How to Target Freshly Funded Startups

How to Use Data Enrichment and Automation to Identify and Engage High-Potential Startups Right After Funding

Tutorialsby JanApril 29, 2025

When startups secure funding, they enter a critical growth phase that creates the perfect window of opportunity for B2B sales and marketing professionals. But knowing exactly when and how to approach these potential companies requires more than just basic funding alerts.

Freshly funded startups are actively hiring, rapidly scaling, and strategically investing in new solutions—making them ideal prospects for your outreach campaigns. The challenge? Efficiently identifying these opportunities at scale before your competitors do.

In this article, I'll walk you through a sophisticated data enrichment workflow that uses raw funding announcements to find qualified, prioritized opportunities using Databar.ai. Let's dive into the complete workflow for targeting freshly funded startups that perfectly match your ideal customer profile.

Why Freshly Funded Startups Make Perfect Prospects

When startups secure new funding rounds, they experience a unique transition that makes them exceptionally receptive to new solutions:

- They have fresh capital earmarked for growth initiatives

- They're actively expanding teams and capabilities

- They face immediate scaling challenges that require external expertise

- Their buying cycles accelerate as they implement growth strategies

The key is identifying which recently funded companies align with your offering and targeting them before your competitors do. This is where data enrichment becomes crucial.

Building Your Funded Startup Targeting Workflow

The following workflow uses Databar.ai to create a sophisticated prospecting system that goes far beyond basic funding alerts.

Phase 1: Portfolio Company Discovery

The first step is identifying companies that have received investment from specific venture capital firms. This approach is often more effective than generic funding searches because it allows you to target startups within portfolios known for certain industries or investment theses.

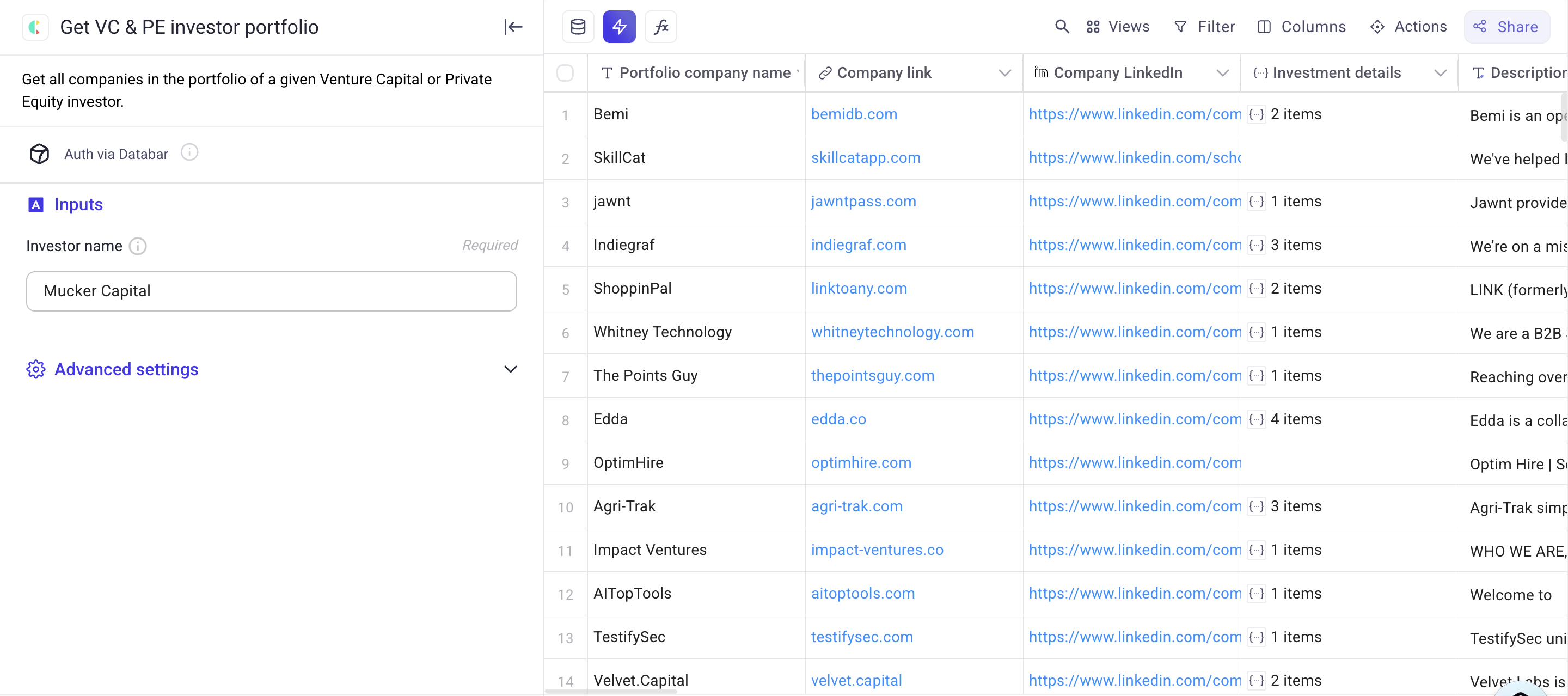

Here's how to set it up in Databar.ai:

- Create a new table and select "Find leads"

- Choose "Get VC & PE investor portfolio" enrichment

- Enter your target venture capital firm (e.g., "Mucker Capital")

This immediately generates a comprehensive dataset including:

- Company names and websites

- LinkedIn URLs

- Company descriptions

- Headquarters locations

- Founding dates

- Employee count ranges

- Crunchbase links

This foundation gives you much more context than a simple list of funded companies.

