10 Best Buying Signals for B2B Sales (And Exactly When to Act on Each)

How to spot and respond to the 10 most reliable buying signals that drive B2B sales success

Blogby JanJune 25, 2025

Picture this: Your biggest competitor just closed a deal with a prospect you've been nurturing for months. Later, you discover they visited your pricing page six times last week, their new VP of Sales is your former champion from another account, and they just raised $50M in funding.

You had all the signals. You just didn't act on them.

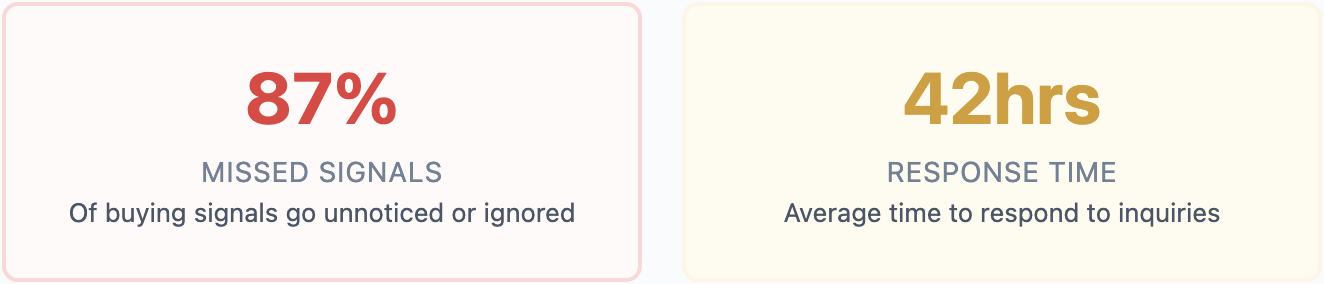

This scenario plays out every day across B2B sales teams. The painful truth? 87% of buying signals go unnoticed or ignored, according to recent sales intelligence research. That's pipeline left on the table and quota at risk.

The good news: the best buying signals are surprisingly consistent across industries. Master these 10 signals and their optimal response times, and you'll capture opportunities your competitors miss.

Cost of Missing Buying Signals

Before diving into the signals themselves, let's address the elephant in the room: why do smart sales teams miss obvious buying signals?

Why Many B2B Opportunities Go Unnoticed

The modern B2B buyer leaves digital footprints everywhere. They research anonymously, engage across multiple channels, and involve an average of 9 stakeholders in purchase decisions. Traditional CRM data captures maybe 20% of this activity.

