Buying Signals & Intent Data: Why Your CRM Is Missing the 5 Accounts

Why Most Teams Miss Their Hottest Prospects (And How to Fix Your Signal Detection)

Blogby JanOctober 06, 2025

Your sales team sits on 30,000 accounts in the CRM. Five of them are hot right now.

Your reps have no clue which five.

That's not a people problem. It's a signals problem. The data exists—job postings for roles that use your solution, funding announcements, new executive hires whose LinkedIn mentions your exact use case. It's all out there, happening in real time.

Your team just doesn't know about it until three weeks later when they stumble across it manually. By then, those accounts have already taken calls with your competitors.

Here's how to fix it: building a system that works like Google Alerts for your CRM. Automatically surfaces the accounts showing real buying signals so your team knows exactly who to call today. Not tomorrow. Today.

This isn't another "what is intent data" explainer. You've read those. This is about building something practical that works.

And here's the part that makes this different: we're not going to pretend you need real-time monitoring of every account interaction. You don't. Daily signal detection works fine, costs less, and doesn't overwhelm your team.

What you need is the right signals, captured automatically, flowing into your CRM where reps actually work.

The Intent Data Lie That's Bleeding You Dry

Most companies treat buying signals like a science project.

They pay $30K annually for intent data platforms. Get overwhelmed by 500 weekly alerts about which accounts visited which third-party websites. Half of it's noise. The other half gets ignored because nobody has time to sort through it.

Then there's the other extreme.

Companies that rely entirely on manual research. "Check LinkedIn for news about your accounts." "Set up Google Alerts." "Monitor their job postings."

This doesn't scale. Your reps are busy. They're in calls, writing follow-ups, dealing with objections. They're not refreshing LinkedIn hoping to catch a signal.

The real solution sits between these extremes: automatic signal detection that flows directly into your CRM, highlighting the 5-10 accounts that matter most today out of your 30,000 total.

This works because it solves three problems simultaneously:

- It's automatic (so your reps don't waste time manually researching)

- It's filtered (so you're not drowning in noise from expensive intent platforms)

- It's actionable (so the intelligence appears exactly where reps already work)

Think about it from your sales rep's perspective.

They open their CRM Monday morning and see a clear priority list: "These 7 accounts are HOT this week" with context about why. Funding announcement. New executive hire. Job posting cluster.

They don't need to check a separate dashboard, run reports, or do research. The signal is already there, enriched with details, ready to act on.

That's the difference between signal detection that drives revenue and signal detection that becomes shelfware.

What Buying Signals Actually Are (Spoiler: Not Website Visits)

Buying signals are observable changes in a company's situation that indicate they're more likely to purchase your solution right now than they were last month.

Not "they visited our website" signals. Those are engagement metrics.

Not "they opened an email" signals. Those are useful for lead scoring.

But they're not the same as trigger events that fundamentally change an account's buying timeline.

Real buying signals answer one question: Why would this company start evaluating solutions like ours today when they weren't three months ago?

Sales trigger events are specific occurrences or circumstances that indicate the prospect may be entering a buying phase, ranging from leadership changes within a company to significant industry trends.

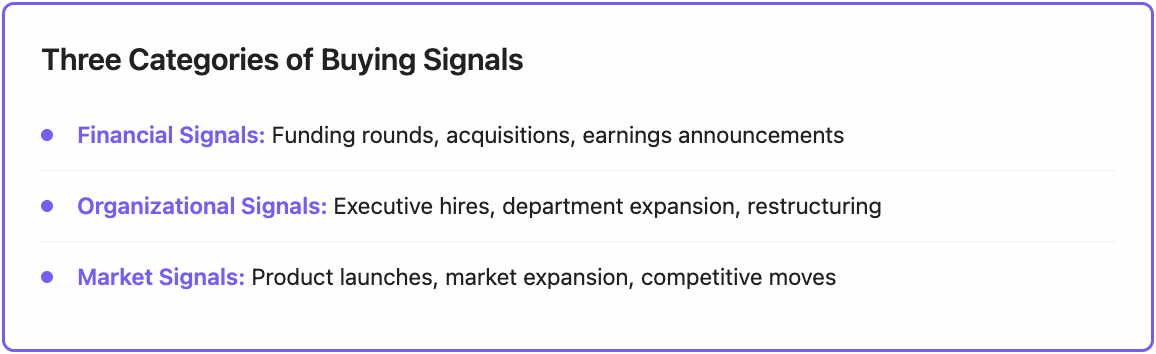

Three Categories of Signals That Predict Revenue

Financial Signals: Show Me the Money

Financial signals indicate budget availability and growth mandates.

