Domain Lookup Tools: Advanced Website Intelligence Beyond Basic WHOIS

Discover Competitor Insights and Business Intelligence Through Strategic Domain Analysis

Blogby JanAugust 08, 2025

Most people think domain lookup tools are just for checking who owns a website. That's like using a smartphone only to make phone calls—you're missing 90% of the value.

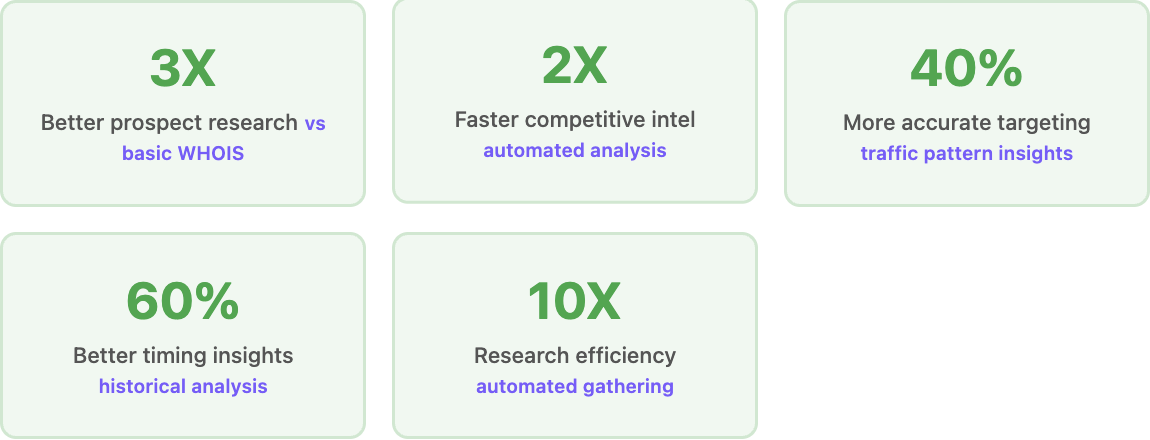

Industry research consistently shows that teams using advanced domain analysis generate more qualified leads than those relying on basic WHOIS lookups. They're not just finding contact information—they're uncovering business intelligence that changes how they research prospects, analyze competitors, and identify opportunities.

The difference isn't the tools themselves. Most domain lookup platforms offer similar basic functionality. The difference is understanding what domain data actually reveals about businesses and how to use that intelligence strategically.

Beyond WHOIS: What Domain Data Actually Tells You

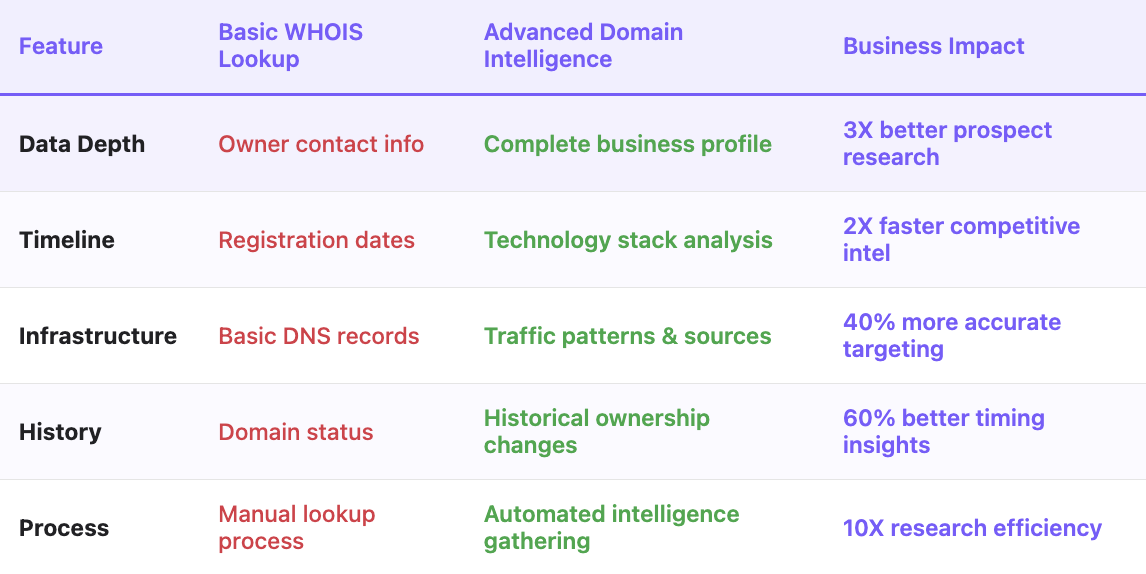

Traditional WHOIS lookups give you the basics: who registered a domain, when it was created, and when it expires. That's useful information, but it's just the surface layer of what domain analysis can reveal.