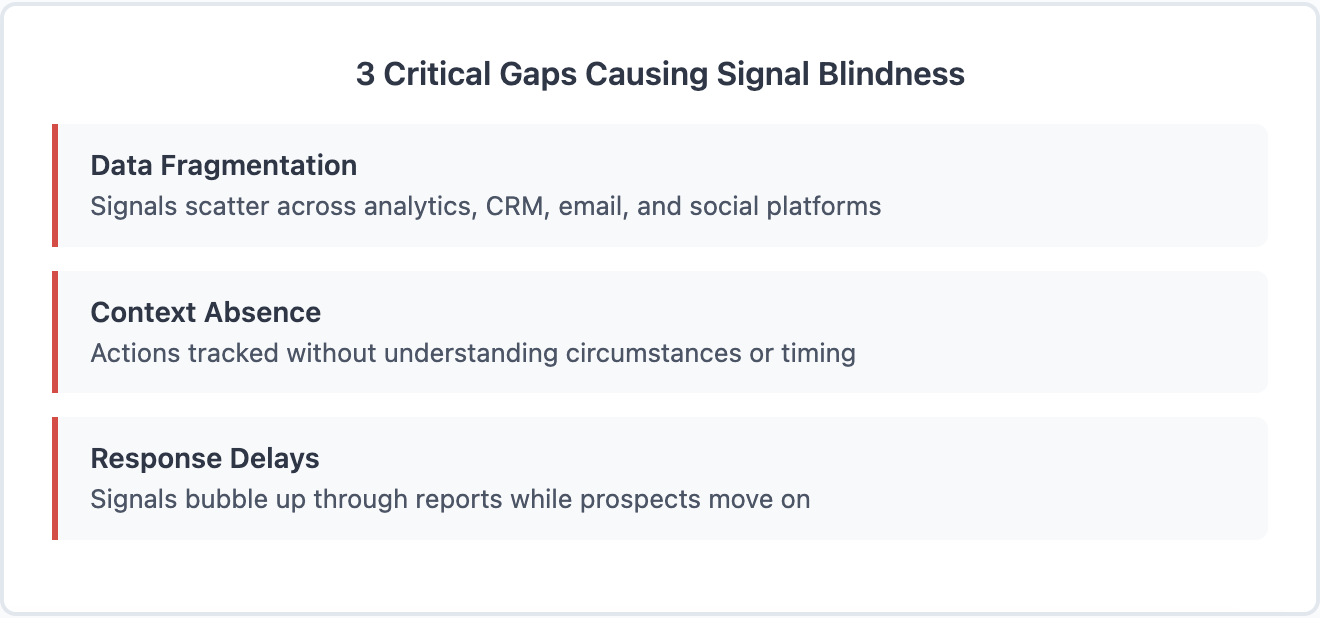

Three critical gaps cause signal blindness:

Data fragmentation: Signals scatter across your website analytics, CRM, email platform, social media, and third-party sites. Without unified tracking, you're looking at puzzle pieces instead of the complete picture.

Context absence: A pricing page visit means something different for a 10-person startup versus a Fortune 500 enterprise. Most teams track actions without understanding circumstances.

Response delays: By the time signals bubble up through weekly reports or manual checks, prospects have moved on. The average B2B sales team takes 42 hours to respond to inquiries. Top performers respond in under 5 minutes.

So, What’s the Impact on Your Pipeline?

Missing buying signals doesn't just mean lost deals. It compounds into larger problems:

- Longer sales cycles: Reps waste time on cold prospects while hot ones wait

- Lower win rates: Competitors who respond faster build stronger relationships

- Inefficient resource allocation: SDRs chase low-intent leads while high-intent signals go unnoticed

- Reduced forecast accuracy: Pipeline predictions miss ready-to-buy accounts

One VP of Sales put it bluntly: "Every missed signal is a competitor's closed deal. We were literally funding our competition's growth."