Fresh capital creates budget for growth initiatives and new tool adoption. Funded companies have explicit mandates to scale quickly and often need new systems to support growth.

These include:

- Funding announcements (Series A through IPO)

- Acquisition or merger activity

- Quarterly earnings that mention your problem space

- Budget allocation announcements in investor presentations

Organizational Signals: New Sheriff in Town

Organizational signals reveal changes in priorities and buying committees.

New hires across target accounts, especially decision-makers in their first 90 days, are 3× more likely to buy. They're evaluating existing vendors and bringing fresh perspectives to technology decisions.

These include:

- New executive hires in relevant roles (CTO, VP Sales, CMO)

- Department expansion based on job postings

- Organizational restructuring announcements

- Leadership changes that suggest strategic shifts

Market Signals: External Pressure Creates Internal Budget

Market signals show external pressure to adopt new solutions.

Quarterly earnings reveal strategic priorities, budget allocations, and growth initiatives. Public companies have to follow through on announced initiatives, creating predictable buying cycles.

These include:

- New product launches that require supporting infrastructure

- Market expansion announcements (new regions, verticals)

- Competitive moves that force response

- Regulatory changes affecting the industry

Here's the key insight: one strong signal matters more than twenty weak ones.

A company that just raised $50M is infinitely more valuable to contact than a company that downloaded three whitepapers.

Why Intent Data Alone Gets You Meetings with Wrong Prospects

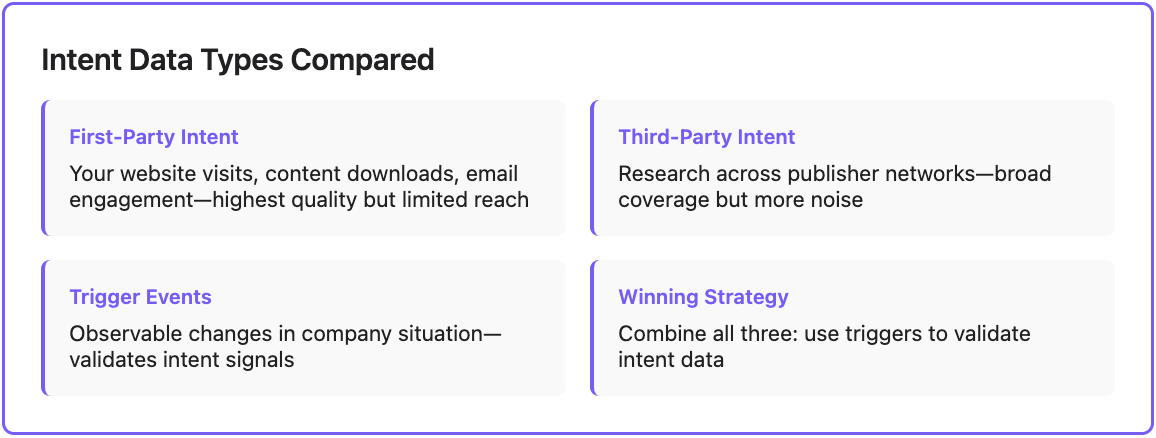

Intent data tells you who's researching. Trigger events tell you why they're researching right now.

55% of companies experienced an increase in lead conversions when utilizing intent data, while over 40% of B2B sales reps use intent data to enrich their CRM.

But here's what the intent data vendors don't tell you: intent signals without context are just expensive noise.

Knowing that "Company X is researching sales automation tools" is interesting.

