How to Build High-Quality Prospect Lists That Convert in 2025

Create Dynamic, Data-Driven Prospect Lists That Drive Resutls

Blogby JanAugust 06, 2025

Here's something that might surprise you: most sales teams are building prospect lists like it's still 2019. They're grabbing contacts from a single database, sending generic emails, and wondering why their response rates are tanking.

Meanwhile, the teams crushing their quotas have figured out something different. They're not just collecting more emails - they're building smarter lists with richer data, better targeting, and AI-powered insights that make every message feel personal.

After analyzing hundreds of successful outbound campaigns and working with GTM teams across different industries, the patterns are clear. What separates high-converting prospect lists from the spam folder disasters isn't about having a bigger database. It's about having better data, properly enriched, and intelligently segmented.

Why Your Current List Building Approach Is Probably Broken

Let's talk about what's actually happening in sales right now. Recent research shows that 67% of teams don't trust their prospect data for decision-making. Think about that for a second - most sales teams are making outreach decisions based on data they don't even believe in.

The problem runs deeper than just bad contact information. Modern buyers complete about 65% of their research before they ever talk to a salesperson. Your prospect lists need to capture buying intent signals, not just surface-level contact details.

Traditional list building looks something like this: grab a database subscription, filter by job title and company size, export a few thousand contacts, and start blasting emails. This approach worked fine five years ago when inboxes weren't as crowded and buyers had more patience for generic outreach.

Now? Generic emails get response rates below 1%. Your prospects are drowning in poorly researched pitches that clearly demonstrate the sender knows nothing about their business, their challenges, or their current situation.

Cost of Low-Quality Prospect Lists

Bad prospect data doesn't just hurt your response rates. It creates a cascade of problems that most teams don't even realize they're dealing with.

First, there's the time sink. Sales reps spend 21% of their day writing emails, and that's just the writing part. Add in the research time for each prospect, the back-and-forth to verify contact information, and the follow-up sequences that go nowhere, and you're looking at massive productivity losses.

Then there's the reputation damage. When you're sending emails to outdated addresses or reaching out to people who left their companies months ago, you're training spam filters to flag your domain. Your deliverability tanks, which hurts even your good emails.

But the biggest cost is opportunity cost. While you're burning through thousands of low-quality contacts with 1% response rates, your competitors with better lists are booking meetings with the same prospects using 3-4% response rates.

The math is brutal but simple: better data equals better results, and better results equal more revenue.

How We Actually Build Lists That Convert

After working with hundreds of sales teams and testing different approaches, patterns emerge around systems that consistently outperform traditional list building by 300-400%.