10 Best Buying Signals Every B2B Team Should Track

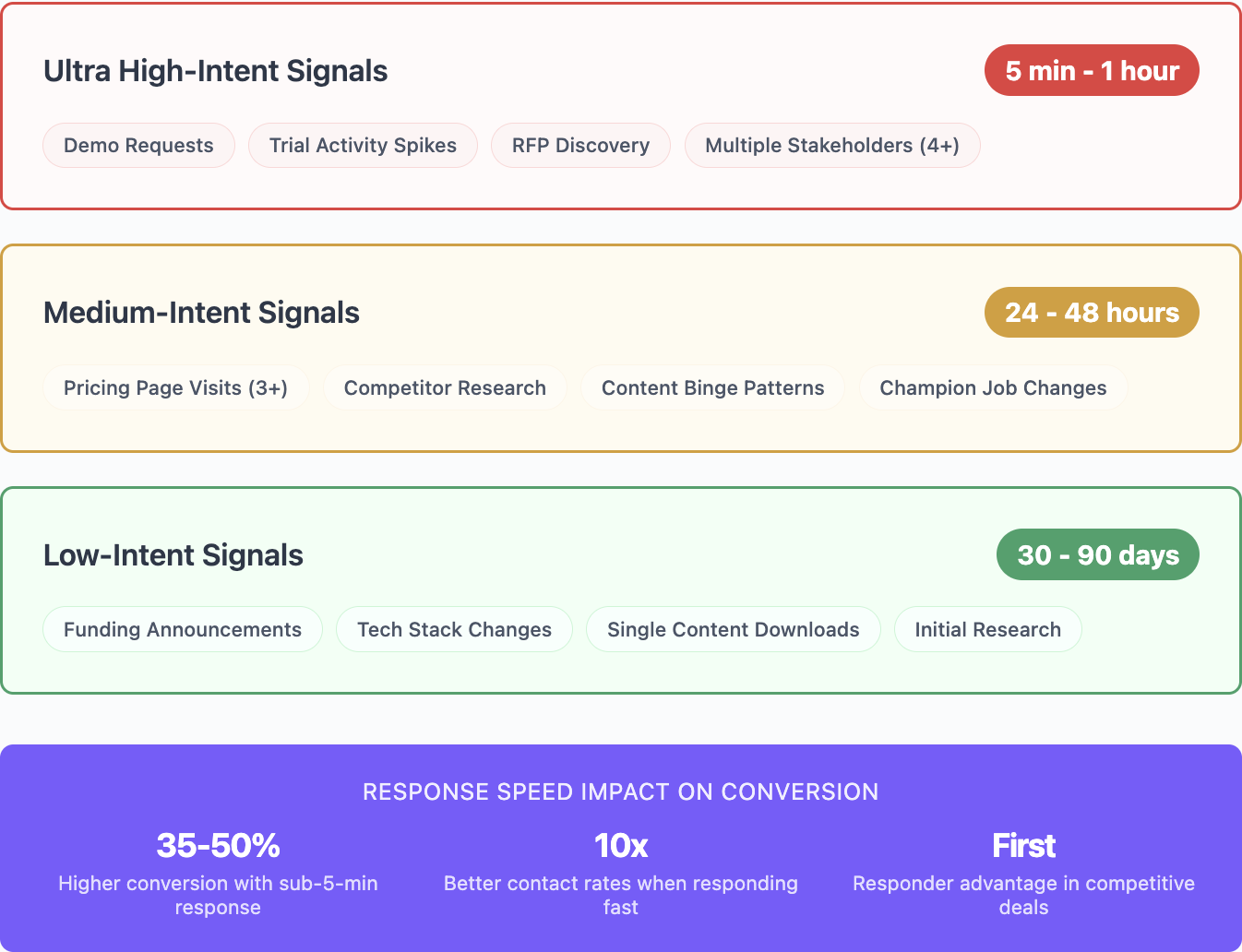

Not all signals deserve equal attention. These 10 consistently predict purchase intent across thousands of B2B deals. More importantly, each has a specific response window where action drives results.

#1 Demo Requests: The Ultimate High-Intent Signal

The signal: A prospect submits a demo request form or explicitly asks to see your product in action.

Why it matters: Demo requests represent the highest intent possible. The prospect has identified a problem, researched solutions, and chosen to evaluate yours. They're allocating time - the scarcest B2B resource - to assess your product.