Phase 2: Funding Intelligence Enhancement

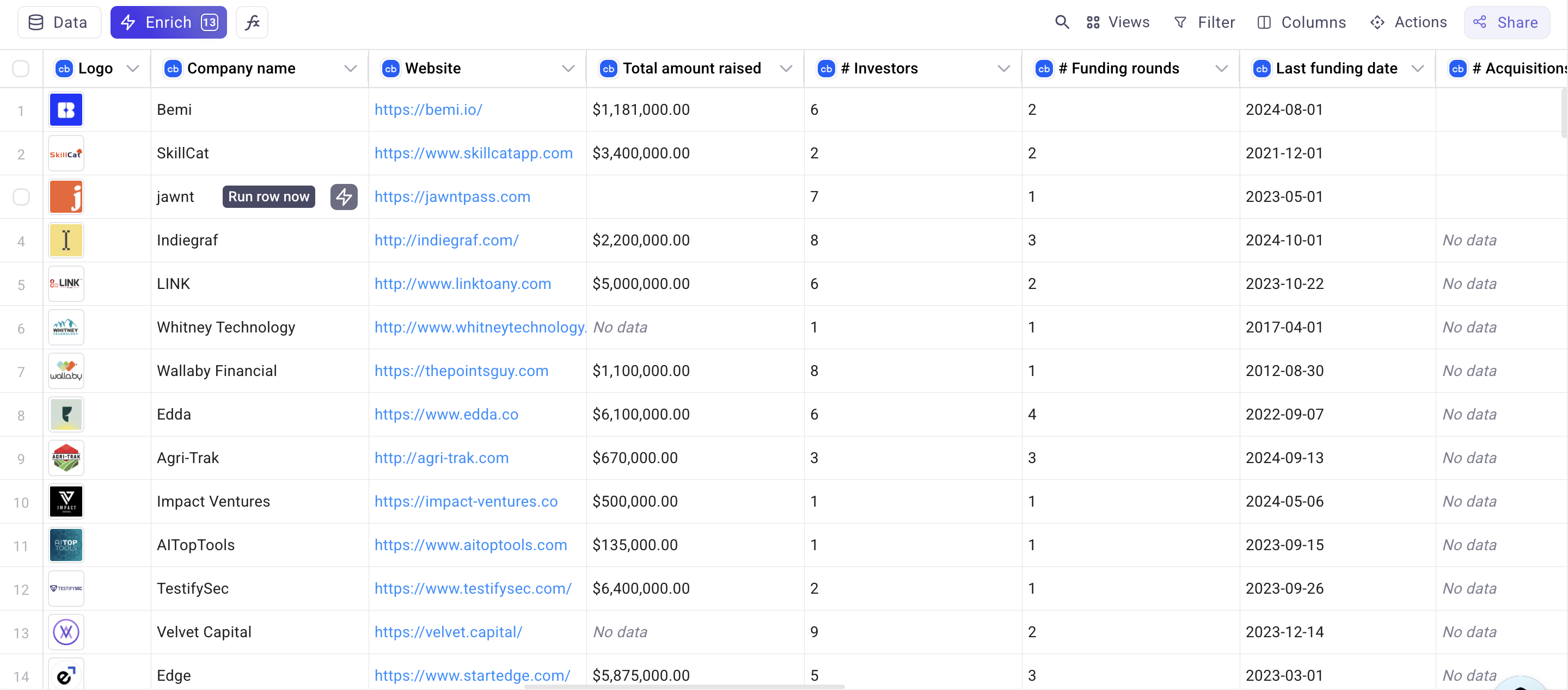

Next, enrich your dataset with detailed funding information to understand each company's financial situation:

- Add the Crunchbase enrichment

- Map it to the Crunchbase URL column from your initial dataset

- Select specific funding data points:

- Total funding amount

- Investor information

- Funding rounds

- Latest investment details (date and amount)

This enrichment provides precise intelligence including:

- Total capital raised to date

- Names of participating investors

- Details of each funding round (including series designations)

- Most recent financing event with specific amounts and lead investors

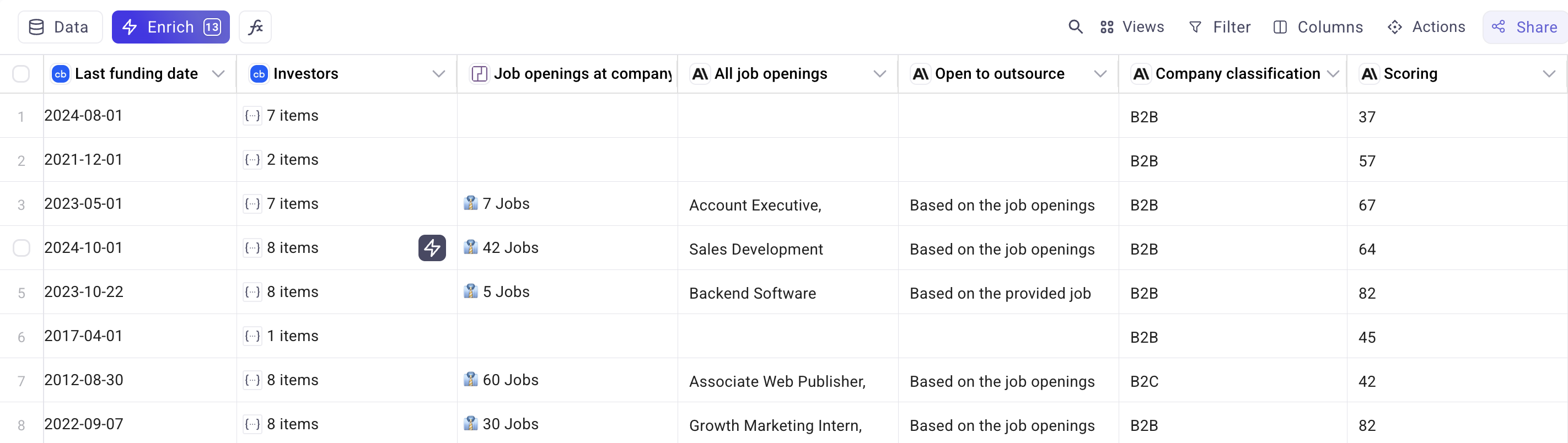

Data-driven funding intelligence allows you to identify companies at various growth stages and prioritize those with recent capital injections.