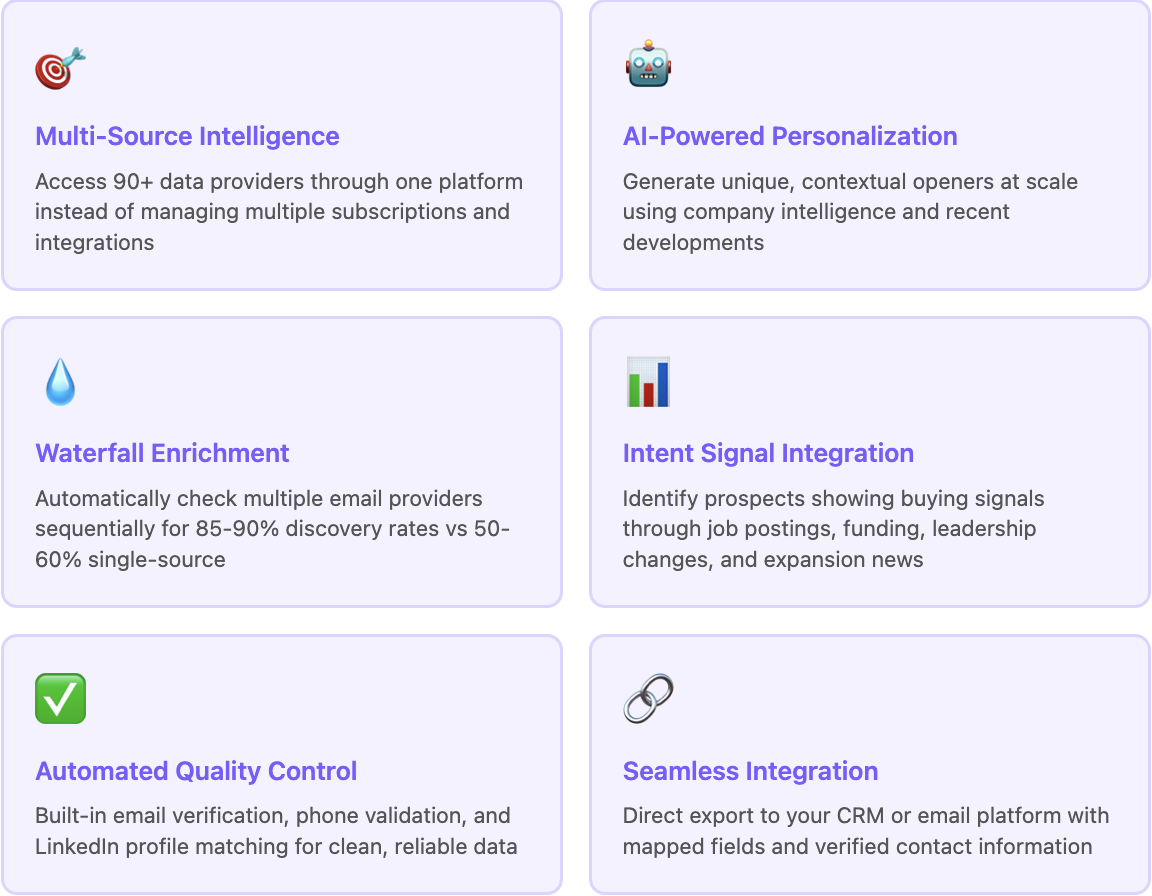

The secret isn't any single tactic. It's combining multiple data sources, using AI to enrich and analyze prospect information, and segmenting lists for hyper-personalized outreach.

Start With a Living, Breathing ICP

Most teams treat their Ideal Customer Profile like a dusty document they created once and never touch. That's backwards. Your ICP should evolve constantly based on which prospects actually convert.

We start with the basics: industry, company size, location, and growth stage. But then we add layers that most teams ignore completely.

What technology are they already using? If you're selling a marketing automation tool, knowing they're currently using HubSpot versus Mailchimp changes everything about your approach.

What about timing indicators? A company that just raised Series A funding is in a completely different buying mode than one that's been bootstrapped for five years. Recent leadership changes, rapid hiring patterns, or news about market expansion all signal readiness to invest in new solutions.

The key insight: your ICP should include negative indicators too. What makes a prospect look good on paper but fail in reality? We call these "fool's gold" prospects, and filtering them out early saves enormous amounts of time.

Source From Multiple Places, Not Just Databases

Here's where most teams go wrong. They buy access to one database, filter it down, and call it a day. That gives you the same prospects everyone else is targeting, using the same incomplete information.

Smart teams source prospects from multiple channels. LinkedIn Sales Navigator for professional insights. Company websites and career pages for timing signals. Industry directories for comprehensive coverage. Social media activity for engaged prospects.

But here's the real secret: you don't just combine these sources, you use them to validate and enrich each other. Found a prospect on LinkedIn? Cross-reference their company website to see if they're hiring for relevant roles. Spot them on a conference list? Check their recent social posts for conversation starters.

This multi-source approach is exactly what separates the best B2B data enrichment tools from basic database providers.

This multi-source approach does something powerful. Instead of competing with everyone else using the same database, you're building lists with prospects and insights your competitors don't have.

The Waterfall Enrichment

This is probably the most important tactical insight in this entire article. Instead running your enrichment using your primary database and calling it a day, set up a waterfall system.

If Database A doesn't have an email for your prospect, automatically check Database B. No luck there? Try Database C. Keep going until you've exhausted all your sources.

