Lead Scoring & Account Segmentation: Why Most CRMs Get This Backward (And How to Fix It)

How to build a system that tells your team who to call, when, and why

Blogby JanOctober 06, 2025

Your sales rep just finished a 45-minute discovery call with what your CRM flagged as a "hot lead" - 90 points, opened every email, downloaded three whitepapers. Turns out they're a student researching for their thesis.

Meanwhile, the CFO at a company that fits your ICP perfectly visited your pricing page three times this week and hasn't heard from anyone on your team.

This happens because most companies treat lead scoring like a math problem when it's actually a prioritization problem. They obsess over point values - should a webinar attendance be worth 10 points or 15? - while ignoring the bigger question: which accounts actually matter to your business?

We're going to fix that. Not with another generic "how to score leads" guide, but by showing you how to build an integrated system where lead scoring and account segmentation work together to tell your sales team exactly who to call, when to call them, and why it matters.

Here's what makes this different from other articles you'll read: we're not going to pretend that lead scoring is some neutral, objective system. It's biased by design and that's exactly why it works. The question is whether your biases match reality.

The Lead Scoring Lie Nobody Talks About

Most lead scoring models are complete fiction.

Companies assign points based on what they think indicates buying intent, not what actually predicts conversions. Someone in marketing decides that downloading a whitepaper = 10 points because... well, it feels like someone downloading content must be interested, right?

Then six months later, the sales team is complaining about garbage leads while marketing defends their MQL numbers. Both sides are right. The leads technically scored high. They're also completely unqualified.

The fundamental problem is this: your lead scoring model is only as good as your CRM data. When 30-40% of your contact records have missing job titles, outdated company information, or no phone numbers, your fancy AI-powered scoring system is essentially making decisions with a blindfold on.

A system must have good quality data to rely on for the ranking to be most effective, because the score is based on the totality of the data on the customer or prospect.

You can't score what you can't see.

But here's what's even more insidious: bad lead scoring doesn't just waste sales time. It actively trains your team to ignore the system. Once your reps learn that "hot leads" are usually cold, they start making up their own prioritization rules. Now you've got chaos.

Why Lead Scoring Without Account Tiering Is Like Having GPS Without a Destination

Let me tell you what happens when you only score leads without tiering accounts.

You get individual contacts lighting up as "sales-ready" based on their behavior. Great. But that VP who downloaded your ebook works at a company with 12 employees and $800K in revenue. Your average customer has 500+ employees and $50M+ revenue.

That high-scoring lead isn't going to become a customer because the account doesn't fit your business model. Yet your sales team just spent an hour preparing for that call.

This is where account tiering comes into play. Before you even look at individual lead scores, you segment your target accounts into tiers based on strategic value.

Account tiering means categorizing companies into priority levels based on their potential value to your business. Most B2B companies use three tiers, but the criteria should match your actual sales motion and revenue model.

Account tiering, categorizing accounts based on their projected value and aligning them with tailored sales engagement strategies, is a fundamental component of successful ABM in today's B2B world.

Here's the “best practice” framework:

Tier 1 accounts are companies where everything aligns. These represent your high-value accounts that typically exhibit a strong fit with your ICP, possess significant revenue potential, and offer strategic advantages such as market leadership or brand recognition.

These get dedicated account teams, custom content, executive-level engagement. You're going to invest serious resources here because a single Tier 1 win could be worth more than fifty Tier 3 deals.

Tier 2 accounts are solid opportunities that fit your ICP but maybe don't have the same revenue potential or strategic value. These accounts demonstrate good potential for growth and alignment with your ICP, although they may not possess the same immediate value as Tier 1 accounts.

They get focused campaigns and proactive outreach, but not the white-glove treatment. Think standardized demos instead of custom presentations.

Tier 3 accounts technically fit your criteria but probably aren't worth heavy investment. They go into automated nurture sequences until they show stronger signals or grow into a higher tier.

