How to Build B2B Lead Lists in 2025: The Complete Step-by-Step Guide

How to build B2B lead lists that actually work and help you close more deals

Blogby JanJuly 07, 2025

Sales teams often blow through thousands on contact lists that generate zero meetings. Meanwhile, their competitors build focused prospect lists for under $200 and close multiple deals in the first week.

The difference? One team bought unverified data and hoped for the best. The other built their list strategically, verified everything, and targeted people who actually wanted to buy.

Here's what nobody tells you about B2B lead lists: the recommendations you see online often come from people who've never had to build a profitable prospecting operation from scratch. Most guides suggest enterprise solutions that cost more than many small teams' entire quarterly revenue.

Truth About B2B Lead Lists Right Now

Most sales teams are still doing this completely wrong. They buy massive contact dumps from sketchy brokers, blast generic emails to everyone, then wonder why their inbox is full of bounces instead of replies.

According to Salesforce research, 79% of marketing leads never convert to sales due to poor data quality and lack of proper nurturing. Teams spend thousands on "premium" lists that turn out to be recycled data from years ago. They're treating lead lists like phone books instead of understanding that contact information changes constantly.

HubSpot's data shows that companies using verified, targeted lists see 4.2x higher response rates than those using generic contact databases. People switch jobs, companies get acquired, email addresses die - yet teams keep using the same stale spreadsheets.

The teams that win have figured out something different. They build their lists from multiple sources, verify everything before sending a single email, and treat their prospect database like a living, breathing thing that needs constant attention.

They've learned that 500 verified contacts who match your ideal customer profile will always crush 10,000 random emails. Always.

What Actually Makes a Lead List Worth Having

Most people screw up completely here. They think a B2B lead list is just names and email addresses thrown into a spreadsheet.

That's like saying a car is just wheels and an engine.

A real lead list tells you everything you need to know about each prospect. Who they are, whether they can actually make buying decisions, if their company fits what you're selling, and most importantly - whether they're showing any signs they might actually want to buy something.

The contact info that converts goes way beyond basic company emails. You need:

Work emails that reach actual humans, not info@ addresses that go nowhere. Direct phone numbers that bypass the receptionist. LinkedIn profiles for social selling. And verification timestamps proving your data isn't older than last season's iPhone.

But contact details are just table stakes. The real money is in the context - recent job changes, published content, speaking gigs, technology choices. This stuff tells you how to approach each person and what they actually care about.