When to Act: The 5-Minute Rule

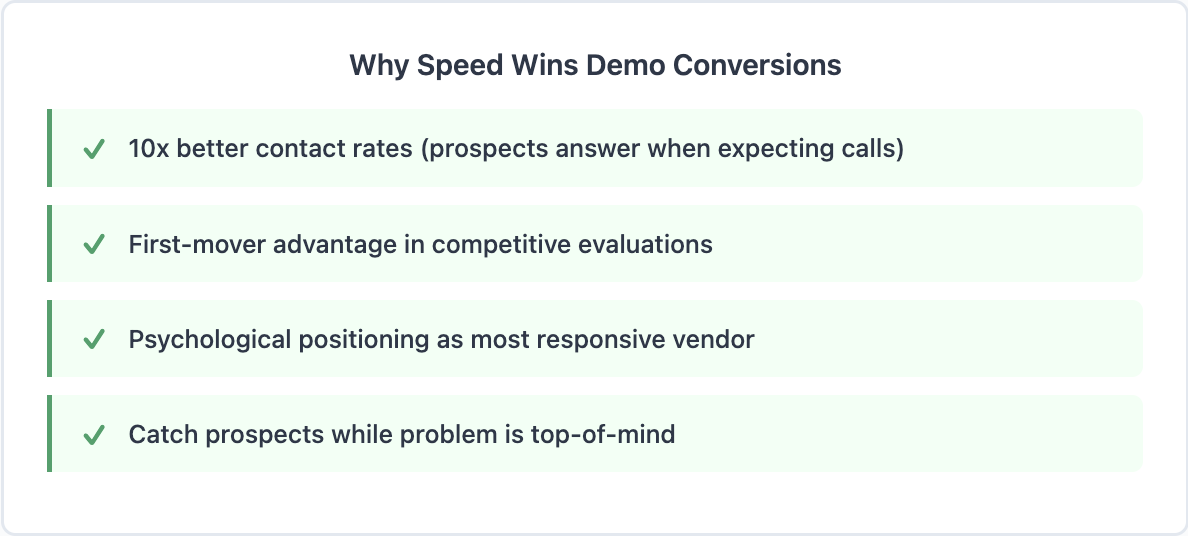

Speed wins deals. Prospects who request demos are often evaluating multiple vendors simultaneously. The first vendor to respond meaningfully gains massive advantages:

- 35-50% higher conversion rates for sub-5-minute responses

- 10x better contact rates (prospects answer unknown numbers when expecting calls)

- Psychological positioning as the most responsive, customer-focused option

Your response window: 5 minutes during business hours, 1 hour maximum.

How to Maximize Demo Conversion

Raw speed without relevance wastes the opportunity. Your immediate response should:

- Acknowledge their specific interest: Reference the product area or use case they indicated

- Confirm their timeline: "When were you hoping to evaluate solutions?"

- Offer immediate value: Share a relevant resource while scheduling the demo

- Multi-thread contact: Call first, email if no answer, LinkedIn connection as backup

Pro tip: Enrich demo request data instantly to understand company size, technology stack, and growth stage before your first contact. This context transforms generic responses into consultative conversations.

#2 Pricing Page Visits: Money on the Table

The signal: Repeated visits to pricing or plans pages, especially with significant time spent reviewing options.

Why it matters: Pricing page visits indicate budget consideration. Unlike casual browsers, these prospects are calculating ROI and building business cases. The repetition reveals internal discussions and comparison shopping.

The 3-Visit Rule

Single pricing page visits often represent curiosity. But patterns reveal intent:

Visit 1: Initial research, often during discovery phase

Visit 2: Comparison shopping, usually days or weeks later

Visit 3+: Internal validation, often with multiple stakeholders

Your response triggers:

After 2nd visit: Add to nurture campaign with ROI-focused content

After 3rd visit: Direct outreach within 24 hours

Multiple visitors from same company: Immediate high-priority outreach

Timing Your Outreach for Maximum Impact

Pricing page behavior reveals where prospects sit in their buying journey. Match your approach accordingly:

For SMB/startup visitors (identified through company enrichment):

- Emphasize quick implementation and time-to-value

- Offer startup discounts or flexible payment terms

- Schedule demos for the same week

For enterprise visitors:

- Focus on scalability and integration capabilities

- Provide security documentation and compliance details

- Offer stakeholder-ready business case templates

Your response window: 24 hours after 3rd visit, ideally 1 hour if multiple stakeholders involved.

#3 Champion Job Changes: Your Warmest Pipeline Source

The signal: A former customer, power user, or sales champion moves to a new company within your target market.

Why it matters: These individuals already know your product's value. They're 5x more likely to purchase at their new company compared to cold prospects. Better yet, they often have budget authority or influence in their new roles.

The 90-Day Golden Window

New executives typically control 70% of their first-year budget within the first 90 days. This creates natural urgency:

- Days 1-30: They assess current tools and identify gaps

- Days 31-60: They build their strategy and request budgets

- Days 61-90: They make vendor decisions and sign contracts

Track job changes systematically to catch champions during this critical window.

Turning Job Changes into Closed Deals

Your outreach must balance personal relationship with professional value:

Week 1-2: Congratulatory message

- "Congrats on the new role at [Company]!"

