. Start with your ideal company characteristics using employee count, industry, and growth rate. Then add department filters to ensure you're reaching the right division. Layer in seniority levels, but remember that LinkedIn's definitions might not match your expectations - always verify with title searches.

Geography filters work best when you think beyond basic country selection. Use headquarters location for company searches but member location for people searches. This catches remote workers and satellite offices that basic searches miss.

Don't overlook the relationship filters. Second-degree connections convert at higher rates than cold outreach. TeamLink extends this by showing connections through your entire company, not just your personal network. Past company filters help you leverage alumni networks and previous customer relationships.

Search Sequencing Best Practices

Building detailed lists requires multiple searches, not just one perfect query. Sales Navigator's result limitations mean you need to slice your total addressable market into digestible chunks.

Start broad to understand your total market size. Run searches with just your core criteria - industry, company size, and geography. This gives you the universe of potential prospects and helps identify which segments to prioritize.

Then create search sequences that systematically cover your market. If targeting sales leaders at software companies yields 10,000 results, break it down. Search for Series A companies separately from Series B, enterprise separately from mid-market. Each search should yield under 2,500 results for complete extraction.

Save searches strategically. Sales Navigator allows 50 saved searches that update automatically. Use them to monitor different market segments, track competitor employees, or watch for trigger events. Organize them by priority - hot prospects, warm leads, future opportunities.

The key is thinking in campaigns, not searches. A campaign targeting financial services might include separate searches for banks, credit unions, insurance companies, and investment firms. Each has different characteristics and decision-making processes despite being in the same broad industry.

Extracting Your Lists: Beyond Copy-Paste

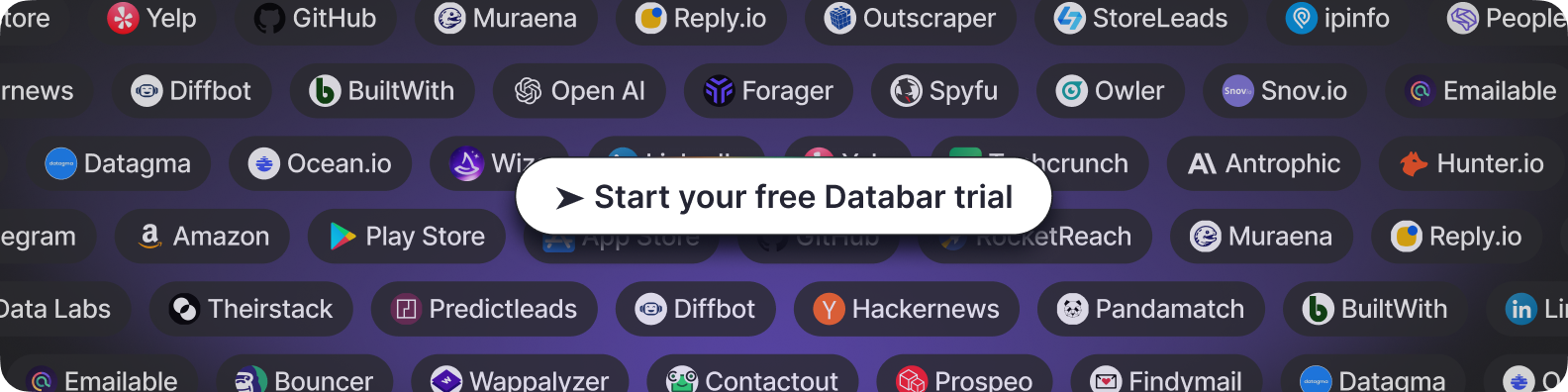

Manual extraction from Sales Navigator is mind-numbing and error-prone. Click profile, copy name, paste in spreadsheet, repeat. There's a better way.

