Build Your Revenue Intelligence Data Skeleton: The GTM Foundation

Why scattered dashboards are killing your growth—and how smart teams architect unified revenue intelligence

Blogby JanSeptember 02, 2025

Here’s what stands out from the analysis of numerous revenue teams: 91% have access to more sales data than ever before, yet only 23% can predict their quarterly revenue within 5%.

The problem isn't lack of data. It's scattered intelligence.

Your marketing automation platform knows lead behavior. Your CRM tracks deal progression. Your customer success platform monitors expansion signals. Your finance system holds the revenue truth.

But none of them talk to each other in a language that drives decisions.

This is exactly why fast-growing companies are shifting from traditional sales reporting to revenue intelligence platforms—unified systems that transform scattered data into predictable growth.

The companies building this foundation aren't just getting better reports. They're creating what we call a "revenue intelligence data skeleton"—the structural framework that supports every revenue decision across marketing, sales, and customer success.

The Revenue Intelligence Transition Nobody Planned For

Something fundamental changed over the last few years that most revenue teams missed.

The shift from departmental tools to unified revenue intelligence platforms wasn't driven by technology—it was driven by buyer behavior that broke traditional reporting models.

B2B buyers now touch 7-11 different systems before making purchase decisions. They research on your website (marketing's domain), engage with sales development (sales' domain), trial your product (customer success' domain), and negotiate contracts (sales' domain again).

Traditional reporting treats these as separate funnels with separate metrics. Revenue intelligence treats them as one connected journey with unified measurement.

Consider this scenario: A prospect downloads a whitepaper, attends a webinar, starts a product trial, books a demo, goes dark for 3 weeks, then suddenly accelerates through your sales process after talking to customer support about implementation.

How do you measure that journey with separate department dashboards? You can't. Each team sees their piece, but nobody sees the complete picture that drives the buying decision.

Revenue intelligence platforms solve this by creating what industry leaders call a "single source of truth" for all revenue-generating activities. Not just another dashboard—a unified data foundation that connects every customer touchpoint.

According to recent research from Gartner, companies using integrated revenue intelligence see 24% faster deal velocity and 37% higher forecast accuracy compared to teams using departmental reporting tools.

The difference comes from seeing connections that departmental silos miss.

What Revenue Intelligence Actually Means in 2025

Let's clear up the confusion around revenue intelligence platforms because marketing teams have muddied these waters.

Revenue intelligence isn't conversation recording. It's not predictive analytics. It's not even advanced CRM reporting.

Revenue intelligence is the systematic capture, integration, and analysis of all revenue-generating activities to create predictive insights that drive coordinated action across go-to-market teams.

Think of it this way: If your CRM is a photo album of deals, revenue intelligence is the movie showing how those deals actually develop and interconnect.

The Four Core Components of True Revenue Intelligence

Unified Data Capture: Automatic collection of activities, interactions, and outcomes across marketing automation, sales engagement, customer success platforms, and financial systems. No manual data entry, no missed touchpoints.

Cross-Functional Analysis: Integration of metrics that span departments—marketing-qualified leads to sales-qualified opportunities, initial deal size to expansion revenue, customer health scores to renewal predictions.

Predictive Modeling: AI-powered insights that forecast deal outcomes, identify expansion opportunities, predict churn risks, and highlight resource allocation needs based on historical patterns and current signals.

Coordinated Action Triggers: Automated workflows that notify relevant teams when specific conditions are met—at-risk accounts that need attention, expansion opportunities ready for sales engagement, leads showing high-intent signals.

How Revenue Intelligence Differs from Traditional Analytics

Traditional sales analytics show you what happened. Marketing analytics show you campaign performance. Customer success analytics show you retention metrics.

Revenue intelligence shows you what's happening now across all systems and predicts what will happen next based on the complete customer journey.

Instead of separate dashboards showing departmental performance, you get unified intelligence showing revenue performance with the ability to drill into any department's contribution.

Instead of monthly reports that are outdated before you read them, you get real-time insights that trigger immediate action when revenue opportunities or risks emerge.

The Data Skeleton: Your Revenue Intelligence Foundation

Most companies approach revenue intelligence backwards. They start with the dashboard and try to force their data to fit.

Smart teams start with what we call the "data skeleton"—the structural foundation that supports unified revenue intelligence.