- No pitch, just relationship maintenance

- LinkedIn connection if not already connected

Week 3-4: Value-add follow-up

- "Saw [Company] is expanding their sales team - thought this might be helpful"

- Share relevant industry report or benchmark data

- Soft mention of how you helped at their previous company

Week 5-8: Direct but consultative outreach

- "How are you settling in? Happy to share what worked well at [Previous Company]"

- Offer specific value prop for their new situation

- Schedule informal "catch-up" call

Your response window: Within 14 days of job change announcement.

#4 Funding Announcements: Fresh Budget, Fresh Opportunities

The signal: Target accounts announce seed rounds, Series A/B/C funding, or private equity investment.

Why it matters: Companies that raised funding are 2.5x more likely to buy new solutions. Fresh capital means expanded budgets, aggressive growth targets, and pressure to show results quickly.

The Post-Funding Sprint Strategy

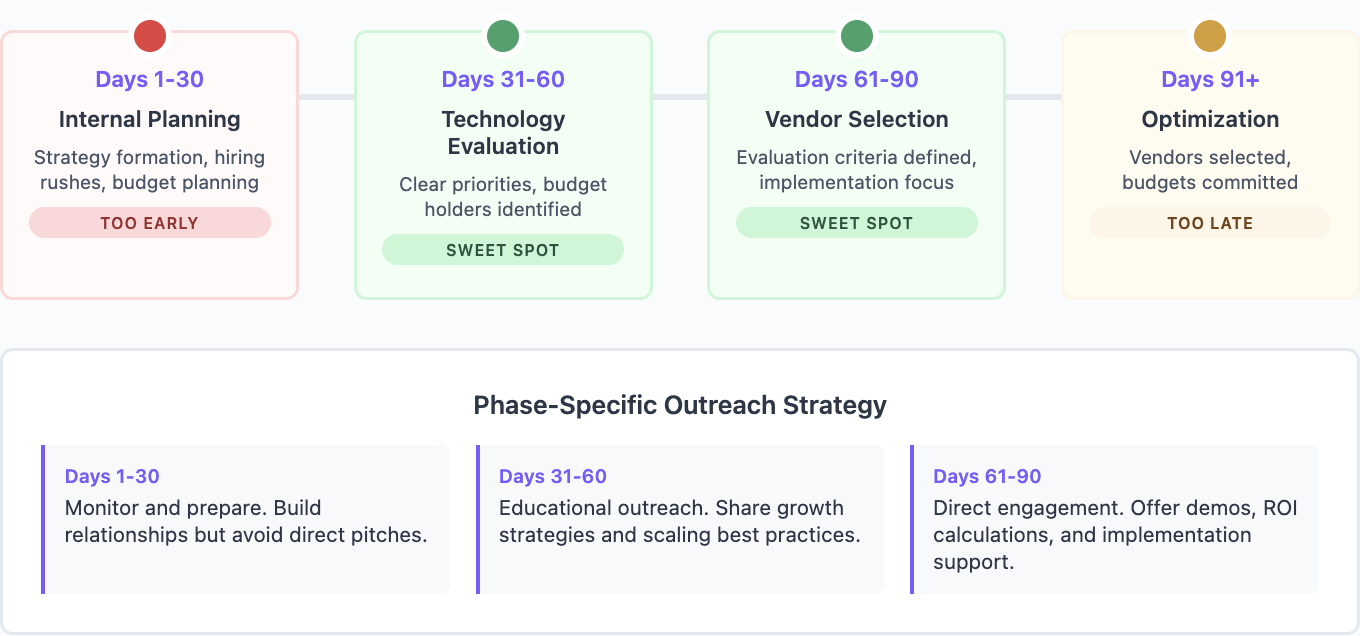

Funding creates predictable buying patterns:

- Days 1-30: Internal planning and hiring rushes

- Days 31-60: Technology evaluation for scale

- Days 61-90: Vendor selection and implementation

- Days 91+: Renewal and optimization focus

The sweet spot? Days 31-90 when budgets are approved but not yet allocated.