Phase 3: Identifying Hiring Activity

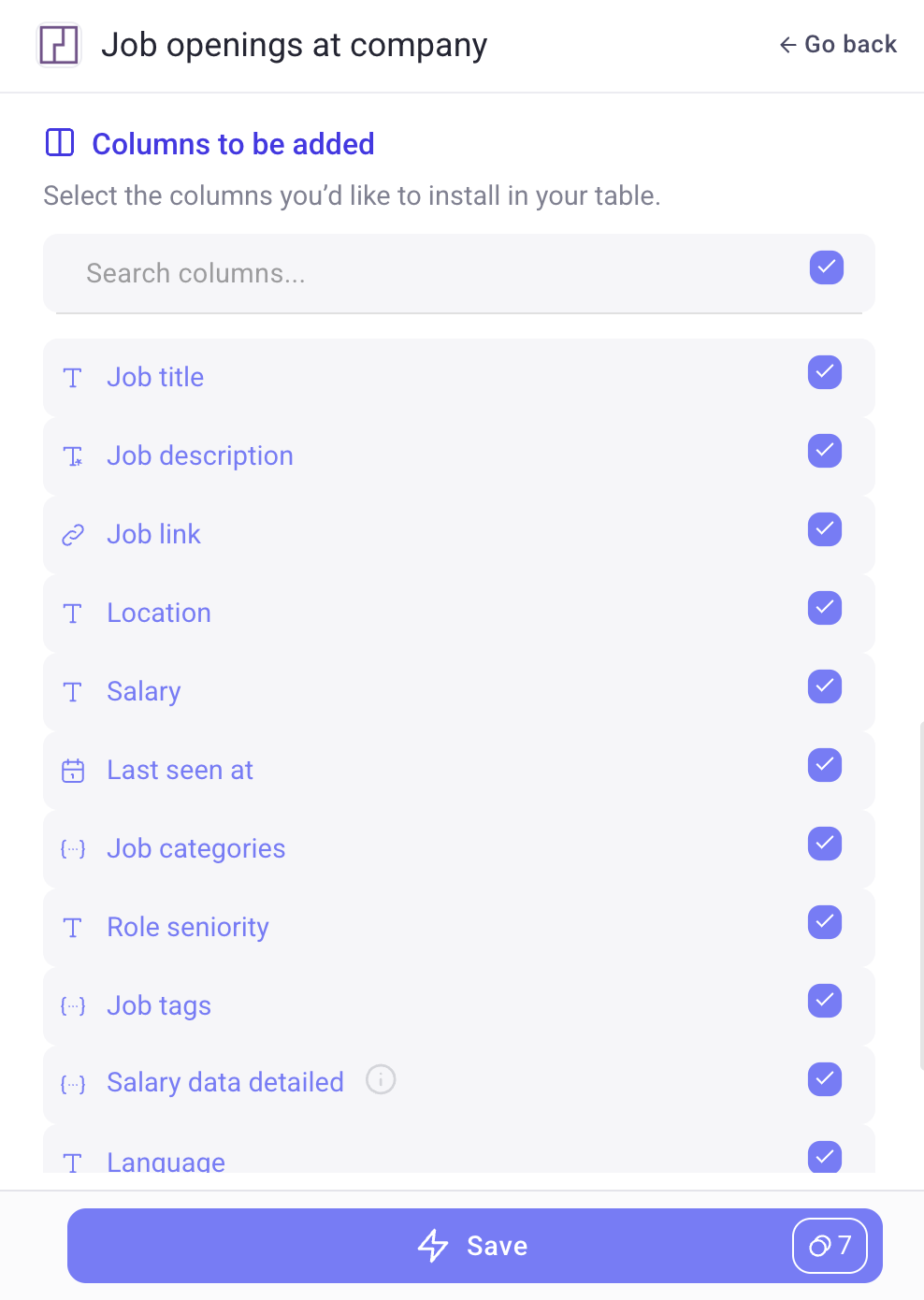

Active hiring is one of the strongest indicators of post-funding growth initiatives and potential outsourcing opportunities. Here's how to detect it:

- Add the "Get Job Postings" enrichment

- Map this to the company domain or LinkedIn URL

- Configure it to retrieve current job listings

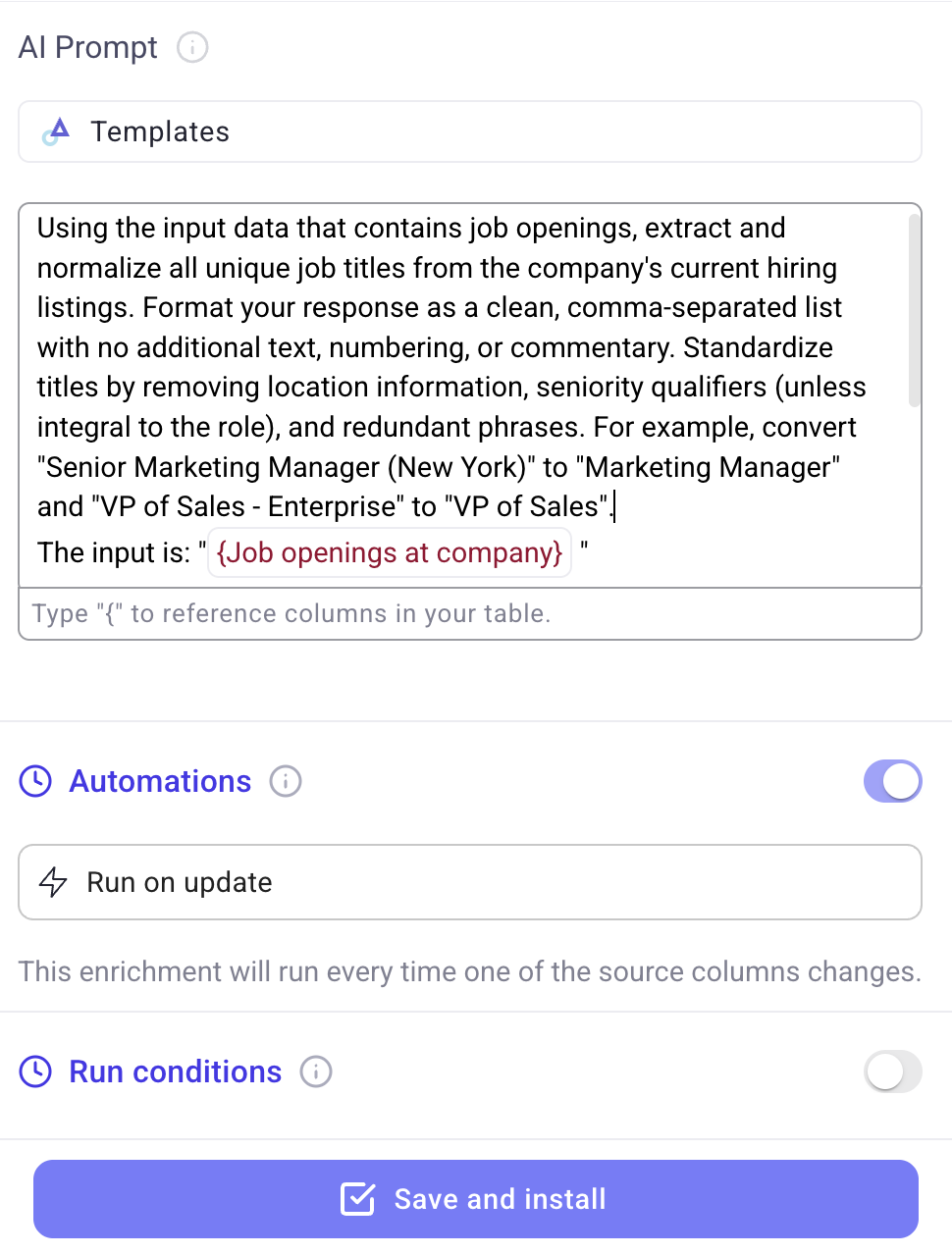

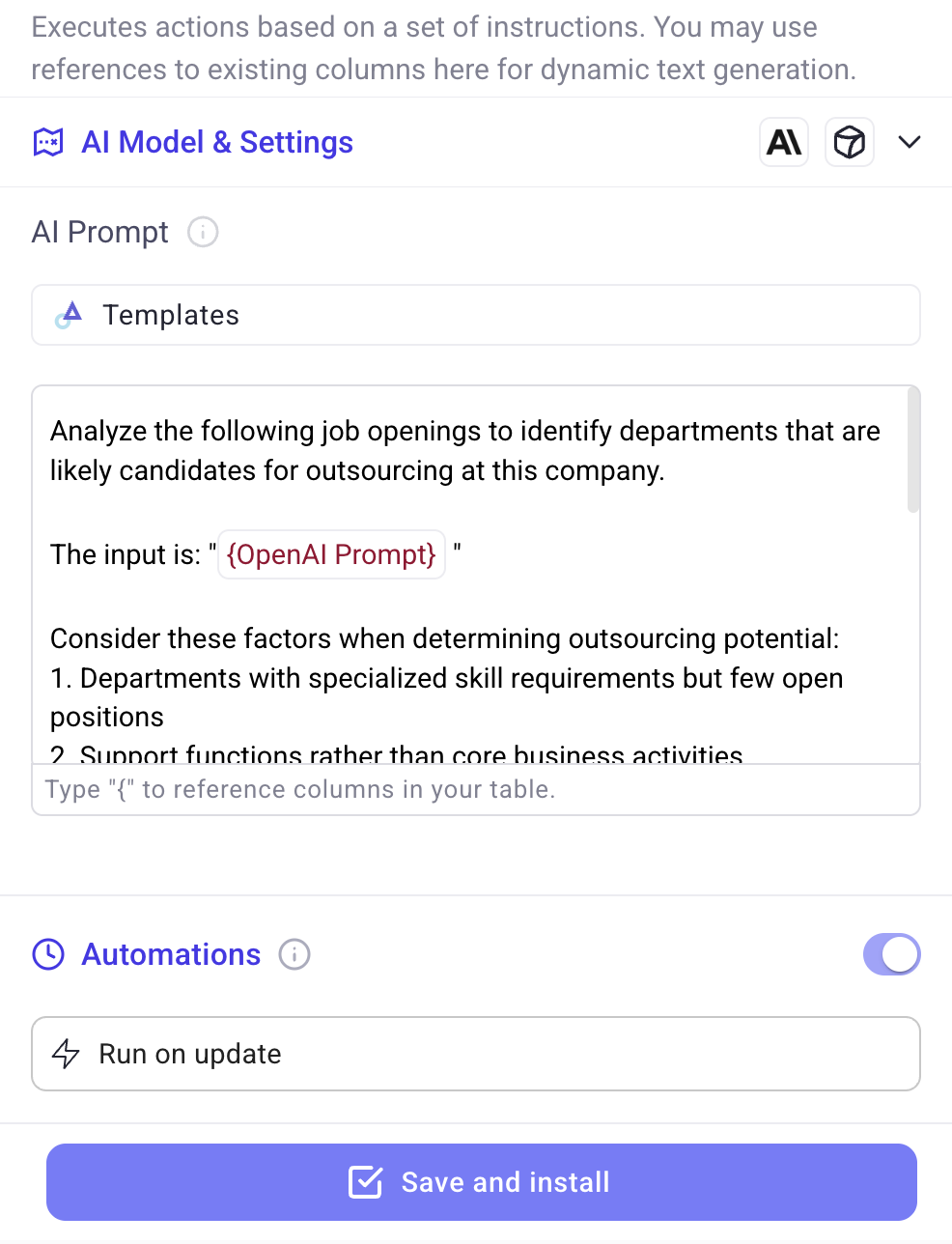

For companies with active listings, create new AI columns to extract actionable intelligence:

For job title extraction:

For outsourcing opportunity identification:

This analysis helps identify which companies might be looking for external vendors in specific departments—giving you targeted conversation starters for your outreach.