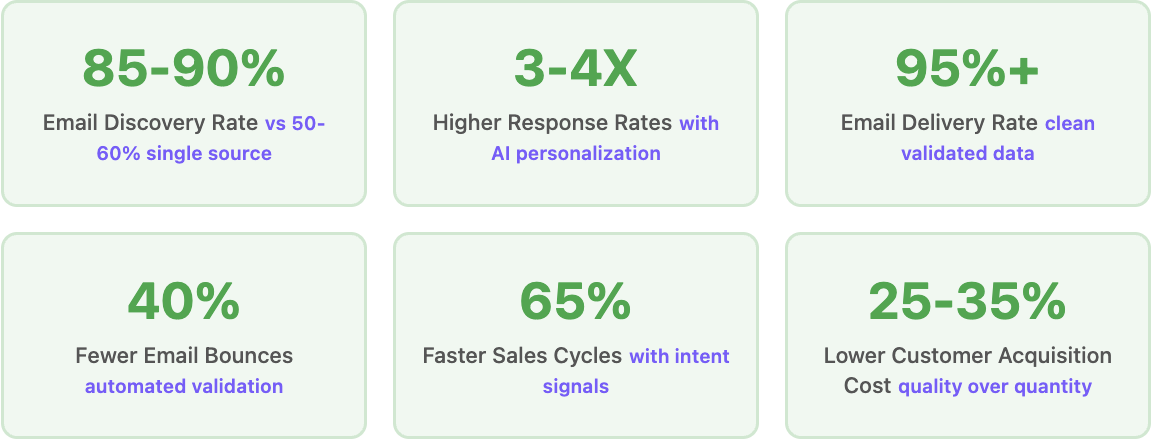

This sounds complicated, but tools like Databar make it automatic. The results are dramatic: email discovery rates jump from 50% with single sources to 80-90% with waterfall enrichment.

The best waterfall enrichment tools for B2B sales teams have improved how successful teams approach prospect data quality.

More importantly, you're often the first person reaching out to these prospects because most of your competitors couldn't find their contact information.

Layer On Intent Signals Like a Detective

This is where list building becomes genuinely intelligent. You're not just finding prospects who fit your ICP. You're finding prospects who fit your ICP and are showing signs they're ready to buy.

Job postings are goldmines of intent data. A SaaS company posting for three new sales development reps is probably evaluating sales tools. A manufacturing company hiring a Head of Digital Transformation is likely investing in new technology.

Funding announcements, leadership changes, and expansion news all signal companies with budget and motivation to solve problems. The trick is systematically monitoring these signals rather than stumbling across them randomly.

Social media activity provides another layer. A CEO posting about scaling challenges on LinkedIn is practically begging for solutions. A CFO sharing articles about cost reduction is telegraphing their priorities.

The best part about intent signals: they give you perfect conversation starters. Instead of generic "I noticed your company" openers, you can reference specific, timely developments that actually matter to your prospect.

Databar’s Approach to Effortless List Building

The ideal process sounds great, but executing it across multiple tools creates a nightmare of data silos, manual work, and integration headaches. This is exactly why we built Databar differently.

Instead of forcing you to juggle subscriptions to five different data providers, manage three enrichment tools, and manually combine everything in spreadsheets, Databar gives you access to 90+ data sources through one platform.

This integrated approach addresses the core challenges that plague traditional prospecting tools for B2B sales.