Why Days 30-90 Matter Most

Smart timing separates winners from also-rans:

Too early (Days 1-30):

- Leadership still forming strategy

- Budgets not yet allocated

- Too many vendors competing for attention

Just right (Days 31-90):

- Clear growth priorities established

- Budget holders identified

- Evaluation criteria defined

Too late (Days 91+):

- Vendors already selected

- Budgets committed

- Change requires displacement

Monitor funding events in real-time through Owler, PredictLeads and Crunchbase integrations. Set up automated alerts for your target account list.

Your response window: 30-45 days post-funding announcement.

#5 Competitor Research Activity: Steal Market Share

The signal: Prospects research your competitors through review sites, comparison pages, or social media discussions.

Why it matters: Competitor research indicates active evaluation. More importantly, it reveals dissatisfaction with status quo. These prospects have budget, need, and buying authority - they're just choosing between vendors.

Displacement Timing Tactics

Successful competitive displacement follows predictable triggers:

- Contract renewal periods: 90-120 days before renewal

- Service failures: Public complaints or support issues

- Pricing increases: Competitor announces rate hikes

- Feature gaps: Competitor lacks crucial functionality

Monitor these triggers through review sites and social listening.

Converting Competitor Users

Your approach must address switching costs while emphasizing unique value:

Initial outreach: Acknowledge their research

- "Noticed you're evaluating [category] solutions"

- Never mention specific competitor by name initially

- Focus on their business challenges, not vendor comparison

Follow-up: Remove switching friction

- Offer migration support and data transfer

- Provide ROI calculator showing switching benefits

- Share case studies of similar companies who switched

Close tactics: Make switching risk-free

- Extended trial periods

- Success guarantees

- Phased implementation options

Your response window: Within 48 hours of competitor research activity.

#6 Multiple Stakeholder Engagement: Committee Formation

The signal: Multiple employees from the same company engage with your content, visit your website, or attend your webinars within a short timeframe.

Why it matters: B2B purchases involve an average of 9 stakeholders. When multiple people engage simultaneously, it signals active internal discussions. The account has moved from individual curiosity to group evaluation.

The Multi-Thread Approach

Different stakeholders care about different values:

- Economic buyers: ROI, cost savings, competitive advantage

- Technical evaluators: Integration, security, scalability

- End users: Ease of use, time savings, daily workflow

- Champions: Career advancement, team success, innovation

Identify all stakeholders through enrichment and tailor messages accordingly.

When Groups Browse, Deals Close

Group engagement patterns predict purchase timing:

2-3 people engaged: Early research phase

- Provide educational content

- Host webinars for common questions

- Build champion relationships

4-6 people engaged: Active evaluation

- Offer team demos

- Provide trial accounts for all stakeholders

- Create stakeholder-specific content

7+ people engaged: Decision imminent

- Executive briefings

- Reference calls with similar customers

- Detailed implementation plans

Your response window: 24 hours when 4+ stakeholders engage within a week.

#7 Trial or Free Account Activity: Usage Spikes Signal Intent

The signal: Dramatic increases in trial usage, feature exploration, or user invitation patterns.

Why it matters: Trial behavior predicts conversion better than any survey. Active trials convert at 25-30%, while dormant trials convert below 2%. Usage spikes indicate the "aha moment" when prospects see real value.

The Engagement Threshold Formula

Not all trial activity signals equal intent. Track these conversion indicators:

High-intent behaviors:

- Inviting 3+ team members

- Integrating with existing tools

- Uploading real data (not test data)

- Using advanced features

- Daily active usage for 5+ consecutive days

Medium-intent behaviors:

- Regular login pattern establishment

- Basic feature configuration

- Documentation access

- Support ticket creation

Low-intent behaviors:

- Single login after signup

- No data uploaded

- Basic feature testing only

Preventing Trial Drop-off

Time your interventions based on behavior, not arbitrary schedules:

Day 1-3: Welcome and quick wins

- Automated onboarding sequences

- Quick win tutorials

- Available but not pushy support

Day 4-7: Value realization check

- If low activity: "How can we help?" outreach

- If high activity: "Great to see you exploring [feature]!"