Company Lifecycle and Growth Signals

Domain registration patterns tell stories about business priorities and growth phases. A company that registers dozens of domains around their brand name is probably preparing for expansion or protecting their intellectual property. Recent registrations of product-specific domains often signal new launches or market entries.

Domain age provides context for business maturity. A 15-year-old domain suggests an established company, while domains registered in the last year might indicate startups or new initiatives from larger companies.

Technology Infrastructure and Priorities

DNS records reveal the technology choices companies make, which tells you about their priorities, budget, and technical sophistication. Companies using premium CDN services like Cloudflare or AWS are probably focused on performance and scale. Those using basic shared hosting might be smaller or more budget-conscious.

Email routing information shows whether companies use professional email services, which third-party tools they integrate with, and how seriously they take their digital infrastructure.

Security Posture and Compliance

Security-related DNS records indicate how seriously companies take cybersecurity. Proper SPF, DKIM, and DMARC configurations suggest mature IT operations. Certificate transparency logs show SSL certificate management practices.

These technical details matter because they reflect organizational priorities and maturity—valuable intelligence when you're evaluating prospects or competitors.

Historical Changes and Strategic Shifts

Domain history reveals strategic changes over time. Companies that recently moved from budget hosting to enterprise infrastructure might be scaling up. Changes in email routing could indicate new tool adoptions or organizational restructuring.

Historical DNS records are like archaeological layers that show how companies have evolved, what technologies they've adopted, and when significant changes occurred.

Strategic Applications: How Smart Teams Use Domain Intelligence

The most successful sales and marketing teams have moved beyond basic domain lookups to strategic domain intelligence. They're using this data to make better decisions about prospects, competitors, and market opportunities.

Advanced Prospect Research and Qualification

Instead of just looking up contact information, advanced teams use domain data to assess prospect quality and readiness. A prospect whose company just upgraded their entire technology infrastructure might be more open to new solutions. Companies with mature domain configurations often have budget and decision-making processes that support larger purchases.

Domain data helps prioritize outreach efforts. Companies showing growth signals through domain activity get higher priority than those with static configurations that haven't changed in years.

Competitive Intelligence and Market Analysis

Smart teams monitor competitor domain activities to identify new products, market expansions, and strategic initiatives before they're publicly announced. New domain registrations often precede product launches by months.

Technology changes revealed through DNS analysis show when competitors adopt new tools or change strategic direction. This intelligence helps teams anticipate competitive moves and adjust their own strategies accordingly.

Market Timing and Opportunity Identification

Domain intelligence reveals market timing opportunities that most teams miss. Companies undergoing technology migrations are often evaluating multiple solutions simultaneously. Recent infrastructure upgrades might indicate budget availability and decision-making momentum.

Industry analysis through domain patterns helps identify market trends and emerging opportunities. When multiple companies in a sector start adopting similar technologies or infrastructure changes, it often signals broader market shifts worth investigating.

Account-Based Marketing and Sales Strategy

For account-based strategies, domain intelligence provides the context needed for personalized, relevant outreach. Understanding a prospect's technology choices, infrastructure maturity, and recent changes enables messaging that demonstrates genuine understanding of their business.

Historical domain data helps sales teams understand decision-making timelines and identify the best moments for engagement based on past behavior patterns.

How Databar Connects Domain Intelligence with Business Insights

Traditional domain lookup tools force you to manually research each domain individually and piece together insights from fragmented data sources. Databar approaches domain intelligence differently—as part of comprehensive business research that connects domain data with other business intelligence.

Automated Domain Analysis at Scale

Instead of manually looking up domains one by one, Databar's platform automatically analyzes domain information as part of broader prospect research workflows. When you're researching a company, the system automatically gathers domain intelligence alongside firmographic data, technology stack information, and business signals.

This automated approach means you get comprehensive domain insights without additional research time. The platform analyzes primary domains, subdomains, and related properties to build complete pictures of companies' digital footprints.