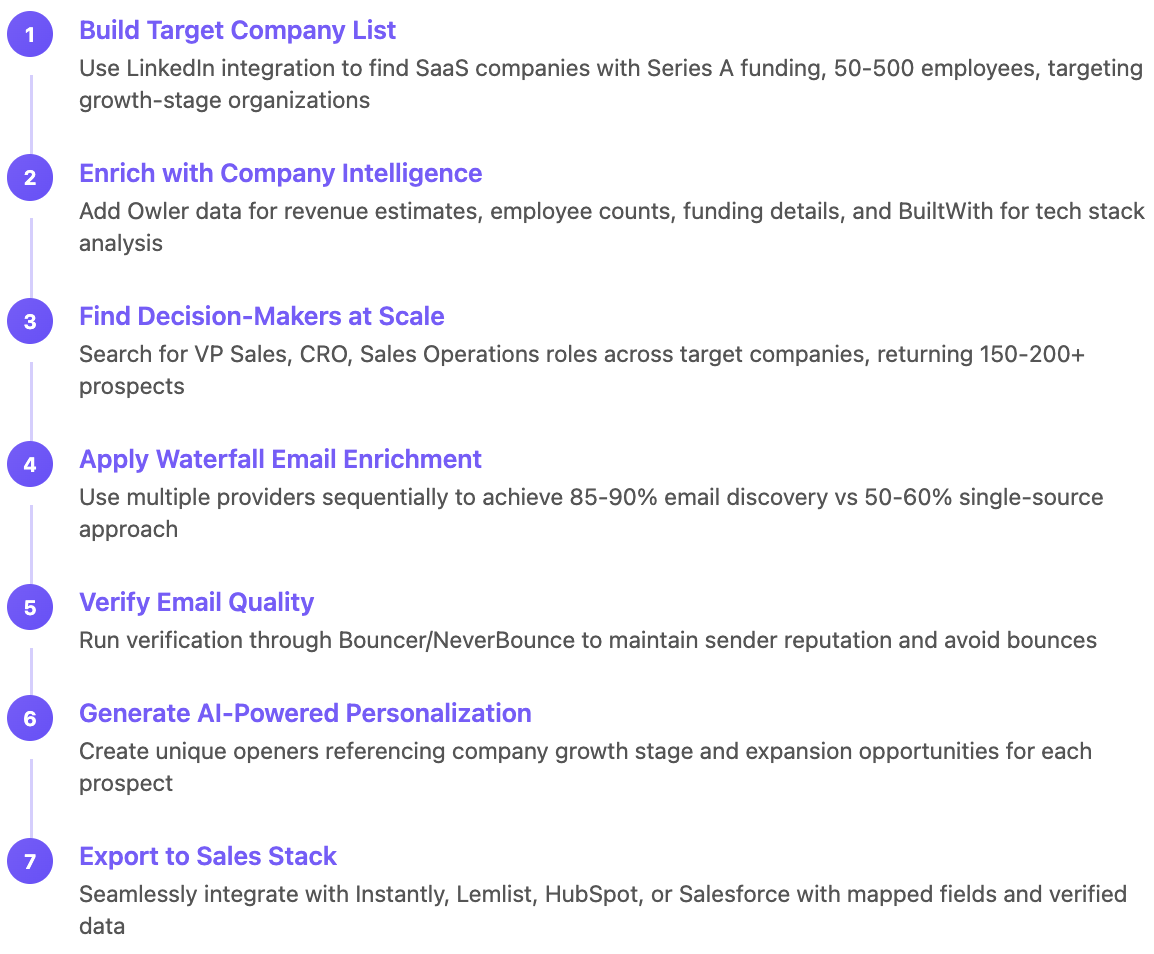

Let me show you exactly how this works with a step-by-step walkthrough. Say you're targeting SaaS companies that recently raised Series A funding and are likely expanding their sales operations.

Step 1: Build Your Target Company List

Start by clicking "Create New" and then "Table" in Databar. Select "Find Companies" to build from scratch rather than importing existing data.

Use the LinkedIn company search integration and set these filters:

- Industry: Information Technology

- Description: Software as a Service or SaaS

- Location: United States (or your target geography)

- Employee Count: 50-500

- Recent funding: Series A in the last 12 months

This search returns companies that match your exact criteria in seconds. You're not getting generic database results - you're getting real-time LinkedIn data about companies actively in growth mode.

Step 2: Enrich with Deep Company Intelligence

Now click "Add Enrichment" and select "Get company data by link or name." We'll use Owler for comprehensive firmographic data.

Map to your company domain column and select the information you want: annual revenue estimates, exact employee counts, founding dates, recent funding details, and technology stacks they're using.

Run the enrichment and watch as each company gets populated with rich intelligence data. You'll see which ones just closed funding rounds, their employee count and estimated revenue.

Add another enrichment using BuiltWith to understand their current tech stack. This tells you what CRM they're using, what marketing tools they have, and what integration opportunities exist.

Step 3: Find Decision-Makers at Scale

Click "Add Enrichment" again and select "Search people at company." This is where Databar really shines compared to manual prospecting.

Set your filters to find people with titles like "VP Sales," "Chief Revenue Officer," "Sales Operations," and "Head of Sales Development." You can target multiple roles simultaneously rather than running separate searches.

The system returns decision-makers with their LinkedIn profiles, current roles, and company information. You get back around prospects across your target companies.

Step 4: Apply Waterfall Email Enrichment

Here's where the magic happens. Instead of accepting whatever email data one provider gives you, set up waterfall enrichment by clicking "Add Enrichment" and selecting "Get email from social link."

Choose the waterfall option, which automatically checks multiple email providers in sequence. If the first provider doesn't have an email, it tries the second, then the third, and so on.

This single step typically increases your email discovery rate from 50-60% to 80-90%. You're now reaching prospects your competitors probably can't contact because they're using single-source data.

Step 5: Verify Email Quality

Before launching any outreach, add email verification by clicking "Add Enrichment" and selecting "Verify emails and phone numbers."

Choose a verification provider like Bouncer or NeverBounce. This step is crucial for maintaining good sender reputation and avoiding bounces that hurt deliverability.

Run the verification across your entire list. You'll get back status indicators showing which emails are valid, risky, or invalid. Clean out the bad ones before they damage your campaigns.

Step 6: Generate AI-Powered Personalization

Now for the personalization that makes your outreach stand out. Click "Add Column" and select "Use AI."