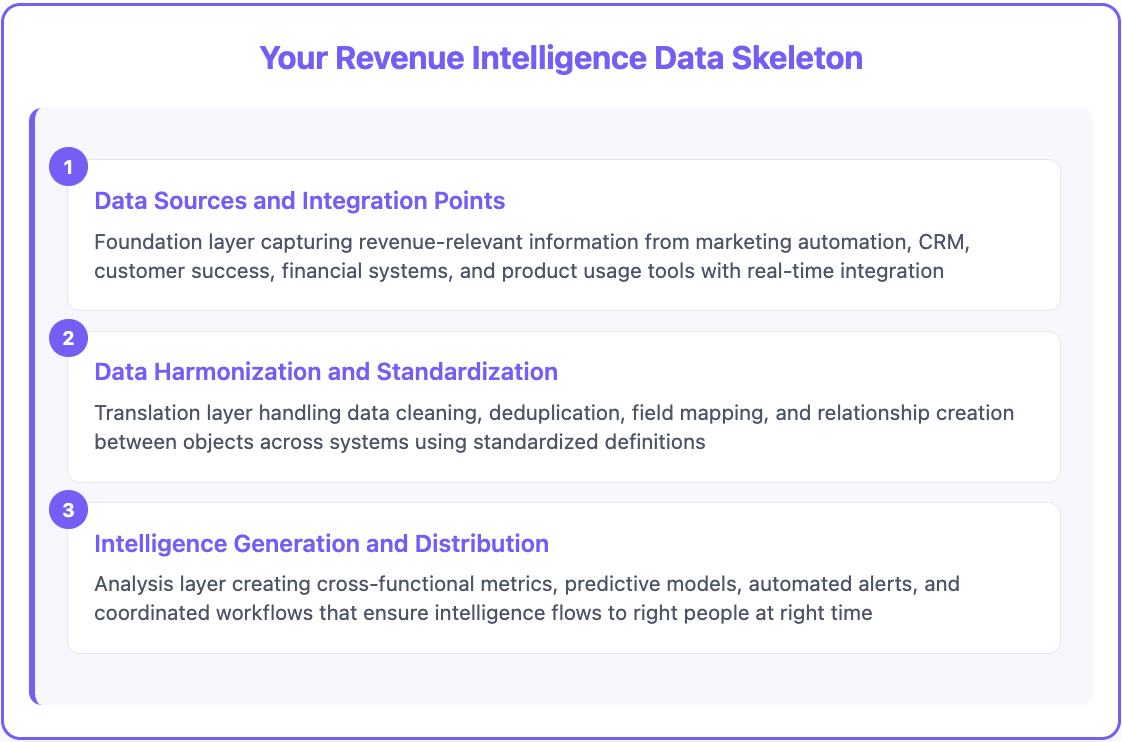

Your data skeleton consists of three interconnected layers:

Layer 1: Data Sources and Integration Points

This is your foundation—every system that captures revenue-relevant information. Marketing automation platforms (HubSpot, Marketo, Pardot). CRM systems (Salesforce, HubSpot, Pipedrive). Sales engagement tools (Outreach, SalesLoft, Apollo). Customer success platforms (Gainsight, ChurnZero, Totango). Financial systems (QuickBooks, NetSuite, Stripe). Support and product usage tools (Zendesk, Mixpanel, Amplitude).

The key is automatic integration without manual data export/import processes. Your revenue intelligence platform should capture data from these sources in real-time, not through weekly CSV uploads.

Layer 2: Data Harmonization and Standardization

Raw data from different systems rarely matches. Marketing calls them "Marketing Qualified Leads." Sales calls them "Sales Qualified Leads." Customer Success calls them "Active Accounts." Finance calls them "Recognized Revenue."

Your data skeleton must translate between these systems using standardized definitions. A contact record in your marketing automation platform should automatically connect to the same contact in your CRM, customer success platform, and financial system.

This layer handles data cleaning, deduplication, field mapping, and relationship creation between objects across systems.

Layer 3: Intelligence Generation and Distribution

This is where raw data becomes actionable intelligence. Cross-functional metrics that show performance across departments. Predictive models that forecast outcomes based on complete customer journey data. Automated alerts that notify teams when action is needed. Coordinated workflows that ensure opportunities don't fall through departmental cracks.

The skeleton framework ensures that intelligence flows to the right people at the right time with enough context to drive immediate action.