This capability represents the evolution from traditional manual research to the comprehensive web scraping tools that actually deliver results in modern business intelligence.

Connected Intelligence Across Data Sources

Databar connects domain intelligence with other business data to provide context that standalone domain tools can't offer. Technology infrastructure choices get analyzed alongside company size and industry to assess fit and maturity.

This connected approach reveals insights that isolated domain analysis misses. For example, a small company with enterprise-grade infrastructure might indicate high growth potential or significant technical requirements.

This multi-source intelligence approach is fundamental to best B2B data enrichment tools in 2025 that combine multiple data streams for comprehensive business intelligence.

Integrated Workflow Example: Complete Prospect Research

Here's how domain intelligence integrates into comprehensive prospect research using Databar:

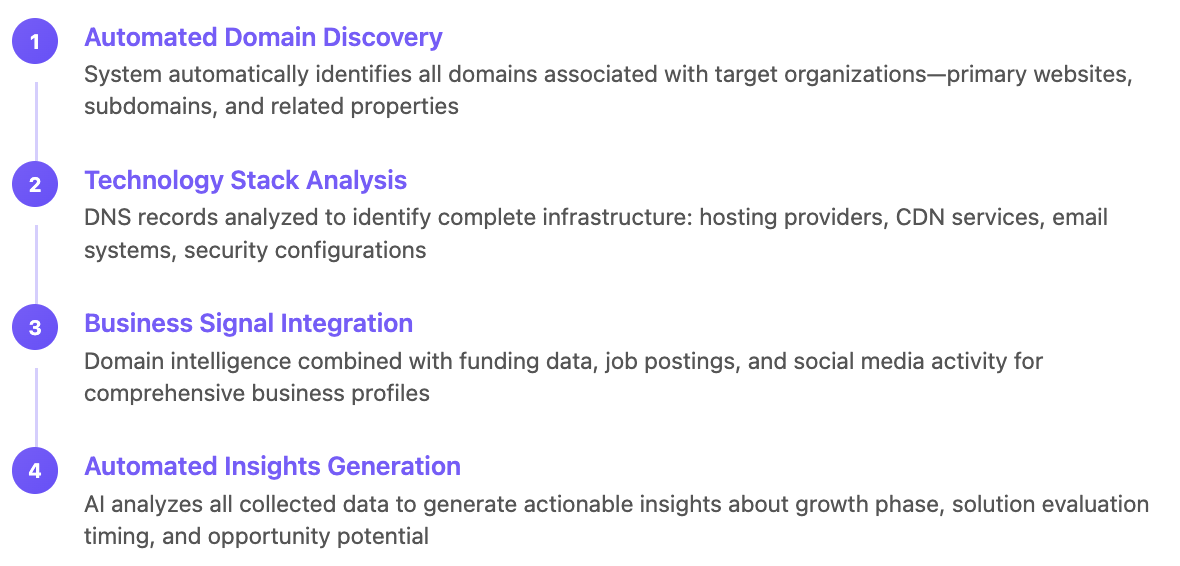

Step 1: Automated Domain Discovery

When researching a target company, the system automatically identifies all domains associated with the organization—not just the primary website, but subdomains, alternative domains, and related properties.

Step 2: Technology Stack Analysis

DNS records get analyzed to identify the complete technology infrastructure, from hosting providers and CDN services to email systems and security configurations. This information gets contextualized with company size and industry data.

Step 3: Business Signal Integration

Domain intelligence gets combined with funding data, job posting information, and social media activity to create comprehensive business profiles that guide qualification and prioritization decisions.

This integration approach is essential for building the kind of comprehensive prospect intelligence that CRM enrichment tools that move the revenue needle provide for modern sales teams.

Step 4: Automated Insights Generation

AI analyzes all collected domain and business data to generate actionable insights: Is this company in a growth phase? Are they likely evaluating new solutions? What technology migrations might create opportunities?

This integrated approach delivers domain intelligence that directly supports business decisions rather than just providing technical information.

Advanced Domain Analysis Techniques

Beyond basic domain lookups, there are sophisticated analysis techniques that reveal deeper business intelligence. These approaches require tools and methodologies that go far beyond traditional WHOIS queries.

Subdomain Discovery and Analysis

Most companies have extensive subdomain structures that reveal internal organization, product lines, and business priorities. A company with dozens of product-specific subdomains is likely managing multiple offerings. Staging and development subdomains indicate active development work.