Knowing that "Company X is researching sales automation tools AND just hired a new VP of Sales AND posted 5 job openings for SDRs" is actionable.

First-Party vs Third-Party Intent: What Actually Works

First-party intent data comes from your own digital properties—website visits, content downloads, email engagement, product trial behavior.

This is your highest-quality intent data because it shows direct interest in your specific solution. First-party data is more accurate and respectful of user privacy, originating from actual user behaviors and approved content privacy regulations.

The problem? Only accounts that already know about you generate first-party signals. You're missing the 90% of your TAM that hasn't discovered you yet.

Third-party intent data tracks research behavior across publisher networks, tracking which companies are consuming content about topics related to your solution.

By 2025, more than 70% of B2B marketers utilize third-party intent data to target prospects or engage groups of buyers in selected accounts.

The advantage is coverage—you can see accounts researching your category even if they've never visited your website. The disadvantage is noise and false positives.

The winning strategy? Use trigger events to validate intent data.

An account showing intent signals becomes infinitely more interesting when they also just received funding or hired a new decision-maker.

10 Buying Signals That Drive Pipeline (With High Conversion Impact)

Not all signals are created equal. We've ranked these based on historical conversion correlation and speed to close.

#1: Series A/B Funding Announcements

Fresh capital creates budget for growth initiatives and new tool adoption. Funded companies have explicit mandates to scale quickly and often need new systems to support growth.

Timing window: 30-90 days post-announcement when teams are actively implementing growth strategies.

Why it works: New money means approved budgets and urgency to deploy capital. Companies are actively building teams and infrastructure.

#2: Executive Leadership Changes

New decision-makers in their first 90 days are 3× more likely to buy as they evaluate existing vendors and bring fresh perspectives to technology decisions.

Timing window: 30-120 days after hire announcement, during their "honeymoon period" when they're reviewing everything.

Why it works: New executives want quick wins and often bring preferred vendors from previous companies.

#3: Department Expansion (Job Posting Clusters)

When you see 3+ job postings for the same department in a short window, that's not normal hiring—that's scaling.

Timing window: Active now, as they're building the team that will use your solution.

Why it works: Rapid team growth requires new infrastructure. They're buying tools to support the expanded headcount.

#4: Product Launch Announcements

New product launches signal need for related services or solutions, creating opportunities for cross-selling or supporting infrastructure.

Timing window: 60-180 days before launch (if you catch planning stages) or 30-60 days after launch.

Why it works: New products require supporting tools, marketing infrastructure, customer support systems—your timing is perfect.

#5: Market Expansion (New Region/Vertical Entry)

When companies announce expansion into new geographic markets or industry verticals, they need new capabilities.

Timing window: 90-180 days from announcement, during implementation phase.

Why it works: Expansion creates gaps in current systems. They need tools that scale to new markets.

#6: Merger or Acquisition Activity

Both acquiring companies and acquired companies need to consolidate or upgrade systems.

Timing window: 180-365 days post-close, during integration planning and execution.

Why it works: System consolidation and standardization are mandatory. Budgets are allocated specifically for integration.

#7: Technology Migration Projects

When accounts announce platform changes (migrating to AWS, moving to Salesforce, adopting new stack), adjacent purchases follow.

Timing window: 60-180 days after migration announcement.

Why it works: Migration projects trigger wholesale technology reviews. "If we're changing X, we should also upgrade Y."

#8: Competitive Win/Loss Events

When your competitor wins or loses a major account, adjacent accounts take notice.

Timing window: 30-90 days after announcement becomes public.

Why it works: Competitive dynamics create urgency. "If our competitor is using this, should we be?"

#9: Regulatory/Compliance Triggers

Industry regulation changes force technology purchases to maintain compliance.

Timing window: 60-180 days before compliance deadline, depending on regulation complexity.

Why it works: Non-negotiable budget. Compliance isn't optional, making these high-probability deals.

#10: Earnings Call Mentions

Quarterly earnings reveal strategic priorities, budget allocations, and growth initiatives. Public companies have to follow through on announced initiatives.

Timing window: 20-120 days post-earnings when initiatives are funded and teams are executing.