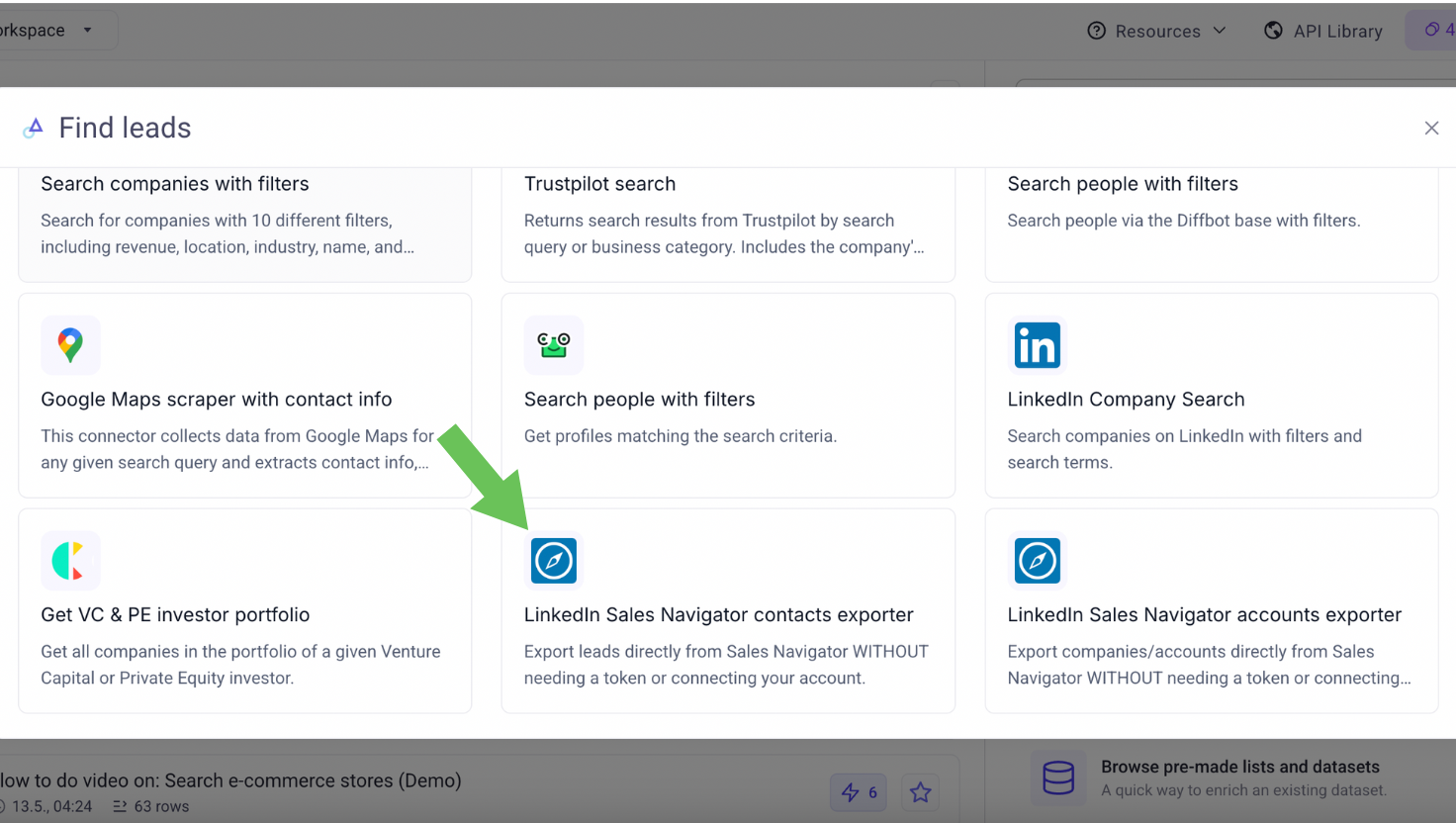

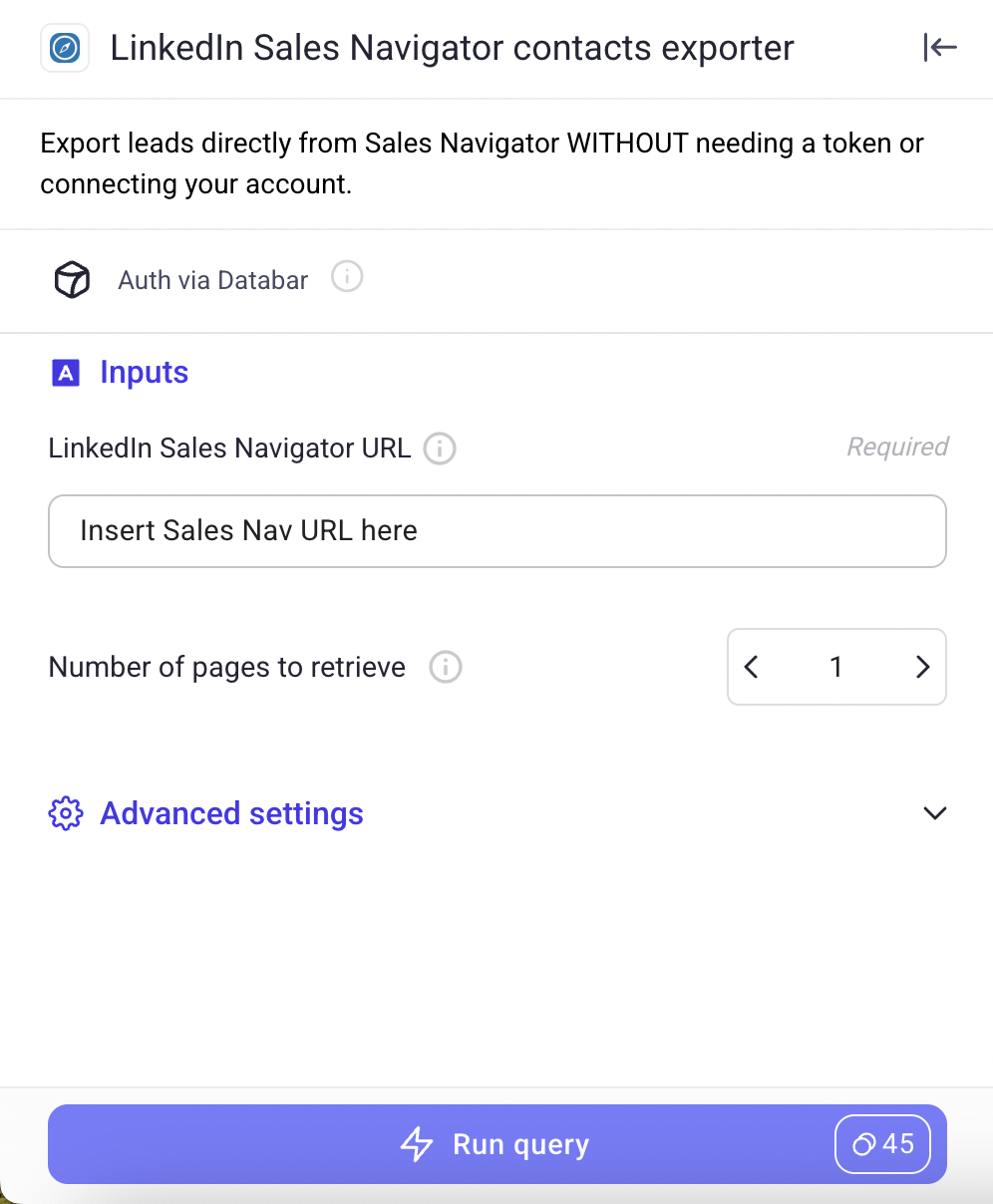

Databar.ai's Sales Navigator integration improves this process a ton. Simply input your Sales Navigator search URL, and the platform automatically extracts all available results with complete profile information. What typically takes hours happens in minutes.