Create a prompt that analyzes the company data you've gathered. Here's one that works well:

"Review the company description and recent funding information. Create a personalized first line that references their growth stage and expansion opportunities. Keep it under 15 words and complete this sentence: 'I saw that [Company] recently...'

Company description: {{company_description}} Recent funding: {{funding_data}}"

Map the AI to use your enriched company data and run it across your prospect list. Each person gets a unique, contextual opener that references real information about their company's situation.

Step 7: Export to Your Sales Stack

Finally, click "Share" and select your email platform or CRM. Databar integrates with tools like Instantly, Lemlist, HubSpot, and Salesforce.

Map your fields - prospect name, email, company, personalized opener, and any other data points you want to include. Everything flows seamlessly into your outreach tool, ready for campaign launch.

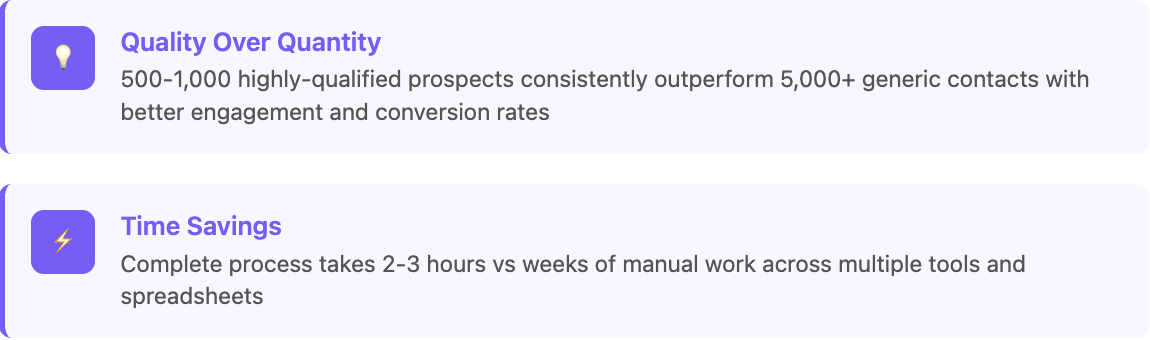

You've just built a highly targeted, intelligently enriched prospect list with verified contacts and personalized messaging. The entire process takes 30 minutes versus the days it would require using multiple tools manually.

The entire workflow that would take a team weeks to complete manually gets done in a few hours. And instead of managing data across multiple spreadsheets and tools, everything flows seamlessly into your CRM or email platform.

This streamlined approach is particularly valuable when compared to managing separate tools for each step of your cold email tech stack.

Advanced Segmentation That Actually Matters

Generic segmentation is dead. Your prospects expect messages that demonstrate you understand their specific situation, not just their job title.

We segment prospects based on buying stage indicators first. High-intent signals like active job postings or recent funding get priority treatment and immediate outreach. Medium-intent signals like technology evaluations or content downloads get nurture sequences. Low-intent prospects get educational content and longer follow-up cycles.

Then we layer on personalization depth. Prospects with rich social presence and recent news get highly customized messages. Those with standard firmographic data get template-based personalization. Basic contacts get broader, value-focused messaging.

Communication channel preference matters too. Some executives are LinkedIn-active and respond well to connection requests. Others prefer email or direct phone calls. Matching your outreach method to their preferred channel significantly improves response rates.

Message complexity is the final layer. Technical decision-makers want detailed product information and integration specifics. Business decision-makers care about ROI and outcomes. End users focus on features and usability.

This level of segmentation sounds complex, but it's actually quite manageable when your data is properly structured. The key is starting with rich prospect intelligence rather than trying to research and segment after the fact.

Quality Control That Prevents Disasters

Data quality isn't something you check once and forget. It's an ongoing process that separates successful campaigns from deliverability disasters.

Before launching any campaign, run comprehensive validation checks. Email deliverability verification catches addresses that will bounce. Phone number validation confirms contact information is current. LinkedIn profile confirmation ensures you're reaching the right person.

During campaigns, monitor performance metrics obsessively. Open rates (if these are tracked) by data source tell you which providers give you the best information. Response rates by segment reveal which targeting criteria actually work. Bounce rates flag data quality issues before they hurt your sender reputation.

Post-campaign analysis feeds into continuous optimization. Which ICP criteria correlated with the highest conversion rates? Which data sources provided the most engaged prospects? Which personalization approaches generated the most meetings?

This feedback loop is crucial because prospect data and market conditions change constantly. The segmentation strategy that worked six months ago might be completely ineffective today.