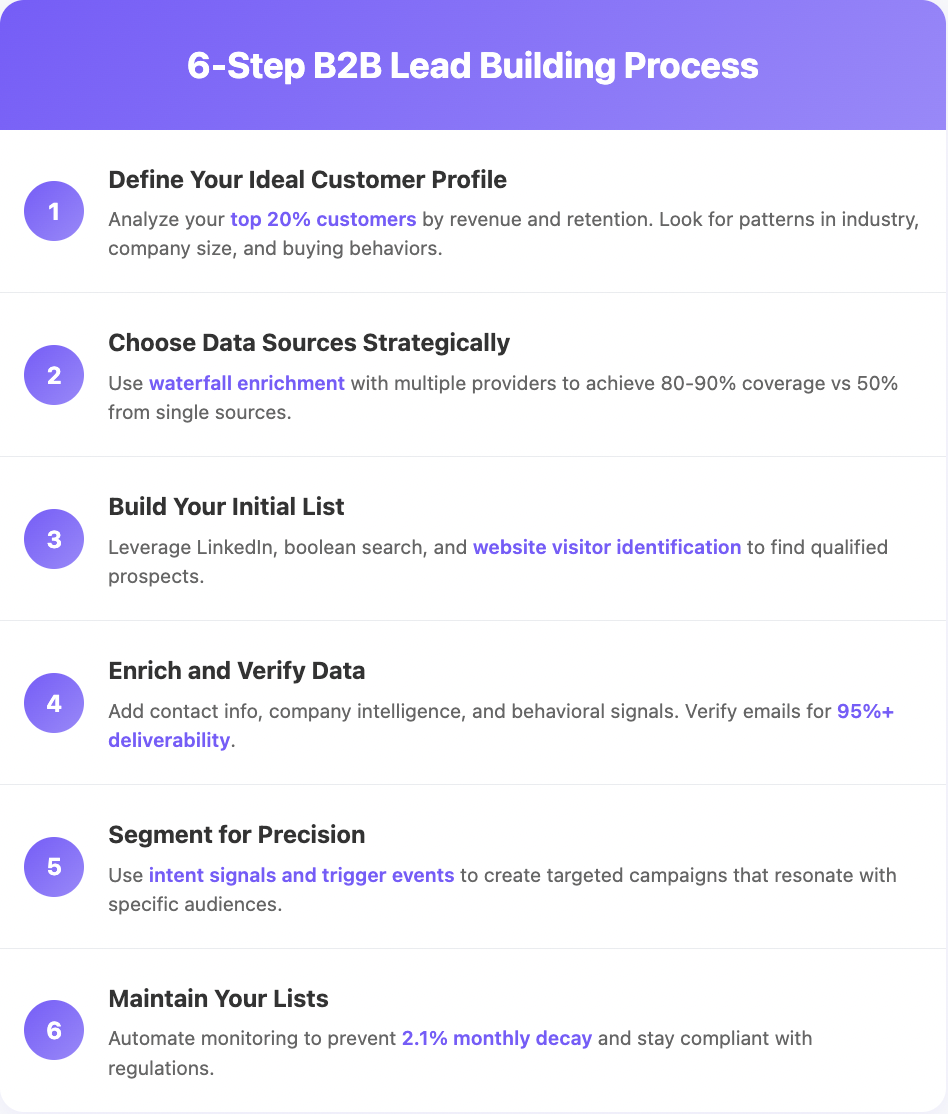

Step 1: Stop Guessing Who Your Customers Are

Your ideal customer profile isn't a wishlist of companies you'd love to work with. It's a data-driven blueprint based on customers who actually buy from you and stick around.

Most teams mess this up by being way too vague. "B2B SaaS companies" tells you nothing useful. But "Series B SaaS companies with 50-200 employees, using Salesforce, making $10-50M annually, headquartered in North America" - now that actually means something.

Same thing with individual targeting. "VP of Sales" is useless. But "VP of Sales hired in the last 18 months at companies with recent funding, posting on LinkedIn about sales process optimization" - that's someone worth calling.

Here's how to build this precision: Take your top 20% of customers by revenue and profit margins. Look for patterns in their industries, company sizes, tech stacks, and growth stages. Pay attention to buying behaviors - deal sizes, sales cycles, common objections.

This usually reveals surprising stuff. Maybe your best customers aren't the biggest companies but the fastest-growing ones. Maybe tech stack matters more than industry. These patterns become your targeting foundation.

Teams often discover that their sweet spot is specific and gain incredibly valuable insights.

Step 2: Why Single Data Sources Will Impact Your Results

Every data provider has blind spots. Some are terrible at finding phone numbers. Others miss significant portions of emails at small companies. Many have outdated technographic data.

The solution isn't finding the mythical "perfect provider" - it's using multiple sources strategically.

Start with your own data - the goldmine most companies completely ignore. Your website visitors are giving you free intelligence through their browsing behavior. Someone spending time on your pricing page is fundamentally different from someone reading blog posts.

Your CRM holds untapped potential too. Inactive leads might be worth re-engaging. Current customers could provide referrals. Even lost deals tell you which competitors you're losing to and why.

For third-party data, the magic happens when you layer sources. Waterfall enrichment using multiple providers can achieve 80%+ contact coverage compared to 40-50% from single sources. The first tool finds emails for maybe 50% of your targets. Add a second tool and you get another 20%. A third catches most of the rest.

This is called waterfall enrichment - start with one source, and if it doesn't find the data, automatically check the next provider. You only pay for successful finds. Databar.ai's waterfall enrichment automates this entire process across 10+ data sources.

Don't forget public data either. SEC filings reveal executive compensation and company strategies. Job postings show growth plans and pain points. Website technology footprints indicate sophistication levels.

Step 3: Build Your Initial List Without Going Broke

Sales Navigator has its place, but free LinkedIn search with proper boolean operators can build equally effective lists. Teams regularly build substantial contact databases using advanced search techniques.