- Share relevant best practices

Day 8-14: Conversion conversations

- High-activity trials: Schedule success planning call

- Medium-activity: Offer personalized training

- Low-activity: Last chance re-engagement

Your response window: Within 4 hours of significant usage spike.

#8 Technology Stack Changes: Integration Opportunities

The signal: Companies adopt new platforms that integrate with your solution or replace tools in adjacent categories.

Why it matters: Technology decisions create cascading needs. A company implementing Salesforce needs compatible tools. One switching from Google Workspace to Microsoft 365 reevaluates their entire stack.

Complementary Tool Adoption

Track technology adoption through BuildWith and similar providers. Focus on:

Direct integration partners:

- New CRM implementations

- Marketing automation platforms

- Communication tools

- Analytics platforms

Adjacent technologies:

- Similar category tools

- Workflow automation

- Data management systems

- Collaboration platforms

The Ecosystem Play

Position yourself as the missing piece in their tech stack:

Research phase: Education on integration benefits

- "How to maximize your new [Platform] investment"

- Integration guides and best practices

- Joint webinars with platform partners

Evaluation phase: Prove seamless connectivity

- Live integration demos

- Data flow diagrams

- Security and compliance documentation

Decision phase: Remove technical barriers

- Free implementation support

- Pre-built integration templates

- Success metrics from similar stacks

Your response window: Within 30 days of major platform adoption.

#9 Content Binge Patterns: Self-Education Signals

The signal: Prospects consume multiple pieces of content in rapid succession, following a logical learning path from awareness to consideration.

Why it matters: Content binging indicates urgent need. Unlike casual readers, these prospects have specific problems they're actively trying to solve. The content sequence reveals their journey stage and pain points.

The Journey Mapping Method

Track content consumption patterns to identify buying stage:

Awareness stage sequence:

- Blog post → Beginner's guide → Industry report

- Response: Educational nurture track

- Timeline: 2-4 week engagement

Consideration stage sequence:

- Comparison guide → Case studies → ROI calculator

- Response: Consultative outreach

- Timeline: 1-2 week decision window

Decision stage sequence:

- Implementation guide → Security docs → Pricing page

- Response: Immediate sales engagement

- Timeline: Days to decision

Content-to-Conversation Timing

Match your outreach to their self-education pace:

After 3 pieces in 24 hours:

- Trigger automated email: "Noticed you're researching [topic]"

- Offer curated resource bundle

- Include calendly link for questions

After 5 pieces in 48 hours:

- Personal outreach from SDR

- Reference specific content consumed

- Offer expert consultation

After case study + pricing view:

- Direct sales rep outreach

- Customized demo offer

- ROI discussion points

Your response window: Within 24 hours of consuming 3+ pieces of consideration-stage content.

#10 RFP and Procurement Activity: Late-Stage Gold

The signal: Companies issue RFPs, engage procurement departments, or request formal proposals in your solution category.

Why it matters: RFPs signal budget approval and active vendor selection. While often seen as late-stage, early awareness allows influence over requirements and evaluation criteria.

Early Influence Strategies

RFP success starts before the RFP:

Pre-RFP monitoring:

- Track job postings for procurement roles

- Monitor industry RFP platforms

- Set Google Alerts for "[Company] + RFP"

- Watch for consultant engagements

Requirement shaping:

- Engage before specifications finalize

- Educate on unique capabilities

- Provide evaluation criteria templates

- Share analyst reports favoring your approach

Shaping Requirements to Win

Transform RFP participation from reactive to strategic:

Upon RFP discovery:

- Immediate executive sponsor assignment

- Competitive intelligence gathering

- Win theme development

- Reference customer preparation

During RFP process:

- Submit clarifying questions that highlight strengths

- Provide extras beyond requirements

- Demonstrate thought leadership

- Build relationships despite procurement barriers

Post-submission:

- Maintain champion relationships

- Prepare for negotiations

- Ready implementation plans

- Continue value communication

Your response window: Within 24 hours of RFP discovery, ideally 30-60 days before issue.

Building Your Signal Response System

Knowing the signals means nothing without systematic response. Here's how to build a signal-based revenue engine that captures opportunities automatically.