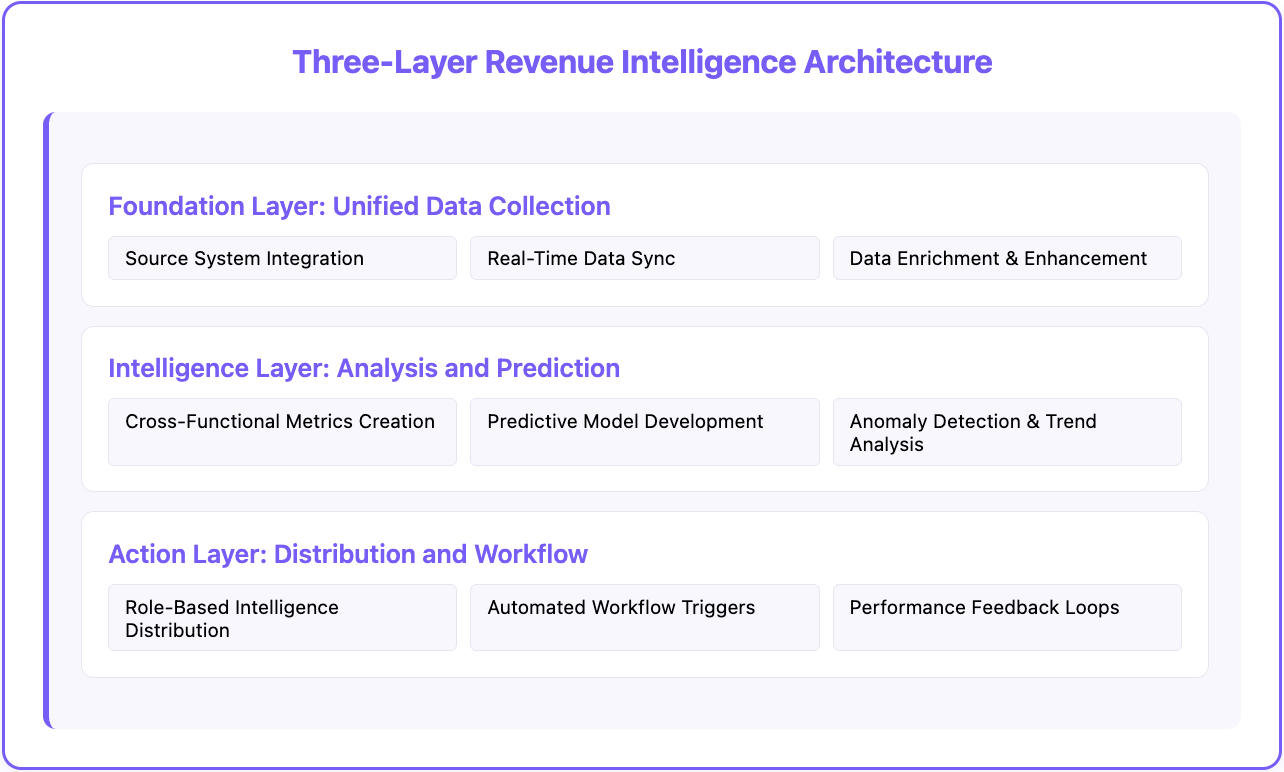

Three-Layer Revenue Intelligence Architecture

Building effective sales intelligence dashboards requires architectural thinking, not just tool selection.

We've analyzed the systems used by high-performing revenue teams and identified three distinct layers that successful implementations share:

The Foundation Layer: Unified Data Collection

Source System Integration: Your foundation must automatically capture data from every revenue-relevant system without requiring manual processes. Modern revenue intelligence platforms use APIs to connect with marketing automation, CRM, customer success, financial, and product usage systems.

Real-Time Data Sync: Batch uploads and nightly syncs create gaps where opportunities disappear. Your foundation should capture activities, interactions, and status changes as they happen, not hours or days later.

Data Enrichment and Enhancement: Raw system data often lacks context. Successful teams enrich their data foundation with company information, technographic data, intent signals, and competitive intelligence to support better decision-making.

This is where platforms like Databar become critical—automatically enriching your revenue intelligence foundation with data from 90+ providers, ensuring every contact and company record has the context needed for intelligent analysis.

The Intelligence Layer: Analysis and Prediction

Cross-Functional Metrics Creation: This layer creates metrics that span departmental boundaries. Marketing-to-sales conversion rates by lead source and qualification criteria. Sales-to-customer success handoff quality and time-to-value metrics. Customer expansion pipeline and renewal probability scoring.

Predictive Model Development: Using machine learning to identify patterns in your complete revenue data. Deal outcome prediction based on engagement history across all touchpoints. Expansion opportunity identification using product usage and support interaction data. Churn risk assessment incorporating sales, success, and support signals.

Anomaly Detection and Trend Analysis: Automated identification of performance changes that require attention. Sudden drops in lead quality from specific marketing campaigns. Changes in deal velocity for particular market segments. Unusual patterns in customer expansion or churn behavior.

The Action Layer: Distribution and Workflow

Role-Based Intelligence Distribution: Different teams need different information from the same underlying data. Sales needs deal-specific insights and pipeline health indicators. Marketing needs campaign attribution and lead quality feedback. Customer success needs account health and expansion opportunity alerts.

Automated Workflow Triggers: When your intelligence layer identifies important conditions, the action layer ensures relevant teams get notified and coordinated. At-risk accounts trigger coordinated retention efforts across sales and customer success. High-intent leads trigger accelerated response workflows. Expansion opportunities trigger handoffs from customer success to sales.