The key is mastering boolean logic. A search like ("VP Sales" OR "Head of Sales" OR "Sales Director") AND ("SaaS" OR "Software") AND "Series B" AND "San Francisco Bay Area" surfaces highly targeted prospects without spending money on premium tools.

For broader prospecting strategies, explore our comprehensive guide to LinkedIn Sales Navigator alternatives.

LinkedIn groups are pure gold that most people ignore completely. Industry-specific groups attract engaged professionals who are often decision makers. Monitor who's actively contributing - they're revealing their priorities through their posts and comments.

But manual searching only gets you so far. Modern list building uses AI to spot patterns at scale. Databar.ai's AI research agent extracts thousands of profiles simultaneously, identifying signals that indicate relevance.

Website visitor identification turns anonymous traffic into named prospects. Tech recruitment agencies typically spend hours researching each prospect. After implementing visitor identification systems, many report cutting research time from hours to minutes while doubling email response rates.

The technology identifies companies visiting your site through IP addresses, tracks behavior that indicates buying intent, and triggers alerts for target accounts. Combined with progressive profiling using content gates, you build rich profiles of people who are actually interested.

Step 4: Turn Raw Data Into Sales Intelligence

Raw contact data is just the starting point. Having someone's name and email address tells you almost nothing about whether they're worth calling or how to approach them.

The real value comes from data enrichment that transforms basic information into actionable intelligence. Think about the difference between knowing "John Smith works at ABC Corp" versus "John Smith, VP of Sales at ABC Corp, recently hired after the company raised $10M Series B, currently evaluating new sales tools based on his LinkedIn activity."

That's the difference between data and intelligence.

Companies often hit walls trying to enrich contacts manually using multiple separate tools. You find an email in one platform, verify it in another, look up company details in a third, then try to piece everything together in a spreadsheet. After switching to integrated platforms like Databar.ai, many eliminate these manual handoffs and cut processing time from hours to minutes.

The enrichment process works in three connected layers:

Layer one provides the foundation - verified emails and phone numbers that actually work. Without this, everything else is pointless.

Layer two adds company context - size, revenue, technology stack, recent news. This tells you whether they fit your ICP and how to position your solution.

Layer three incorporates behavioral intelligence - intent signals, timing indicators, engagement patterns. This reveals when to reach out and what message will resonate.

Each layer builds on the previous one. You can't effectively use behavioral data if you don't have verified contact information. You can't craft relevant messaging without company context.

Email verification deserves special attention because it affects everything downstream. According to Return Path research, poor email deliverability costs B2B companies an average of $611 per employee annually. Bad emails don't just bounce - they destroy your sender reputation and can get your entire domain blacklisted.

Phone validation follows the same principle. Switchboard numbers are dead ends that waste your time, but direct dials connect to decision makers significantly more often. The validation process includes carrier verification to confirm line types, do-not-call registry checks for compliance, time zone mapping for appropriate outreach timing, and historical connection data to prioritize the most reliable numbers.

When all three layers work together, you turn a basic contact list into a strategic sales weapon. For comprehensive approaches to implementing this process, check out our guide on best B2B data enrichment tools.

Step 5: Segment Like Your Revenue Depends on It

Generic outreach is spam, regardless of how many people receive it. Effective segmentation transforms your database into targeted campaigns that actually resonate.

Behavioral segmentation crushes demographic targeting consistently. High-intent behaviors like multiple pricing page visits, documentation downloads, competitor comparison research, or ROI calculator usage indicate serious buyers. These people deserve immediate, personalized attention.

Trigger events create urgency and relevance. Recent funding means fresh budgets. New executive hires bring change mandates. Office expansions signal growth and potential system strain. Technology implementations reveal integration needs.

For advanced intent tracking strategies, explore Bombora alternatives that provide deeper behavioral insights.

Technographic intelligence provides the deep insights into prospect readiness. Understanding their tech stack shows whether they're early adopters or cautious implementers, whether they build custom solutions or buy enterprise platforms, whether they've embraced cloud technology or remain on-premise.

A company using Salesforce but lacking marketing automation is fundamentally different from one with a fully integrated stack. These gaps create opportunities.

Intent-based targeting catches prospects at the perfect moment. Research phase prospects consume educational content. Evaluation stage sees solution comparisons and review reading. Decision phase brings pricing page visits and demo requests.