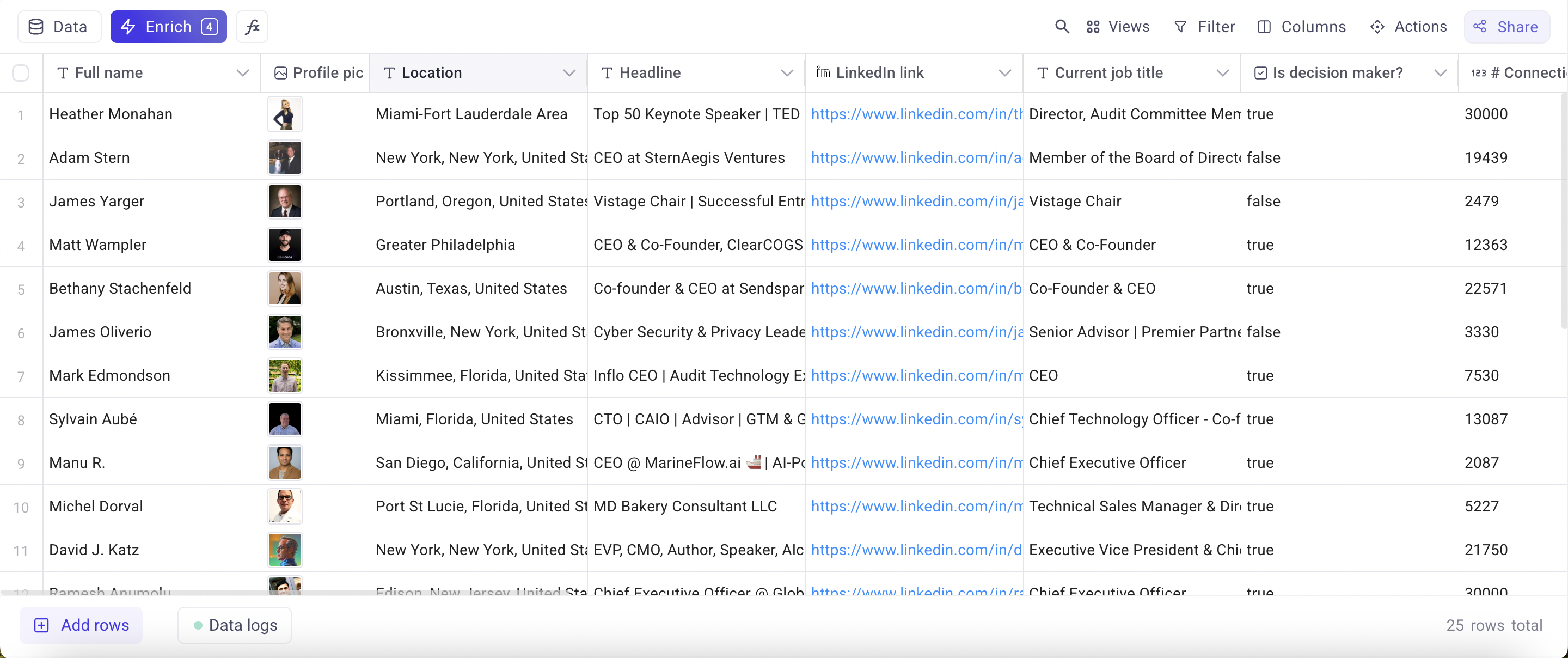

But extraction is just the beginning. The real value comes from enrichment. Sales Navigator provides professional information but lacks direct contact details. Databar.ai automatically enriches extracted profiles with verified email addresses, phone numbers, and additional company intelligence from 90+ integrated data providers.

Here's the exact workflow:

1. First, perfect your Sales Navigator search using advanced filters and boolean logic. Copy the search URL from your browser.

2. In Databar.ai, create a new table and select "LinkedIn Sales Navigator Accounts Exporter" or "LinkedIn Sales Navigator Contacts Exporter" depending on your needs. Paste your URL and let the system extract all available results. The extraction preserves all Sales Navigator data.

