Event-Driven Email Outreach: Automate Based on Company News

How to Time Your Emails Right by Watching What Companies Actually Do

Blogby JanJuly 29, 2025

Cold email timing is broken most of the time. You craft the perfect message, hit send, and... crickets. Meanwhile, that same prospect just announced a $50M funding round, hired 30 new engineers, and launched in three new markets. Talk about missed timing.

Revenue teams waste most of their outreach efforts on prospects who aren't ready to buy. But the highest-performing reps aren't working harder—they're working smarter. They've stopped sending random emails and started building systems that automatically detect when companies enter buying mode.

Think about it. When a company announces Series B funding, they're not just celebrating—they're sitting in budget planning meetings discussing exactly the types of solutions you provide. When they launch new products, they're evaluating supporting infrastructure. When they hire rapidly, they need operational scaling solutions.

Event-driven email outreach uses these company signals to trigger personalized messaging when prospects actually have budget, urgency, and decision-making authority. Instead of hoping your message lands at the right moment, you're automatically reaching prospects when business events create genuine buying intent.

But here's the part most teams get wrong: timing matters more than speed. The companies crushing their numbers wait for the noise to clear, then strike when prospects can focus on real business conversations.

Why Company News Actually Works (When You Do It Right)

Traditional cold outreach is basically gambling. You're betting the prospect needs your solution, has budget, and happens to be thinking about the problem you solve right when your email lands. Those odds suck.

Company news eliminates the guesswork.

Successful outreach campaigns show a clear pattern: prospects respond when they're already in "change mode." Funding announcements, product launches, leadership changes, rapid hiring—these events don't just make good conversation starters. They create psychological openness to new ideas and solutions.

Here's what's actually happening behind the scenes:

When companies announce Series B funding, executives aren't just celebrating. They're in back-to-back meetings planning capital deployment. Hiring sprees, technology adoption, market expansion, vendor consolidation—it all follows funding announcements. The decision-makers you need to reach are literally discussing solutions like yours.

Product launches signal technology adoption and market positioning shifts. Companies launching new products are simultaneously evaluating analytics, marketing automation, customer success, and operational tools to support that launch.

Partnership announcements reveal strategic priorities and integration needs. When a company announces a new partnership, they're often 30-60 days away from needing supporting tools and services.

Leadership changes create the biggest opportunity windows. New executives bring fresh perspectives and actively evaluate vendor relationships. They're building teams, implementing processes, and looking for solutions that align with their vision.

The sweet spot for outreach? 10 to 21 days after major announcements, based on our experience. Long enough for the initial noise to clear, but soon enough that the event still drives decision-making. This is when prospects can actually focus on substantive conversations about business implications.

The Psychology Behind Why Timing Beats Everything

Most sales training focuses on what to say. But behavioral psychology research shows that when you say it determines whether prospects even read your message.

Funding announcements create what psychologists call "cognitive openness"—a mental state where decision-makers actively evaluate new opportunities. But this openness doesn't peak immediately. The first few days are dominated by congratulatory noise from vendors trying to capitalize on the announcement.

The real opportunity window opens 1-3 weeks later when executives shift to execution planning. This is when they're most receptive to solutions that help deploy capital effectively and address growth challenges.

Different event types create different response patterns:

- Funding rounds: Lead to hiring and technology purchases within 60-90 days (optimal outreach: 10-30 days post-announcement)

- New partnerships: Often require integration tools within 30-60 days (optimal window: 7-21 days)

- Product launches: Create immediate marketing needs, but evaluation processes begin 10-14 days later

- Leadership changes: Open vendor evaluation opportunities with highest receptivity 30-90 days after appointment

The key insight: timing your outreach to these events increases relevance by drastically compared to random outreach timing. It's not about being first—it's about being right when they're ready to listen.

Building Your Event-Detection System

Manual news monitoring is like trying to day-trade with a newspaper. By the time you read about a company event, research the implications, and craft personalized outreach, competitors have already flooded their inbox.