Performance Feedback Loops: Continuous measurement of decision quality to improve intelligence accuracy. Tracking whether predicted outcomes actually occur. Measuring response time and quality when automated workflows trigger. Analyzing the revenue impact of coordinated vs. siloed team actions.

Building Cross-Functional Metrics That Matter

Traditional revenue reporting measures department performance. Revenue intelligence measures revenue system performance.

The difference determines whether you can predict and influence your revenue trajectory or just react to what already happened.

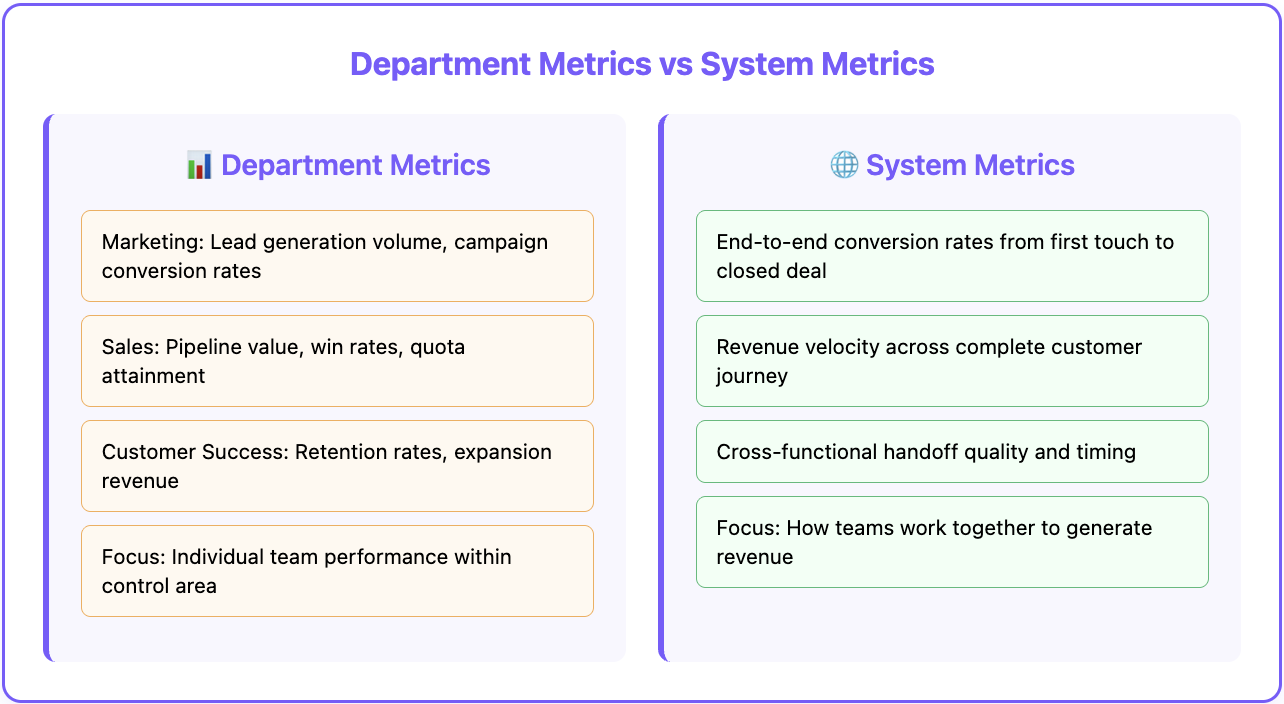

Department Metrics vs. System Metrics

Department Metrics focus on individual team performance within their area of control:

- Marketing: Lead generation volume, campaign conversion rates, cost per lead

- Sales: Pipeline value, win rates, quota attainment

- Customer Success: Retention rates, expansion revenue, customer health scores

System Metrics focus on how teams work together to generate revenue:

- End-to-end conversion rates from first touch to closed deal

- Revenue velocity across the complete customer journey

- Cross-functional handoff quality and timing

- Customer lifetime value including acquisition, expansion, and retention

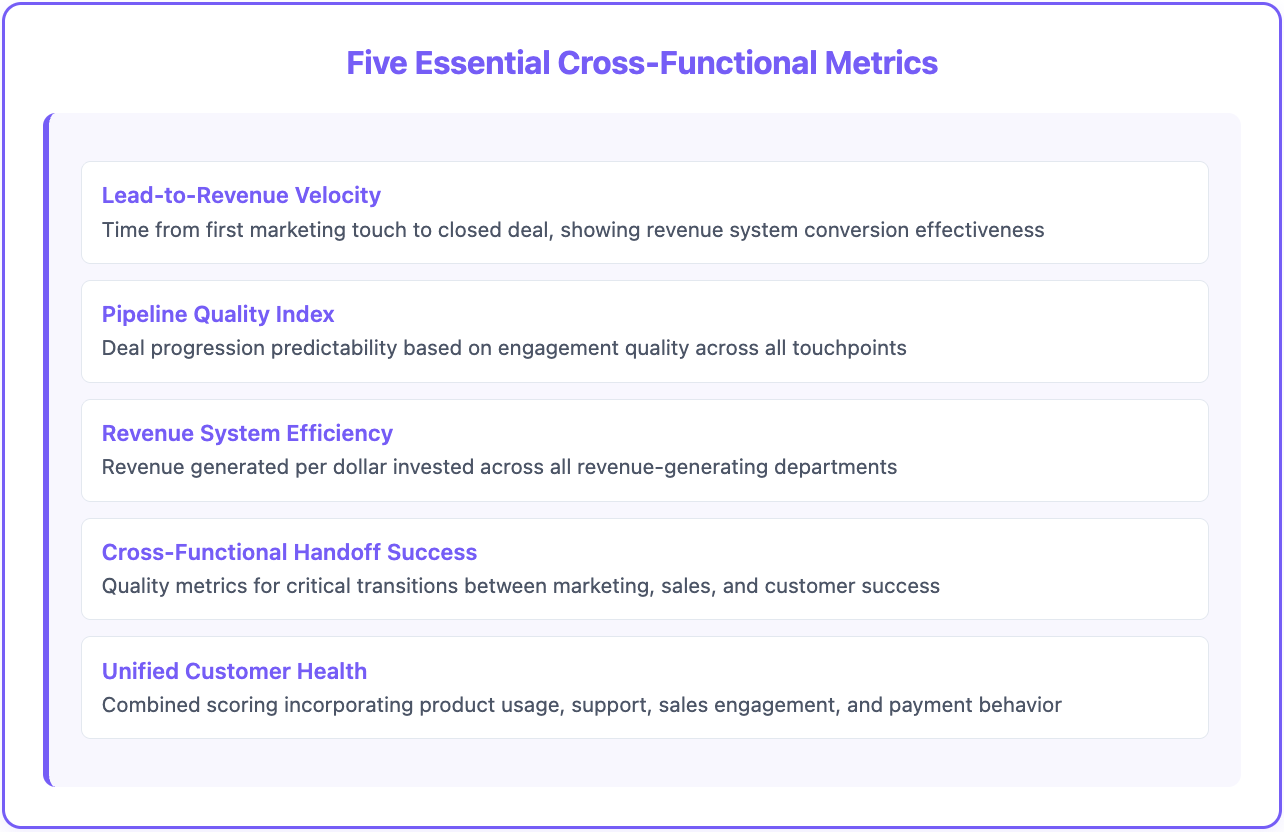

The Five Essential Cross-Functional Metrics

Lead-to-Revenue Velocity: Time from first marketing touch to closed deal, broken down by lead source, qualification path, and deal characteristics. This metric shows how effectively your entire revenue system converts interest into revenue.

Pipeline Quality Index: Measurement of deal progression predictability based on engagement quality across marketing, sales, and product touchpoints. Not just pipeline volume—pipeline that actually converts.

Revenue System Efficiency: Revenue generated per dollar invested across all revenue-generating departments, including marketing spend, sales costs, and customer success investment.

Cross-Functional Handoff Success: Quality metrics for critical transitions—marketing to sales qualification, sales to customer success implementation, customer success to sales expansion.

Unified Customer Health: Combined scoring that incorporates product usage, support interactions, sales engagement, and payment behavior to predict renewal probability and expansion potential.

Implementing Unified Revenue Reporting

Building unified revenue reporting requires more than connecting data sources. You need standardized definitions that make sense across departments.

Create Shared Vocabulary: Every department should use the same definitions for critical terms. What constitutes a "qualified lead"? When does a "deal" become an "opportunity"? How do you define "customer success"?

Establish Cross-Functional SLAs: Set expectations for handoff timing and quality. How quickly should sales respond to marketing-qualified leads? What information must sales provide to customer success for new accounts? When should customer success notify sales about expansion opportunities?

Build Feedback Mechanisms: Create processes for departments to provide input on lead quality, deal progression, and customer satisfaction that inform the intelligence system and improve prediction accuracy.

From Data Chaos to Revenue Clarity

Most revenue teams are drowning in data but starving for insight.

Marketing has engagement metrics, lead scores, and campaign attribution. Sales has pipeline reports, activity tracking, and win/loss analysis. Customer success has health scores, usage analytics, and renewal predictions.

The problem isn't lack of data—it's lack of connection between data sources.

Each department optimizes for their metrics while revenue results depend on how well departments coordinate. Marketing generates leads, but sales conversion depends on lead quality and timing. Sales closes deals, but revenue growth depends on customer success driving expansion and retention.