When multiple signals converge - a prospect from a recently funded company visiting your pricing page while their competitor just became your customer - that's when you drop everything and call immediately.

Step 6: Keep Your Lists From Dying

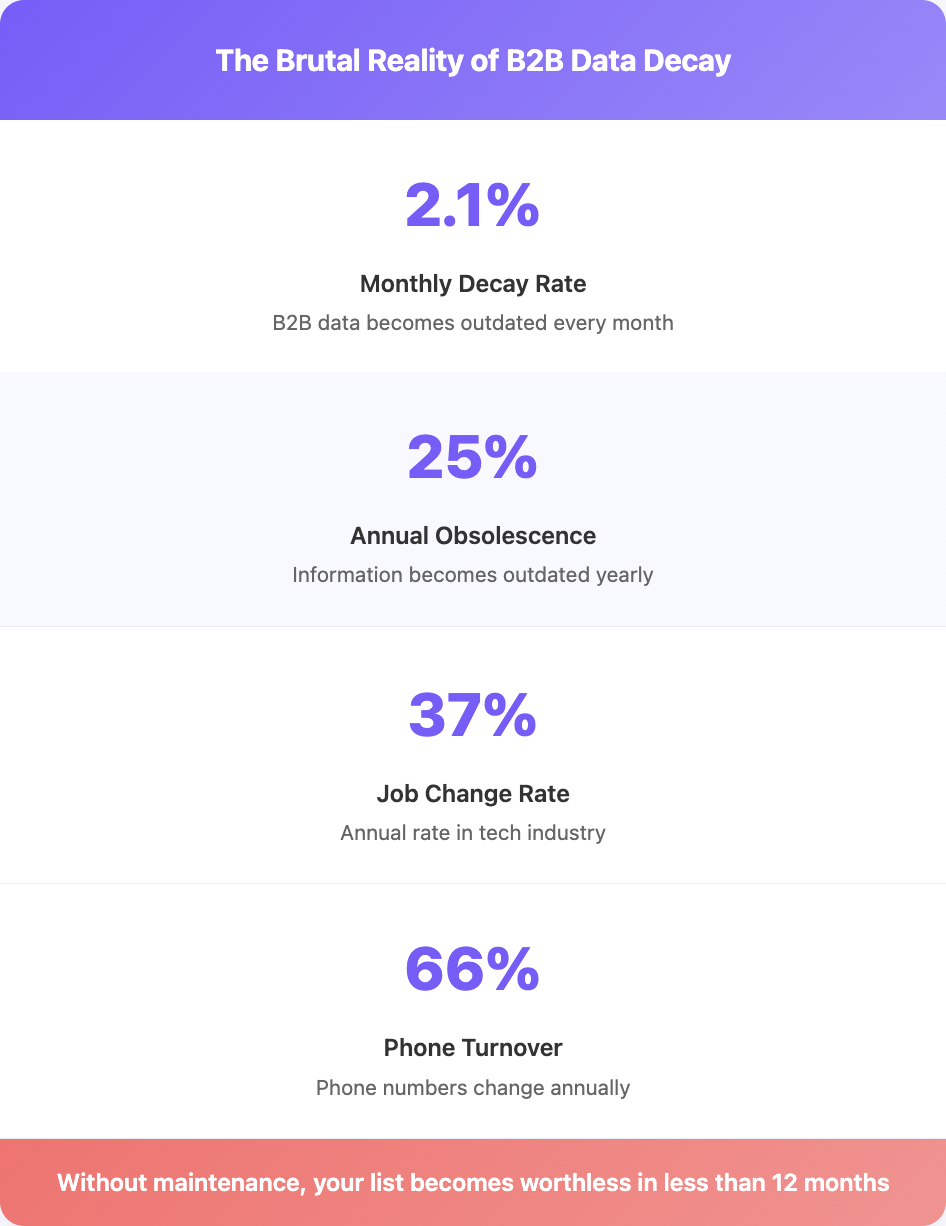

Your list starts deteriorating the moment you build it. Contact information changes constantly - people switch jobs, companies get acquired, email addresses die.