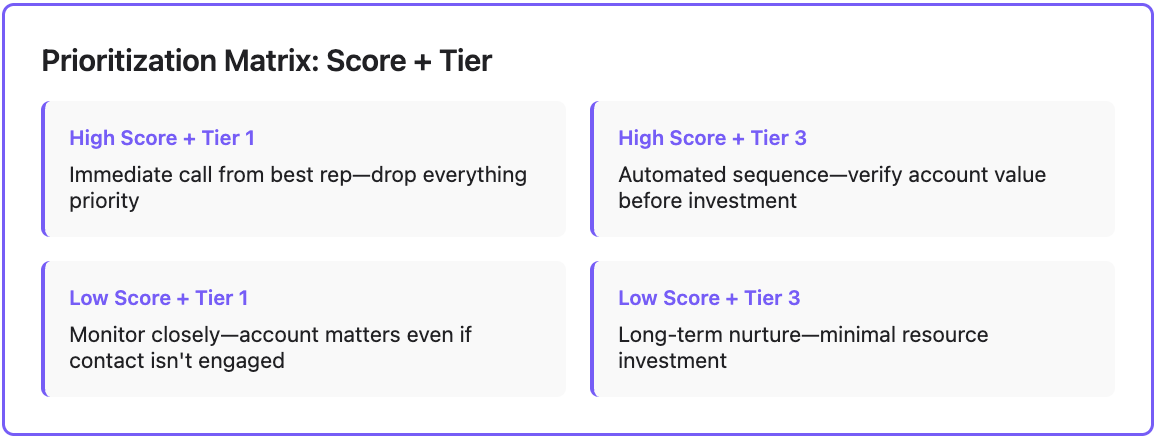

Now here's where it gets interesting: when you combine lead scores with account tiers, you create a prioritization matrix that transforms how your team operates:

- A high-scoring lead at a Tier 1 account? That's an immediate phone call from your best rep.

- A high-scoring lead at a Tier 3 account? That goes into an automated sequence to see if the account is actually more valuable than you thought.

- A low-scoring lead at a Tier 1 account? Still worth monitoring because the account matters, even if this particular contact isn't engaged yet.

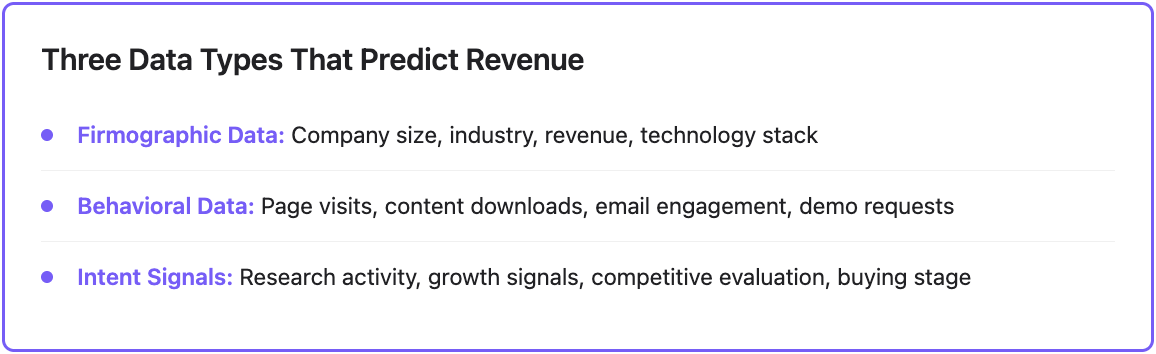

The Three Types of Data To Predict Revenue

Many teams overcomplicate their scoring models. They track dozens of behaviors and try to assign precise point values to each one, ending up with a system nobody understands.

Start with three data categories that actually correlate with revenue:

Firmographic Data: Who They Are

This evaluates companies based on characteristics that indicate whether they can actually buy from you and implement your solution successfully.