Automated Detection and Enrichment

Manual signal tracking doesn't scale. Modern teams need automated detection across all signal sources:

Essential signal sources to monitor:

- Website behavior (through IP identification)

- CRM activity patterns

- Email and content engagement

- Social media interactions

- Third-party intent data

- Technology changes

- Personnel movements

- Funding and news

Unify these signals through data enrichment that adds context automatically. When someone visits your pricing page, instantly know their company size, growth rate, technology stack, and recent news.

Response Time Optimization

Speed requires preparation. Build your rapid response system:

Signal routing rules:

- High-intent → Sales rep within 5 minutes

- Medium-intent → SDR within 24 hours

- Low-intent → Marketing nurture within 72 hours

Response templates by signal:

- Demo requests: Calendly link + value prop

- Pricing visits: ROI resources + consultation offer

- Job changes: Congratulations + catch-up invitation

- Trial spikes: Success resources + training offer

Escalation protocols:

- No response in 24 hours → Manager notification

- No response in 48 hours → Alternative channel attempt

- No response in 72 hours → Executive outreach

FAQs About B2B Buying Signals

Q: Which buying signal is most important to track?

Demo requests consistently show the highest intent and conversion rates. However, the "best" signal varies by business model. Transactional sales prioritize trial activity. Enterprise sales emphasize stakeholder engagement. Track all 10, but weight them based on your specific conversion data.

Q: How quickly should we respond to different signals?

High-intent signals (demos, trials, RFPs): Within 5 minutes to 1 hour. Medium-intent signals (pricing visits, content binges): Within 24 hours. Low-intent signals (single content downloads, initial research): Within 72 hours through automated nurture.

Q: Can small teams effectively track all these signals?

Yes, with the right automation. Start with the top 3 signals that drive your revenue. Use tools that unify signal detection and automate enrichment. Even 2-person teams can excel by focusing on quality over quantity.

Q: How do we avoid seeming creepy when referencing signals?

Never mention the tracking. Instead of "I saw you visited our pricing page," try "I help companies evaluate [solution category] investments." Reference their implied needs, not their observed behaviors.

Q: What if we don't have budget for expensive intent data?

Start with first-party signals from your website, email, and CRM. Use free tools like Google Alerts for company news. Build your signal detection gradually - even basic tracking beats no tracking.

Q: How do we know which signals actually predict sales?

Analyze your closed-won deals from the past year. What actions did buyers take before purchasing? Track those patterns forward. Refine monthly based on results.

Turn Buying Signals into Closed Deals

Identifying the best buying signals gives you the roadmap. But success requires three things most teams lack: unified data, instant enrichment, and systematic response.

For revenue teams ready to capitalize signals, Databar.ai eliminates the complexity of signal-based selling. Our platform detects, enriches, and helps you act on buying signals before competitors even notice them.

Stop leaving pipeline on the table:

✓ Monitor critical signals automatically - from job openings to funding rounds

✓ Instant enrichment with 90+ data sources - know everything about prospects in seconds

✓ Waterfall data coverage - 80%+ match rates ensure signals don’t go unenriched

✓ AI research agent for unique prospect insights

✓ Automate personalized outreach based on signal patterns

The best time to reach a buyer? The moment they show intent. The second best time? Before your competitor does.

Start your free Databar.ai trial and turn buying signals into booked meetings today.

Related articles

How to Run Closed-Won Analysis with Claude Code

How Claude Code Turns Your CRM Data into Actionable Sales Strategies

by Jan, February 21, 2026

How to Automate GTM Research with Claude Code

How Claude Code Cuts Weeks of GTM Research into Hours Without Sacrificing Depth

by Jan, February 20, 2026

Best MCP Servers for Sales Teams in 2026

How MCP servers are turning AI into a hands-on sales assistant that gets real work done

by Jan, February 20, 2026

How to Scrape Google Maps and Find Business Owners with Claude Code

A Step-by-Step Guide on How to Find Business Leads and Owner Emails From Google Maps with Claude Code

by Jan, February 19, 2026