Why it works: Public commitments to investors create accountability and budget availability.

How to Actually Implement Signal Tracking (Without Hiring a Data Team)

The biggest barrier to effective signal tracking isn't technology—it's operational complexity.

Most teams over-engineer this.

Start with the "Five Signal Minimum Viable System"

Pick five signal types that correlate most strongly with your closed-won deals. Don't try to track everything.

For most B2B SaaS companies, we recommend starting with:

- Funding announcements

- Executive hires (specific roles)

- Job posting clusters (specific departments)

- Company news mentions (specific keywords)

- Technology adoption signals (if relevant to your product)

Set Up Automated Monitoring

You have three options for automation, ranging from simple to sophisticated:

Option 1: Google Alerts + Manual CRM Updates

The lowest-tech approach. Set up Google Alerts for your target accounts with specific search operators.

Example: "[Company Name]" AND (funding OR "series A" OR "series B")

Pros: Free, simple to set up

Cons: Requires manual monitoring and CRM updates, misses signals not indexed by Google news

Option 2: LinkedIn Sales Navigator Alerts + CRM Integration

Sales Navigator can alert you to job changes and company news for saved accounts.

Pros: Good coverage of hiring signals, integrates with most CRMs

Cons: Expensive, limited to LinkedIn-indexed data, still requires manual categorization

Option 3: Automated Signal Detection + CRM Enrichment

This is where platforms like Databar improve the workflow. Instead of monitoring signals manually, you connect your CRM and set signal criteria. When a target account triggers a signal, Databar automatically:

- Detects the event across multiple data sources

- Enriches the CRM record with signal details

- Adds context (funding amount, new hire's LinkedIn, job posting descriptions)

- Timestamps when the signal was detected

Your sales rep opens the account record and sees everything they need without leaving the CRM.

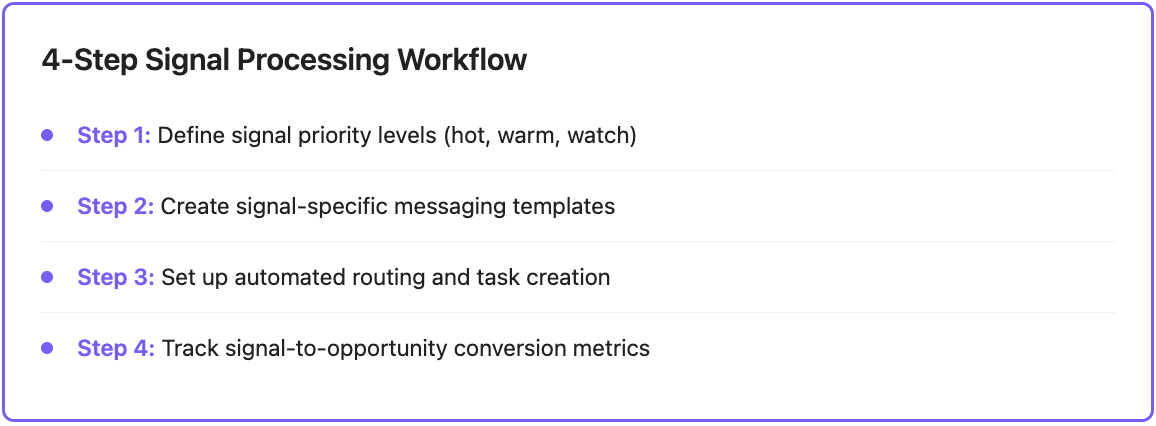

Build Your Signal Processing Workflow

Trigger-based marketing creates opportunities to improve trust, loyalty, and satisfaction by focusing efforts where buyer intent is highest, allowing teams to act in real time.