- Company size matters. If your product or service is tailored to enterprises, assign higher scores to leads from larger companies; conversely, if you're targeting SMBs, adjust your scoring model accordingly.

- Industry matters. Some verticals adopt your category of solution faster than others. If 70% of your customers come from financial services and healthcare, weight those industries higher.

- Revenue matters. Many businesses filter their prospects by revenue size to ensure leads have the financial capacity to make a purchase. No point spending time with companies that can't afford your solution.

- Technology stack matters. Leads using technologies that integrate with or complement your solution should receive additional points, especially in SaaS-based models where compatibility with existing infrastructure is key to sales success.

Behavioral Data: What They Do

This tracks actual engagement across your digital properties and campaigns.

But here's what most companies get wrong: they treat all engagement equally. Opening an email gets the same weight as visiting your pricing page. That's absurd.

- Opening emails is valuable, but actions like clicking through to your site or engaging with a product demo indicate stronger intent, so assign higher scores to actions that drive engagement such as visiting sales pages or downloading lead magnets.

- Page visits matter, but context matters more. Someone who visits your pricing page after reading a case study in their industry is showing completely different intent than someone who lands on pricing from a Google search and bounces.

- Engagement frequency ranks as the top criterion in lead scoring for surveyed companies, with other key factors including lead source at 52%, company industry, company size and budget.

- Content consumption patterns reveal buying stage. Tracking progression from awareness stage whitepapers to solution-specific case studies and product data sheets helps identify accounts entering buying cycles.

Intent Signals: When They're Ready

This is where modern lead scoring separates from the pack. Intent data tells you when companies are actively researching solutions in your category, even if they haven't engaged with your brand yet.

- Intent and engagement data tracks behaviors such as content consumption, product research, marketing event attendance, and sales interactions.

- Growth signals matter tremendously. Companies on a growth trajectory based on funding rounds or hiring sprees can be more likely to invest in new solutions, and this information can be integrated into your CRM and used to boost lead scores accordingly.

- Technology research activities signal evaluation mode. When you see searches for implementation guides, API documentation, and integration requirements, that's not curiosity - that's buying committee research.

- Competitive evaluation signals are gold. Visits to vendor comparison pages, third-party review sites, and downloads of analyst reports featuring multiple solutions indicate active vendor selection.

How AI Lead Scoring Works

Everyone wants to talk about AI-powered lead scoring. But in reality? Most companies should fix their data quality and basic scoring model before touching AI.

But when you're ready for it, here's what AI changes:

Traditional lead scoring makes you guess which behaviors indicate buying intent. AI lead scoring learns from your actual conversion data.

Companies using AI-powered lead scoring tools see an increase in conversion rates and a reduction in sales cycles.

Here's how it works differently: AI lead scoring uses machine learning models to automatically evaluate and rank leads by analyzing what qualified leads do, who they are, and how they behave across channels.

The system ingests data from your CRM, marketing automation, website analytics, and sales interactions. It identifies patterns across thousands of deals, learning which combinations of attributes and behaviors actually predict conversion in your specific business.

The potency lies in detecting correlations humans miss. The system might discover that prospects who visit your pricing page before the product overview page convert 40% more often. Or that leads from companies with 200-500 employees close 3X faster than those with 50-100 employees, even though both technically fit your ICP.

But, and this is crucial, AI only works if you feed it quality data. Garbage in, garbage out applies here more than anywhere. If your CRM records are missing key fields or haven't been updated in months, the AI will learn patterns from bad data and produce worse results than a simple manual model.

This is why we built Databar's enrichment system to run before scoring happens. When a lead enters your CRM, it fills missing firmographic data, validates contact information, and adds technographic details from 90+ data sources. Your AI model now has complete, accurate data to learn from.

Building Your Lead Scoring Model: A Framework For Scaling

Start by analyzing what actually drives revenue in your business, not what you think should drive revenue.

Step 1: Mine your conversion data

Pull a list of every deal that closed in the last 12 months. Now look at the common patterns:

- What firmographic attributes do they share?