3. Select the data points you want to enrich and choose the providers. You'll get not just names and titles but verified contact information, technographic data, company insights, and buying signals. This turns a basic LinkedIn list into an actionable prospect database.

Enriching Navigator Data for Better Insights

LinkedIn profiles tell you who someone is, not how to reach them or whether they're ready to buy. Enrichment transforms basic profiles into actionable intelligence.

Start with contact information. Using Databar.ai's waterfall enrichment, the platform checks multiple data sources sequentially until it finds verified email addresses. If one provider doesn't have the email, it automatically tries others. This approach typically achieves 80-90% email discovery rates compared to 40-50% from single sources.

Add technological context to understand what prospects currently use. Sales Navigator shows company basics, but technographic enrichment reveals their entire tech stack. Knowing they use Salesforce but not your category of tool identifies opportunity. Seeing they just added a competing solution suggests different timing.

Company intelligence goes beyond LinkedIn's basic firmographics. Funding data shows budget availability. Hiring patterns indicate growth areas. News monitoring catches trigger events. This context helps you prioritize which prospects to pursue first and how to position your solution.

Don't stop at individual enrichment. Build account intelligence by connecting multiple stakeholders at target companies. If you're selling enterprise software, you need to identify champions, decision makers, and potentially influencers. Enrichment helps you map the entire buying committee.

The beauty of systematic enrichment is its compound effect. Each data point makes others more valuable. Knowing someone's email is good. Knowing their email, current tech stack, recent company funding, and active hiring initiatives creates a complete picture that drives relevant outreach.