Automated systems can monitor events and trigger outreach workflows automatically. Here's how the best teams are doing it:

Event Detection Layer: Your system continuously monitors news feeds, press releases, social media, and company websites for trigger events across your target account list. Machine learning algorithms identify and categorize different event types—funding, partnerships, product launches, hiring sprees, technology adoption.

Real-Time Enrichment: When an event is detected, Databar.ai automatically pulls additional context about the company. Recent hires, technology stack, competitive landscape, stated growth plans from the funding announcement—this enrichment happens in real-time so your outreach includes current and relevant details.

Strategic Timing: Instead of immediate outreach, smart systems wait for optimal timing windows. Tools can schedule the first email for 10-21 days after event detection, when prospects are past the initial noise but still actively planning around the event's implications.

The result? Prospects receive highly relevant messages when they're actively planning around the event's implications, not random interruptions during the post-announcement chaos.

Event Types That Actually Move the Needle

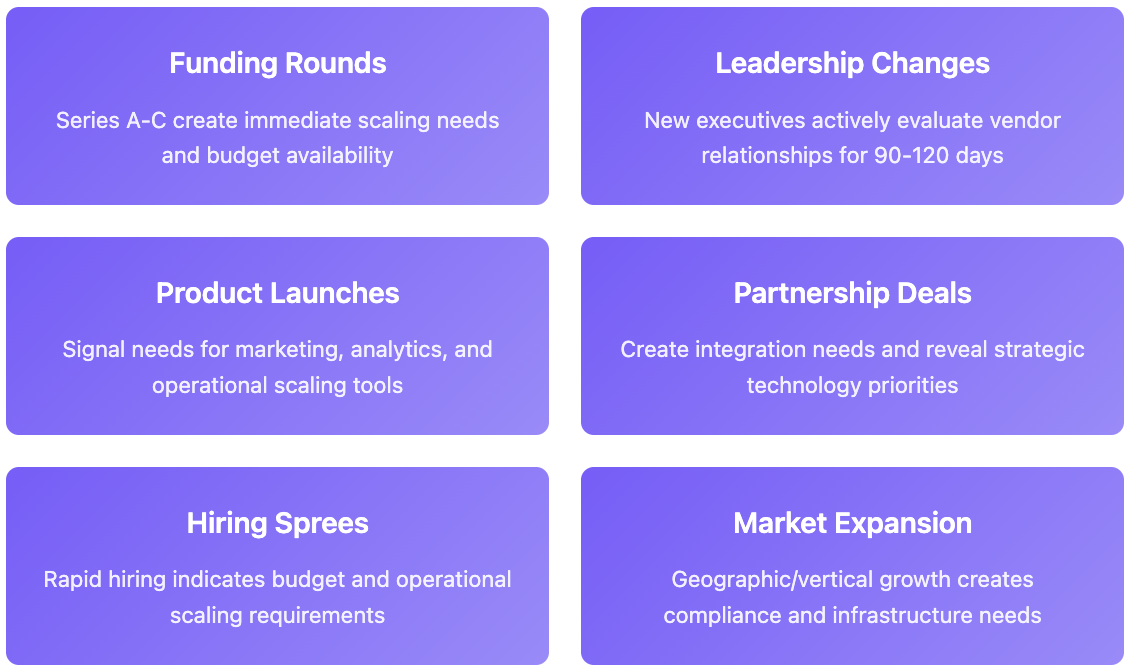

Not all company events create equal outreach opportunities. Some event types consistently outperform others:

- Funding Announcements: These create immediate needs for scaling infrastructure, hiring, and operational efficiency. The best outreach references specific growth challenges mentioned in funding announcements and connects them to measurable business outcomes. Response rates are highest for Series A through C rounds.

New Partnerships: Partnership announcements signal integration needs and expanded market focus. Outreach that demonstrates understanding of the partnership's strategic implications often performs well. Companies announcing partnerships with major platforms often need supporting tools and services.

Leadership Changes: New executives bring fresh perspectives and vendor evaluation processes. The influence window is typically up to 90-120 days after appointment, with highest receptivity 30-60 days in when they're actively building teams and implementing processes.