- Which content did they consume before requesting a demo?

- How many touchpoints occurred between first contact and close?

- What was the trigger event that moved them from consideration to evaluation?

Research current customers to identify the common characteristics that led them to convert by looking at demographics and behavior along their journey from first contact to closing the deal.

Then do the same analysis for deals that stalled or lost. What patterns emerge there? Those become your negative scoring criteria.

Step 2: Build your ICP from actual customer data, not assumptions

Your ideal customer profile should reflect reality, not aspiration. If you keep trying to land Fortune 500 companies but your actual customers are mid-market businesses with 200-500 employees, adjust your ICP accordingly.

Use this firmographic data to set your baseline scoring thresholds.

Step 3: Create separate fit and engagement scores

Don't mash everything into one number. Split your scoring into two components:

Fit score measures how well they match your ICP based on demographic and firmographic data. This number shouldn't change much over time.

Engagement score tracks their behavioral signals and intent. This number should update frequently based on recent activity.

When both scores are high, that's your signal to pounce. When fit is high but engagement is low, they go into targeted nurture. When engagement is high but fit is low, proceed with caution - they might be wasting your time.

Step 4: Assign point values based on conversion correlation, not gut feeling

This is where most teams fail. They assign arbitrary points because "it feels right" rather than analyzing what actually predicts revenue.

Run the analysis. Which actions correlate with closed-won deals? Which firmographic attributes appear most frequently in your best customers?

Use those insights to weight your scoring criteria. If 80% of your customers have 500+ employees, company size should carry more weight than industry vertical (unless industry also shows strong correlation).

Step 5: Set score thresholds that match your sales capacity

These thresholds are entirely subjective as every business's lead scoring model is unique, and finding the right numbers may involve trial and error accelerated with feedback from sales reps and customers.

If you set the bar too low, you'll flood sales with unqualified leads. Too high, and you'll miss opportunities.

Calculate your lead-to-customer conversion rate. This is calculated by dividing the number of leads converted to customers by the total number of leads generated. Use this as your baseline to determine where to set thresholds.

Step 6: Implement score decay

Recent activity matters more than old activity. Build decay into your model so that engagement from six months ago loses point value over time.

This prevents leads from maintaining artificially high scores based on ancient behavior while they've gone completely cold.

Step 7: Add negative scoring to filter out bad-fit prospects

Not all signals are positive. If a lead has been disqualified through previous interactions or does not meet minimum requirements for your ideal customer profile, they can be scored negatively to avoid wasting resources on pursuing them.

Use negative scoring for:

- Company size too small to buy your solution

- Geographic regions you don't serve

- Industries where you have no product-market fit

- Contact roles that never have budget authority

- Competitors researching your positioning

Adding Your Account Tiering System

Most companies build their account tiers based on deal size potential alone. That's one-dimensional thinking that misses strategic opportunities.

Build your tiers using multiple dimensions:

Revenue Potential

Yes, deal size matters. Estimate the potential deal size or lifetime value of the account when calculating revenue potential.

But don't just look at initial contract value. Consider expansion potential, multi-year commitments, and cross-sell opportunities.

ICP Alignment

Assess how closely the account matches your ideal customer profile when determining alignment with ICP.

Perfect ICP fits should tier higher even if initial deal size is smaller, because they're more likely to become long-term customers with higher retention and expansion rates.

Strategic Value

Some accounts matter beyond their revenue. Landing a well-known brand in your target industry opens doors with other prospects. A customer who becomes a vocal advocate creates reference value worth far more than their contract.

Consider:

- Market leadership position in target verticals

- Brand recognition that creates social proof

- Willingness to be a public reference customer

- Potential for case study development

- Executive relationships that open other opportunities

Buying Intent Signals

Monitor engagement behaviors such as website visits, content downloads, or event attendance when assessing buying intent signals.

An account showing strong intent signals should move up a tier temporarily, even if they don't perfectly match your other criteria. They're in-market right now.