Advanced subdomain analysis reveals business structure and priorities that aren't visible through main domain analysis alone. Marketing subdomains, customer portal subdomains, and API endpoints all tell stories about business operations and customer engagement strategies.

Technology Migration Tracking

By monitoring DNS changes over time, you can track technology migrations and adoption patterns. Companies moving from basic hosting to cloud infrastructure are often in growth phases. Email system changes might indicate new tool adoptions or organizational changes.

Migration tracking reveals decision-making patterns and technology preferences that inform sales strategies. Companies that recently completed major migrations might not be ready for additional changes, while those with outdated infrastructure might be prime prospects for modernization solutions.

Certificate Analysis and Security Posture

SSL certificate information reveals security practices and organizational sophistication. Companies with comprehensive certificate management often have mature IT operations. Certificate transparency logs show certificate issuance patterns that can indicate new projects or security improvements.

Security-focused prospects often prioritize vendors with strong security practices, making certificate analysis valuable for qualification and positioning strategies.

Hosting and Infrastructure Analysis

Hosting choices reveal budget levels, technical sophistication, and scalability priorities. Companies using enterprise-grade infrastructure are likely serious about performance and have budgets to match. Those on shared hosting might be price-sensitive or early-stage.

Geographic hosting choices can indicate target markets and compliance requirements. Companies using multi-region hosting are probably serving global audiences and thinking about scalability.

Business Intelligence Applications

Domain analysis becomes most valuable when applied to specific business intelligence challenges. Here are proven applications that generate measurable results for sales and marketing teams.

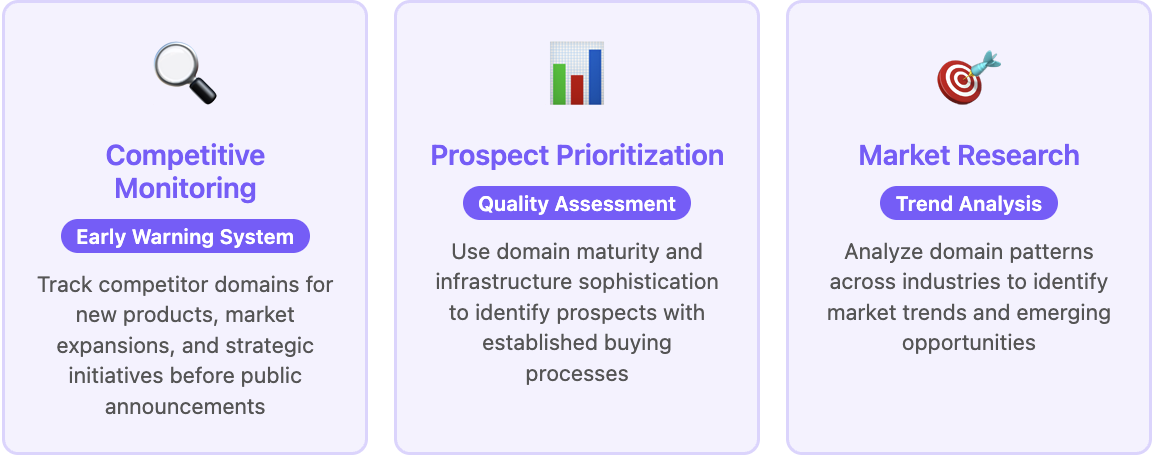

Competitive Monitoring and Market Intelligence

Set up automated monitoring of competitor domains to identify new products, market expansions, and strategic initiatives. New subdomain creation often precedes product launches. Technology infrastructure changes might indicate strategic shifts or new partnerships.

Competitive domain monitoring provides early warning about market developments and helps teams prepare responses to competitive threats before they fully materialize.

Prospect Prioritization and Qualification

Use domain intelligence as part of lead scoring and qualification processes. Companies with mature, well-configured domain infrastructure often have established buying processes and adequate budgets. Recent technology investments might indicate budget availability and willingness to evaluate new solutions.

Domain data helps separate serious prospects from companies that aren't ready or able to make purchasing decisions.

Market Research and Trend Analysis

Analyze domain patterns across industry segments to identify market trends and emerging opportunities. When multiple companies in a sector start adopting similar technologies or infrastructure patterns, it often indicates broader market shifts worth investigating.

Industry-wide domain analysis reveals market maturity, technology adoption patterns, and potential opportunities for new solutions or market education.