Building Lists for Different Sales Motions

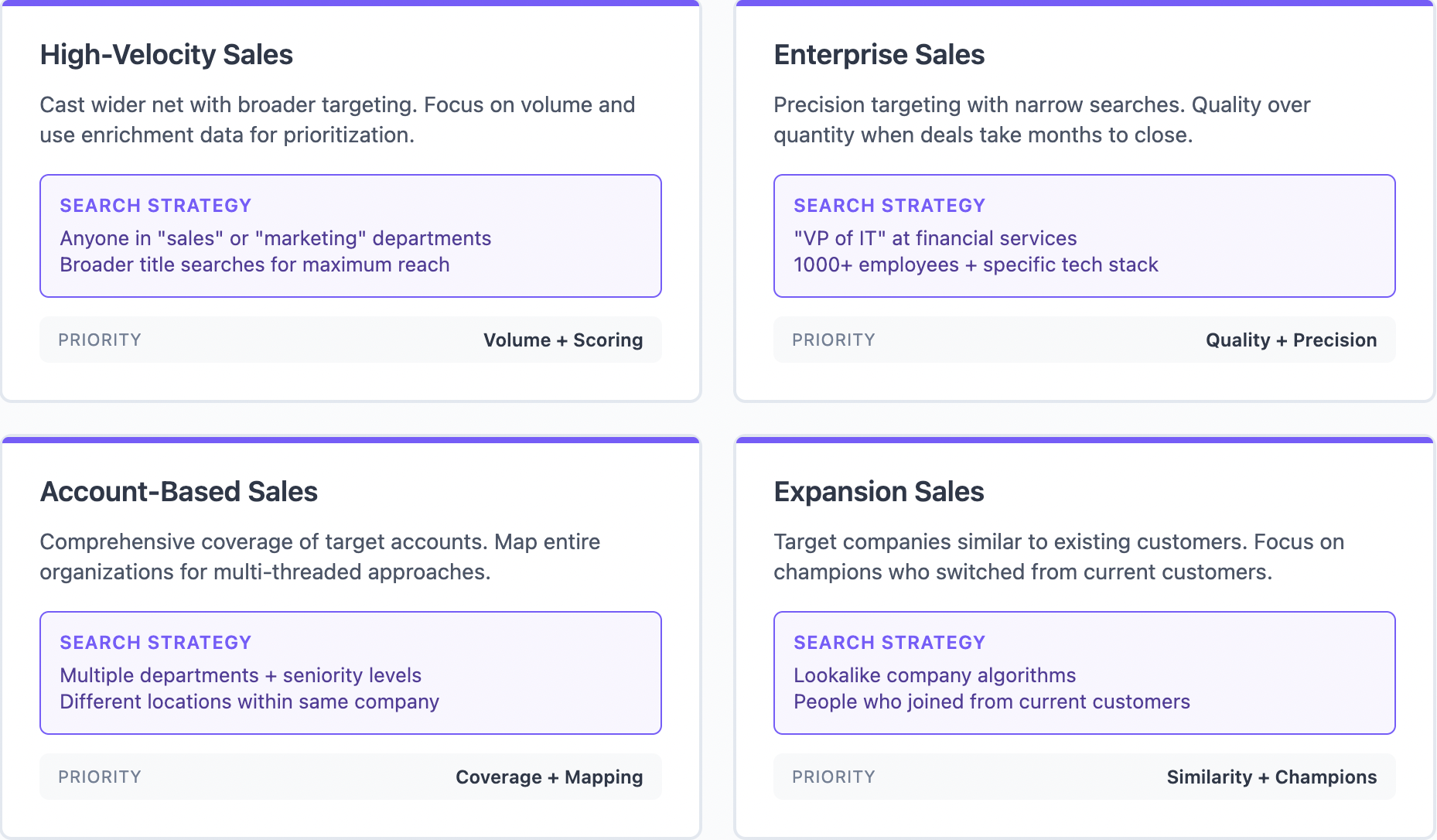

Different sales strategies require different list-building approaches. What works for transactional sales fails for enterprise deals, and vice versa.

For high-velocity sales, cast a wider net with Sales Navigator. Use broader title searches like anyone in "sales" or "marketing" departments. Focus on volume and let enrichment data help you prioritize. Export larger lists and use scoring models to identify the hottest prospects for immediate outreach while others enter nurture campaigns.

Enterprise sales demands precision. Use narrow searches targeting specific titles at specific companies. Layer in multiple criteria - not just "VP of IT" but "VP of IT at financial services companies with 1000+ employees using Oracle who posted on LinkedIn recently." Quality matters more than quantity when deals take months to close.

Account-based strategies require comprehensive coverage of target accounts. Don't just find one contact - map the entire organization. Search for different departments, seniority levels, and locations within the same company. Build multi-threaded approaches into your lists from the start.

Expansion sales need different filters entirely. Focus on companies similar to existing customers using lookalike algorithms. Search for people who recently joined these companies from your current customers. They already know your value and can champion you internally.

Trigger-based selling requires dynamic lists. Save searches for specific events - companies that just raised funding, hired new executives, or announced expansions. Set up alerts and automatically extract new matches weekly. Speed matters when selling to triggers.

Advanced Navigator Techniques

Here are techniques that dramatically improve results beyond basic searching and filtering:

- The connection path strategy - Leverage your entire company's network using TeamLink to find the shortest path to prospects through colleagues. A second-degree connection through your CEO carries more weight than a third-degree through you.

- Industry mapping - Go beyond basic categorization by searching for keywords in company descriptions to find specific segments. "AI-powered" in financial services companies identifies fintech innovators versus traditional banks.

- The posting pattern technique - Filter for people who posted in the last 30 days, then enrich their profiles to find contact information. Active LinkedIn users respond better to outreach and often champion internal initiatives.

- Title archaeology - Search for deprecated titles that indicate responsibility without current recognition. "Acting VP" or "Interim Director" often have full authority but extra motivation to prove themselves.

- Geographic arbitrage - Search headquarters location separately from employee location. Remote work means decision makers might be anywhere. That VP in Austin might work for a New York company you'd otherwise miss.

Common Navigator Mistakes That Kill Conversions

Even experienced users make mistakes that sabotage their Sales Navigator efforts. Understanding these pitfalls helps you avoid months of poor results.