Existing Relationships

Consider whether you already have connections within the account that could accelerate the sales process when evaluating existing relationships.

A warm introduction from an existing champion is worth more than any amount of cold outreach. Mutual connections, previous employer relationships, or existing users within the organization all reduce sales friction significantly.

How to Implement This Without Breaking Your CRM

We all know, theory is easy. Implementation is where most teams fall apart.

Start with your tech stack audit

You need a CRM that can handle both contact-level scoring and account-level scoring simultaneously. Use a lead scoring tool that is built into your CRM so your data stays updated and synced, as the tool will score your leads using the fields in your CRM.

Most modern CRMs (HubSpot, Salesforce, Pipedrive) support this natively. If yours doesn't, you'll need middleware to make it work.

Build your data enrichment layer first

Before you start scoring anything, fix your data quality problem. When your CRM records are missing key fields, your scoring model can't function properly.

This is exactly why we built Databar's waterfall enrichment system. When a new lead enters your CRM, it automatically:

- Fills missing firmographic data (company size, revenue, industry)

- Validates and enriches contact information (job title, phone number, email)

- Adds technographic details (technology stack, tools used)

- Updates with intent signals (funding announcements, hiring activity, news mentions)

The enrichment happens before scoring, so your model always has complete data to work with. Instead of scoring based on 60% complete records, you're scoring based on 95% complete records. That accuracy difference transforms results.

Configure your scoring rules in stages

Don't try to build the perfect model on day one. Start with basic fit scoring using firmographic data, then layer in behavioral scoring once you've validated the foundation works.

Run your initial model in "shadow mode" for 30 days. Score all your leads but don't change how your sales team operates yet. Compare the scores against actual conversion outcomes to validate your criteria.

Set up automated workflows for score-triggered actions

High-scoring leads at Tier 1 accounts should automatically:

- Create a high-priority task for the assigned AE

- Send a Slack notification to the account team

- Queue up a personalized email sequence

- Schedule a calendar hold for potential demo timing

Lower-scoring leads should flow into appropriate nurture sequences without manual intervention.

Create visibility for sales and marketing

Build dashboards that show:

- Lead score distribution across your database

- Conversion rates by score range

- Account tier breakdown

- Score trends over time

- Top-scoring accounts by tier

Sales needs to see which accounts are heating up. Marketing needs to see which campaigns generate high-scoring leads.

The Integration Most Teams Miss: Connecting Buying Signals to Account Tiers

This is where things get sophisticated.

Most teams treat lead scoring as reactive - someone takes an action, they get points. But the highest-performing revenue teams layer in proactive signals that trigger account tier changes before prospects even engage.

Dynamic tiering uses real-time intent signals from content consumption and research activities, engagement pattern analysis across multiple touchpoints, predictive analytics to identify accounts entering buying cycles, and behavioral scoring based on website visits and interactions.

When Databar detects that a Tier 2 account just:

- Received Series B funding

- Posted three new job openings for roles that use your category of solution

- Had their CEO mention your problem space in a LinkedIn post

That account should automatically escalate to Tier 1 status, at least temporarily. These are buying signals that indicate the account is in-market right now.

The sales team should get an alert that includes:

- What triggered the tier change

- Links to the relevant signals (funding announcement, job postings, etc.)

- Suggested talking points based on the context

- Pre-drafted outreach that references the trigger event

This is trigger-based selling at scale. Instead of generic cold outreach, your reps are reaching out with timely, relevant context that shows you understand what's happening in their business.

Advanced Playbook: The Four-Tier Approach for Complex Sales

Some organizations need more nuance than a simple three-tier system, especially when selling into enterprises with long sales cycles and complex buying committees.

B2B buying teams on average involve between seven and 12 members across industries, with each stakeholder coming with unique priorities and level of influence.