Step 1: Define signal priority levels

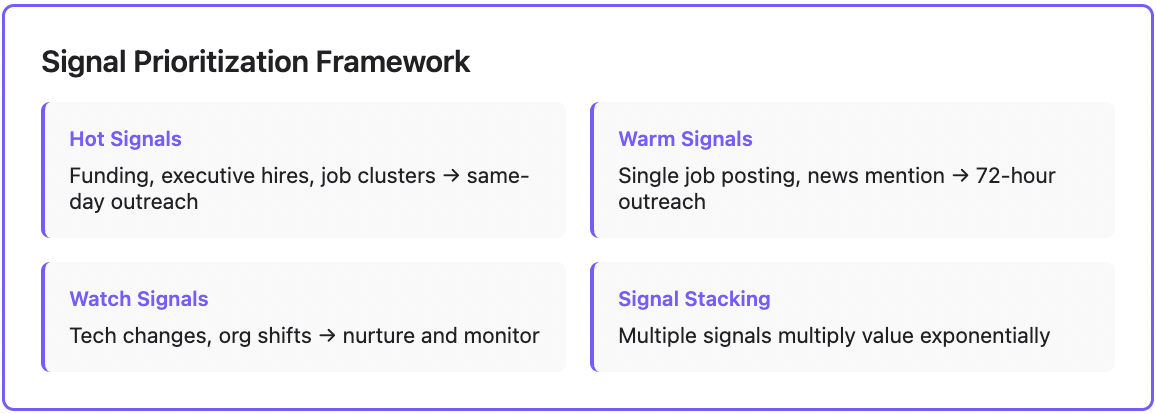

Not all signals deserve immediate action. Categorize them:

- Hot signals: Funding, new executive in buying role, multiple job postings → same-day outreach

- Warm signals: Single job posting, news mention, earnings call reference → outreach within 72 hours

- Watch signals: Technology signals, organizational changes → add to nurture, monitor for additional signals

Step 2: Create signal-specific messaging templates

Triggered messages should feel handcrafted, avoiding cookie-cutter messaging, as leads will notice generic approaches.

Step 3: Set up automated routing and tasks

When a hot signal triggers, your CRM should automatically:

- Create a high-priority task for the assigned AE

- Send a Slack/Teams notification with signal details

- Update account status to "Hot - Active Signal"

- Queue up the appropriate outreach template

- Schedule a reminder if no action is taken within 24 hours

Step 4: Track signal-to-opportunity conversion

Measure which signals actually drive pipeline:

- Signal detection → first touch: How quickly do reps act?

- Signal → meeting booked: Which signals generate meetings?

- Signal → opportunity created: Which signals drive pipeline?

- Signal → closed-won: Which signals predict revenue?

Use this data to refine which signals you monitor and how you prioritize them.

Why "Real-Time" Signal Detection Is Overrated (And What to Do Instead)

Here's a hot take: you don't need real-time signal detection for most B2B sales.

If your sales cycle is 3-6 months, the difference between getting a signal notification immediately versus getting it tomorrow morning is irrelevant. The account isn't going to close a deal in 24 hours.

Daily signal processing works fine for most companies and costs significantly less than real-time monitoring.

The exception? If your sales cycle is measured in days or weeks (transactional SMB sales), real-time matters. But for complex B2B with long sales cycles, prioritize signal accuracy and relevance over speed.

We see this constantly with customers using Databar. They'll ask about real-time updates, then realize their sales process involves 10+ touchpoints over four months. Whether they get the funding signal today or tomorrow doesn't change the outcome—they still need to build a relationship over months.

What matters is consistency.

Daily signal detection that runs reliably beats real-time monitoring that misses events.

How Databar Turns Signal Chaos Into CRM Clarity

The signal tracking problem has three layers:

- Signal detection—Finding the events across fragmented data sources

- Signal enrichment—Adding context so signals are actually actionable

- Signal delivery—Getting that information into your CRM where reps work

Most tools solve one layer. Databar solves all three.

Automatic Signal Detection Across 90+ Sources

Instead of setting up Google Alerts for 30,000 accounts or manually checking LinkedIn, Databar monitors your target accounts across:

- Funding databases (Crunchbase, Owler)

- News sources (press releases, industry publications)

- Job posting aggregators (LinkedIn, Indeed, company career pages)

- Social media (executive LinkedIn activity, company posts)

- Public company filings (earnings transcripts, SEC filings)

- Technology adoption signals (new tools detected in tech stack)

When any of your target accounts triggers a relevant event, Databar captures it.