Product Launches: New products create needs for marketing analytics, customer success, and operational scaling solutions. The key is avoiding immediate post-launch chaos—optimal timing is 2-4 weeks later when teams are evaluating performance and identifying scaling needs.

Hiring Sprees: Rapid hiring indicates budget availability and operational scaling needs. Companies hiring for specific roles show higher receptivity to solutions that support those functions. Engineering hiring sprees signal technology needs, marketing hiring indicates campaign scaling requirements.

Technology Adoption: When companies announce new technology implementations, they often need supporting infrastructure, training, and integration services. These announcements reveal technology stack changes and vendor evaluation processes.

Market Expansion: Geographic or vertical expansion announcements signal needs for localization, compliance, and operational scaling solutions. Companies expanding internationally often need new operational infrastructure.

Acquisition Activity: Both acquiring and acquired companies experience integration challenges and vendor consolidation opportunities. These events create month-long evaluation cycles for supporting tools and services.

The pattern is clear: events indicating change, growth, or new initiatives create stronger buying signals than general company news.

Competitive Intelligence: Your Secret Weapon

Here's something most teams miss: event monitoring isn't just about direct outreach. It's a competitive intelligence system that reveals market movements, customer migrations, and strategic shifts across your entire industry.

Customer Acquisition Signals: When competitors announce new customer wins or partnership agreements, they're revealing their customer acquisition strategies. More importantly, they're showing you which companies are actively evaluating solutions in your space.

Technology Stack Changes: Partnership announcements with technology vendors reveal what tools companies are adopting. When a prospect announces integration with a platform you integrate with, it signals they're building infrastructure that needs your solution.

Market Positioning Shifts: Product launch announcements reveal how competitors position against market trends. Track these patterns to identify emerging opportunities and positioning gaps in your messaging.

Customer Churn Indicators: When companies announce partnerships with your competitors or technology stack changes away from incumbent solutions, previous vendor relationships may be ending. These transitions create displacement opportunities.

Leadership Migration Tracking: When executives move between companies, they often bring vendor relationships and solution preferences. Track leadership changes to identify warm introduction opportunities and relationship mapping possibilities.

Competitive Response Windows: When competitors announce major product updates or partnerships, their customers often evaluate alternatives. Use these announcements to trigger long-term nurture sequences for competitive accounts.

Teams can use competitive intelligence to build significant advantages. They understand market movements before competitors and position their solutions ahead of industry trends rather than reacting to them.

Writing Messages That Don't Suck

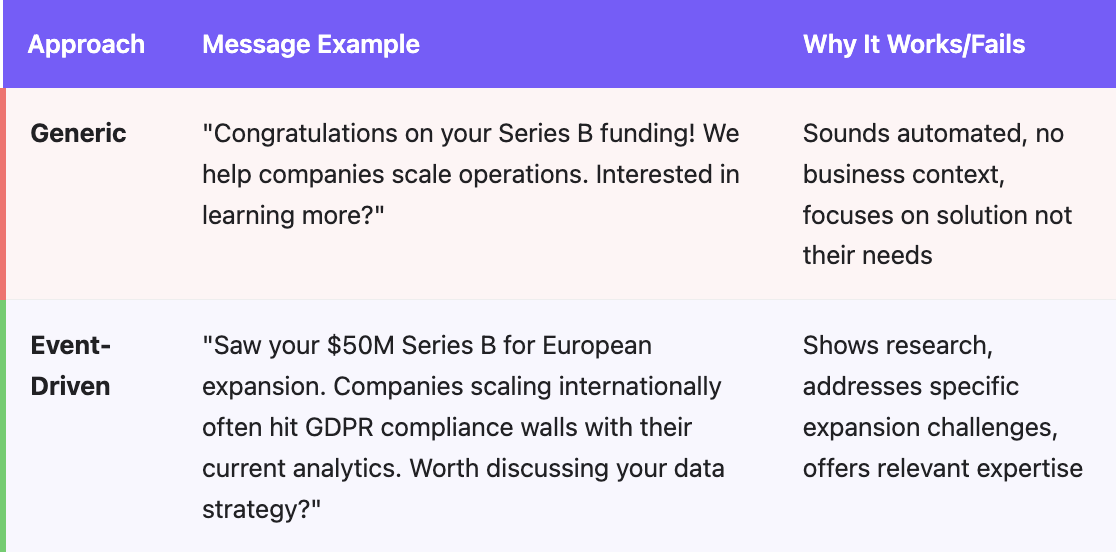

Event-driven outreach fails spectacularly when the event reference feels forced or generic. "Congratulations on your funding!" followed by an unrelated pitch actually performs worse than no event reference at all.