Here's the four-tier framework we see working for companies with average contract values above $100K:

Tier 1: High-Intent Target Accounts

Tier 1 high-intent accounts receive assigned XDR portfolio with high-touch, personalized outbound sequences and multi-channel outreach including email, LinkedIn, and cold calls.

These accounts get dedicated resources - a named AE and SDR, custom content, executive engagement, and regular account reviews. Everything is manual and personalized.

Tier 2: Bridge Accounts

Tier 2 bridge accounts get XDR oversight with automation and semi-automated outreach with automated LinkedIn connections and sequence emails under XDR name.

These receive focused campaigns with some personalization, but you're using more automation and templates to scale your efforts.

Tier 3: Marketing Nurture

Tier 3 marketing nurture receives warming activities to move toward Tier 2 or Tier 1 status.

These accounts go into automated campaigns designed to warm them up until they show stronger signals or grow into a better fit.

Tier 4: Future Potential

Tier 4 future potential gets mass communication only with newsletters and mass emails but no direct outbound.

Keep them on your radar with minimal investment until circumstances change.

The key insight: accounts should move between tiers dynamically based on changing signals. Be prepared to adjust your tiering system as market conditions, company goals, or account data change, as flexibility ensures your strategy remains effective over time.

Why Sales and Marketing Alignment Isn't Optional Anymore

Lead scoring only works when both teams agree on definitions and commit to the process.

Sales provides feedback on lead quality while marketing has insights into what's driving engagement, and a strong collaboration makes lead scoring more effective.

Schedule monthly alignment meetings where sales shares:

- Which high-scoring leads actually converted

- Which high-scoring leads were complete duds and why

- What questions prospects are asking that indicate real buying intent

- What criteria should be weighted differently

Use this feedback to refine your model quarterly. Buyer behavior evolves, your product positioning changes, market conditions shift - your scoring model needs to evolve with them.

Create shared goals around revenue, not vanity metrics

Marketing shouldn't be measured on MQL volume. Sales shouldn't be measured purely on activity metrics. Both teams should have shared revenue targets that force collaboration.

When marketing gets credit for pipeline created and sales gets credit for conversion rates by lead source, both teams have incentives to make lead scoring work properly.

What Good Lead Scoring Looks Like in Practice

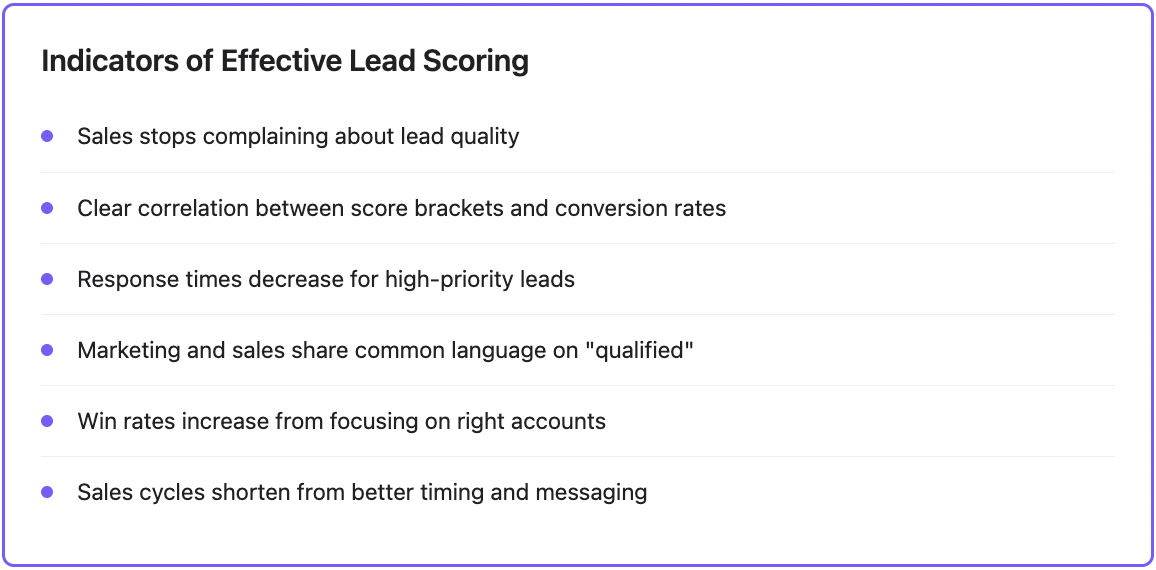

You'll know your lead scoring system is working when:

Sales stops complaining about lead quality because high-scoring leads actually convert at predictable rates. Your reps start trusting the scores and prioritizing accordingly.

Your conversion rates improve by score bracket. Leads scoring 80+ convert at 15%, leads scoring 60-79 convert at 8%, leads scoring 40-59 convert at 3%. The correlation is clear and actionable.

Response times decrease because reps know which leads need immediate attention versus which ones can wait. Your Tier 1 accounts with high-scoring leads get called within an hour, automatically.

Marketing and sales share a common language. Nobody argues about what "qualified" means anymore because you have objective criteria backed by data.

Your win rates increase because your team focuses energy on accounts that actually match your ICP and show genuine buying intent, rather than chasing every lead that enters the funnel.

Sales cycles shorten because you're engaging prospects at the right time with the right message, not too early (annoying them) or too late (after they've chosen a competitor).

That's when you know the system is working.

Start Prioritizing Your Champions

Your sales team has 40 hours a week. Your CRM has 10,000 contacts. Without a real lead scoring and account segmentation system, they're basically throwing darts blindfolded and hoping something sticks.

The teams winning right now are the ones who know exactly which accounts matter, which contacts are actually ready to buy, and which signals indicate it's time to pick up the phone.

But all of this falls apart if your CRM data is incomplete. You can't score what you can't see. You can't tier accounts when half your records are missing company size, revenue, or industry. You can't identify intent signals when contact information is six months out of date.

Databar solves the data problem before it breaks your scoring model. Automatic enrichment from 90+ providers fills missing firmographic details, validates contact information, and adds intent signals - so your scoring system has complete, accurate data to work with from day one.

Fix your data quality first, then watch your lead scoring actually work.

Frequently Asked Questions

What's the difference between lead scoring and account-based marketing?

Lead scoring evaluates individual contacts based on their characteristics and behavior. Account-based marketing (ABM) treats entire companies as single units and coordinates all outreach around the account, not individual contacts. Account tiering is the bridge between these approaches - it helps you determine which accounts deserve ABM treatment and which should be handled through traditional lead-based selling.

Should you score accounts or contacts first?

Start with account tiering, then layer in contact-level scoring. There's no point in having high-scoring contacts at accounts that will never become customers. Tier your accounts based on strategic value and ICP fit, then score the contacts within those accounts based on engagement and role. This prevents you from wasting time on the "wrong" opportunities.

How do you prevent high-scoring leads from ghosting after the demo?

This usually means your scoring model is tracking engagement behaviors that don't actually predict buying intent. Someone can consume lots of content and still have no budget, authority, or timeline to purchase. Add negative scoring for missing key qualifications (wrong company size, wrong role, wrong industry). Also track post-demo behaviors - if people who ghost typically showed certain patterns before the demo, adjust your model to catch those signals earlier.

Can lead scoring work for small businesses with limited data?

Yes, but start simple. Don't try to build a sophisticated AI model when you only have 100 customers. Create a basic tier system (hot/warm/cold) based on two criteria: ICP fit (do they match your best customers?) and engagement (are they actively researching solutions?). As you gather more data, refine your model. Even simple prioritization dramatically improves sales efficiency.

How often should you update your lead scoring model?

Review your model quarterly and make adjustments based on actual conversion data. But don't change it constantly - your sales team needs consistency to build trust in the system. Track leading indicators (score distribution, conversion rates by score bracket) monthly, but only make model changes quarterly unless something is dramatically broken.

Related articles

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026