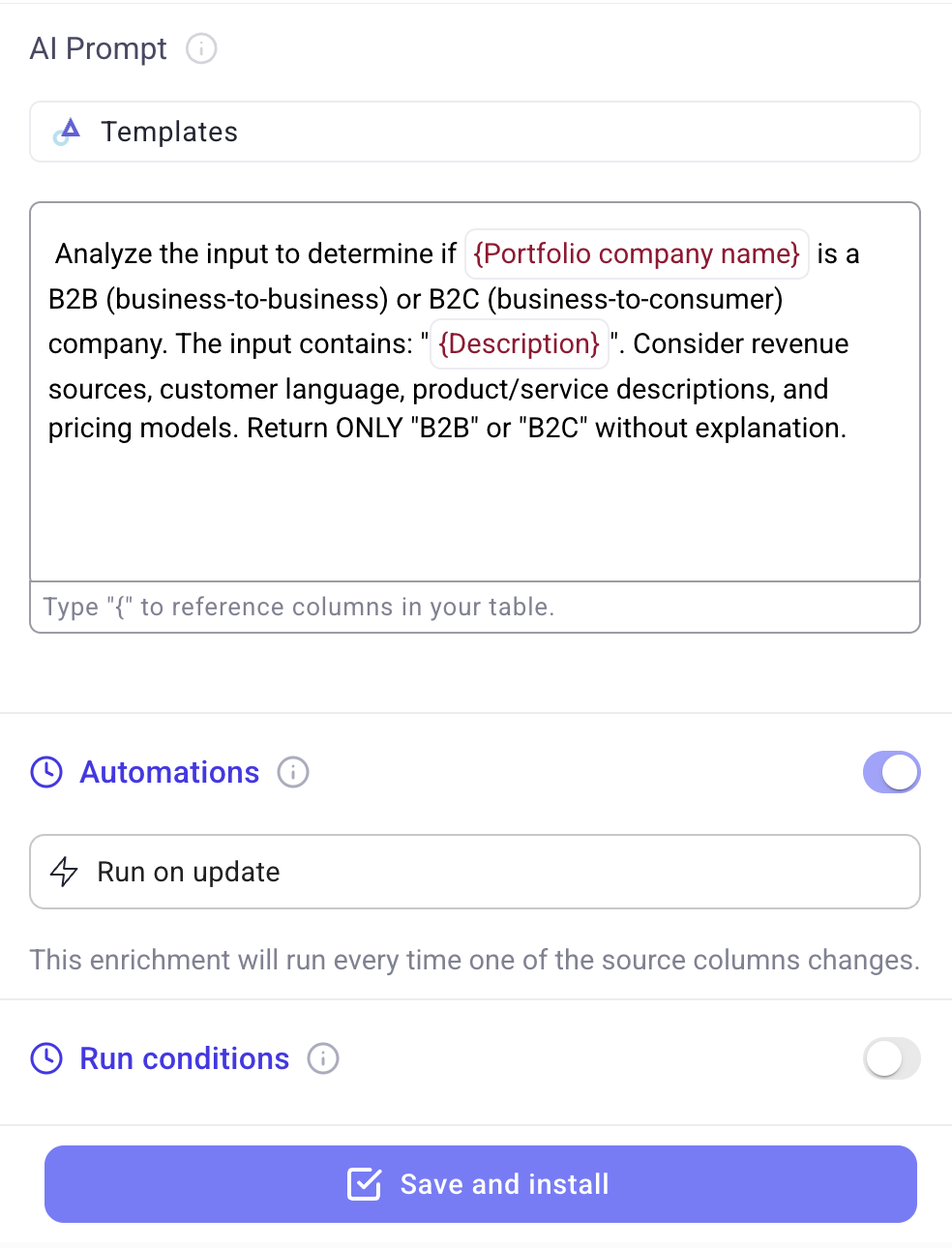

Phase 4: Business Model Classification

Understanding whether a company operates in the B2B or B2C space is critical for qualification, especially if your solution is designed for one specific model.

Add an AI column with this prompt:

This classification becomes a key input for your scoring model and helps ensure alignment with your ideal customer profile.

Phase 5: Comprehensive Scoring Model

Now it's time to implement a sophisticated scoring model that evaluates startups based on multiple criteria. Add an AI column with a comprehensive scoring prompt. Here is an example:

"Instructions

You are an expert startup opportunity analyst for Databar.ai. Your task is to evaluate freshly funded startups based on specific criteria to identify the highest potential prospects for our services. Analyze each startup thoroughly and assign scores that reflect their fit and opportunity level.

Scoring Framework

For each startup, evaluate the following five dimensions and assign an overall score from 0-100, where 100 represents an ideal prospect with immediate opportunity.

1. Team Size Evaluation

Assess the startup's current employee count to determine if they're at the optimal growth stage. Employee Count Parameters:

- Highest value (15 points): 20-50 employees (early growth stage with scaling needs)

- Moderate value (10 points): 10-20 or 50-100 employees

- Lower value (5 points): Fewer than 10 or more than 100 employees

2. Funding Amount Assessment

Evaluate the total funding raised in their most recent round. Funding Parameters:

- Highest value (20 points): $5M-$10M (Series A or early B with sufficient runway)

- Moderate value (12 points): $1M-$5M or $20M-$50M

- Lower value (5 points): Below $1M (too early) or above $50M (too established)

3. Investor Quality Analysis

Analyze the quality and relevance of investors backing the startup. Investor Quality Parameters:

- Highest value (15 points): Tier 1 VCs (Sequoia, a16z, Accel) or relevant industry-specific investors

- Moderate value (10 points): Established mid-tier VCs or strategic corporate investors

- Lower value (5 points): Angel investors only or unknown investment firms

4. Open Position Alignment

Evaluate if open job positions indicate needs in our service area. We offer data enrichment and prospecting services. Position Alignment Parameters:

- Highest value (20 points): Multiple open positions in exactly your service area (marketing, engineering, etc.)

- Moderate value (12 points): 1-2 open positions in your service areas

- Lower value (5 points): No open positions in your service areas

5. Business Model Assessment

We are servicing B2B. Business Model Parameters:

- Highest value (15 points): B2B SaaS (if that's your target)

- Moderate value (10 points): B2B service or B2B2C

- Lower value (5 points): Pure B2C

Return ONLY the final numerical score between 0-100.

Input:

{Investment details} contains investment details

{Description} contains company description

{Employee count range} contains employee count range

{Total amount raised} contains total amount raised

{Investors} contains investors

{Job positions} contains job positions the company is hiring for

{Company classificaiton} cotains if the company is targeting B2B or B2C

Please only return the final score as result: E.g. "67""

This produces a numerical score for each company, allowing your team to focus outreach efforts on the highest-potential opportunities first.