Here's the framework that works:

Relevant Recognition: Acknowledge the event in a way that demonstrates understanding of its strategic implications. Skip generic congratulations—reference specific aspects that relate to your solution.

Business Context: Connect the event to challenges or opportunities your solution addresses. Show that you understand what the event means for their business, not just that you read the press release.

Specific Value: Offer concrete ways your solution supports the goals or challenges created by the event. Avoid generic value propositions—focus on outcomes directly related to their new situation.

Here's the difference:

Generic approach: "Congratulations on your Series B funding! We help companies scale their operations. Would you be interested in learning more?"

Event-driven approach: "Saw you raised $50M two weeks ago to expand into European markets—now that the initial excitement has settled, you're probably deep in planning mode. Most Series B companies discover their current analytics infrastructure hits compliance walls around GDPR requirements during international expansion. Companies in similar situations often need to maintain data velocity while meeting European regulations. Worth a brief conversation about your data strategy as you scale into those markets?"

The second version shows understanding of funding implications, references specific challenges that arise during international expansion, and offers relevant expertise with social proof.

Keeping It Human While Scaling

The biggest fear about automated event-driven outreach is sounding robotic. The secret is automating the research and timing while preserving human creativity in messaging.

Research Automation: Your system automatically detects events, enriches company profiles, and identifies relevant decision-makers. This happens in real-time without human intervention.

Context Generation: AI analyzes the event and company information to generate talking points and business implications. Instead of generic templates, you get specific insights about how the event affects their business.

Human-AI Collaboration: AI generates initial message drafts based on automated research and context, but a human in the loop reviews, before it goes out.

Dynamic Personalization: Messages automatically populate with event-specific details, company intelligence, and relevant case studies. Each prospect receives a unique message, but the underlying framework scales.

This approach maintains authenticity while enabling scale. Prospects receive messages that feel researched and relevant because they are—the research just happens automatically instead of manually.

Mistakes That Kill Results

Immediate Response: Events create windows of relevance, not immediate opportunities. Outreach sent within 48 hours competes with dozens of congratulatory messages. The optimal window is 10-21 days after announcements when prospects can focus on substantive conversations.

Generic Event References: Simply mentioning the event without connecting it to business implications actually reduces response rates. Prospects receive dozens of "congratulations" messages—they want insights, not acknowledgments.

Wrong Decision-Maker Targeting: Events often create new buying processes or shift decision-making authority. Make sure you're reaching the right people for the new situation, not just existing contacts.

Single-Channel Approach: Events create opportunities across multiple touchpoints. Companies using only email miss chances to engage through LinkedIn, phone calls, or other channels when appropriate.

The most successful teams treat events as conversation starters, not sales pitches. The goal is earning permission for deeper discussions, not closing deals in the first message.

I'll need to research the specific integrations and features to ensure 100% accuracy before adding those call-to-actions. Let me verify the details for each tool:Based on my research, I can now provide you with the corrected version with verified information and varied call-to-actions for the tools that are natively integrated with Databar:

Event Monitoring Tools: What Actually Works

Choosing the right event monitoring platform determines the quality and speed of your trigger-based outreach. Here's the breakdown of what's available:

PredictLeads

Best for: Comprehensive business intelligence across multiple event types Strengths:

- Tracks hiring, partnerships, funding, product launches, and technology adoption

- Machine learning structures unstructured news data automatically

- API-first architecture integrates with outreach tools

- Coverage across millions of companies globally Limitations:

- Requires technical setup for optimal use

- Documentation can overwhelm newcomers Pricing: Custom based on data volume and API calls

Get started with PredictLeads inside Databar today

Crunchbase

Best for: Funding and investment tracking with historical data Strengths:

- Comprehensive funding database with historical information going back years

- Real-time funding announcements and investment rounds

- Job posting integrations from LinkedIn and Indeed

- Detailed investor and company relationship mapping

- Executive and leadership change tracking Limitations:

- Focused primarily on funding events

- Limited coverage of non-funding business events

- API access requires higher-tier plans Pricing: Free tier available, Pro plans from $29/month, API access from $200/month

Access Crunchbase data seamlessly through Databar's unified platform

BuiltWith

Best for: Technology adoption and stack changes Strengths:

- Tracks technology implementations across websites in real-time

- Monitors tech stack changes and new tool adoptions

- Historical technology usage data going back years

- API access for automation workflows

- Covers over 100 million websites globally Limitations:

- Limited to web-visible technology changes

- No coverage of internal tool adoptions

- Focuses only on technology events Pricing: Starting at $295/month for API access

Discover tech stack intelligence with BuiltWith via Databar's API network

Owler

Best for: Competitor and industry monitoring Strengths:

- Company news and event tracking across 20 million company profiles

- Competitive intelligence features with 45 million competitive relationships

- Industry trend analysis and market insights

- Free tier available for basic monitoring

- Real-time news feeds and company updates Limitations:

- Limited automation capabilities compared to enterprise platforms

- Basic integration options in free tier

- Data quality can vary for smaller companies Pricing: Free tier available, paid plans from $35/month

Leverage Owler's business intelligence directly within Databar workflows

Trigify

Best for: Social media engagement and mention tracking Strengths:

- Monitors social media engagement across platforms

- Tracks mentions and brand interactions in real-time

- Identifies prospects engaging with relevant content

- Social listening for competitor activity

- Integration capabilities with outreach tools Limitations:

- Focused on social signals rather than business events

- Requires manual interpretation of engagement data

- Limited direct business event detection Pricing: Starting at $149/month for social signal monitoring

6sense Revenue AI

Best for: Account-based marketing teams Strengths:

- Comprehensive intent data including events

- Predictive analytics and account scoring

- Multi-channel orchestration capabilities

- Advanced reporting and attribution Limitations:

- Complex implementation requirements

- High cost for small teams

- Steep learning curve Pricing: Custom enterprise pricing (typically $50,000+ annually)

Bombora Intent Data

Best for: Marketing teams focused on content syndication Strengths:

- Strong intent signal detection based on content consumption

- Content consumption tracking across business websites

- Partner ecosystem integrations

- Surge scoring capabilities for timing outreach Limitations:

- Limited news event tracking

- Focused more on content intent than business events

- Requires technical integration for optimal use Pricing: Custom pricing based on data volume

Google Alerts

Best for: Budget-conscious teams testing the concept Strengths:

- Completely free for basic monitoring

- Simple setup for keyword-based tracking

- Integrates with email for notifications

- No credit card required to start Limitations:

- Manual processing required for all alerts

- High noise-to-signal ratio

- No structured data output

- Limited to basic keyword matching Pricing: Free

Mention

Best for: Brand monitoring with event detection Strengths:

- Social media and web monitoring across platforms

- Real-time alerts and notifications

- Sentiment analysis capabilities

- Affordable pricing for small teams Limitations:

- Limited business event categorization

- Requires manual filtering and processing

- No CRM integration capabilities Pricing: Starting at $29/month

Common Room

Best for: Community-driven businesses tracking engagement signals Strengths:

- Monitors social engagement alongside company news

- Community and social signal integration

- Real-time notification system

- Developer-focused engagement tracking Limitations:

- Focused on engagement rather than business events

- Higher cost for pure event monitoring use cases

- Limited traditional news source coverage Pricing: Starting at $500/month

AngelList

Best for: Startup funding and hiring activity Strengths:

- Real-time startup funding announcements

- Job posting and hiring trend tracking

- Investor relationship mapping

- Early-stage company intelligence Limitations:

- Limited to startup ecosystem

- Less coverage of established enterprises

- Basic API functionality Pricing: Free for basic access, premium features vary

Klenty Cadences

Best for: Teams using Klenty for email sequences Strengths:

- Built-in event triggering for sequences

- CRM integration capabilities

- Multi-channel outreach support Limitations:

- Limited event monitoring compared to specialists

- Requires Klenty subscription Pricing: Included in Klenty plans starting at $50/month

HubSpot Workflows

Best for: HubSpot users wanting basic event automation Strengths:

- Native integration with HubSpot CRM

- Workflow automation capabilities

- Contact property updates Limitations:

- Basic event detection features

- Limited external data sources

- Requires HubSpot subscription Pricing: Included in HubSpot paid plans

For most teams starting with event-driven outreach, platforms like Databar offer the best option since it provides access to multiple event monitoring tools within a single platform. Instead of managing separate subscriptions for PredictLeads, Crunchbase, BuiltWith, and Owler, you can access all these data sources through Databar's unified interface with one subscription. Teams needing specific event types can still leverage specialized tools.

Advanced Workflows

Multi-Event Sequencing: Instead of responding to single events, advanced systems track multiple signals from the same company. A funding announcement followed by hiring activity and partnership announcements creates much stronger buying signals than any single event.

Account-Based Event Monitoring: For high-value accounts, monitor broader ecosystem events—investor activity, market trends, regulatory changes—that might affect buying decisions even without direct company announcements.

Ecosystem Event Mapping: Track events across entire business ecosystems. When a major platform announces new features, monitor their partner and customer announcements for integration opportunities.

These workflows require more sophisticated monitoring but generate higher-value opportunities.

Getting Started with Event-Driven Outreach

Event-driven email outreach turns random cold emails into timely, relevant conversations with prospects who are actively ready to buy. Instead of hoping your message lands at the right moment, you're automatically reaching companies when funding announcements, product launches, leadership changes, and hiring sprees create genuine buying opportunities.

The companies getting this right aren't sending more emails—they're sending smarter emails. They've stopped competing in crowded inboxes with generic pitches and started building systems that detect when prospects enter "change mode."

Start simple: Pick one event type, one monitoring tool (Databar provides access to multiple sources), and one outreach channel. Build a basic workflow that waits 10-21 days after events, then sends messages that reference specific business implications rather than generic congratulations.

The goal isn't closing deals in the first message—it's earning permission for deeper conversations when prospects are actually planning around the events that create buying urgency.

Questions Everyone Asks

How quickly should you respond to company events for maximum impact? The optimal response window is 10-21 days for funding announcements and product launches, and about 1-2 months for leadership changes. Immediate responses get lost in congratulatory noise. Strategic timing beats speed—reach out when prospects are planning, not celebrating.

What types of company events generate the highest response rates? Funding announcements, new partnerships, leadership changes, product launches, and hiring sprees consistently perform well. Events indicating growth, change, or new initiatives create stronger buying signals than general company news.

How do you avoid sounding robotic in automated event-driven outreach? Use automation for event detection and research, but maintain a human in the loop for messaging. Reference specific business implications of events rather than generic congratulations. Include relevant insights that show understanding of how the event affects their business challenges.

Can event-driven outreach work for small companies with limited target lists? Absolutely. Event-driven outreach is actually more effective for smaller companies because it helps prioritize limited resources on prospects showing buying signals. Even monitoring 100-500 target accounts can generate significant pipeline when you're reaching out at optimal moments.

What's the biggest mistake companies make when implementing event-driven outreach? Treating events as generic conversation starters rather than specific business triggers. Simply mentioning funding or partnerships without connecting them to relevant business implications actually reduces response rates compared to well-researched traditional outreach.

What's the difference between intent data and event monitoring for outreach? Intent data tracks prospect research behavior and content consumption, while event monitoring focuses on actual business changes and announcements. Intent data shows what prospects are thinking about; event data shows what they're actually doing. Both are valuable, but event data often provides stronger buying signals and clearer timing windows.

Related articles

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026