According to industry research, B2B contact data decays at approximately 2% monthly, meaning nearly 25% of your list becomes outdated annually. Without maintenance, you're building on quicksand.

Email verification needs monthly attention minimum. Contact information should refresh quarterly. Company data might last six months.

Effective maintenance systems track email bounces automatically, monitor job changes through LinkedIn, capture company updates like mergers and acquisitions, and flag technology stack changes that create new opportunities.

Compliance monitoring prevents catastrophic fines. Companies across Europe have faced substantial GDPR penalties for poor list management, even when their data came from "compliant" vendors. The buying company always pays the fine, not the data provider.

Databar.ai's automated monitoring handles opt-out synchronization, enforces geographic restrictions, tracks consent expiration, and documents all processing activities.

Advanced Strategies That Separate Winners from Losers

Once you master the basics, advanced strategies create real competitive advantages.

Competitor customer targeting identifies prospects already educated about your solution category. Mine competitor case studies for target accounts. Analyze review sites like G2 and Capterra for dissatisfied users. Scan websites for technology announcements mentioning competitors.

Job change monitoring unlocks fresh opportunities. New executives bring priorities and budgets from day one. The first 30-60 days offer maximum receptivity to new ideas. Former customer champions moving to new companies provide warm introductions.

Strategic timing multiplies everything. A prospect who ignored you last quarter might desperately need you today after their competitor launched a disruptive product, their legacy system announced end-of-life, or new regulations required compliance changes.