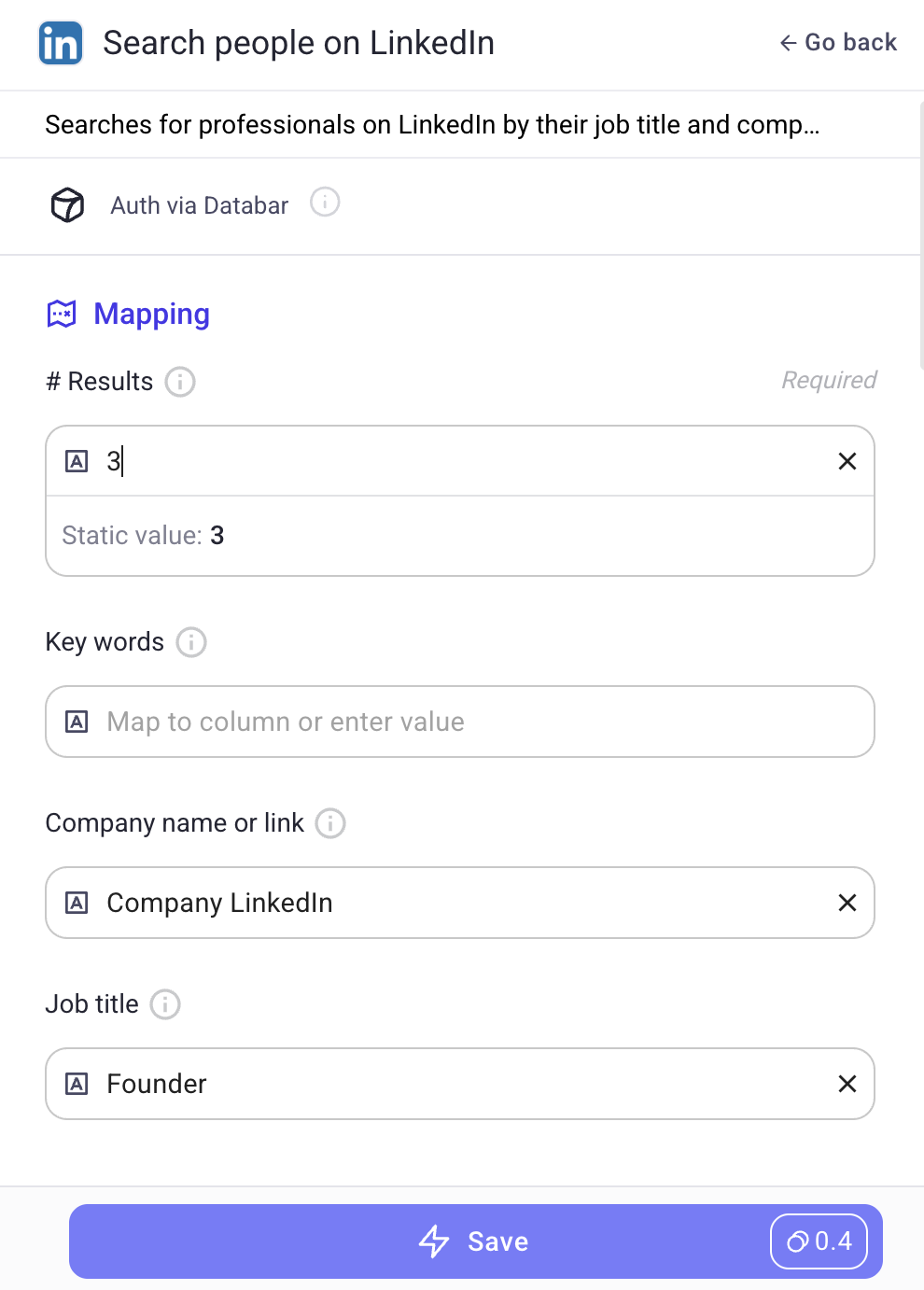

Phase 6: Decision-Maker Identification

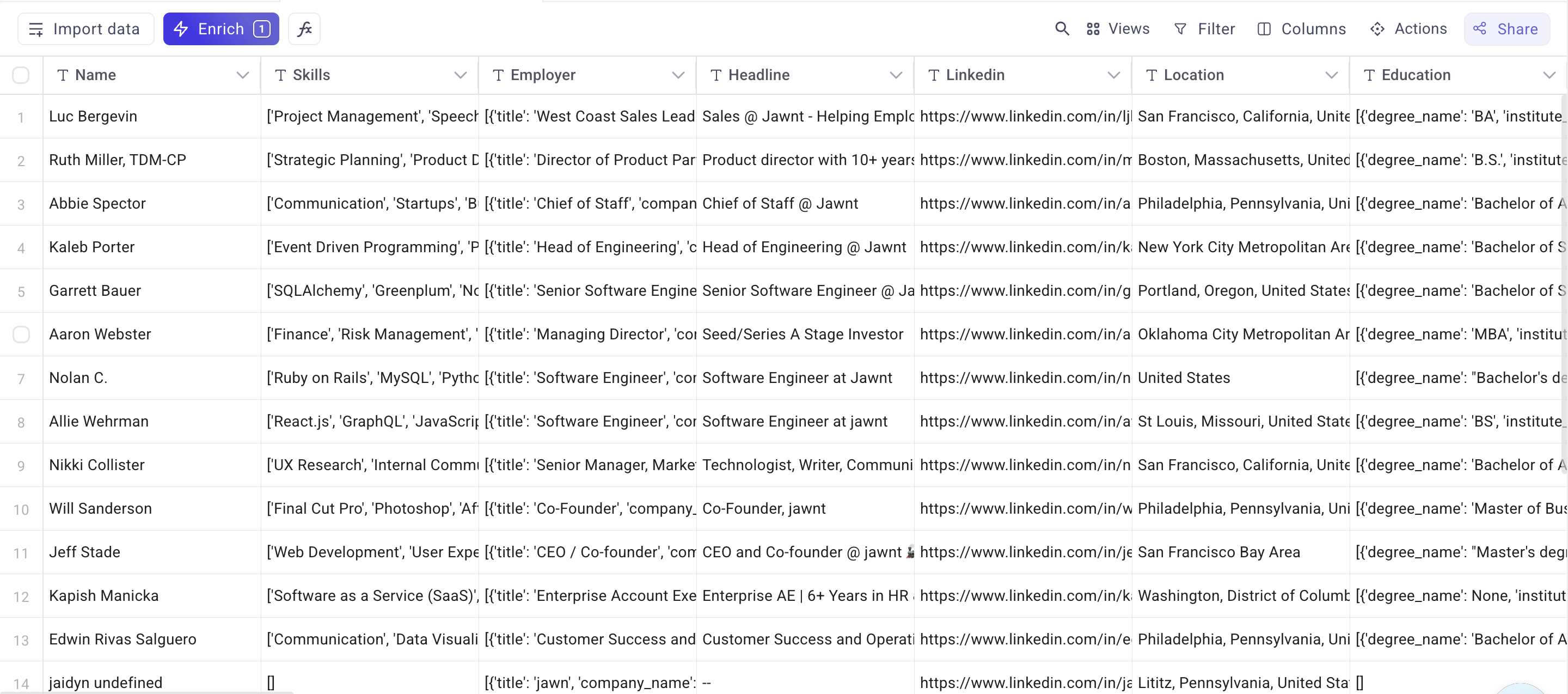

Now that you've identified and scored potential companies, it's time to find the right people to contact:

- Add the "Search People on LinkedIn" enrichment

- Map it to the Company LinkedIn URL

- Focus on founders, C-level executives, and VP/Director-level roles

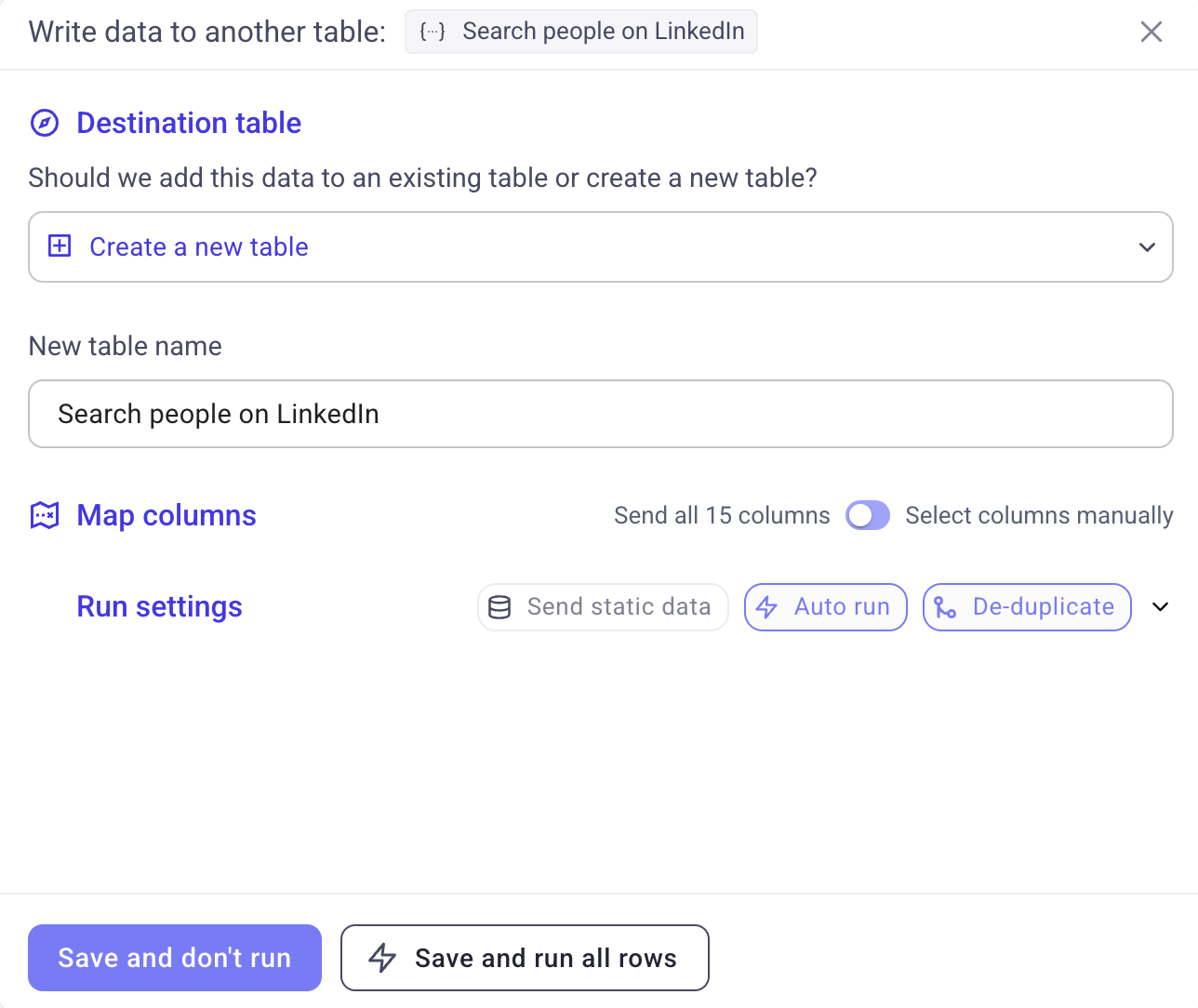

To make this data more accessible:

- Select "Write to Table" and create a "Startup Decision Makers" table

- Ensure you carry over all the company intelligence gathered previously

- Add the "Enrich Person from LinkedIn" enrichment to capture full professional backgrounds

This gives you valuable context for personalization and helps identify the best point of contact at each company.