The Hidden Revenue Leaks

Handoff Delays: Marketing-qualified leads that sit uncontacted for 24+ hours have 60% lower conversion rates. Yet most teams don't measure or monitor handoff timing.

Context Loss: When leads transition from marketing to sales, critical engagement history often gets lost. Sales doesn't know which content the prospect consumed, what questions they asked, or what concerns they expressed.

Expansion Blindness: Customer success identifies expansion opportunities, but 40% never reach sales due to poor internal processes. Revenue growth opportunities disappear in departmental handoffs.

Forecasting Fiction: Each department builds forecasts using different assumptions and timelines. Marketing projects leads, sales projects deals, customer success projects renewals—but nobody integrates these projections into unified revenue predictions.

Building Revenue Clarity

Single Source of Truth: Every customer interaction, engagement signal, and outcome gets captured in one system that all departments can access and contribute to.

Unified Timeline View: Complete customer journey from first touch to expansion, showing marketing campaigns, sales activities, product usage, support interactions, and financial transactions in chronological context.

Predictive Intelligence: AI-powered insights that analyze the complete customer journey to predict deal outcomes, expansion opportunities, churn risks, and resource allocation needs.

Coordinated Action: Automated workflows that ensure teams work together rather than in parallel, with clear handoffs, shared objectives, and mutual accountability.

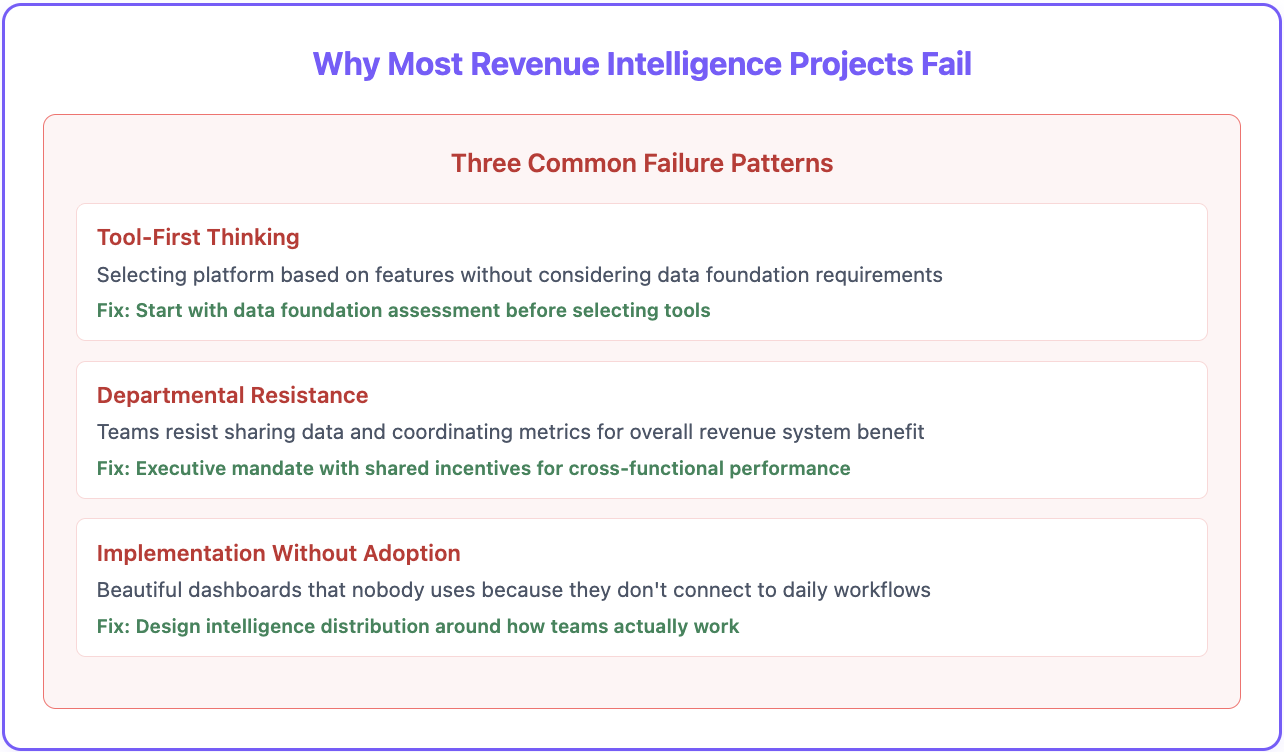

Why Most Revenue Intelligence Projects Fail

Three failure patterns emerge repeatedly:

Failure Pattern 1: Tool-First Thinking

Companies select a revenue intelligence platform based on features and pricing without considering their data foundation requirements.