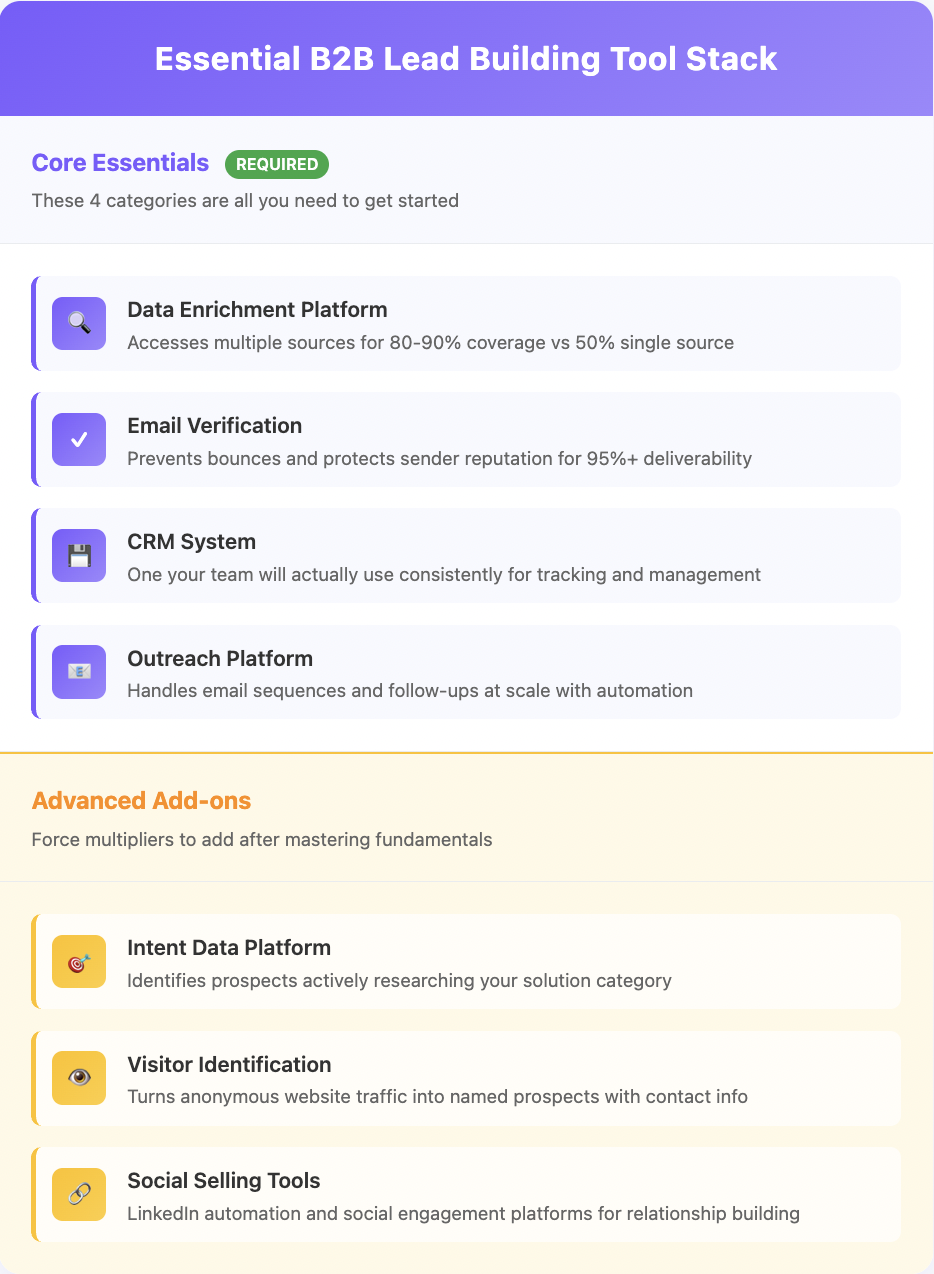

Building Your Tool Stack Without the Bloat

Sales teams with too many prospecting platforms often get worse results than SDRs using just a few core tools. Tool addiction kills more pipelines than bad messaging.

Your essential stack comes down to four categories:

A data enrichment platform that accesses multiple sources - Databar.ai excels here by integrating 90+ providers. Email verification that actually works and protects sender reputation. A CRM your team will consistently use. An outreach platform that handles sequences at scale.

Everything else - intent data platforms, visitor identification, social selling tools - can transform results but only after mastering fundamentals. They're force multipliers, not foundational elements.

For comprehensive guidance on building effective sales technology, explore our analysis of top prospecting tools for 2025.

Add sophistication gradually as your process matures. Perfect execution with basic tools beats mediocre execution with premium platforms every time.

Your Next Steps (Don't Overthink This)

Your competitors are still buying unverified contact lists and wondering why their emails bounce. While they're handing bounced emails, you'll be having conversations with actual buyers who have real budgets.

Start simple:

- 1: Define your ICP using your best customers as the blueprint

- 2: Set up data sources and build your first 500-person list

- 3: Enrich and verify everything before sending a single email

- 4: Launch targeted campaigns and measure what actually matters

The difference between having a contact database and having a revenue machine comes down to execution. Start focused, measure results, and scale what works.

Ready to build lists that convert? Explore how Databar.ai's integrated data providers can deliver the coverage and quality your sales team needs.

Frequently Asked Questions

How many contacts should I start with for my first B2B list?

Quality beats quantity every single time. Start with 500-1,000 highly qualified prospects rather than 10,000 random contacts. You can always scale up once you've validated your targeting and messaging. Teams often close more deals with 200 perfect-fit prospects than competitors using 10,000 generic contacts.

What should I budget for effective B2B list building?

Plan $0.50-$1.50 per fully enriched, verified contact depending on your industry and requirements. A typical SDR needs 1,000-2,000 fresh contacts monthly. Factor in platform subscriptions and expect significant ROI when executed properly. The investment pays for itself through improved conversion rates.

How often do I need to update my lead lists?

Email verification needs monthly attention minimum. Contact information should refresh quarterly. Company data might last six months. Set up automated systems - manual updates don't scale past 1,000 contacts. Fresh data dramatically outperforms stale lists in every metric that matters.

Which data source gives the best ROI?

No single source dominates all scenarios. Top performers use waterfall enrichment combining multiple sources. Different providers excel at different data types and company segments. The combination delivers much higher coverage than any single source.

Should I build lists internally or buy from vendors?

Use both approaches strategically. Buy foundational data from proven providers like Databar.ai, then enrich with proprietary intelligence from your website visitors and first-party data. Pure list purchasing gives you the same data as competitors. Pure internal building doesn't scale efficiently.

What indicates high-quality B2B data?

Look for verification timestamps within 30 days, multiple data points per contact, transparent source attribution, and deliverability guarantees. Be skeptical of providers claiming unrealistic accuracy rates - legitimate providers acknowledge that perfect data doesn't exist.

Related articles

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026