Signal Enrichment That Makes Signals Actionable

Raw signals aren't enough. "Company X raised funding" is a fact. What your rep needs is:

- Funding amount and lead investors

- What they said they'll use the money for

- Link to the announcement

- Pre-populated outreach template referencing the specific funding round

- Contact information for relevant decision-makers

Databar's enrichment flow automatically adds this context so your rep can act immediately without additional research.

Direct CRM Integration

This is the key differentiator: signals flow directly into your existing CRM.

Your rep doesn't log into a separate "signals dashboard." They're working in Salesforce or HubSpot like always, and they see:

- Account record automatically updated with "Hot Signal: Series B Funding - $15M"

- New activity logged with details and source link

- Task created: "Reach out regarding recent funding announcement"

- Suggested talking points based on what the company said they're focusing on

- Relevant decision-makers identified and enriched

Everything they need to act is right there in the workflow they already use.

The Signal Prioritization Matrix: Which Accounts to Call First

You've got signals flowing into your CRM. Now what?

Not all signal + account combinations deserve the same urgency. You need a prioritization framework.

The Four-Quadrant Signal Priority Matrix

High ICP Fit + Hot Signal = Immediate Action

These are your Tier 1 accounts showing active buying triggers. Same-day outreach, multiple touchpoints, executive engagement if possible.

Example: Enterprise account matching your ICP perfectly just hired a new VP of Sales and posted 7 SDR job openings.

High ICP Fit + Warm Signal = Scheduled Outreach

Strong fit accounts showing moderate signals. Add to outreach sequences, but not drop-everything urgent.

Example: Mid-market account in target vertical mentioned in news article about market expansion.

Medium ICP Fit + Hot Signal = Research & Qualify

These signals might indicate the account is better fit than you thought, or might be noise. Worth investigating.

Example: Smaller company (normally below your threshold) just raised Series B and is suddenly in your target revenue range.

Medium ICP Fit + Warm Signal = Monitor

Keep watching for additional signals, but don't initiate outreach yet. Let them accumulate more signals first.

Example: Account showing some intent data but no concrete trigger events and doesn't perfectly match ICP.

Signal Stacking: When Multiple Signals Multiply Value

The most valuable accounts aren't showing one signal—they're showing multiple.

93% of B2B marketers see an increase in their conversion rate when using intent data, while 82% say their sales team can convert intent-based leads faster than normal leads.

When you see signal stacking, multiply your prioritization:

- Funding announcement + executive hire = 2X priority

- Funding + executive hire + job posting cluster = 5X priority

- Funding + executive hire + job posting cluster + intent data spike = 10X priority

These accounts should jump to the absolute top of your outbound queue regardless of other factors.

Advanced Signal Strategies: Beyond the Basics

Once you have basic signal detection running, you can layer in more sophisticated approaches.

Trigger-Based Account Tier Movement

Use signals to automatically adjust account tiers. Funding announcements or technology migrations can trigger automatic tier changes when accounts show signals indicating they're more valuable than initial assessment suggested.

A Tier 2 account that raises Series B and hires aggressively might automatically escalate to Tier 1 status, at least temporarily. This makes sure accounts get appropriate attention based on current opportunity, not just static firmographic fit.

Competitive Signal Monitoring

Don't just monitor your target accounts—monitor your competitors' major wins and losses.

When a competitor wins a major account, their other customers often start evaluating alternatives. When a competitor loses a public customer, that's a signal to reach out to other customers in similar situations.

Customer Expansion Signals

The same signal framework applies to existing customers:

- Customer hires new users of your product = expansion opportunity

- Customer announces new product line = cross-sell opportunity

- Customer raises funding = upsell timing

- Customer executive change = risk signal (new person might prefer different vendor)

Tracking contacts allows teams to re-engage champions when they move, or detect churn risk when key stakeholders leave.

Geographic Expansion Playbooks

When you see signals indicating expansion (job postings in new regions, partnership announcements, acquisition of companies in new markets), you can trigger region-specific plays.