The problem: Most revenue intelligence tools assume clean, standardized data across integrated systems. If your CRM is missing 40% of contact data, your marketing automation has duplicate leads, and your customer success platform isn't connected to anything, no intelligence platform will solve these problems.

The fix: Start with data foundation assessment before selecting tools. Audit data quality across all revenue-generating systems. Identify integration requirements and gaps. Plan data standardization and cleanup before implementing intelligence tools.

Failure Pattern 2: Departmental Resistance

Revenue intelligence requires departments to share data, coordinate metrics, and sometimes change their processes for the benefit of the overall revenue system.

The problem: Sales doesn't want marketing to see their pipeline data. Marketing doesn't want to be held accountable for sales conversion rates. Customer success doesn't want their churn data scrutinized by other teams.

The fix: Start with executive mandate and shared incentives. Revenue intelligence only works when departments are measured and rewarded for cross-functional performance, not just departmental metrics.

Failure Pattern 3: Implementation Without Adoption

Teams build beautiful sales intelligence dashboards that nobody uses because they don't connect to daily workflows and decision-making processes.

The fix: Design intelligence distribution around how teams actually work. Sales needs deal-specific insights during pipeline reviews. Marketing needs campaign feedback during planning cycles. Customer success needs risk alerts during account reviews.

How Modern Teams Build Their Data Skeleton

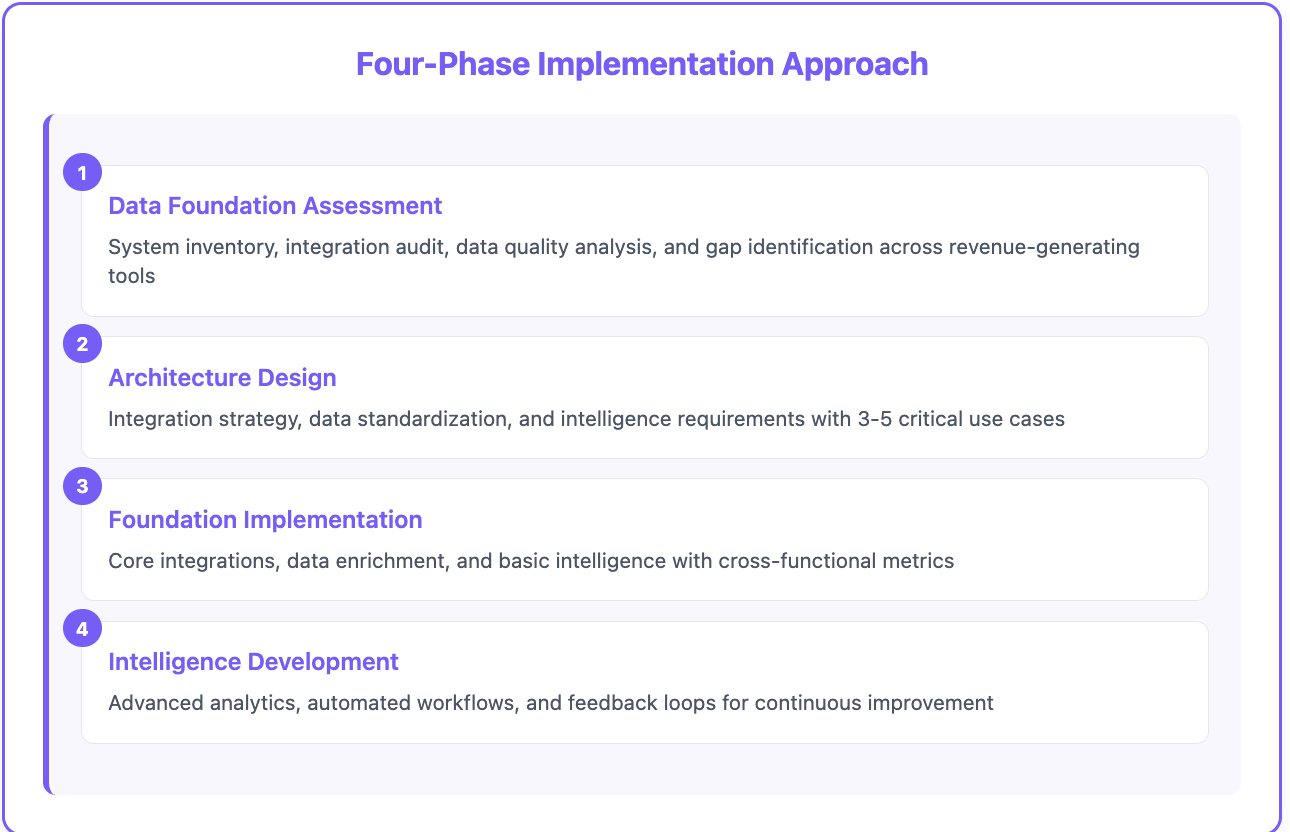

Smart revenue teams approach revenue intelligence platform implementation like software architecture—foundation first, features second.