Over-filtering is the most common error. Adding too many criteria shrinks your market artificially. Start broad, then narrow based on results. It's easier to disqualify prospects later than to miss them entirely because your search was too specific.

Ignoring recency signals wastes effort on outdated profiles. LinkedIn shows when profiles were last updated. Focus on recently active users - they're more likely to see your outreach and have current information.

Title fixation misses key prospects. Organizations use different titles for similar roles. Don't just search for "Chief Marketing Officer" - include "VP Marketing," "Head of Marketing," and "Marketing Director." Title inflation means a "VP" at a startup might have CMO responsibilities.

Single-threading accounts reduces success rates. Finding one contact per company isn't enough for complex sales. Build lists with multiple stakeholders from the start. It's harder to add contacts later when deals stall.

Neglecting negative keywords pollutes lists with false positives. That "Sales Director" might be selling real estate, not B2B software. Add negative keywords to exclude irrelevant matches. Common exclusions include "real estate," "insurance," "retail," and "recruiting."

Your Complete Sales Navigator Workflow

Let me walk you through the exact process for building and extracting high-value lists from Sales Navigator using modern tools.

- Define your ideal customer profile with precision. Don't just say "enterprise software companies" - specify revenue ranges, employee counts, technologies used, and growth indicators. This clarity drives everything else.

- Open Sales Navigator and begin with a broad search to understand market size. Use basic filters for industry, company size, and geography. Note the total results - this is your theoretical market size.

- Add behavioral filters to identify engaged prospects. Include "posted on LinkedIn in past 30 days" and relevant keywords in profiles. Add seniority and department filters. Watch how result counts change with each addition.

- Break large result sets into manageable chunks. If you have 8,000 total results, create 4 searches of 2,000 each by segmenting by company size, geography, or other criteria. Save each search with a clear naming convention.

- Copy your Sales Navigator search URL and paste it into Databar's Sales Navigator exporter. The platform automatically extracts all available results, preserving every data point while adding enrichment.

- Let the system enrich your data automatically. The platform pulls in verified emails through waterfall enrichment, adds phone numbers where available, includes technographic data, and appends company intelligence.

- Set up recurring extractions for saved searches. Markets change, people switch jobs, and new companies emerge. Weekly or monthly updates ensure you're always working with fresh data.

- Export your enriched lists directly to your CRM or sales engagement platform. No manual data entry, no CSV manipulation - just clean data flowing into your revenue systems.

FAQs

How many results can I export from LinkedIn Sales Navigator at once? Sales Navigator displays up to 2,500 results per search, but manual extraction is tedious and time-consuming. Using Databar.ai's Sales Navigator exporters, you can automatically extract available results from any search URL in minutes, complete with enriched contact information.

Why can't I find email addresses in Sales Navigator? LinkedIn intentionally limits contact information to protect user privacy and encourage InMail usage. Sales Navigator shows professional information but not direct contact details. That's why enrichment through third-party data providers is essential for building actionable prospect lists with verified email addresses and phone numbers.

What's the best way to search for decision makers in Sales Navigator? Combine multiple title variations using boolean OR operators, add seniority filters, and include department specifications. For example: ("VP Sales" OR "Vice President Sales" OR "Head of Sales") AND "Director level" in the Software industry. Always include negative keywords to exclude assistants or coordinators who might match your search terms.

How often should I update my Sales Navigator lists? Update frequency depends on your sales cycle and market dynamics. For fast-moving industries or trigger-based selling, weekly updates catch new opportunities. For enterprise sales with longer cycles, monthly updates suffice. Set up automated extraction workflows to maintain fresh data without manual effort.

What data should I prioritize when enriching Sales Navigator exports? Focus first on verified email addresses and direct phone numbers for outreach. Then add technographic data to understand their current tools, funding information for budget insights, and recent news for trigger events. The goal is building complete prospect profiles that enable personalized, timely outreach.

Related articles

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026