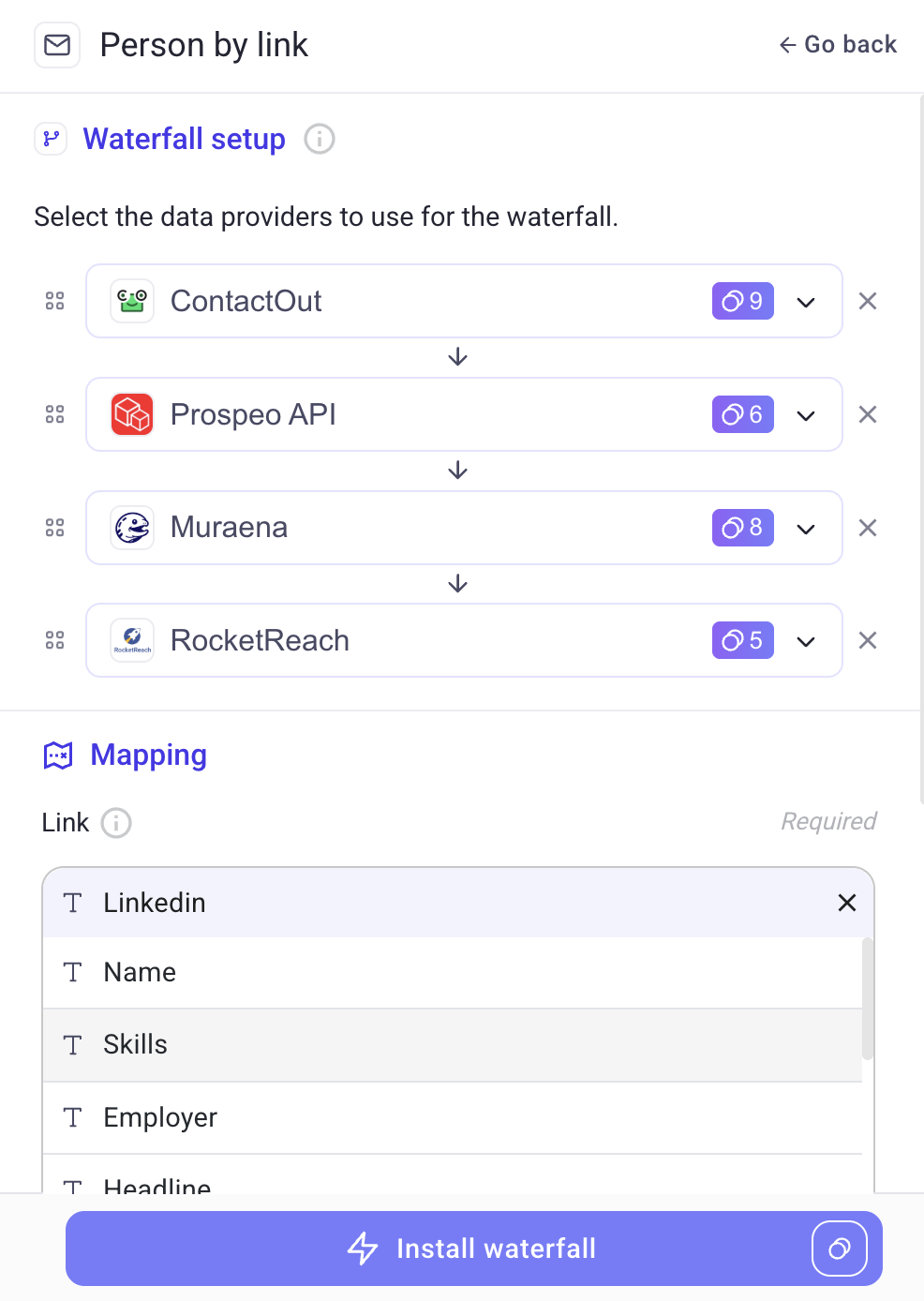

Phase 7: Finding Decision Makers' Contact Information

With your key decision-makers identified, the next step is obtaining their direct contact information:

- Click "Add Enrichment" and select "Get Email from Social Link"

- Choose between specific providers or Databar's waterfall enrichment approach

- For high-priority targets, consider adding phone number enrichment as well

What makes Databar.ai particularly powerful here is the waterfall enrichment approach, which tries multiple providers in sequence to maximize your email discovery rate. This significantly increases your chances of finding valid contact information compared to relying on a single data source.

This step transforms your list of potential contacts into actionable outreach opportunities with direct communication channels.

Implementing This Workflow In Your Organization

The workflow outlined above transforms basic funding announcements into comprehensively qualified opportunities. This approach allows you to:

- Systematically identify companies at the ideal growth stage

- Gather multi-dimensional intelligence beyond basic firmographic data

- Apply objective scoring criteria that align with your specific ICP

- Create highly contextual outreach that resonates with founders and executives

With Databar.ai, you can build this entire workflow without writing a single line of code or juggling multiple data tools. The platform's unified approach to data enrichment and outreach automation ensures you can move quickly from raw data to personalized engagement.

Beyond Funding: Extending Your Targeting Strategy

While funding status provides an excellent starting point, consider extending this workflow with additional data points:

- Technographic data to identify specific technology adoption patterns

- Website traffic growth as another indicator of momentum

- Content and social engagement to gauge market presence

- Geographic expansion signals from new office locations

Each additional data dimension increases your targeting precision and provides more context for personalized outreach.

Start Targeting Funded Startups Today

Freshly funded startups represent one of the most efficient segments to target for B2B sales and marketing professionals. Their growth mindset, available capital, and urgent scaling needs create the perfect conditions for new vendor relationships.

By implementing a sophisticated data enrichment workflow with Databar.ai, you can identify and engage these prospects at exactly the right moment—giving you a significant advantage over competitors relying on generic funding alerts or manual research processes.

Ready to implement this workflow in your organization? Visit databar.ai to start your trial or schedule a consultation with our team for a customized implementation.

Related articles

How to Integrate Attio CRM with Databar and Enrich Your Data

Fill CRM Data Gaps with Verified Contacts, Intent Signals, and Buying Intelligence

by Jan, January 12, 2026

Instagram Profile Data Scraper: Complete Guide to Finding and Enriching Business Accounts

Instagram Profile Research: Collect, Enrich, and Analyze Data to Boost Your Marketing Strategy

by Jan, May 23, 2025

How to Clone Your Best Customers

The Ultimate B2B Lookalike Audience Guide

by Jan, May 14, 2025

How to Build a Complete GTM Database in Under 20 Minutes

Step-by-step guide on how to build your list

by Jan, May 02, 2025