If a US company acquires a European company, they probably need solutions that work globally. If they're posting jobs in APAC for the first time, they're setting up new infrastructure.

How to Measure Signal-Based Selling ROI

Track these metrics to validate your signal detection system is driving revenue:

- Signal Coverage Rate: What percentage of your target accounts are you successfully monitoring for signals? Target: 80%+ of priority accounts

- Signal Detection Speed: How quickly do you detect signals after they occur? Target: Within 24-48 hours for most signal types

- Signal-to-Action Time: How quickly does your team act after a signal is detected? Target: Same day for hot signals, 48-72 hours for warm signals

- Signal-to-Meeting Rate: What percentage of accounts with signals result in booked meetings? Target: 15-25% for hot signals (compare to 2-5% for cold outreach)

- Signal-to-Opportunity Rate: What percentage of signal-triggered outreach creates pipeline? Target: 8-15% for hot signals

- Signal-to-Close Rate: Do deals sourced from signals close faster and at higher rates? Target: 20-40% higher win rates, 30-50% faster sales cycles

Intent-driven leads convert at 2 to 3 times the rate of traditional leads, with intent data platforms achieving conversion rates of 20-25% compared to 5-10% with conventional methods.

Frequently Asked Questions

What's the difference between buying signals and intent data?

Buying signals are specific, observable events that change an account's buying timeline—funding announcements, executive hires, job postings. Intent data tracks research behavior and content consumption that suggests interest. Buying signals tell you WHY an account is in-market right now. Intent data tells you WHAT they're researching. The most effective approach combines both: use intent data to identify research activity, then validate with concrete trigger events.

Do you really need expensive intent data platforms to track buying signals?

No. Many of the highest-value buying signals—funding announcements, executive changes, job postings—are publicly available and can be monitored without paid intent platforms. You can start with Google Alerts, LinkedIn Sales Navigator, and Crunchbase free tiers. However, automated signal detection platforms save significant time and catch signals you'd miss manually. The ROI calculation depends on your team size and deal values—if finding one extra signal-driven opportunity per quarter pays for the tool, it's worth it.

How often should you check for new buying signals?

Daily signal processing works for most B2B companies with sales cycles over 30 days. Real-time monitoring sounds appealing but is rarely necessary—the difference between detecting a funding announcement today versus tomorrow doesn't materially impact a 6-month sales cycle. The exception is transactional SMB sales with short cycles, where real-time detection might matter. Focus on consistency over speed: reliable daily signal detection beats spotty real-time monitoring.

Which buying signals have the highest correlation with closed deals?

Funding announcements and executive leadership changes consistently show the highest conversion correlation. Companies that just raised capital have approved budgets and growth mandates. New executives in relevant roles are 3X more likely to buy in their first 90 days as they review existing vendors and implement changes. Job posting clusters indicating department expansion are also highly predictive, as rapid hiring requires new infrastructure. Start by monitoring these three signal types before expanding to others.

How do you prevent signal fatigue where your team ignores alerts?

Signal fatigue happens when teams track too many signal types or set thresholds too low, generating noise instead of actionable intelligence. Prevent this by: (1) Only tracking 3-5 high-value signal types initially, (2) Setting clear prioritization rules so reps know which signals demand immediate action, (3) Building signal-specific outreach templates so acting is easy, (4) Measuring and sharing signal-to-opportunity conversion rates so teams see ROI. If reps are ignoring signals, you're either tracking the wrong signals or making them too hard to act on.

Related articles

Lead Scoring & Account Segmentation: Why Most CRMs Get This Backward (And How to Fix It)

How to build a system that tells your team who to call, when, and why

by Jan, October 06, 2025

The CRM Data Cleaning & Hygiene Playbook

Your Guide to A Clean & Up-To-Date Database

by Jan, October 04, 2025

Everything You Need To Know About CRM Enrichment

Your Step-By-Step Guide To CRM Data Enrichment

by Jan, October 03, 2025

HubSpot CRM Enrichment: Step-By-Step Integration Guide

Everything you need to enrich contact and company records in HubSpot

by Jan, October 01, 2025