Phase 1: Data Foundation Assessment

System Inventory: Catalog every tool that captures revenue-relevant information. This typically includes 8-15 different systems across marketing, sales, customer success, and finance.

Integration Audit: Identify which systems currently connect to each other and how data flows (or doesn't flow) between them. Most teams discover that data lives in silos with manual bridges between systems.

Data Quality Analysis: Assess completeness, accuracy, and standardization of data in each system. Look for duplicate records, missing information, inconsistent field usage, and different definitions of the same concepts.

Gap Identification: Determine what data enrichment is needed to support intelligent analysis. This often includes company firmographics, contact enrichment, technographic data, and intent signals.

Phase 2: Architecture Design

Integration Strategy: Plan how systems will connect, what data will flow between them, and how conflicts will be resolved. Modern teams prioritize API-based real-time integration over batch file transfers.

Data Standardization: Create unified definitions for critical objects and fields across systems. One contact record should connect to the same person across marketing automation, CRM, customer success, and financial systems.

Intelligence Requirements: Define what insights you need to generate and what actions those insights should trigger. Start with 3-5 critical use cases rather than trying to solve everything at once.

Phase 3: Foundation Implementation

Core Integrations: Connect your primary revenue systems (CRM, marketing automation, customer success platform) with real-time data synchronization.

Data Enrichment: Implement automated enrichment to fill gaps in contact and company information. This is where platforms like Databar provide immediate value—automatically enriching your database with information from 90+ data providers without manual research.

Basic Intelligence: Start with fundamental cross-functional metrics like lead-to-revenue conversion rates, pipeline velocity, and customer expansion tracking.

Phase 4: Intelligence Development

Advanced Analytics: Build predictive models for deal outcomes, expansion opportunities, and churn risks using your complete customer journey data.

Automated Workflows: Create triggers that coordinate team actions based on intelligence insights—at-risk accounts, high-intent leads, expansion opportunities ready for sales engagement.

Feedback Loops: Measure whether intelligence-driven decisions actually improve outcomes and use that feedback to refine your models and workflows.

Building revenue intelligence isn't about creating better reports—it's about architecting a data foundation that improves how your entire revenue system operates.

The companies that invest in this foundation now are the ones that will dominate their markets as data becomes the primary competitive advantage in revenue generation.

Start with your data skeleton. Build unified intelligence. Create coordinated action.

Because in 2025, revenue predictability isn't a nice-to-have—it's the difference between companies that scale and companies that struggle.

Frequently Asked Questions

What's the difference between a revenue intelligence platform and advanced CRM reporting?

CRM reporting shows you what happened within your sales process. Revenue intelligence platforms integrate data across marketing, sales, and customer success to show you the complete customer journey and predict future outcomes. While CRM reports are department-specific, revenue intelligence provides cross-functional insights that drive coordinated action across teams.

What's the most important factor for revenue intelligence success?

Executive support and cross-functional buy-in. Revenue intelligence requires departments to share data and coordinate metrics. Without leadership mandate and shared incentives across marketing, sales, and customer success, even the best technology won't drive adoption or results.

Do I need to replace my existing CRM to implement revenue intelligence?

No. Revenue intelligence platforms typically integrate with your existing CRM, marketing automation, and customer success tools. The goal is to connect and enhance your current systems, not replace them. Most implementations work with Salesforce, HubSpot, Pipedrive, and other popular platforms.

What data quality requirements are needed for revenue intelligence?

You need consistent contact and company records across systems, standardized field definitions, and regular data cleaning processes. Most successful implementations start with 80%+ data completeness in their CRM and marketing automation platforms. Data enrichment tools can fill gaps, but basic hygiene must be in place first.

How does revenue intelligence handle data privacy and security?

Modern revenue intelligence platforms provide enterprise-grade security with role-based access controls, data encryption, and compliance with regulations like GDPR and CCPA. You can control which teams see which data while maintaining unified intelligence across the organization.

Related articles

Claude Code for RevOps: How Revenue Operations Teams Are Using AI Agents to Fix CRM Data, Automate Pipeline Ops & Build Systems

Using AI Agents to Fix CRM Data and Streamline Revenue Operations for Scalable Growth

by Jan, February 24, 2026

Claude Code for Sales Managers: A Practical Guide to Deal Reviews, Rep Coaching, Pipeline Inspection, and Forecast Prep in 2026

Speed Up Coaching and Forecast Prep with Data You Can Trust

by Jan, February 23, 2026

How to Build a Client Onboarding System in Claude Code for GTM Agencies

How To Cut Client Onboarding from Weeks to Hours with Claude Code

by Jan, February 22, 2026

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026