Common Mistakes That Kill Results

Teams make the same mistakes repeatedly, usually because they're following outdated advice or trying to shortcut the process.

Buying pre-built lists seems efficient but backfires spectacularly. These lists are often outdated, non-compliant, and sold to multiple buyers. You end up competing with dozens of other companies reaching out to the same prospects with the same stale information.

Ignoring data decay is equally problematic. In today's job market, prospect information becomes outdated within 30-45 days. Job changes, company updates, and role modifications happen constantly. Static lists perform worse and worse over time.

Over-targeting creates the opposite problem. Extremely narrow criteria can limit your addressable market to the point where you don't have enough prospects to run meaningful campaigns. Start broader and refine based on actual performance data.

Under-segmenting kills personalization opportunities. If you're sending the same message to CTOs and sales directors, you're missing opportunities to speak directly to their specific challenges and priorities.

Focusing only on contact information without gathering intelligence insights leads to generic outreach that doesn't resonate. Rich prospect data drives better conversations and higher conversion rates.

What Success Actually Looks Like

The metrics that matter most aren't the ones most teams track. List size doesn't correlate with results. Response rates without context are meaningless. Here's what actually predicts success:

Email delivery rates above 98% indicate clean, validated data. Phone number accuracy above 85% suggests your sources are current and reliable. LinkedIn profile match rates above 90% confirm you're reaching the right people.

Engagement metrics reveal message-market fit. Email open rates by segment show which targeting criteria resonate. Response rates by personalization level indicate the value of your research. Meeting booking rates measure actual business impact.

Conversion metrics connect your prospecting efforts to revenue. SQL conversion rates, sales cycle length, and deal size by segment all help optimize your approach. Customer acquisition cost by source guides resource allocation.

The best-performing teams track these metrics religiously and use them to continuously refine their approach. They treat list building as a systematic process that improves over time, not a one-time activity.

Your Next Steps

The difference between successful and struggling sales teams often comes down to list quality. Teams with high-quality, well-segmented prospect lists consistently outperform those relying on generic databases and spray-and-pray tactics.

Start by auditing your current approach using the framework outlined here. Are you using multiple data sources? Do you have intent signals integrated into your targeting? Can you segment prospects based on buying stage and personalization requirements?

Implement waterfall enrichment to improve your email discovery rates. This single change often produces immediate results by reaching prospects your competitors can't contact.

Add intent signals to identify high-priority prospects showing active buying behavior. This shifts your focus from cold outreach to warm conversations with prospects already in buying mode.

Create specific segments for personalized outreach rather than blasting everyone with the same generic message. This typically doubles or triples response rates immediately.

Track performance metrics and optimize continuously. List building isn't a set-it-and-forget-it activity. The best lists evolve based on real performance data.

Most importantly, treat prospect list building as a systematic capability, not a tactical task. The teams winning in 2025 have built repeatable processes that consistently generate high-quality prospects at scale.

Ready to build prospect lists that actually convert? The strategies covered here represent hundreds of hours of testing and optimization across different industries and company sizes. Start with one element, perhaps implementing waterfall enrichment or adding intent signals, and build from there.

Great prospecting starts with great data. Make 2025 the year you finally build a systematic approach to prospect list building that scales with your growth.

Frequently Asked Questions

How often should I update my prospect lists? Update your lists every 30-45 days minimum. In today's job market, contact information and company details change rapidly. Automated refresh cycles work best for high-priority segments, with manual updates for strategic accounts.

What's the difference between leads and prospects in 2025? Leads are anyone who shows interest - form fills, content downloads, website visitors. Prospects are qualified individuals who match your ICP, have buying authority, and show intent signals. Focus your efforts on prospects, not just leads.

How many data sources should I use for enrichment? Three to five sources in a waterfall approach typically hits the sweet spot. This achieves 80-90% email discovery compared to 50-60% from single sources, without creating too much complexity in your workflow.

What's the ideal prospect list size for outbound campaigns? Quality beats quantity every time. 500-1,000 highly-qualified prospects consistently outperform 5,000+ generic contacts. Better to have deep intelligence on fewer prospects than surface-level data on thousands.

How do I measure the quality of my prospect data? Track email deliverability (target 98%+), phone accuracy (85%+), and LinkedIn profile matches (90%+). Engagement metrics like open and response rates by data source also reveal quality differences between providers.

Should I build lists in-house or use external services? Build in-house for better quality control and competitive advantage. Pre-built lists are often outdated and sold to multiple buyers. Use tools that integrate multiple data sources rather than relying on single-provider solutions.

Related articles

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026