Account-Based Marketing Strategy

For target accounts, domain intelligence provides context for personalized outreach and relationship building. Understanding a prospect's technology choices, infrastructure sophistication, and recent changes enables messaging that demonstrates genuine business understanding.

Historical domain data helps identify optimal timing for engagement based on past change patterns and decision-making cycles.

Tools and Platforms: Choosing the Right Approach

The domain intelligence landscape includes basic lookup tools, advanced analysis platforms, and integrated business intelligence solutions. Choosing the right approach depends on your use cases and integration requirements.

Basic WHOIS and DNS Lookup Tools

Traditional tools like Whois.com, GoDaddy WHOIS lookup, and MXToolbox provide basic domain information and DNS records. These tools work well for occasional lookups and simple research needs.

However, basic tools require manual research for each domain and don't provide historical data or business context that change domain information into actionable intelligence.

These limitations are why many teams are moving toward comprehensive GTM tools in 2025 that integrate domain intelligence with broader business research capabilities.

Advanced Domain Analysis Platforms

Specialized domain intelligence platforms like DNSDumpster, DomainTools, and SecurityTrails offer enhanced analysis capabilities including historical data, subdomain discovery, and infrastructure analysis.

These platforms provide more comprehensive domain intelligence but often require separate tools for business context and prospect research integration.

Integrated Business Intelligence Solutions

Platforms that combine domain intelligence with broader business research capabilities offer the most strategic value. These solutions connect domain data with firmographic information, technology analysis, and business signals to provide actionable insights.

This integrated approach represents the evolution toward best waterfall enrichment tools for B2B sales teams that combine multiple data sources for comprehensive business intelligence.

Integrated approaches eliminate the need to correlate data across multiple tools while providing domain intelligence in business context rather than isolated technical information.

Conclusion: Converting Domain Data into Strategic Advantage

Domain lookup tools have evolved far beyond basic WHOIS queries into sophisticated business intelligence platforms that provide strategic advantages for sales, marketing, and competitive analysis.

The teams generating the best results from domain intelligence aren't just looking up contact information—they're using domain data to understand business priorities, technology sophistication, growth patterns, and strategic timing that inform better decision-making.

Start with clear objectives. Define specific business questions that domain intelligence can help answer rather than collecting data for its own sake.

Think systematically. Build repeatable processes that can scale with your needs and provide consistent results across team members.

Integrate with business context. Connect domain intelligence with other business data to provide complete pictures rather than isolated technical information.

Focus on actionable insights. Use domain analysis to generate specific recommendations and strategic decisions rather than just gathering interesting information.

The future belongs to teams that can convert data into intelligence and intelligence into action. Domain analysis provides a foundation for understanding businesses in ways that traditional research methods miss.

Ready to change your approach to prospect research and competitive intelligence? Start by identifying one high-impact use case where domain intelligence can provide immediate value. Build systematic processes around that application, measure results, and expand from there.

Your competitors who master domain intelligence first will have sustainable advantages in understanding markets, timing opportunities, and making strategic decisions. Make sure you're leading that development rather than trying to catch up later.

Frequently Asked Questions

What's the difference between WHOIS lookup and domain intelligence? WHOIS lookup provides basic registration information like owner contact details and dates. Domain intelligence analyzes DNS records, technology infrastructure, historical changes, and business signals to provide strategic insights about companies and their priorities.

How can domain analysis help with prospect research? Domain analysis reveals technology sophistication, infrastructure maturity, recent changes, and growth signals that help qualify prospects and identify optimal timing for outreach. Companies with mature domain configurations often have established buying processes and budgets.

What business intelligence can you gather from DNS records? DNS records reveal hosting choices, technology stack, email systems, security configurations, and geographic presence. This information indicates budget levels, technical priorities, scalability requirements, and organizational sophistication.

How do you monitor competitors using domain intelligence? Set up automated monitoring of competitor domains and subdomains to identify new products, market expansions, technology changes, and strategic initiatives. New subdomain creation and infrastructure changes often precede major business announcements.

Can domain analysis predict when companies are ready to buy? Domain intelligence combined with other business signals can indicate buying readiness. Recent technology migrations, infrastructure upgrades, and new subdomain creation often correlate with evaluation phases and budget availability.

What domain data is most valuable for sales teams? Technology infrastructure choices, recent changes, domain age, and subdomain structure provide the most sales value. This information helps assess prospect sophistication, timing, and personalization opportunities for outreach.

Related articles

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026